Aercap

the comeback

Aercap

the comeback

By Manuel Maurício

August 23, 2022

New to AerCap? Read my previous posts here.

I’m currently reading the book Capital Returns by Edward Chancellor. In it, the author makes the point about investors focusing too much on the future demand for a certain product/service and not so much on the future supply. He’s of the opinion that it’s much more important to focus on what the competitors are doing and in what part of the investment cycle the industry is.

It’s obvious that the supply side is important and I must confess my failure in focusing more of my attention on it. With that in mind, I decided to read both AerCap, AirLease, and Avolon’s conference call transcripts this time.

As a broad statement, the three companies are seeing the same 2 trends:

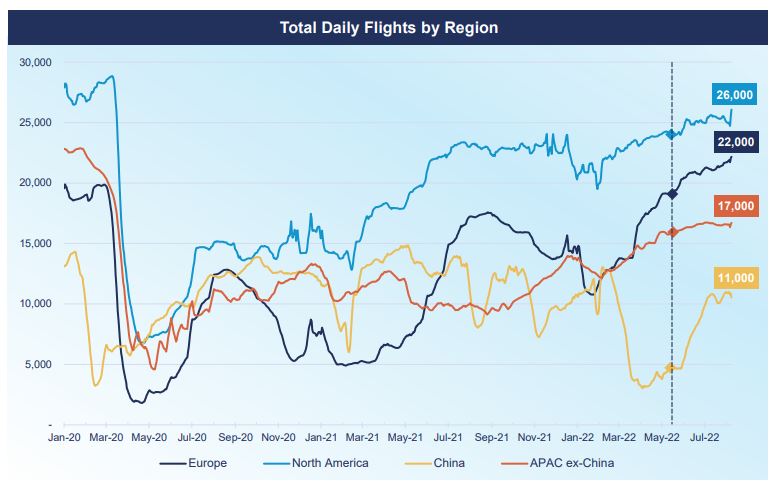

1 – Travel recovering globally: Of the 190 countries in which AerCap operates, over half of them surpassed 80% of 2019 traffic in June 2022.

Ryanair alone flew 9% more passengers in the second quarter of 2022 compared to the second quarter of 2019 (I was one of those). Impressive.

2- Supply constraints likely to persist for the foreseeable future, supporting leasing demand. This is somewhat akin to what is happening with the auto industry. As the auto makers can’t manufacture enough cars to meet demand, used car prices are going up. I find this funny as AerCap reported a big impairment charge during the pandemic due to the declining value of its airplanes. I don’t think they will reverse that impairment now, they’ll probably just harness that overvaluation through the higher margin on the sale of old airplanes.

And it’s not only Airbus and Boeing that are having trouble spitting out airplanes as fast as the market demands. There’s not enough engines to keep up with demand. Airlines with aircraft on the ground are requesting spare engines to be diverted from new aircraft, thus reducing the delivery rates from Airbus and Boeing.

When airlines can’t get their engines from the OEM’s, they turn to the leasing companies. And that’s great for AerCap as it just bought GECAS’s which came with a big engine leasing business.

In the most recent edition of the Farnborough Airshow – which is typically where the majority of contracts for new airplanes are signed – there were very few contracts signed. This isn’t so much because of lack of demand, but due to lack of availability by Boeing and Airbus to deliver. As a result, lease rates are going up.

Financials

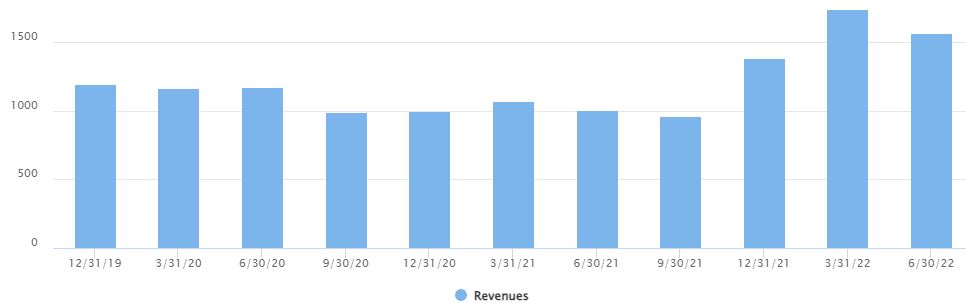

Although the company is seeing increased activity, the revenue coming from the basic lease rents was lower than the previous quarter given the loss of revenue from the aircraft and engines that were on lease to Russian Airlines.

