Basic-Fit vs

The Gym Group,

a fundamental analysis!

July 15, 2019

TICKER: BFIT

ISIN: NL0011872650

SHARE PRICE: 31,45€

MARKET CAP: €1,72B

July 15, 2019

TICKER: BFIT

ISIN: NL0011872650

SHARE PRICE: 31,45€

MARKET CAP: €1,72B

1. INTRODUCTION

I’ve been wanting to compare The Gym Group to its Dutch competitor Basic-Fit for some time now and I’m finally doing it. If you haven’t read my write up on The Gym Group, I would advise you to do it before reading this one.

Without further delay, let’s go to their website and take a look around.

2. BUSINESS OVERVIEW

2.1. BUSINESS DESCRIPTION

Like The Gym Group, Basic-Fit was founded by a sportsman with a racket. The Gym’s founder used to be a squash player while Basic-Fit’s used to be a tennis player. Basic-Fit is Europe’s largest owner and operator of low-cost gyms.

The business model is similar to The Gym’s one: The company pursuits an aggressive growth strategy, opening around 150 gyms per year while The Gym Group is expected to open about 15 to 20 new gyms in 2019. This is an industry where scale matters because the company is able to buy equipment for less than smaller competitors, rent spaces at a lower price and offer its clients lower prices than its competitors.

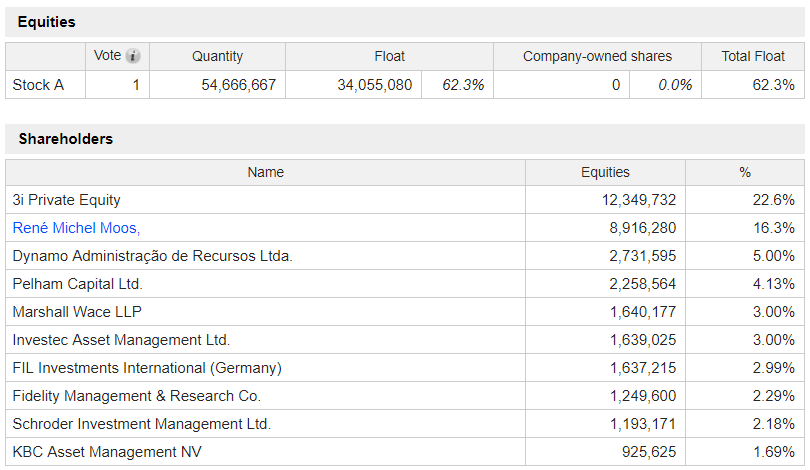

2.2. LARGEST SHAREHOLDERS

It’s interesting to see a Private Equity firm as the largest shareholder. And even more interesting is seeing the founder and CEO owning 16,3% of the business.

Although I’ve been preaching about the need for private investors to look for skin in the game in the form of large ownership by a company’s managers, I’m starting to think that that fact alone isn’t enough. But that is a subject for another day… Let’s proceed.

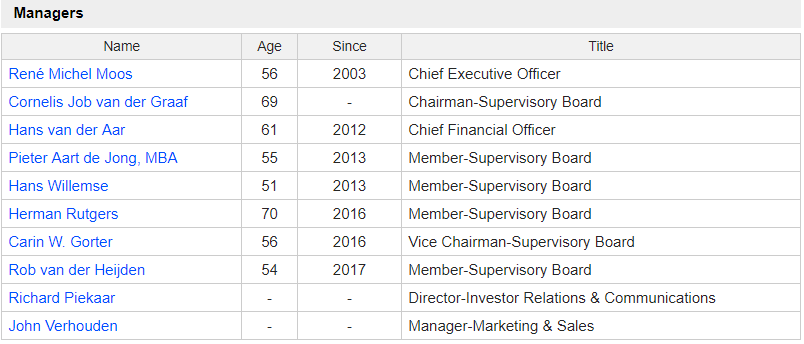

2.3. MANAGEMENT TEAM

As I was saying, the founder is still at the helm of the operations.

He earned a total compensation of €1.43M in 2018 which is about 0,4% of sales. Although as a percentage of sales this compensation isn’t significant, as an absolute number, I think it’s a bit too much. Just so we have a means of comparison, Richard Darwin, the CEO of The Gym Group has earned a total compensation of €377K in 2018 which is about 0.2% of total revenue.

