All in Stocks Portfolio

The spreadsheet below may take a few moments to load. Please be patient.

Closed Positions

Closed Positions

Operations executed

Operations executed

Dividends received

Dividends received

The All in Stocks Portfolio is a virtual portfolio created to allow subscribers to follow my track record.

The strategy behind it is to own a diversified collection of the best businesses I can find to be held for the long term or until the story changes. It will also be useful to gauge the analytical and investment criteria used.

In order to make this the most realistic possible, transaction costs and commissions will be accounted for in every transaction, penalizing high activity while rewarding long holding periods.

Any change to the portfolio will be communicated to the subscribers until 12:00 on the day of its incorporation, thus giving time for subscribers to act upon such information if they wish so.

If the communication comes after 12:00, the stock will be bought in the next day,

The price at which the stock will enter the portfolio will be the closing price of the day of buying.

This might hinder the portfolio’s performance sometimes, but I feel that this will only happen in certain cases of microcaps or very illiquid stocks.

PORTFOLIO MANAGEMENT

The portfolio started with a value of €100.000. This is merely an indicative value.

I chose it because it’s a round number. It could be €10.000, €20.000 or €200.000. It doesn’t really matter as long as we are talking about “small” amounts.

If you’re planning on investing a few millions, it might be hard for you to invest in some of the smaller and less liquid companies that I choose for the portfolio.

I don’t mind holding cash if I feel it’s the right thing to do. I don’t care much about opportunity cost if I don’t find good opportunities to deploy my capital. As Warren Buffett’s life-long business partner once said: “There are worse things than sitting on a huge pile of cash“.

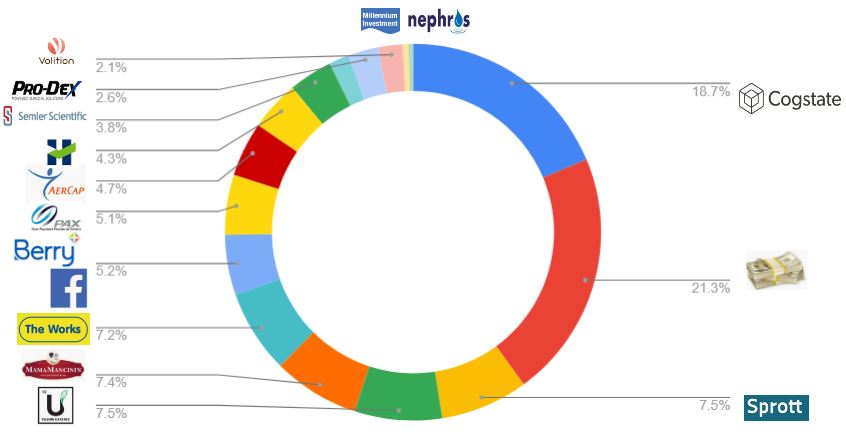

I aim to hold a diversified portfolio of 10 to 20 stocks, depending on the opportunities that I find.

Regarding the weight of each position, I’m not a huge fan of equal weight positions. If I have more conviction in one stock than in another, I will buy a bigger chunk. But I am only human and I will make mistakes. That’s why no position will be higher than 10% at cost and there will also be a diversification of industries.

DIVIDENDS

The dividends will automatically be added to the cash.

COMPARISON

There are several indexes to which we could compare the returns of the Portfolio and none would be perfect. Given that I will be looking for attractive investment ideas across the world I think the MSCI World will be a good benchmark. I chose the MSCI World for comparison, but I could’ve chosen the S&P 500 which is broadly seen as a reflection of “The Market”. Either way, I think both of these represent a high enough hurdle rate for a sound comparison. Let me remind you that there are very few money managers in the world that can beat it.

DISCLAIMER

The All in Stocks Portfolio is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.