Not only that, but because of accounting rules relating to the acquisition of GECAS, the revenue is also “artificially” lower. This is one of the reasons why I dislike investing in companies that grow by acquisitions. It makes it very hard to compare numbers over the years.

The company sold 20 aircraft, 5 engines and 4 helicopters, for a total of $386 million with a sale margin of 10%.

As an aside, the FAA recently gave the green light for the 787 Max, whose production had been halted due to the design issues that led two airplanes to crash. From what both AerCap and AirLease are saying, the demand for these airplanes is strong.

Balance Sheet

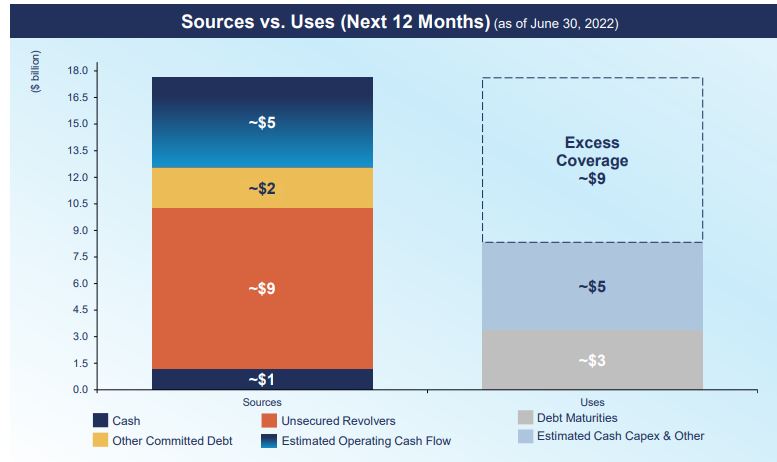

The sources to uses coverage ratio for the next 12 months is of 2.1x – well above the target of 1.5x.

The leverage ratio was 2.8 to 1, down from 2.9 in the last quarter. The target is 2.7 by the end of the year. This is remarkable as the company just impaired $4 billion after the pandemic and the Russian sanctions. The low level of debt should help the company get better ratings from the rating agencies and it should also lead to increased buy backs.

In June, Fitch revised AerCap’s outlook to positive and, apparently, there have been some positive commentaries from Moddy’s too. AerCap targets a mid-BBB rating from the 3 ratings agencies. This is important as the better the rating, the lower the cost of funds for AerCap – a big competitive advantage.

Valuation

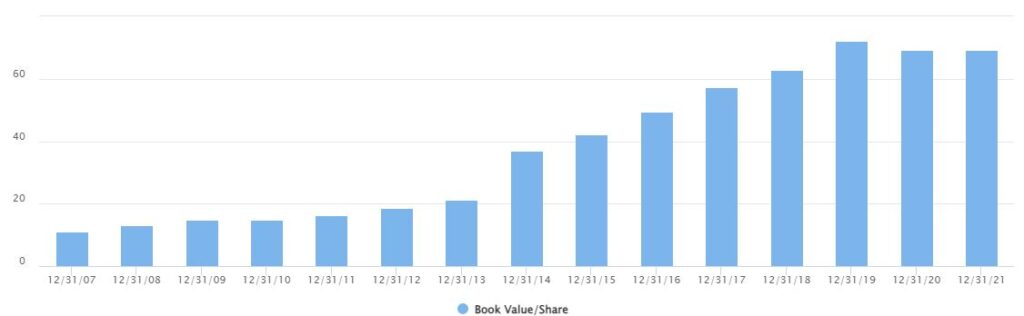

Right now, the book value per share is $61.11 and the share price is $47 – a discount of 23%.

The adjusted Price/Earnings ratio is around 7x.

We should be seeing these companies trade slightly below book-value and around a Price/Earnings of 10x, but the market is usually (and maybe fairly) weary of such businesses and that’s why they’ve been so cheap for so long.

Answering Diogo Perneta

In the Forum, Diogo Perneta was asking me if the company can keep compounding book value per share. The answer is of course it can. AerCap grows, not in a recurring steady way, but in lumps (just like Berry Global) when it buys other leasing companies.