3. HISTORICAL CONTEXT

3.1. LONG TERM CHART

The company went public in 2016 and if you had invested at the time of the IPO you would’ve benefited from a 30% CAGR!!!

While if you had invested in The Gym Group at the time of the IPO, you would’ve benefited from a 6% CAGR.

3.2. MARKET CAP AND SHARES OUTSTANDING

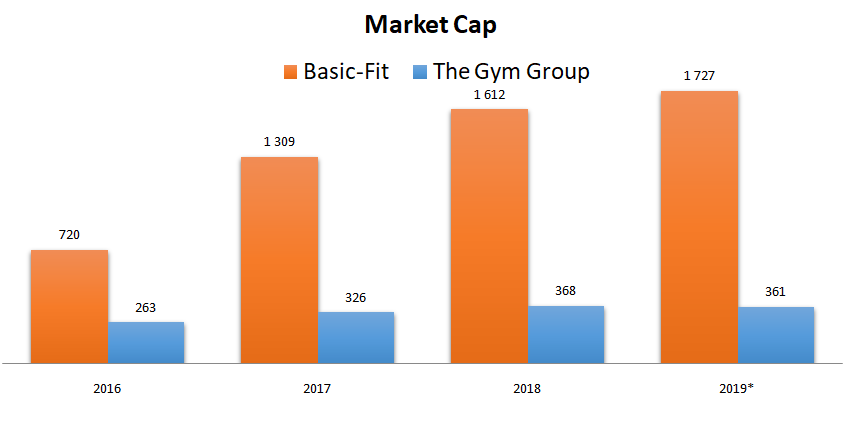

If we look at the market cap for both companies, there is no doubt. Basic-Fit is 5 times larger than its competitor across the English Channel.

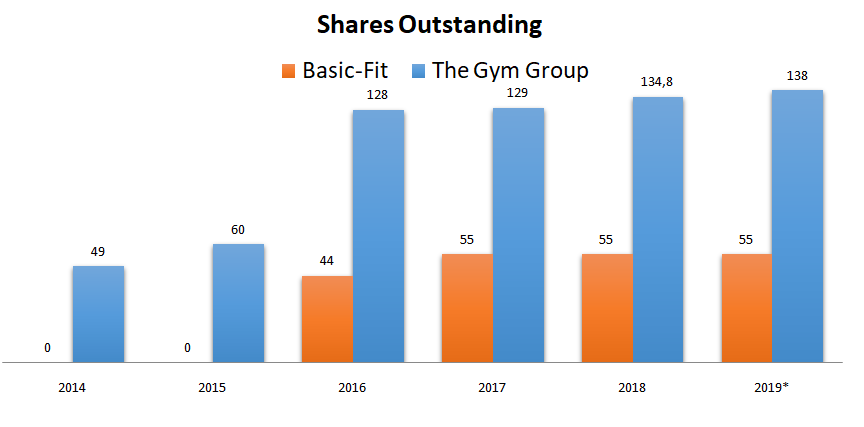

The number of shares outstanding has remained steady for Basic Fit for the last 4 years while for The Gym Group this number has been growing at a rate of 5% for the same period.

Note: I used a conversion rate GBP/EURO= 1.11

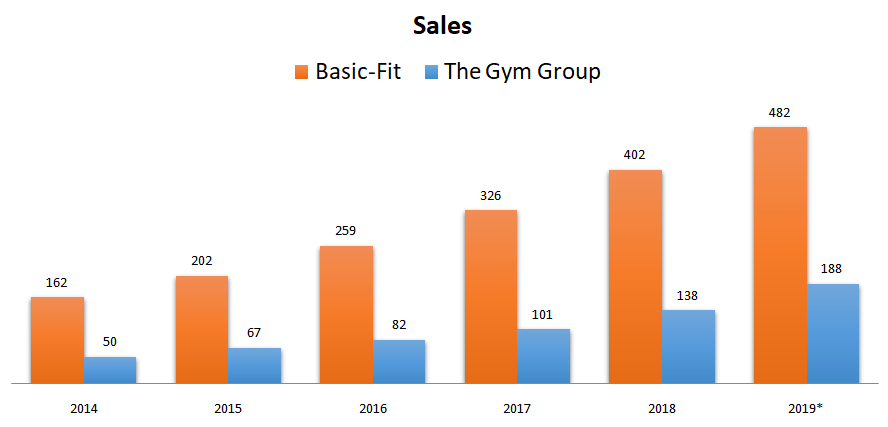

3.3. SALES

The revenue gap between the two companies is stark but the sales figure alone doesn’t justify the market cap difference. While Basic-Fit is 5 times larger in Market Cap, its sales are only 2,5 times those of The Gym Group.

