Aimia,

a fundamental analysis!

July 08, 2019

TICKER: AIM.TO

ISIN:

SHARE PRICE: C$3,86

MARKET CAP: C$451M

July 08, 2019

TICKER: AIM.TO

ISIN:

SHARE PRICE: C$3,86

MARKET CAP: C$451M

1. INTRODUCTION

Ever since I’ve read Jeff Gramm’s book “Dear Chairman: Boardroom battles and the rise of shareholder activism” I’ve been fantasising about being at the level of big activist investors like Buffett, Ackman or Icahn. Until that day arrives, I am just fine investing alongside them.

One of the money managers I follow is Matt Sweeney from Laughing Water Capital. I love reading his quarterly letters and I’ve noticed an activist situation on one of his holdings – Aimia.

Earlier this year, he wrote two very cool letters to the directors of Aimia telling them he was tired of watching them destroying shareholder’s value and asking for their resignation. Two of those directors have already left but there are four more to go. Adding to this, the largest shareholder in the company is a value oriented investment firm called Mittleman Brothers who also wrote letters to the board of directors telling them how much they sucked. I love it.

The Mittleman Brothers have two board seats (one for one of the brothers and another one for the CEO that was brought in by them last year) but these two seats were earned through a standstill agreement that blocked them from voting against the board of directors until last Tuesday, 2nd of July . What everyone was waiting to happen (until Tuesday) was for an extraordinary shareholders meeting to be called by Mittlemann to kick the rest of the directors out of the company. That announcement hasn’t been made so far so the Mittleman Brothers might be taking a different strategy. I’ll get to that in a minute.

Of course, all of this is happening because both Matt and the Mittleman Brothers have done their math and have reached the conclusion that the company is worth much more than what you can buy it for today. I’ll also get to that but to begin with, let’s look at the company’s website.

2. BUSINESS OVERVIEW

2.1. BUSINESS DESCRIPTION

Until the recent sale of Aeroplan to Air Canada, Aimia was mostly a loyalty program owner and operator. Aeroplan was a loyalty program co-owned by Air-Canada and Aimia.

How does a loyalty program work? I must confess I’ve struggled with this one for a while myself but thanks to the help of fellow investors like Cigarbutt1 and others, I’ve been able to simplify it enough for everyone’s understanding. Here it goes:

If you are acquainted with Warren Buffett and his investment history you might remember that he once owned Blue Chip Stamps, a trading stamps company that eventually bought Sees Candy. Aimia’s loyalty businesses are a lot like Blue Chip Stamps.

Aimia issues and sells units/points/miles to its “Accumulation Partners” which are mostly credit card issuers (Banks) but could be your local restaurant. These partners offer those points to their customers so the customers use their credit cards more often. After accumulating a certain number of points, the customers can then redeem them and trade them for flights or discounts on an affiliated air company (Redemption Partners). It is only when this redemption happens that Aimia has to pay for these flights.

When Aimia originally issues those points and in return gets money for them, that money isn’t recognized as revenue (on the income statement) but rather as deferred revenue (a liability on the balance sheet) because it’s something that the company now owes (in the form of a flight trip or something else).

It is only when a customer accumulates a certain amount of points and uses them to get a free flight or a discount on a plane ticket that Aimia recognizes it as revenue. At that moment, the part of the money associated to that customer that was on the “deferred revenue” liability transitions to the income statement as revenue and the related cost is also recognized.

While customers don’t redeem their points, the deferred revenue (pre-paid cash) is considered float (like in an insurance business). Money that doesn’t belong to the company but that the company holds and can invest to make a profit. The average time between issuance of a point and its redemption was usually 30 months in the case of Aeroplan.

When a customer doesn’t redeem those points, it’s called a “breakage”. The breakage let’s companies – like Aimia – know if a loyalty program is dying or not. The bigger the breakage, the less people are using the program. And yes, if there is a breakage, that money belongs to the company.

The loyalty programs can be very good businesses. Customers are paying for something they won’t be needing until later (if ever) and the company will only be delivering the products weeks, months or even years down the line.

Here is a picture in case you are a more visual person like me.

