Air Lease

Q3 2021

By Manuel Maurício

November 09, 2021

Aercap will be posting earnings this week so a look at AirLease is called for.

Airlease posted earnings last Friday and the market clearly liked them.

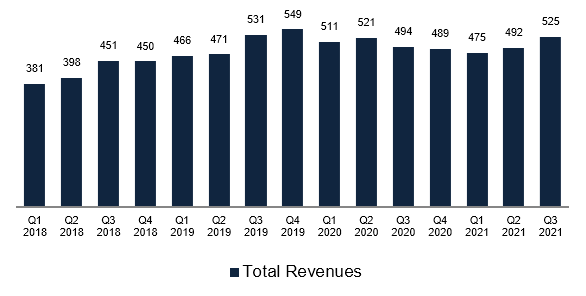

As expected, the revenue went up, not only from the year-ago-quarter, but from last quarter as well having reached $525 million.

In fact, this was a record quarter if we look solely at the rental income and forget about the sale of airplanes.

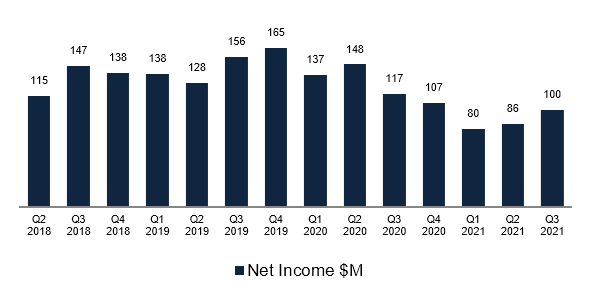

Also as expected the net income has kept its positive trend.

Higher demand for new airplanes - Lower sales of airplanes

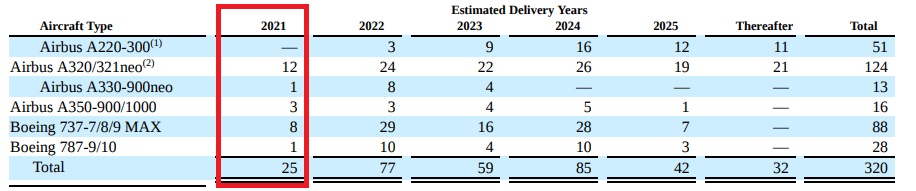

The company has scaled back the sale of airplanes mostly because of delivery delays from Boeing and Airbus which led to lower investment in new airplanes.

Once the deliveries get back to normal, the sale of aircraft will also ramp up.

Of all the airplanes that the company has on order, the ones that are seeing the longer delays are the twin-aisle Boeing 787’s.

Airlease was scheduled to receive 10 new 787’s by the end of this year, but it now looks like they won’t be getting any. In some cases the 787’s are 12 months late.

In total, the company was contracted to take delivery of 25 airplanes in the fourth quarter, but they’re only getting 15.

In fact, the management says that there’s huge demand for new airplanes right now, in part because of past production delays, and in part because of higher fuel costs (benefiting the more modern and fuel efficient aircraft). The Airbus 320/21 NEO, for example, has its production fully booked through 2025.

Even AirLease itself has more requests for new single-aisles than they can handle.

This shortage has led to lease rates going up in the narrow bodies, in some cases, to levels higher than in 2019, before the pandemic.

But these higher lease rates haven’t been enough to lift the broad profitability to 2019’s levels. Clearly lease rate factors for the majority of airplanes is still very low and the deferrals are still impairing the revenue.

Deferrals

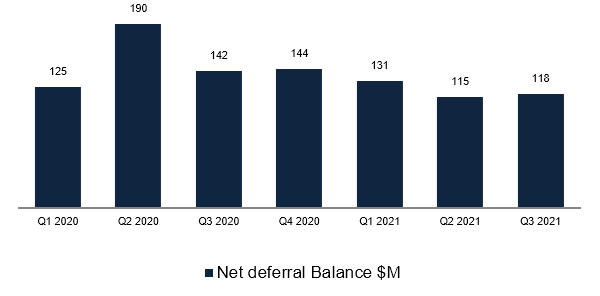

As of November 4, 54% of the lease deferrals granted have been repaid, representing $138 million. This led to a 30% increase in the operating cash flow.

The net deferrals of $118 million represented approximately 1.4% of the total available liquidity, a bit above the prior quarter. Investors should keep this trend under close watch in the coming quarters.

Debt and Capital Allocation

The company recently issued $1.1 billion in debt with interest rates of 0.8% and 2.1%. It’s incredible how cheap money is right now. No wonder asset prices are through the roof.

To keep its investment grade rating, AirLease also issued 300.000 preferred shares at 4.125%.

What this tells us is that the debt markets are still alive and well and investor’s appetite for financing airplanes is still strong.

Overall, the management believes that its business is strong – so much so that it sent a message to “the market” by raising the dividend by 15.6% from $0.16 per share to $0.185 per share.

Going forward, investors should keep an eye on the mismatch between debt maturities and lease terms. I suspect that the management is taking the deceptive road of financing long-ish term assets with short term debt, believing that it will be able to refinance when time comes. This is all nice and good until it isn’t.

Conclusion

I understand why the market liked these results. Things are slowly coming back to normal, and Air Lease, with its young and in-demand fleet of new technology airplanes, stands to benefit from it.

I’m counting on similar good news coming from Aercap this week.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.