Air Lease,

a fundamental analysis!

April 3, 2019

SHARE PRICE: $35,54

MARKET CAP: $3,99B

April 3, 2019

Share Price: $35,54

Market Cap: $3,99B

1. INTRODUCTION

Given that I’ve spent a whole week studying the aircraft leasing business when I wrote the Aercap analysis, I’ve decided to keep at it for a little longer and take a look at Air Lease Corp. as well.

For a better understanding of the business, I recommend you to read my Aercap analysis first and then come back to this one. As always I’ll start by taking a look at the company’s website.

2. BUSINESS OVERVIEW

2.1. COMPANY PRESENTATION

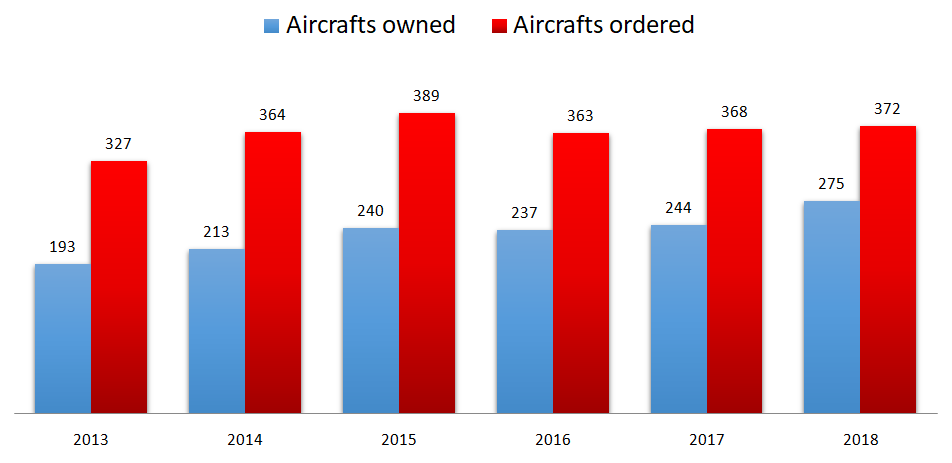

Air Lease buys large numbers of new airplanes from Boeing/Airbus/Embraer at a discount to list prices and then leases them out to the airline companies around the world for a profit. The company currently owns 275 airplanes, and is waiting for another 372 planes to be delivered.

Air Lease was founded by the “father” of the aircraft leasing business Steven Udvar-Házy in 2010.

Steve Hazy (that’s how they call him) founded the International Lease Finance Corporation (ILFC) back in 1970 with a single airplane that he leased out to AeroMéxico. ILFC went on to become so big that in 1990 it was sold to the giant insurance company AIG. Steve worked as the CEO until 2010 when he parted ways with the company to found his own company, the Air Lease Corporation.

In the meantime, AIG was in such a desperate need to fix its balance sheet in the aftermath of the financial crisis that it sold ILFC to AerCap.

With the largest order book in the industry and its top management team, it is regarded as one of the best companies out there.