2.2. LARGEST SHAREHOLDERS

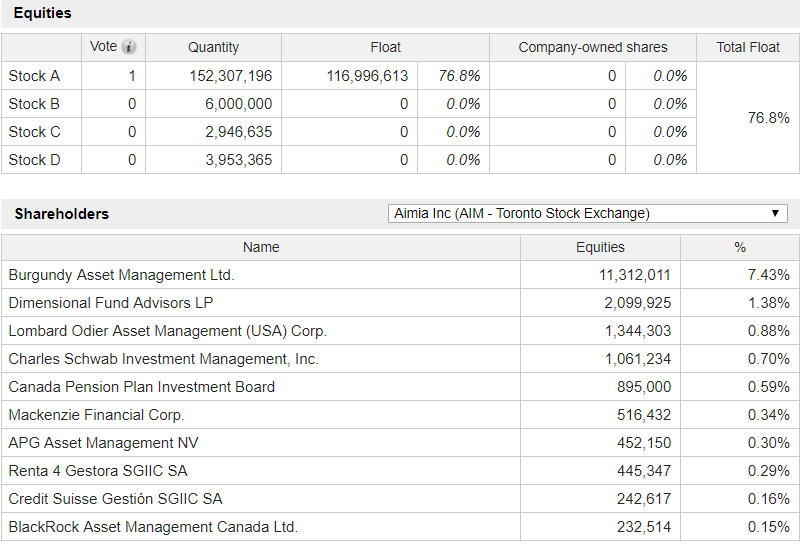

As previously explained, the largest shareholder in Aimia is the “Mittleman Brothers” who unfortunately doesn’t appear in the table shown below. I use marketscreener.com for this but I must say that I must find a better source to collect this data from.

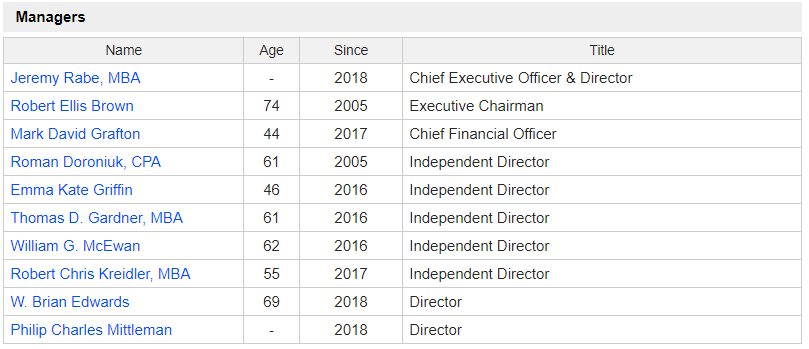

2.3. MANAGEMENT TEAM

Not only did Mittleman put two of its guys on the board, it also put Jeremy Rabe as the CEO. Rabe was chosen for his experience with loyalty programs but now that the company has sold Aeroplan – its major asset – to Air Canada and the company might be heading to a different kind of business, he might not be the right guy for the job.

Rabe has recently said that he wants to further invest in the loyalty space while Mittleman wants to run from it as fast as he can, so it will be interesting to see how this plays out.

3. HISTORICAL CONTEXT

3.1. LONG TERM CHART

Aimia’s stock has been a horror movie, especially as of March 2017 when Air Canada announced it wouldn’t renew its partnership with Aimia for the Aeroplan loyalty program.

Since then, Aeroplan has been sold to Air Canada and the stock has bounced back a bit but not a lot.

3.2. MARKET CAP AND SHARES OUTSTANDING

With this big sell off, the Aimia’s market cap is $451M today…

…but at least the number of shares outstanding has been decreasing over the years. One of the good things this board of directors has done recently is to take advantage of the depressed prices and buy back huge amounts of stock.

Earlier this year the company bought back shares worth C$150M, or about 10% of the shares outstanding.

Note: All currency in CAD unless stated otherwise.

3.3. SALES - OPERATING INCOME - OPERATING MARGIN

The 2018 revenue was C$167M , down from $232M in 2017. The big fall we see from 2016 to 2017 is due to the selling of Nectar (another loyalty program) and Aeroplan so it’s kind of difficult to compare apples to apples here.

3.4. SALES BY GEOGRAPHY

The sources of revenue are now well diversified with Canada and the UK as the largest contributors to the top line (jargon for revenue or sales because it’s the first line on the income statement).

3.5. SALES BY SEGMENT

As we can see on the next chart, the Aeroplan business was the one bringing in the big bucks to the company. Now that the company has sold Aeroplan to Air Canada, Aimia is just a collection of smaller businesses, cash and NOL‘s (Net Operating Losses).

In case you are wondering, the ILS in an acronym for “Insight and Loyalty Solutions”.

