One Group Hospitality

a fundamental analysis

Part 2

November, 28 2019

TICKER: STKS

ISIN: US88338K1034

SHARE PRICE: $3,27

MARKET CAP: $97M

November, 28 2019

TICKER: STKS

ISIN: US88338K1034

SHARE PRICE: $2,53 HKD

MARKET CAP: $7,7B HKD

And we’re back. The first part of this analysis can be found here.

3.10. BALANCE SHEET AND RENTS

As already hinted by the negative Cash Conversion Cycle, the current ratio below 1 tells us that this is a negative working-capital business. Clients pay in cash when they eat well before the company pays its suppliers.

Now, if you look at the chart below, you will see that the debt to equity has shot up in 2019.

Whenever an investor studies a retail business he has to look into the rents, its components, its maturities and to whether those lease agreements are non-cancelable.

If they are non-cancelable – as in the case of STKS – they should be considered as debt. That’s what happened there in 2018. *See technical note below.

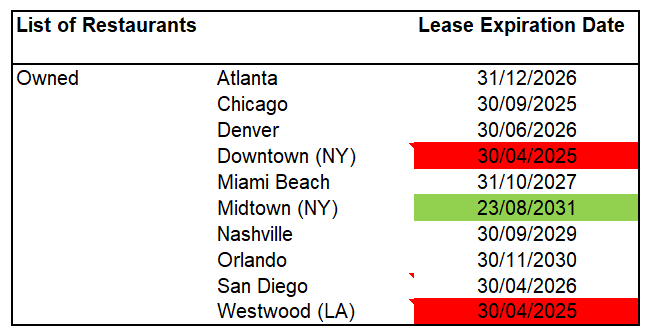

STKS locks in lease terms for 10 to 15 years with renewal options for 1 to 5 years. As we can see from the table below, the shortest maturity lease will expire in 2025 – 6 years from now – and the longest maturity lease will expire in 2031 – 12 years from now.

Although these rents have a small contingent part that is variable (as a % of revenue), most of the rent is fixed.

It’s true that long term leases are typically cheaper than short-term leases but they also represent a very long and inflexible obligation. Although several of STKS’ restaurants are extremely well located, some will certainly perform poorly. And when that happens, the company will face the choice to keep them running while losing money or close them and pay the remainder of the lease obligation. Both of them are less than optimal situations.

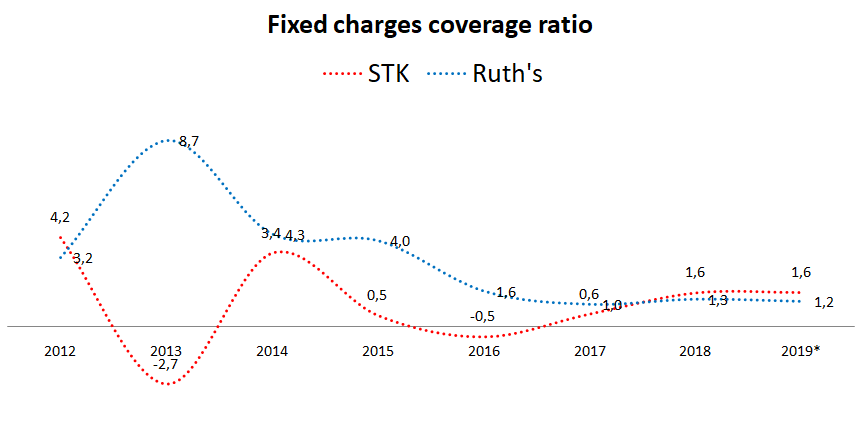

As we can see, the Fixed Charges Coverage Ratio is 1,6 which is better than Ruth’s. I would like to see this ratio reach a sounder level.

Technical stuff about rents for the interested investor:

Up until the new accounting standard IFRS 16 came into place, the future rents weren’t shown on the balance sheet. They weren’t treated as debt. They were considered off-balance sheet arrangements. Finding out the present-value of that liability required a lot of work so (some) investors used a rule of thumb to calculate the liability corresponding to the future rent payments. They would take the annual rent and multiply it by 8. Then, in recent years, that number lowered to 6. Fortunately the IFRS 16 has brought the future rental payments to the balance sheet making our lives much easier so we don’t have to guess anymore.