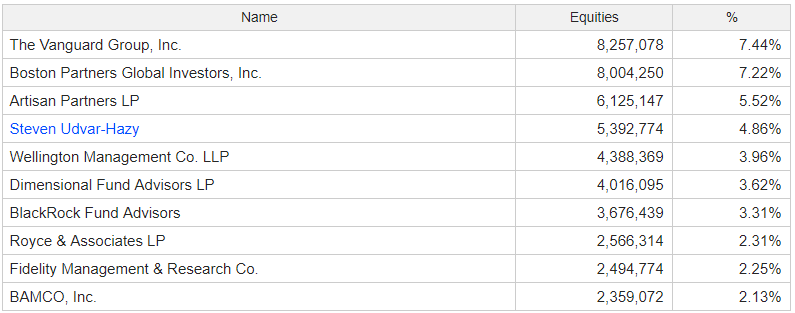

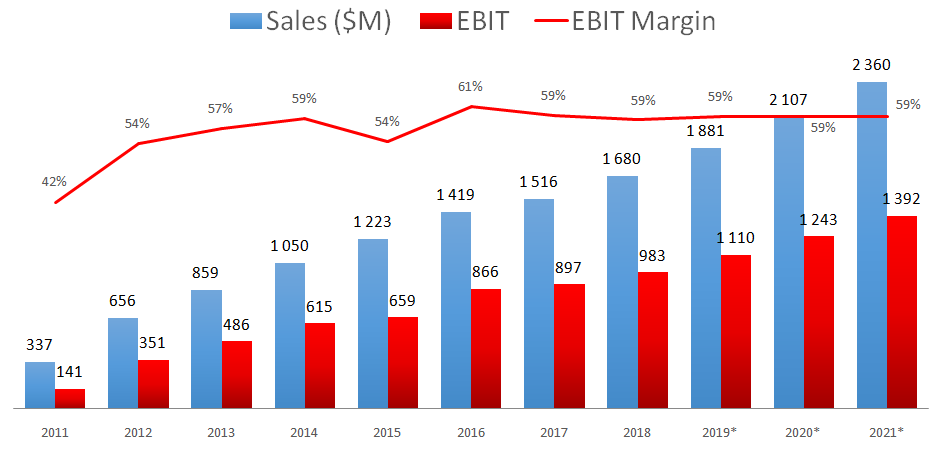

2.2. LARGEST SHAREHOLDERS

Steve Hazy still holds a considerable 4,8% stake in the company and…

2.3. MANAGEMENT TEAM

…he is the executive chairman, which leads me to believe that we are in good hands.

John Plueger, the CEO, has been a partner in crime for Steve Hazy for more than 30 years. He has a great understanding of the business and if you listen to their latest conference call you will surely recognize the great dynamic between the two.

3. HISTORICAL CONTEXT

3.1. LONG TERM CHART

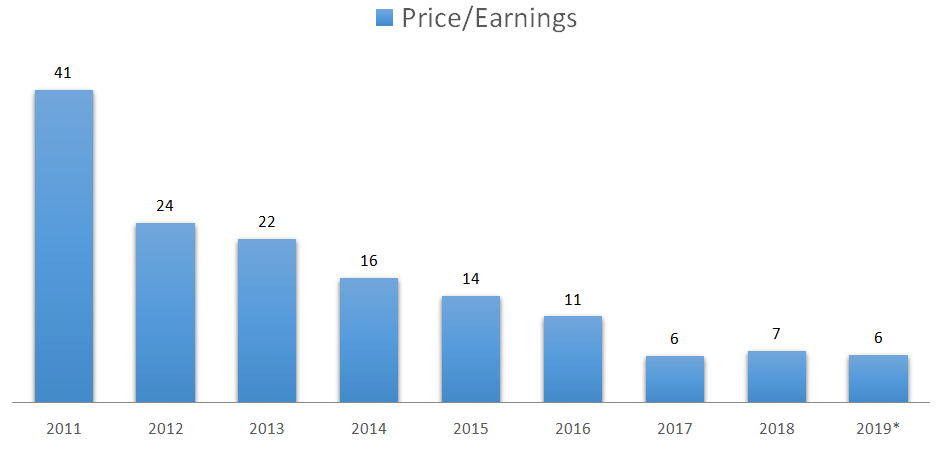

The share price is at $35,54, not that different from the $26,5 share price at the IPO. I suspect that Mr. Market was very enthusiastic about this stock in 2011 but has since lost his confidence.