3.6. NET INCOME

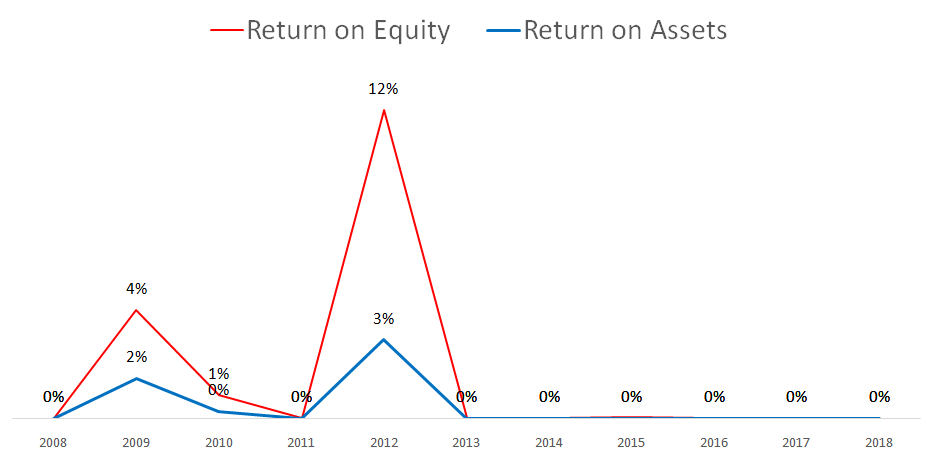

And here is where we get to the point where I’ve struggled. In the past twelve years, the company has turned a profit on only two of them, the last being 2012. How can a company be unprofitable for so long?

3.7. CASH FLOWS

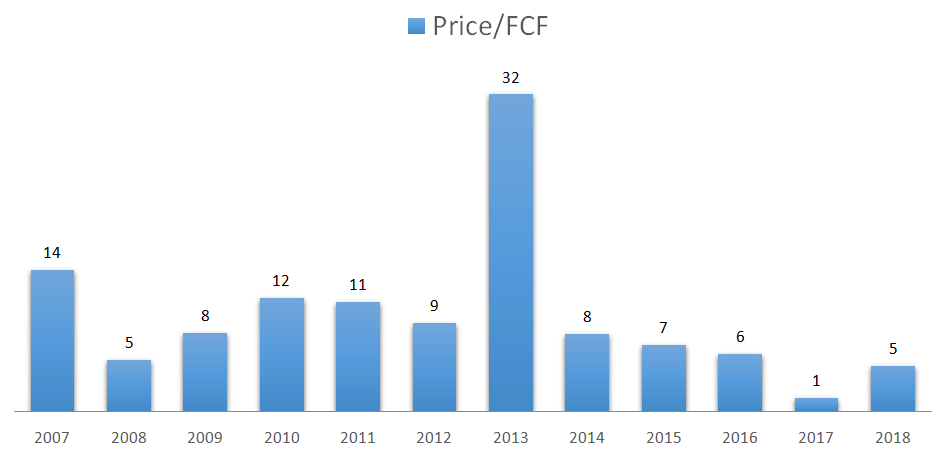

Because although the net income has been negative for most of the company’s recent history, the company has been generating cash all along . The Free Cash Flow has been positive for all these years. Who would’ve thought!

This is why one metric alone isn’t enough to analyse or value a company. We’ve got to get the whole picture.

3.8. PROFITABILITY RATIOS

These can’t help us much as the net income has been negative.

3.9. FINANCIAL RATIOS

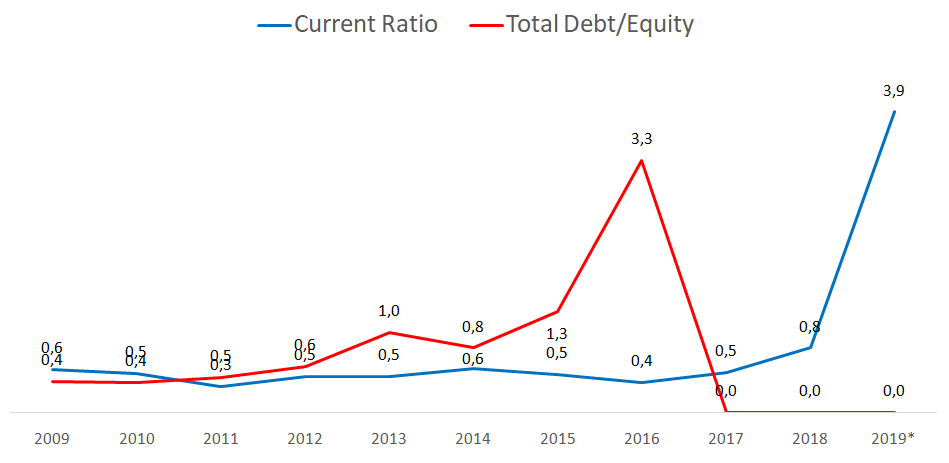

As expected, this is a negative working capital business so the current ratio is usually lower than 1 (current liabilities are higher than current assets) and the debt to equity ratio is 0 because the company has had negative equity for the last couple of years.

Fortunately the company has no debt and a lot of cash now.

3.10. PRICE RATIOS

As seen above, if we want to look at this company through a multiple analysis, we should be looking at the FCF. The current P/FCF is 4!?!?! which goes to show just how bearish Mr. Market is on this stock.