3.8. CASH FLOWS

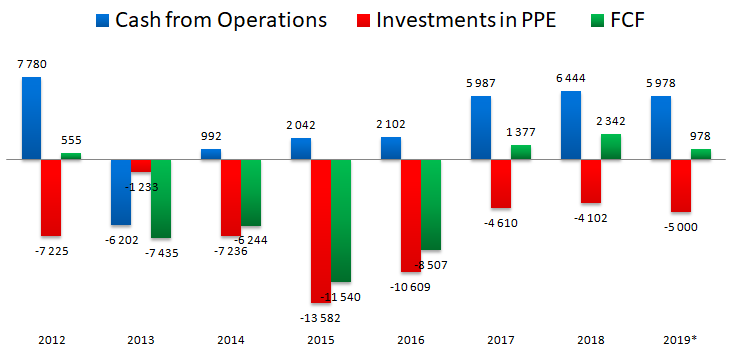

Turning now to the FCF generation, this has been very low. Notice the massive cash outflows up until 2016.

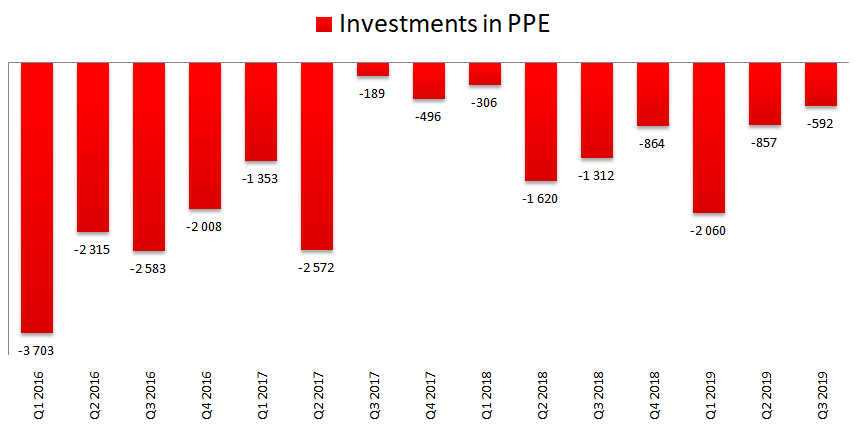

It’s interesting to note that the bleed was stopped in the second half of 2017, right around the time when Manny came on board.

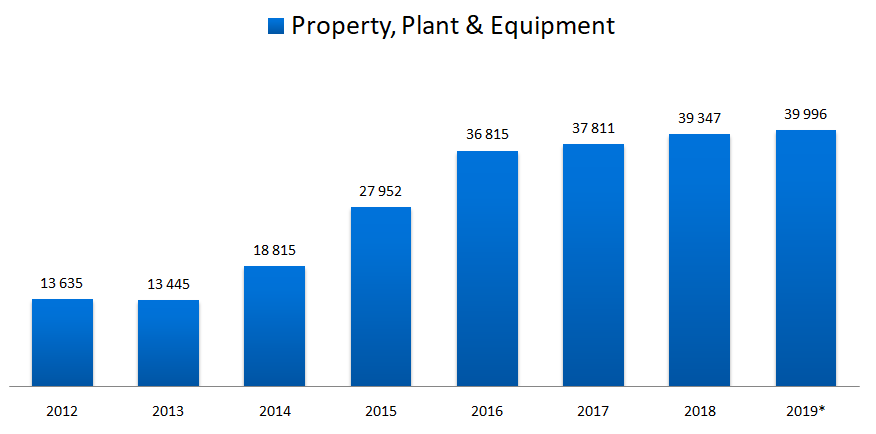

We can also see this decision reflected on the balance sheet.

In the latest Q3 call, the management has said that they are expecting to open 6 to 8 restaurants in 2020, including 5 to 6 STK’s (only one might be company-owned) and 1 to 2 food and beverage deals.

The guidance for 2020 CAPEX is somewhere in between $8M and $10M. Given that they’re not planning on opening any company-owned restaurants, I’d like to better understand why the much larger CAPEX.

3.8. DIVIDEND

The company doesn’t pay a dividend.