3.2. MARKET CAP AND SHARES OUTSTANDING

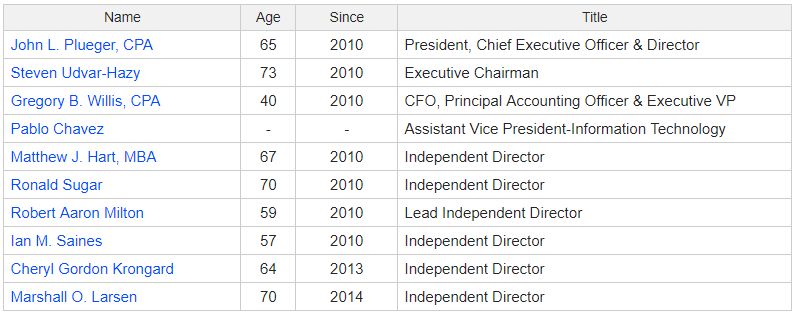

The whole company can be bought for roughly $4B and it’s good to see that the number of shares outstanding has been stable for years now. Having the (former) CEO as one of the largest shareholders in the company is definitely a plus for small investors.

3.3. SALES - OPERATING INCOME - OPERATING MARGIN

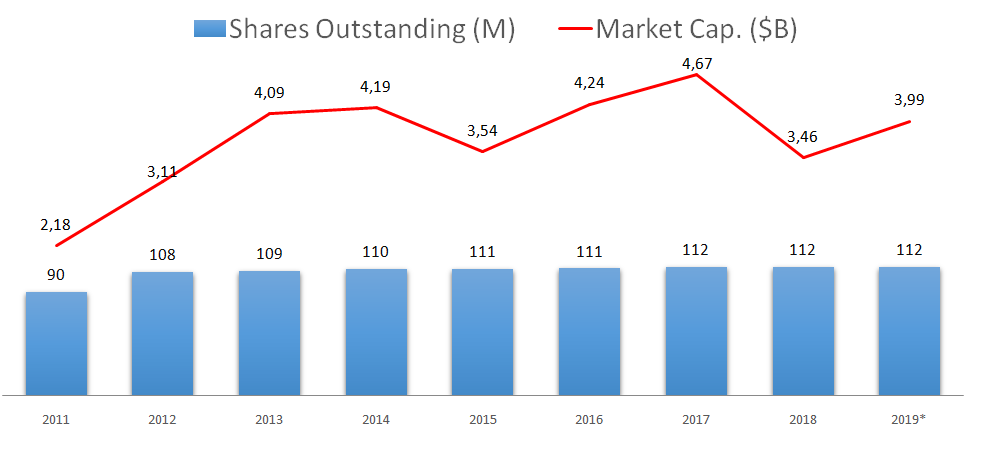

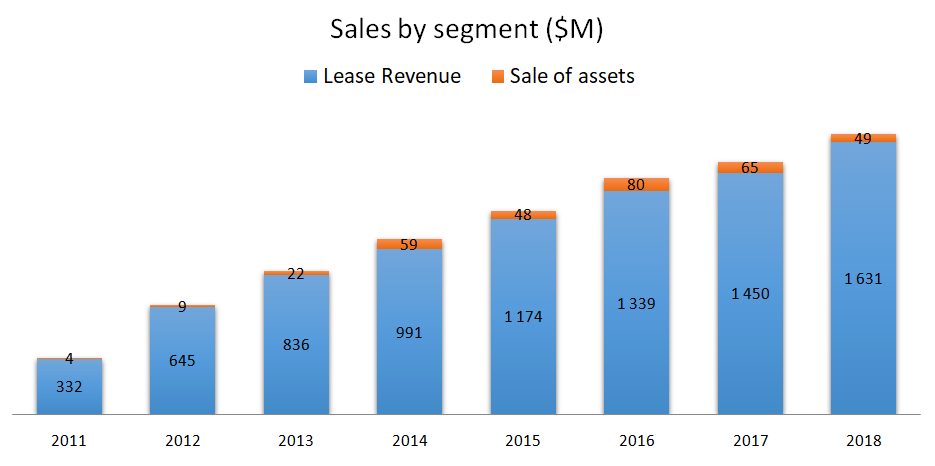

The revenue has been growing at a CAGR of 26% since the IPO and the operating margin is expected to stay at 59% going forward.