4. GAINING PERSPECTIVE

4.1. INDUSTRY AND STRATEGY

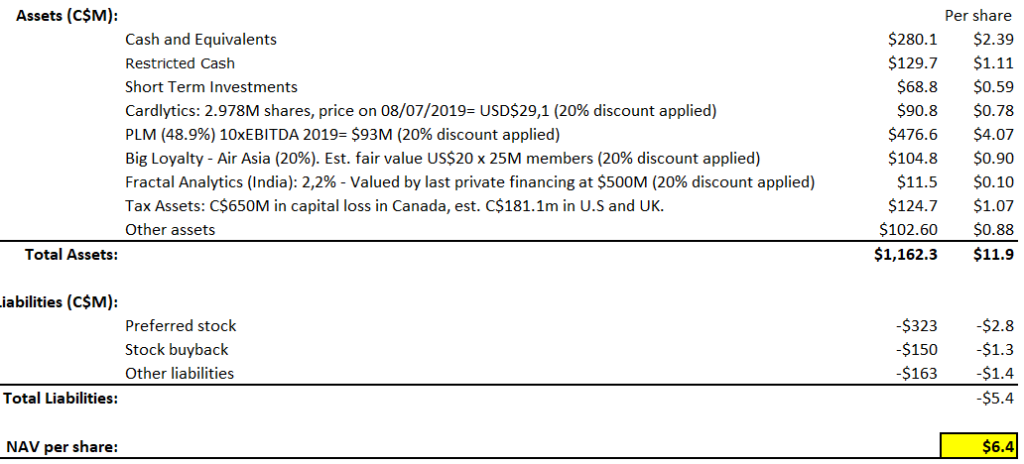

So the whole bull thesis for this stock is that the sum of the parts (SOTP) is greater than the whole. If the company were to liquidate its assets today it would be able to gather more cash than what the whole company is currently being sold for.

Aimia is now composed of several “small” businesses, none as strong or as big as Aeroplan so I won’t be writing extensively about each one individually. If you’d like to further discuss these you can do it on the Facebook Group.

Given that the latest financial disclosure was related to the Q1 that ended on March 31, and in the meantime there has been a repurchase of shares and the operations continued to run, the calculations below might not be the most accurate but the point of doing a SOTP valuation is to assess if the company is trading at a big enough discount to NAV (Net Asset Value) where small inaccuracies aren’t really going to materially affect the big picture:

Even being conservative, I get to a NAV of C$6,4 per share, or 66% higher then today’s stock price.

4.2. SEASONALITY

Aeroplan was seasonal. The first half of the year was when members redeemed their points and the second half of the year when members accumulated points. Now that Aeroplan was sold, the ILS business has a different seasonality with higher redemptions around christmas season.

4.3. TYPE OF PLAY

Aimia is both a hidden assets play and an activists play.

4.4. RISKS AND COMPETITION

As the company is at a turning point and its business has been profoundly changed, I’ll be looking at the risks of the current situation rather than the risks of each business the company owns:

- The risk of unexpected events. This might seem like a joke but it isn’t. There are several ways this can play out so I might be missing something.

- The company might make some ruinous acquisitions in the loyalty space.

- The company might keep operating ILS that is a money losing business.

- PLM can’t be sold for how much it’s supposedly worth.

5. OVERVIEW AND CONCLUSION

5.1. OVERVIEW

I just loved to research this company. I get all fired up when I see activists coming in and unlocking potential that is hidden in plain sight.

This story is far from being over and no one knows exactly what will happen and that’s why this one is so exciting. I think the following scenarios are the most likely to happen in the future:

1- Mittleman transforms Aimia in his own Holding Company (much like Buffett has done with Berkshire). This way investors would benefit from the NOL’s in the future. This strategy might make the share price to continue depressed for a long time.

2- The company is sold to a competitor. These NOL’s are just too attractive for other profit making companies so a sale is definitely a possibility and my favourite outcome.

3- The company is liquidated. On such scenario investors might get more than $5 in return but the NOL’s won’t be of use to anyone. I’m not sure Mittlemann will let this happen.

4- By not making a move, Mittleman allows the share buy back to be carried at great prices and he might buy the whole company at a super depressed valuation after the buyback is done. This doesn’t seem a very likely scenario due to the fact that his investors should be pressuring him to make a quick profit out of this situation.

Whatever happens, I’ll be watching very closely.

Did you enjoy Aimia’s story? I would love to hear your opinion. You can share it with the rest of us on our…

5.2. CONCLUSION

This section will be available to paying subscribers in 2019 when we launch the Portfolios.

Don’t forget to check our other analyses.

6. DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.