Basic-Fit has been able to compound its annual sales by 25% in the last five years while The Gym Group has done it at a 28% rate. Of course, the larger you are the harder it gets to grow at high rates but I don’t think Basic-Fit has reached that level yet.

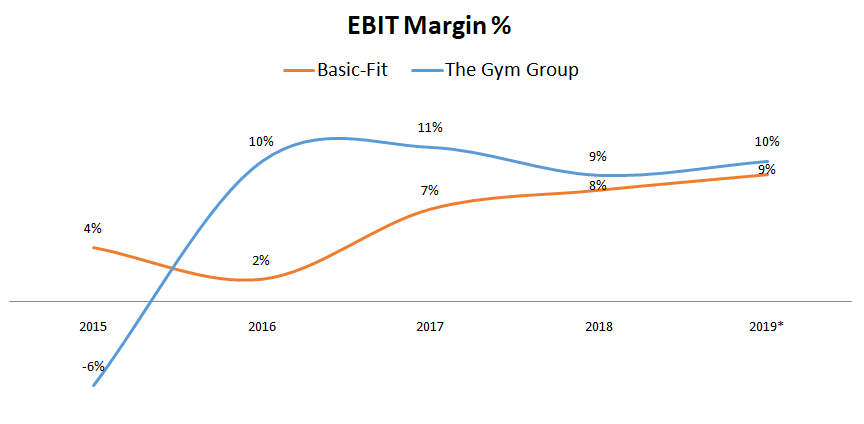

3.4. EBIT MARGIN

Although there have been some variations, in recent years both companies have been converging to similar operating margins around the 10% mark.

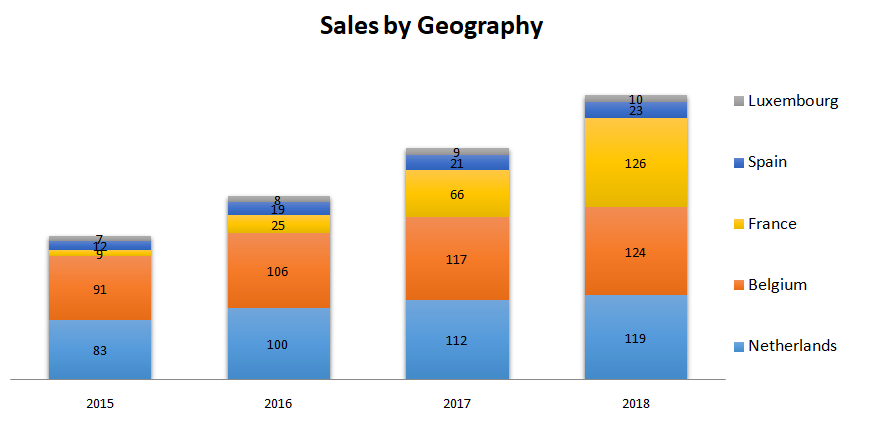

3.5. SALES BY GEOGRAPHY

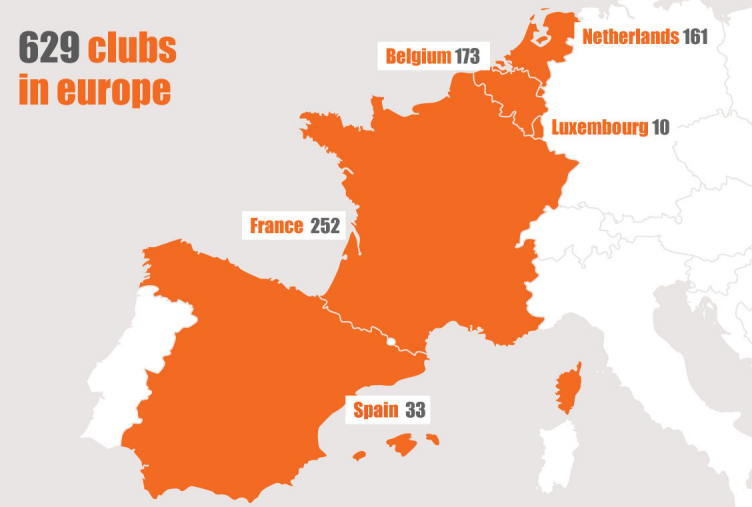

And while The Gym Group operates exclusively in the UK, Basic-Fit operates in several European countries:

I was thinking that their main alley of growth is France and growth in the BENELUX was stabilizing but then the company went out and acquired Fitland – the third largest player in the Netherlands with 37 gyms- not even a month ago, so there you have it: When it becomes hard to grow organically, the company is able to buy its competitors.

Unfortunately the figures involved weren’t disclosed but the company said that “the rebranding and refurbishment of the Fitland clubs per acquired club is expected to be similar to the initial investment for building a new Basic-Fit club.” which in my opinion is amazing.

The time it would take them to build 37 gyms and get the members to fill those gyms would definitely hinder their profitability. This way they can easily transform the gyms and carry on with the regular operations.

I’m still curious though, about this acquisition given the fact that Fitland operates in a higher segment than Basic-Fit but given that all the gyms will be transformed, maybe this isn’t an issue.

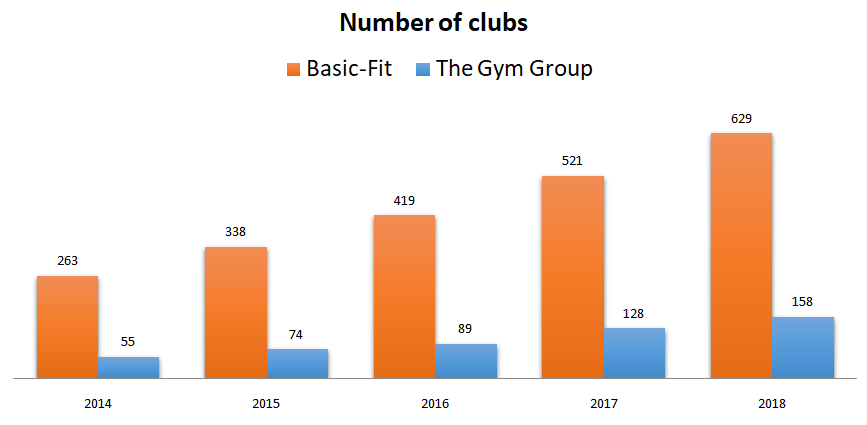

3.6. NUMBER OF CLUBS

With 629 clubs at the end of 2018, Basic-Fit has 4x the number of gyms as The Gym Group

A rough estimate would tell me that Basic-Fit is able to earn €640K from each gym while The Gym Group is able to squeeze €870K from each of its gyms.

At first I thought this difference might’ve been flawed because of a different proportion between mature and immature gyms for both companies but it turns out this isn’t the case. The proportion is more less the same. 56% of The Gym’s sites are mature while for Basic-Fit this stands at 52%.

What I’ve found is that The Gym Group has a lot more members per gym than Basic-Fit. While Basic-Fit has about 2925 members per club, The Gym Group has 4582. I’m pretty sure this is because Basic-Fit’s gyms are smaller than those from The Gym Group.

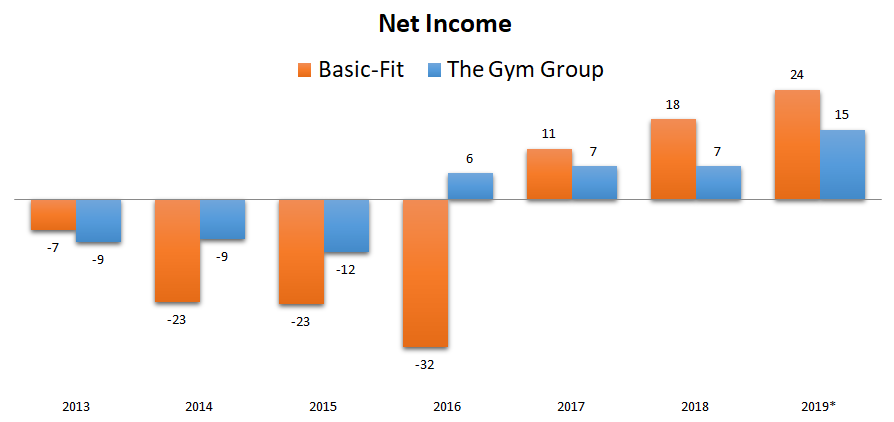

3.7. NET INCOME

Both companies recorded net losses for some time while they were growing their number of clubs but both of them now report positive net income.