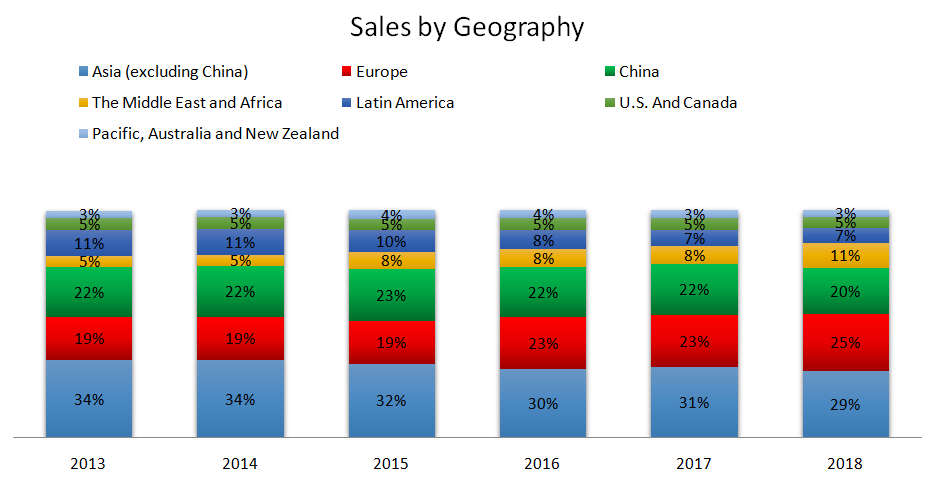

3.4. REVENUE BY GEOGRAPHY

Asia, Europe and China are the company’s largest markets.

3.5. REVENUE BY SEGMENT

And as expected, the bulk of the revenue comes from the leasing of airplanes.

3.6. FLEET

Air Lease’s fleet is one of the company’s advantages over its competitors. With 275 owned airplanes and a 3.8 average age, this is one of the youngest fleets in the industry. It is also composed of mostly narrow bodies which are the most in demand airplanes in the world, hence the 100% average utilization rate.

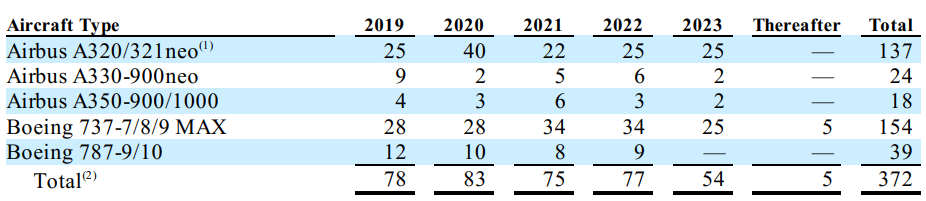

The company is expecting to double its fleet in the next 4 to 5 years. This makes it the largest buyer in the world right now. Just to put this into perspective, Air Lease has grown its fleet by 83 airplanes since 2013 and is now expecting to grow by 367 airplanes in the next five years.

72% of the airplanes they are expecting to take delivery of through the first half of 2020 are already leased out which gives the business a great visibility.

3.7. ORDER BOOK

Unfortunately, the company is expecting delays from Airbus and now with the Boeing 737-Max issues, I fear that 2019 and 2020 might not get the boost the company was expecting. But then again, if Air Lease isn’t getting these planes on time, no one will either.

