Tinybeans

a 100 bagger social network?

By Manuel Maurício

September 10, 2021

Symbol: TNY (ASX)

Share Price: AUD$1,14

Market Cap: AUD$52 Million

Tinybeans is a tiny social network from Australia trying to become the go-to place for all things parenting.

Tinybeans was originally an app where parents and grandparents could share their children’s photos, track milestones, and journal their kids evolution.

It worked as an invitation-only, highly secure app (whatever that means) where families felt at ease to share photos and videos of their tiny ones (aged 0-6 years old).

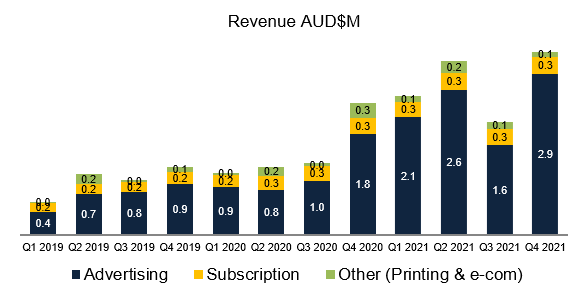

As a freemium model, the revenue came mostly from advertising, with a small percentage coming from paid subscriptions and printed photographs that can be shipped to users’ homes.

But recently the company decided to turn its business model around and become an all-things parenting platform monetized via paid subscriptions at $60 per year per family.

To follow up on this plan and to improve its content, in 2020, the company bought Red Tricycle (redtri.com), a website focused on creating and sharing content for parents of kids aged 6-12 like “what to do with your kids on the coming Sunday?“.

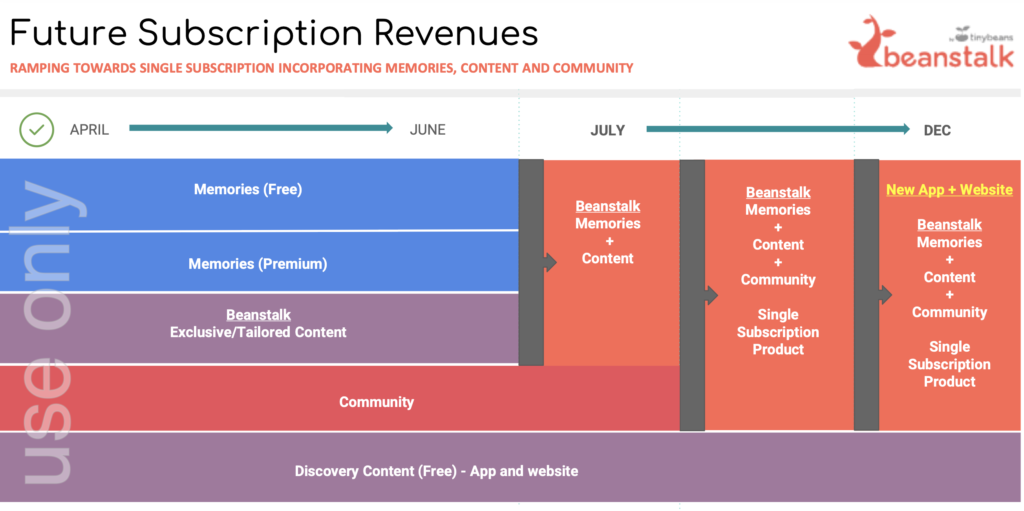

The slide below shows the changes that are taking place as we speak.

The previous features are all coming together in a paid bundle. With this new app, users will be able to upload photos and videos of their little ones, but also gain access to tailor made content, a thriving community, and somewhere in the future there will be a marketplace and e-commerce capabilities.

Users must now sign up for a 30 days free trial, by filling out their credit card details and after those 30 days are over, they’ll become paying subscribers.

This is a bold move. If you go to the Google Store, you’ll find many negative reviews as the company decided to put a paywall on the app with little warning, even for those families that had been using it for years. Needless to say that those users, who had all the photos of their kids inside the app, weren’t happy.

This is a misstep that I don’t understand. All it took was to send an email and create a pop up inside the app letting users know of the coming changes.

Either way, I’m curious to know how this model will work out in the end. Maybe these guys have it all though out.