This net income tells us very little given the fact that the high depreciation charges don’t actually reflect the Maintenance Capex, which is much lower.

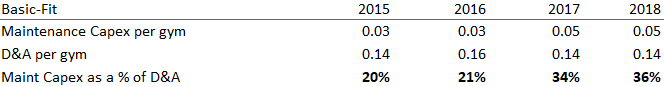

Here we have the comparison between “Maintenance Capex” and “Depreciation and Amortization” for Basic-Fit:

And here it is for The Gym Group:

We could say they’re the same.

As in other real estate companies, there is always the risk that as the properties and the equipment gets older, the Maintenance Capex tends to approximate the D&A expense, especially after 10 or 15 years, but as the management of The Gym Group told a fellow investor (who I’ve met on twitter and unfortunately can’t remember his name), a lot of the initial Capex was used in one-time items like the concrete floors, the architectects, the mezzanines, etc. and that is why the D&A should stay higher than the Maintenance Capex.

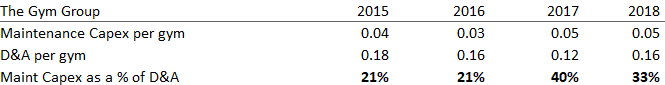

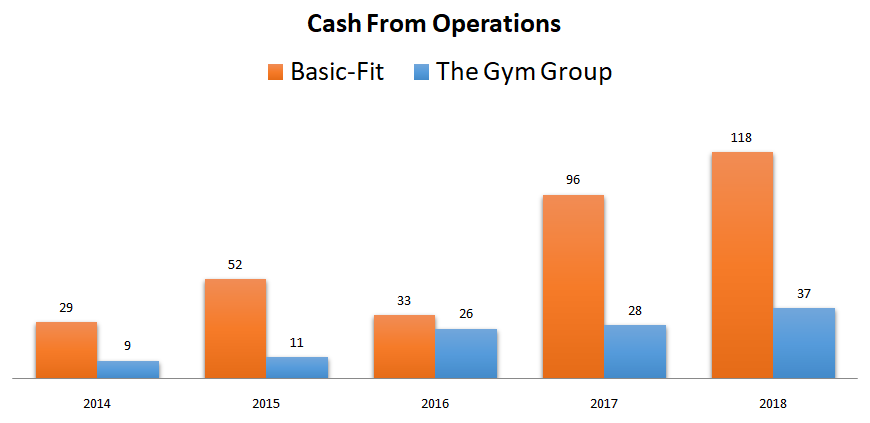

3.8. CASH FLOWS

If we disregard the year of 2016 for a minute, Basic-Fit has been able to grow its FCF steadily over the years while The Gym Group’s FCF has been growing very slowly for the last 3 years.

I wonder if this is due to a larger proportion of CAPEX being spent by The Gym Group…

Remember:

Free Cash Flow = Cash From Operations – CAPEX (Capital Expenditures in Property, Plant and Equipment) so if the CAPEX is higher, the FCF is lower.

But if we take a look at the cash from operations, we’re able to see that it tells the same story as the FCF.

Cash from Operations didn’t grow in 2017 mainly due to changes in working capital (increase in the receivables).

3.9. PROFITABILITY RATIOS

Both companies aim for a ROIC higher than 30% for each gym opened and they’ve been doing that. They calculate the ROIC as “Adjusted EBITDA / Invested Capital”.