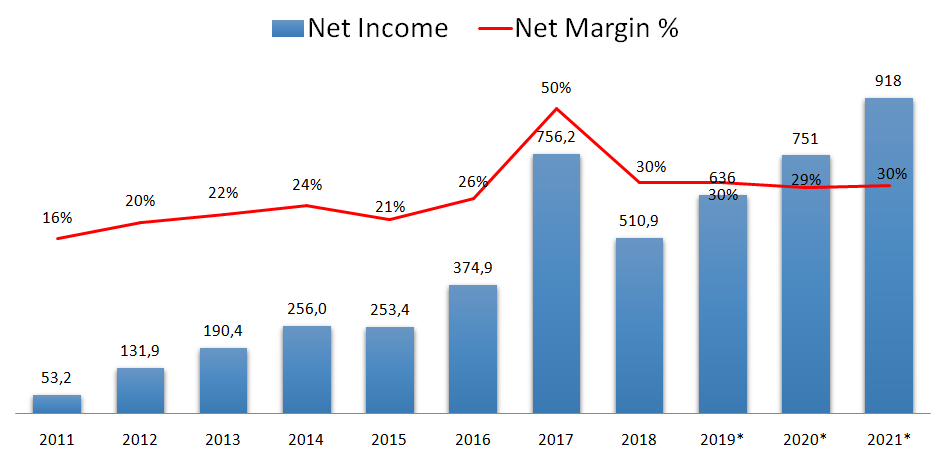

3.8. NET INCOME, NET MARGIN

The net income for 2018 was $511M, way less than what was recorded in 2017 because of the TCJA. The net income expected for 2021 is $918M, 80% more than 2018 numbers.

If we think that the company will double its assets in the next five years and that the money the company makes comes from the leasing of those assets, we might be looking at a doubling in profit for the next five years.

Like most american companies, Air Lease will benefit from a lower income tax rate going forward, but there’s another thing. While reading the financial statements and presentations, the management never talks about the net income, focusing instead on the adjusted net income before taxes. They do this because Air Lease doesn’t pay taxes. At first this might be hard to grasp but here’s how it works:

For tax purposes, the company depreciates its airplanes in about 7 to 8 years while for accounting purposes, it depreciates them in 25 years (yes, it works like this). This increased depreciation allows the taxable income to be zero. At the end of those 7 to 8 years, the company sells the fully depreciated airplane.

Now, in the USA, if you buy a new plane with that money, you can defer the tax on the original gain (it’s called a 1031 exchange). This way the company never pays taxes and probably never will. That is why book value might also be understated. Because this deferred tax will go to the liabilities side of the balance sheet, but in fact that liability will never be paid.

3.9. SEASONALITY

There is no relevant seasonality to Air Lease’s sales.

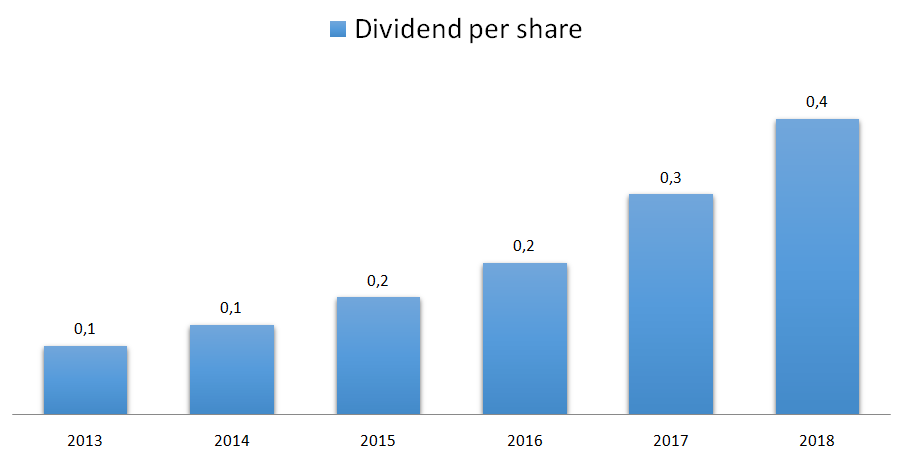

3.10. DIVIDENDS

The company pays a small and growing dividend.