3.9. PROFITABILITY RATIOS

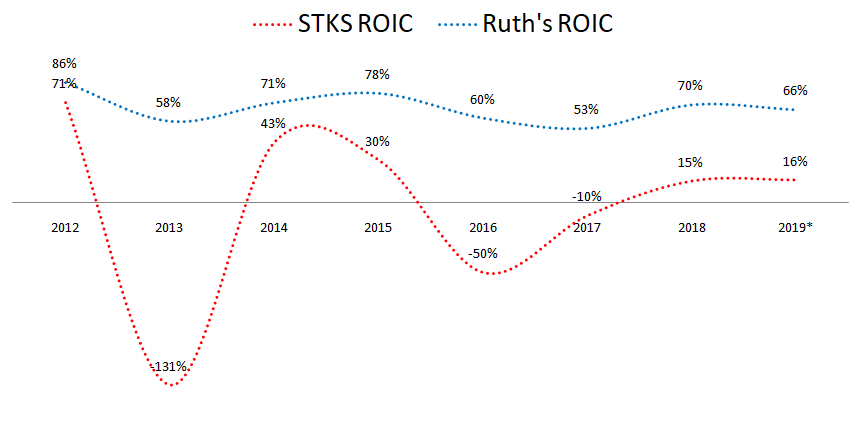

Given the high volatility in profits, the Return-on-Invested-Capital has also been erratic, but in 2018 this was 15% and it seems to be going higher this year, at 16%, a far cry from Ruth’s Return-on-Invested-Capital of 66%(!?!)

3.11. PRICE RATIOS

To be fair, I should account for the contribute from Kona Grill to the 2019 numbers, but I purposely left it out. Because of that, the ratios I’m presenting here are of limited help to us, but nonetheless I’m going to look at them very quickly.

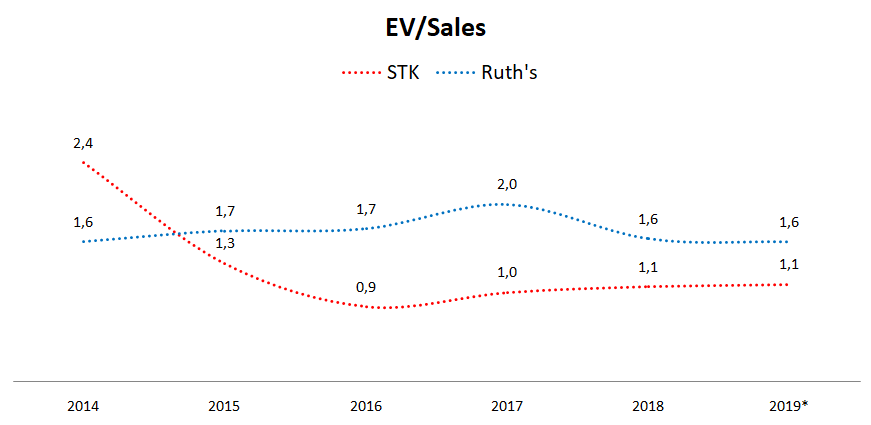

Ruth’s EV/Sales is a bit higher than STKS’.

STKS’ EV/EBITDA is near 13 while Ruth’s is 10.

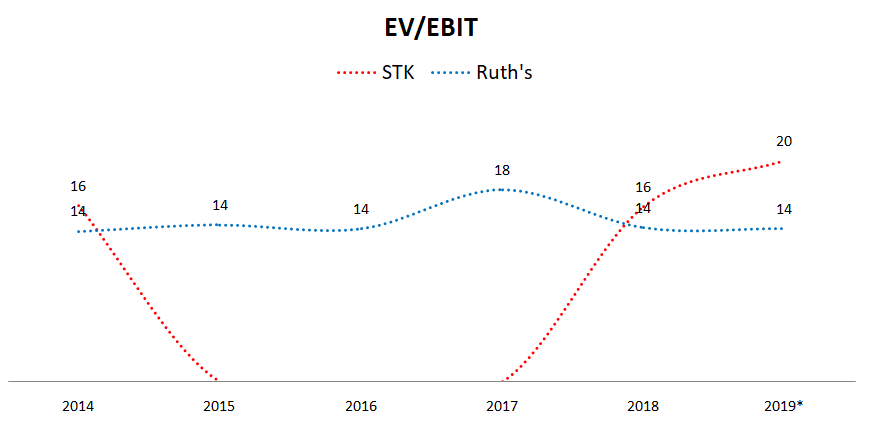

STKS’ EV/EBIT is 20 while Ruth’s is 14 (and fairly stable)

STKS’ Price/Cash from operations is 16 while Ruth’s is 12.