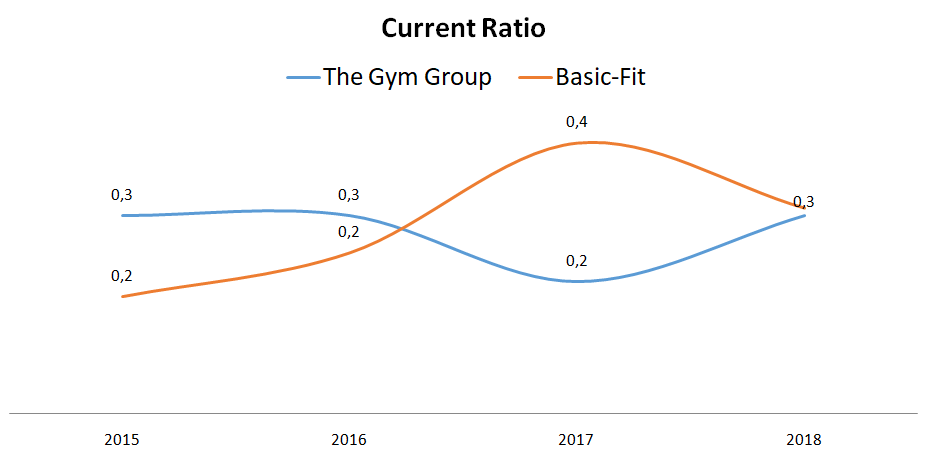

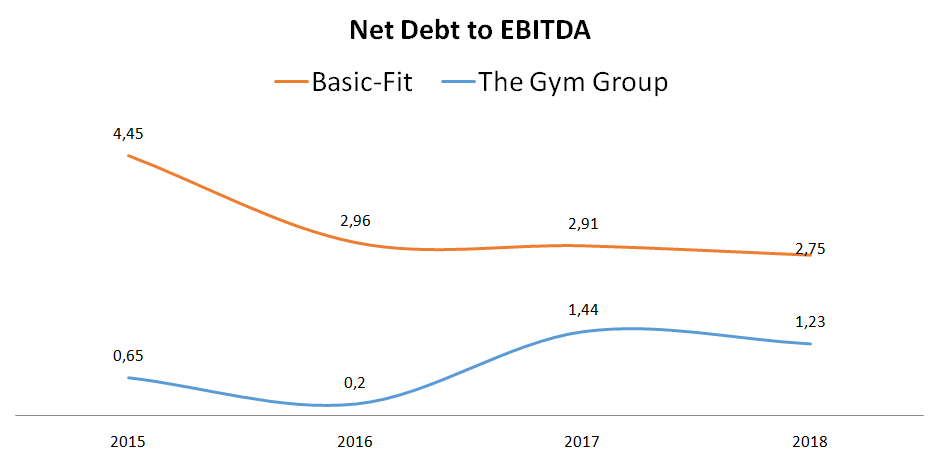

3.10. FINANCIAL RATIOS

Both companies are working capital negative, which is a feature of their business model I like and both of them show similar current ratios.

With a Net Debt/EBITDA ratio of 2.75, Basic-Fit has twice the debt of The Gym Group but I think it’s fair to say that 2.75 is still a manageable level.

The Gym Group can still raise a considerable amount of debt whereas Basic-Fit is almost at the limit of its Bank covenants (max 3x EBITDA). This is important if they want to go out and acquire smaller competitors.