3.11. PROFITABILITY RATIOS

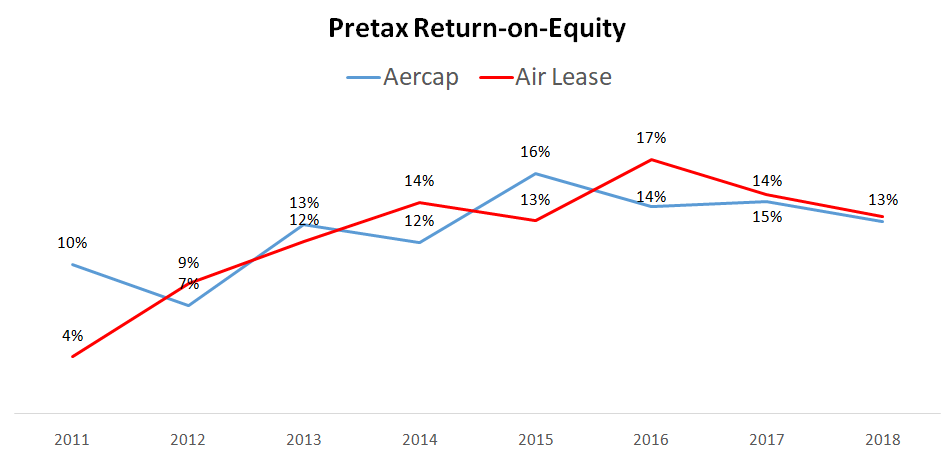

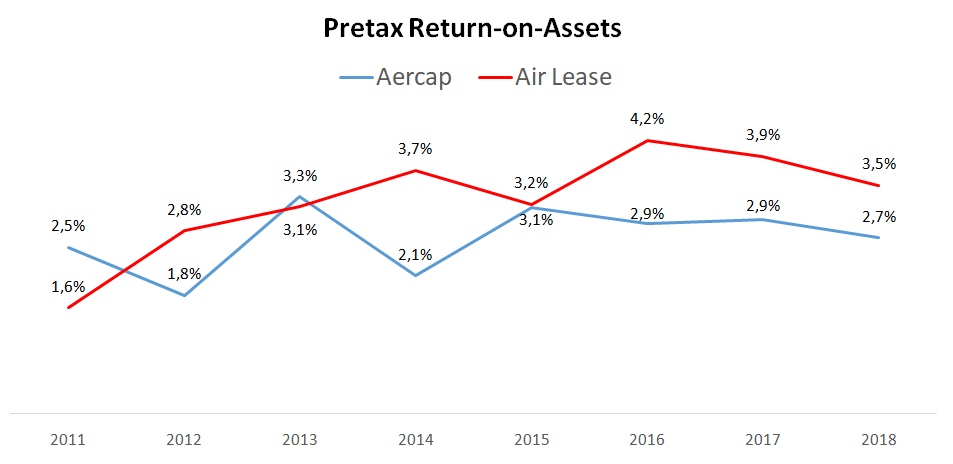

Due to the tax gimmicks these companies employ, I’ve decided to look at pre-tax profitability ratios.

The Return-on-Equity ratio has had practically the same trajectory for both companies along the years, but I would have to give it to Air Lease because in recent years it has been able to get better ROE’s with less leverage (we’ll get to that in a second).

Air Lease has also been able to get consistently better Return-on-Assets than Aercap.

3.12. FINANCIAL RATIOS

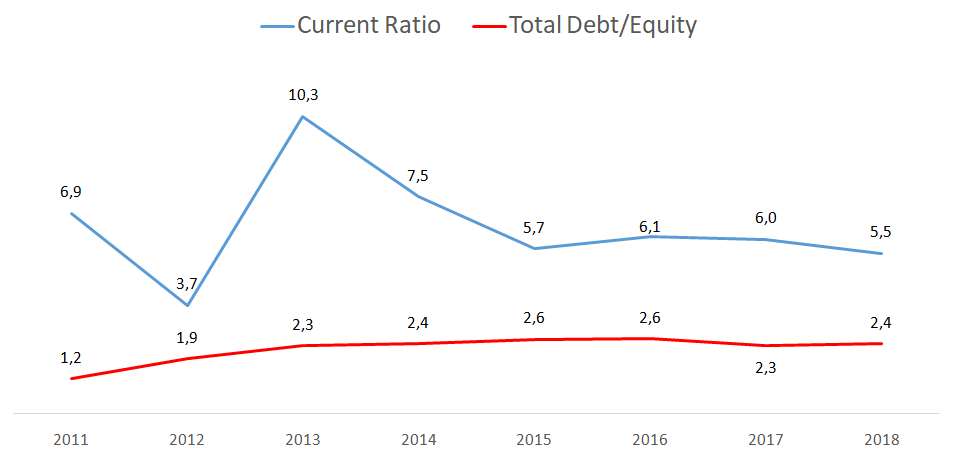

The current ratio at 5.5 shows high liquidity as it is required by the nature of the business…

..and the Debt-to-Equity ratio at 2.4, albeit high, is lower than Aercap’s (3.3). The management team wants to keep this ratio at around 2.5 and we have to remember that the book value is understated because of the deferred tax liability that will probably never be paid.