Looking at all of these, I would say that Mr. Market is putting a premium to STKS’ growth prospects.

4. GAINING PERSPECTIVE

4.1. INDUSTRY AND STRATEGY

Now to the Kona Grill acquisition.

After a couple of years steering the company to an asset-light model based on licensing or just managing restaurants, it seems that Manny has come across a once-in-a-lifetime opportunity when he saw that the bankrupt Kona Grill was selling 24 of its restaurants to pay its creditors. Why else would he make such a radical shift in his strategy?

Let me just say that we are actually looking at two different industries here, the fine dining (STKS) and the casual dining (Kona Grill), and although they may seem alike, they aren’t. By sheer coincidence, recently I found a great twitter thread about the misfortunes of casual dining restaurants (including Kona Grill). If you want to understand what’s happening to the industry right now, you should read it.

It seems that the casual dining industry is much more difficult than the fine dining industry. These restaurant chains are going through a really rough period. This is due to several reasons, some of the most important (in my opinion) are – poorly executed growth fueled by large amounts of debt, the reduction of foot traffic in malls across the US, the increase in competition and the dissemination of food delivery apps.

The reason for the Kona Grill fall? Probably a mix of all them.

Kona Grill had 42 restaurants at the end of 2018. During its bankruptcy process, Manny was able to get his hands on the 24 that were good and profitable for $25M. AAH, the joys of capitalism!

We’ve been looking at several metrics regarding the “old business”. The great question now is: Will Many Hilario be able to turn those 24 Kona Grill restaurants into cash machines? And given the fact that these small casual dining chains are like a commoditized product, how can one take people out of their homes to go to a mall and have dinner while they can just order it through their phones?

Manny is tackling this problem with the same recipe he used at STKS. He is turning Kona Grill into a slightly more party-like venue, with louder, more upbeat music where the happy-hour will bring in the customers which will be around for dinner and probably a little later. A place where the bar takes center stage. Manny is counting on raising high-margin beverage sales to 35% of revenue from the current 30%.

But the thing is. Running party-restaurants in prime locations, usually in the city center is one thing, doing it in malls across the suburbs of the USA is a completely different one. Will it work? Well, if those 24 restaurants are already profitable like Manny has said, maybe this will work out.

And after integrating these 24, he can license them across the country getting back to the old strategy of a capital-light business model.

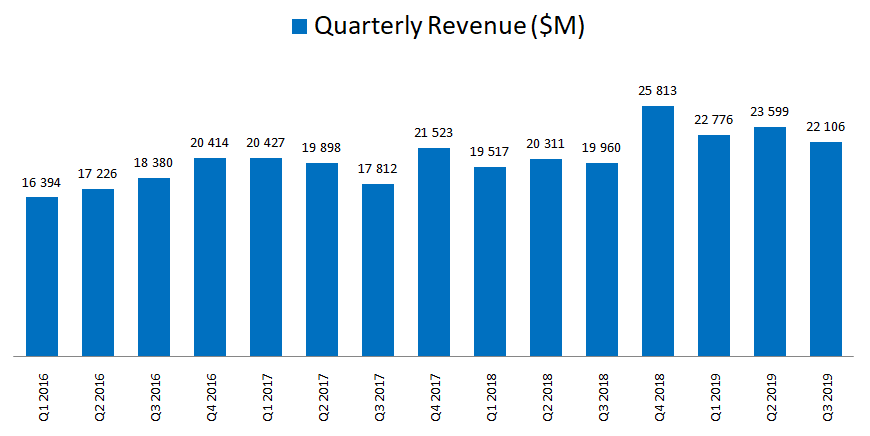

4.2. SEASONALITY

There is some seasonality to One Hospitality Group. Typically the second and fourth quarter are the strongest ones.

4.3. TYPE OF PLAY

One Group Hospitality is definitely a turnaround play.