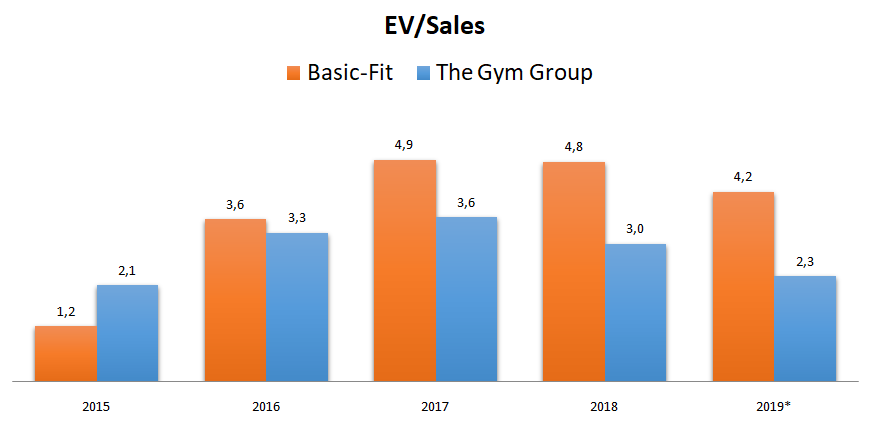

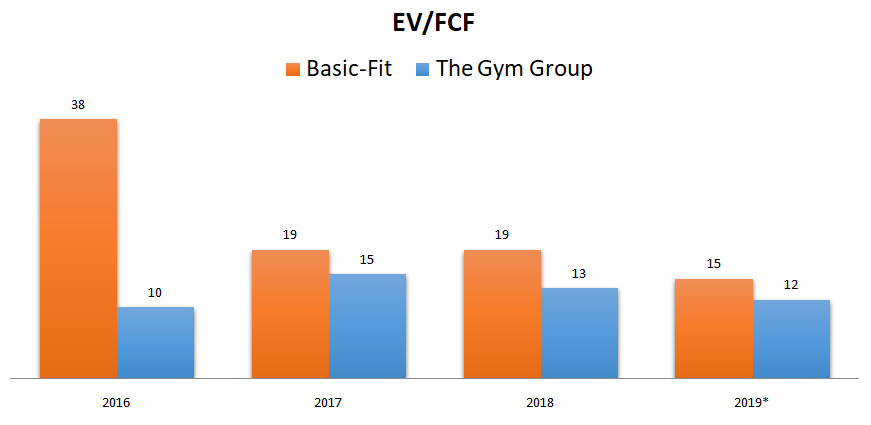

3.11. PRICE RATIOS

If we were to look at the EV/Sales ratio alone, we could guess that Mr. Market is expecting Basic-Fit to grow more than The Gym Group, as he is willing to pay 4x 2019 sales for Basic-Fit and only 2x sales for The Gym Group.

And if we look at the projected FCF, The Gym Group is still cheaper.

I would say that this is mostly due to fears and doubts about the Brexit.

4. GAINING PERSPECTIVE

4.1. INDUSTRY AND STRATEGY

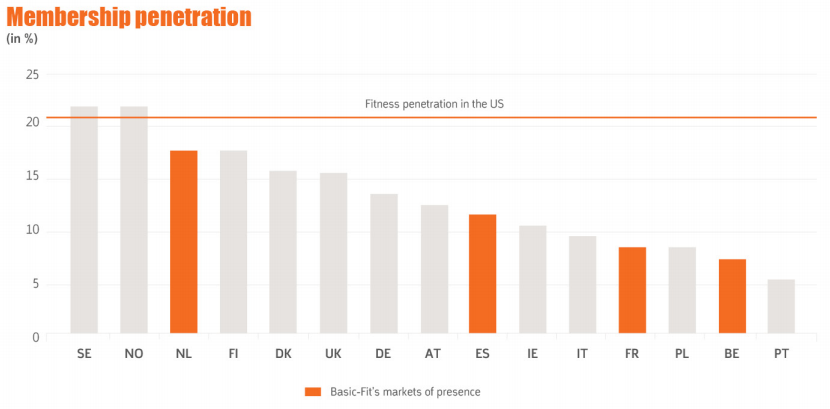

When I see the geographic representation bellow, I can’t help to think that there is still a huge runway for Basic-Fit, both in its existing markets as in new markets (think Italy).

The company gives us a picture of how European countries like working out at a gym as compared to the US and it seems that the southern you go the less people like to be in shape (I’m portuguese and we are at the bottom of the table).

4.2. SEASONALITY

Like any other gym operator, the best quarter for Basic-Fit is the first quarter although this is somewhat masked by their growth.

4.3. TYPE OF PLAY

Basic-Fit is definitely a growth company.

4.4. RISKS AND COMPETITION

The risks I see for both of the companies are:

Price wars leading the companies to lower their membership fees.

Economic downturn.

Higher operating costs.

Execution risk.

5. OVERVIEW AND CONCLUSION

5.1. OVERVIEW

I started my research wanting to find a company that was a worse investment than The Gym Group but in the end I think I’ve found one that is very similar to it. Yes, it has a higher debt level which might limit its growth compared to The Gym Group but on the other hand it is already expanding into new geographies (Spain and France). The only thing that is kind of bothering me is the low level of ownership by The Gym’s management team compared to Basic-Fit.

Which one do I prefer? Humm, that’s a hard question but The Gym Group is cheaper and has lower debt, so I’ll go with The Gym Group.

What do you think about Basic-Fit? Do you prefer it to The Gym Group? If you’d like to discuss this stock, join our group:

5.2. CONCLUSION

This section will be available to paying subscribers in 2019 when we launch the Portfolios.

Don’t forget to check our other analyses.

6. DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.