Just like Aercap, Air lease also has an investment grade balance sheet and this allows it to have a combined cost of capital of 3.46% while Aercap cost of capital is 4.1%. The percentage of fixed rate debt was 86,4% of which 96,5% was unsecured. This high proportion of unsecured debt means that lenders have a strong conviction in Air Lease’s future cash flows.

3.13. PRICE RATIOS

As I suspected, Mr Market was once very optimistic but he is now very pessimist regarding Air Lease’s future. The forward 2019 Price-to-earnings ratio is just 6…

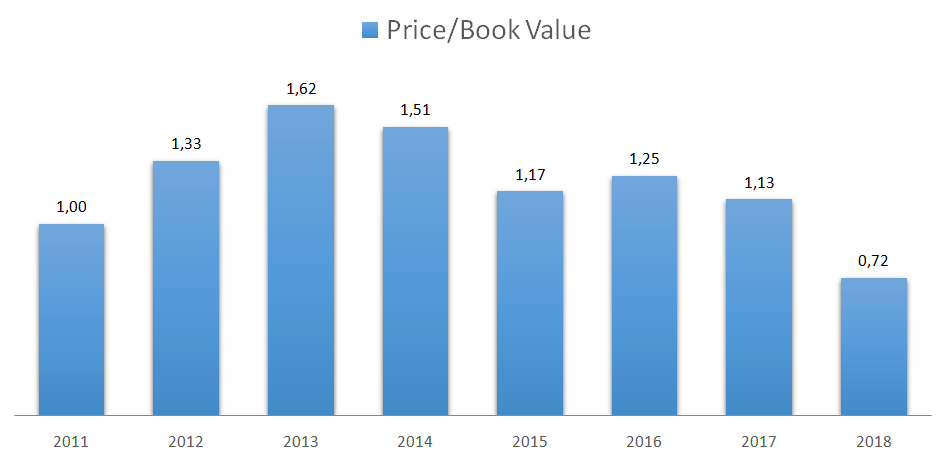

…while the Price-to-Book value is 0,72. Both of these ratios tell us that this company is seriously undervalued by Mr. Market.

4. GAINING PERSPECTIVE

4.1. INDUSTRY AND STRATEGY

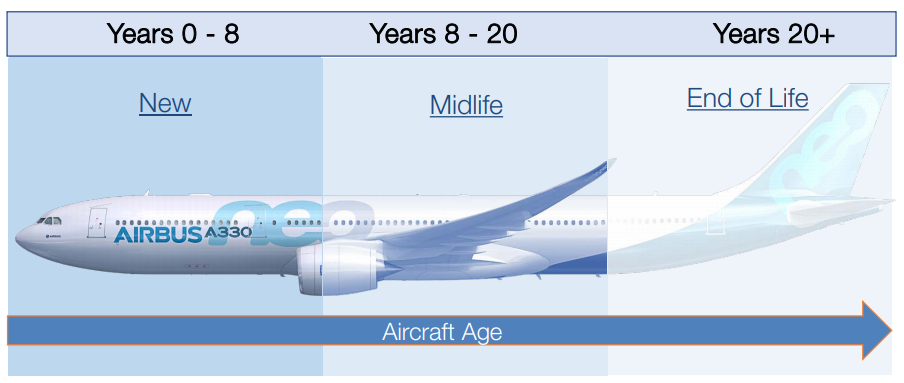

The company’s strategy is a very simple one. Buy in-demand airplanes, put them on lease contracts for the long term (12 years) and sell them when they reach one third (8 years) of their useful lives. This allows the company to maintain a very young fleet and sell airplanes at a premium to the book value because they still have lease contracts on them.