Then it engages in this financial engineering of selling airplanes at prices higher than book value only to use the proceeds to buy back shares at under book value. I’ve written about it before. This creates tremendous value for shareholders by increasing the book value of each share.

Diogo also asked what happened in the period between 2014 and 2017 that led the share price to stay flat. Let’s start with the revenue:

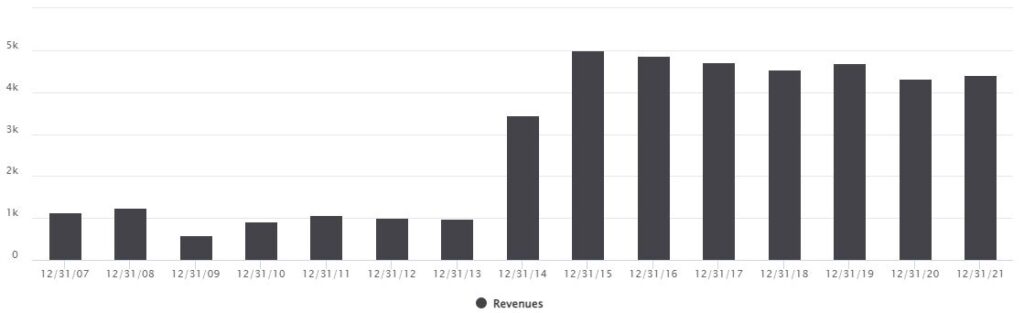

As we can see from the chart below, the revenue increased massively in 2014 and 2015 with the ILFC acquisition, but then it gradually went down year after year.

This happened because just after the acquisition, AerCap immediately started selling the older airplanes from its fleet only to buyback shares.

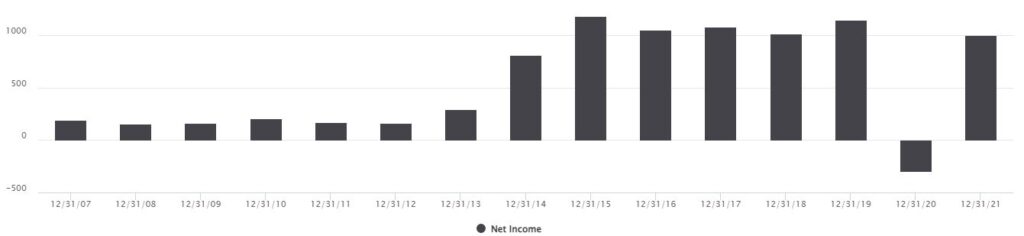

This led to lower profits…

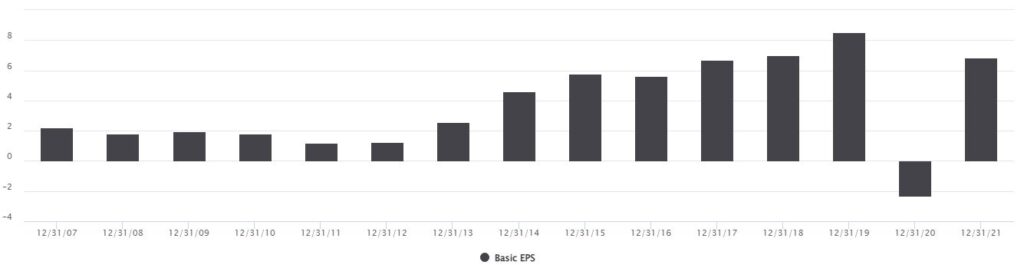

But as the number of shares was going down at a faster rate, the Earnings-per-Share was going up. (a good thing for shareholders).

Now, why was the stock flat for that period of time? It’s always hard to say, but I think that the market didn’t quite understand the acquisition and the amount of shareholder value that Aengus Kelly, the CEO, was able to extract from it.

Conclusion

There is now much more propensity for the airlines to lease their airplanes rather than to own them. Aengus Kelly mentioned that, previous to the pandemic, he did not believe that leasing would surpass 50% of the market, but it’s now 65% and it doesn’t look like it will stop here.

Comparing to AirLease, which is much more dependent on growing its revenue by buying new airplanes, this supply-tight environment obviously favours AerCap the most, especially so after the acquisition of GECAS, but both are top notch companies in their industry.

For all of these reasons, AerCap will remain in the Portfolio.

If you want to discuss AerCap, head over to the Forum and let me know your opinion.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.