ADVERTISING FOR PAID USERS

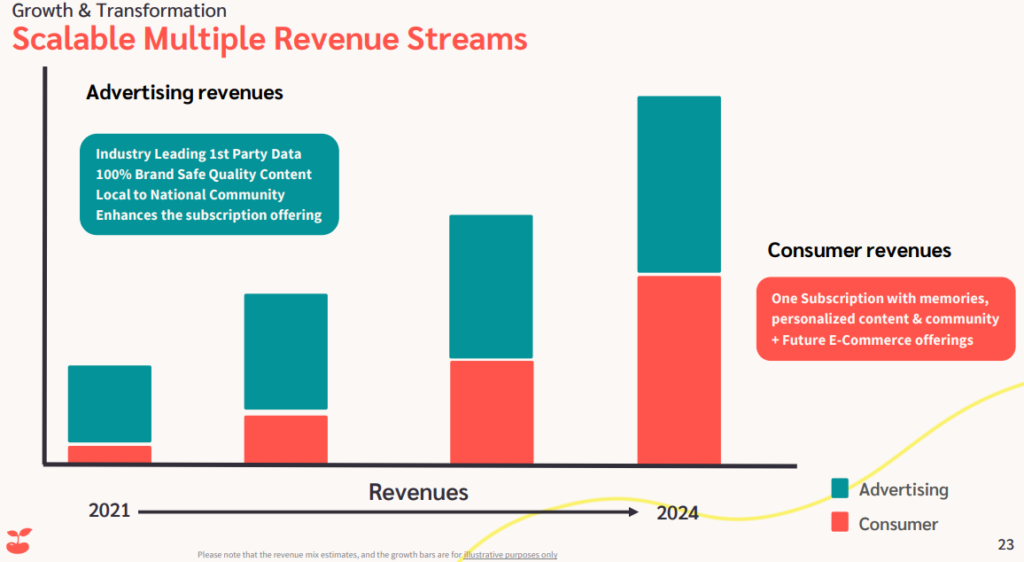

And on top of charging a subscription fee, the company will still show ads to its paid users.

Now, the way the advertisement works inside Tinybeans app is different from that of Google or Facebook where anybody can set up a business account and upload some ads that will be screened by the Artificial Intelligence.

Tinybeans works with a lot of big brands (think Lego, Disney or Youtube Kids) and will talk to these brands in person, much like an ad agency would do.

Tinybeans’ marketing team will be curating the advertising content to the extent that they’ll even be able to influence the content to create a positive atmosphere inside the platform.

This is great, but I don’t think it’s that scalable. It also reminds me of what Mark Zuckerberg (Facebook CEO) said recently about his highly advanced Artificial Intelligence being one of Facebook’s competitive advantages. It’s likely that Tinybeans just doesn’t yet have the technology to do all the filtering need for compliance reasons.

The management is guiding for the revenue coming from the subscriptions to equal that of the advertising business. This is a lofty goal.

Although user growth has been mostly organic through word-of-mouth, to reach that goal, these guys will need to invest a lot of money into customer acquisition.

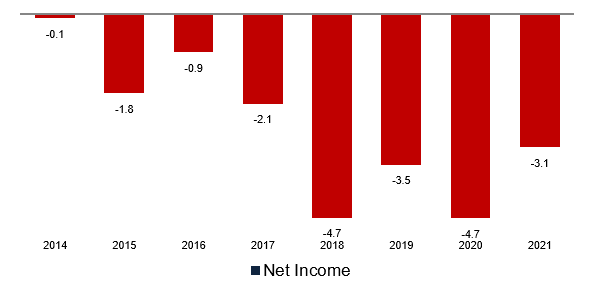

But they’ve been losing money for years.

So how will they get the cash needed?

100% of Tinybeans’ revenue comes from the USA and the management is in NY so there’s no real reason for it to keep being listed in an Australian stock exchange and that’s why we should be seeing the company listing in a US stock exchange in the next 12 months or so.

The CEO mentioned that they’ll be seizing the opportunity to raise the cash needed to fuel the acquisition of new users.

Conclusion

Tinybeans is a story stock.

These guys want to become a Software-as-a-Service platform with a mix of Facebook/Instagram and Alibaba, earning money not only from paid subscriptions, but also from listing fees and transaction fees for the products that they help selling. Smart!

The kids and parenting industry is gigantic, so if they’re able to grab just a tiny fraction of that, they’ll be making a lot of money.

But it’s too early to tell.

If we were talking about an app that was growing organically without much changes to the user experience, maybe I would consider investing in it.

But they’re turning it into a completely new thing. And although, on paper, it all sounds amazing (“the number 1 parenting app in the world”), there’s a lot that can go wrong.

We don’t know how many users will churn, we don’t know if the users will like the ad load inside a paid subscription, if there’s going to be interaction inside the community (this might not seem hard to do, but believe me, it is – I’ve been trying to cheer up the Subscribers FB group for one and a half years and you can see the results).

These guys are betting that their new model will eventually work out. But will it?

This is more of a Venture Capital/Startup kind of speculation. There could be huge gains, but the risk is immense. There’s no guarantee at all that it will work.

I’ll keep following Tinybeans. If it turns out to become a successful story, I’ll have plenty of opportunities to become a shareholder.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.