In addition to all the operating and financial advantages the company has, they have another one. Steve Hazy is a living legend in the leasing business. He knows everyone from manufacturers to customers, he is known for being a hard negotiator, he invented the business, so you get the point. Air Lease has great insights into the industry as it even has access to the design and planning committees for new planes.

It’s amazing to see the level of insight these guys have on the industry. Not only do they work closely with Boeing and Airbus but they also have really tight relations with manufacturers of engines, seats, tires, brakes, you name it.

Most of the times they buy the airplanes from the OEM’s without the engines or seats and then they buy the engine and seats directly from the manufacturers and ask the OEM’s to install them. This way they can get the best prices in the industry.

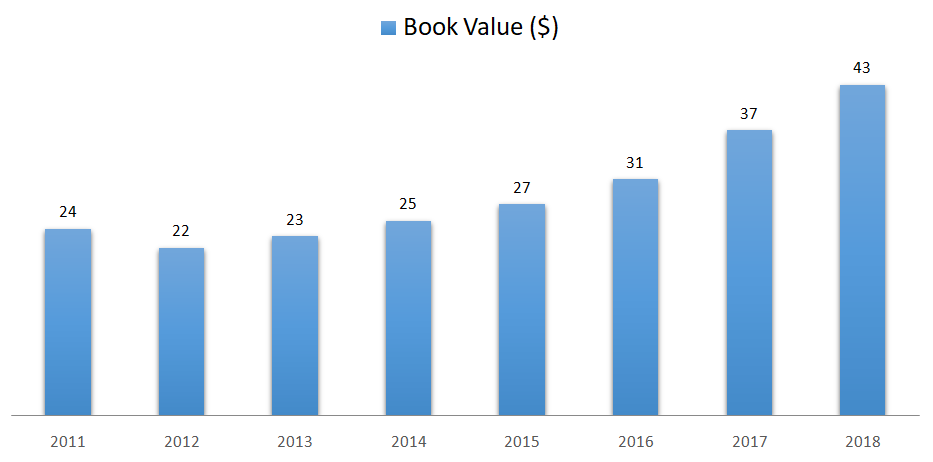

Like Aercap, Air Lease has also been growing its book value over the years. The current book value per share is $43 while the stock is trading at $35,5.

4.2. RISKS AND COMPETITION

The risks and competition for Air Lease are the same as for Aercap:

Residual value risk;

Interest rate risk;

Oil price variations;

Competition;

and I would add demand: Although every study and economical indicator points out to a higher demand in years to come, with slower demand, the business would obviously be severely hurt.

4.3. TYPE OF PLAY

I define Air Lease as a value and a growth play due to its low valuation and high growth.

5. OVERVIEW AND CONCLUSION

5.1. OVERVIEW

As you may have noticed by now, I find the aircraft leasing industry amazing. I’ve analysed both Aercap and Air Lease and I think both of them have great chances of doubling in price in the near future.

If I were to choose one of these two, I would go with Air Lease because of its younger fleet, its growth prospects (doubling fleet in the next 5 years), its sounder balance sheet, its margins and its profitability. I’m not saying that Air Lease will definitely turn out to be a better investment than AerCap, I’m just saying that it fits MY bill better.

Making a quick estimate (not even taking into account that the company pays no income taxes) if the company is doubling its fleet in the next 5 years, we can assume that it will double its revenue, net income and book value.

If this were to happen, and if we apply a conservative PE of 10 and a P/BV of 1 we would get a share price in between $86 and $91 which would represent at least a 19% CAGR for the next 5 years.

5.2. CONCLUSION

This section will be available to paying subscribers in 2019 when we launch the Portfolios. If you’d like to get early-bird conditions, please send us an e-mail.

Don’t forget to check our other analyses.

If you want more, join us at our new…

6. DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.