4.4. RISKS

The fine dining industry faces a lot of risks. The most important ones, in my view are:

- The fact that this industry is highly influenced by discretionary spending.

- Now that Manny bought Kona Grill, there is a high risk of unsuccessful integration. Kona Grill is a casual dining restaurant chain. And that’s a different game than the fine dining.

- Shortage in foods and price fluctuations. 35% of the food and beverage cost is related to the purchase of beef. Although the company says that they have been successful in passing that cost on to their customers by increasing the price of the menu, there is only so much you can raise prices before customers start to go to other restaurants.

- Most of the company’s restaurants are leased with terms ranging from 10 to 15 years with renewals ranging from 1 to 5 years. If the company closes a restaurant, it will remain committed to perform its lease obligations until the lease term.

- Any health or food issue.

- Labour inflation.

5. OVERVIEW AND CONCLUSION

5.1. OVERVIEW

One Group Hospitality is a simple business and one that is easy to understand. When things go well, the business goes well, when things go bad, there’s no escape.

Is this the best business in the world? No. Is this a business protected by an unsurmountable moat? Definitely not. Fine dining is a very competitive business. Not to talk about the casual dining business.

I’ve spent several days diving into the company’s financials, listening to the conference calls and compiling data into an Excel model. Did I have to do this to understand this story and get an idea of the cheapness of STKS?

Definitely not, but I am compiling detailed excel sheets for all the companies I analyse so I can follow them closely without many surprises and know when something’s changing. Making estimations for next year was quite simple actually:

In 2020 sales will probably be around $205M (company guidance) and EBITDA (regular, not adjusted) will be around $16M. At a 10x multiple we would get an EV of $160M, which would be equivalent to a market cap of $124M ($2M cash and $38,3M debt). With 29,9M diluted shares this would lead to a $4,1 share price or an upside of 26%. What about after next year? Well, I think it’s anyone’s guess.

I started my research wanting to like this story and the truth is that I’m rooting for Manny and for this to be a successful turnaround. But how sure am I about the Kona Grill turnaround? And why am I not quite 100% comfortable with it?

In all truth, two things keep me from entering this stock: a) the arguments of bad quality of earnings from Fire_303 at valueinvestorsclub.com (which I confirmed) and 2) the fact that Kona Grill is in the brutal casual dining space which will fall like a rock whenever the economy turns sour.

Regarding the first one, here’s a little detail that I can’t stop thinking about. What Manny has said on the 2018 Q4 Conference Call:

“Because, frankly, one of the things that I do want to establish culturally here is that the numbers that we go out and tell people — we make the numbers, which actually is exactly why we met exactly the high end of our guided EBITDA for the numbers. So we do try to create a culture of meeting the numbers that we lay out in our guidance.”

Manny Hilario 4Q18 CC

Although having a management team that can actually reach its own goals is a great thing, that affirmation together with the poor quality of earnings and some rule bending regarding the accounting has left me a bit on my guard. This is one of the red flags identified in books like “Quality of Earnings” or “Financial Shenanigans“.

Regarding the second one, do I have a crystal ball to tell me when will the economy turn south? Of course not. But I would be much more at ease with this fact if the company hadn’t bought the Kona Grill and staid with the asset-light model. Now that they own a lot more restaurants, the risk is much higher.

Although both STKS and Kona Grill are subject to discretionary spending, when you want to go out for dinner and have a party night nothing will substitute something like STKS but the same doesn’t happen with Kona.

Kona is in a space that is highly affected by competition and nowadays delivery apps are a dime a dozen and cloud kitchens are coming. Even if Manny is able to transform the dining experience over at Kona, I’m not sure about the company’s future prospects.

Manny now owns not one, but two brands that he can scale up. He went from 11 owned locations to 35 with this move. I wouldn’t be admired to see him turn Kona around and start selling licenses, probably even licensing back some of those 24 locations. This has the potential to be huge, but the downside is too big or too unknown for my liking. I will eagerly wait until the full year results are out.

If you liked this analysis, you can join our community by clicking the button below:

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.

Warning: Undefined array key "cat" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 176

Warning: Undefined array key "tag" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 177

Warning: Undefined array key "css_id" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 200

Deprecated: preg_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /home5/manuelbean/public_html/wp-includes/formatting.php on line 2431