Airbnb

a fundamental analysis

By Manuel Maurício

November 27, 2020

Introduction

Just like many other investors out there, I too have been waiting for Airbnb’s prospectus to come out. I’ve been using the platform for many years and I can’t imagine how my travels would look like without it. But is that enough? Is a great product synonymous of a great business? And is a great business synonymous of a great investment? On this write-up I’ll be taking a deep dive into the business model, the financials, the competition, and the future prospects of Airbnb to try to answer those questions.

But before I start, a word of appreciation to all the members in the AiS Facebook group who shared their opinions on the business. Thank you!

*A prospectus is the document where private companies looking to go public report the financials for previous years, what they’ll do with the money they’re raising, etc.

Business

Airbnb is THE dominant online marketplace for short-term rentals. It is also THE global hospitality disruptor. Travelers love it, hosts love it, hotels hate it.

When people travel to other countries, they want to be immersed in the culture; they want to stay in a quirky little apartment in Rome near Piazza Navona; they want to dive straight from their balcony in Ilha Grande into the ocean; they want to hike to the top of a Peruvian mountain and actually sleep there. Other people who are traveling in groups may find it cheaper to rent a whole house rather than book several hotel rooms. Others just like to meet new people. Airbnb addresses all those needs in ways that hotels just can’t.

On the other side of the equation stand the hosts, people with extra rooms or extra houses who want to put them to work. Actually, the company was born out of the necessity of its founders, Brian and Joe, to pay for the rent on their apartment in San Francisco. There was a design conference going on in town so they decided to rent an air bed. That experience went so well that they realized they had something going on. Soon, they were turning it into a real business, Air Bed and Breakfast.

The company’s history is quite interesting and I encourage you to read it. Airbnb got to where it is today, in part, because the founders did things differently; they did things that didn’t scale.

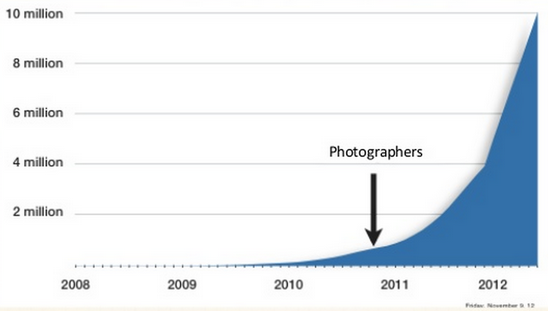

As a paradigmatic example, in the beginning, they felt that the photos being uploaded by the hosts were really bad so they took it up to themselves to change that. They thought that they had to have the best pictures to attract critical mass. They rented a $5.000 camera and they flew every weekend from San Francisco to New York just to take great pictures of apartments that were already listed on Airbnb.

Guess what? It worked. Soon, the revenue coming from NY had doubled. That experience led them to create the Airbnb Photography Program.

Now that the introductions are done, what we’ll want to figure out is if Airbnb can actually be a good investment opportunity. Let’s dive in.

Operating Metrics

The first thing I’ll want to be looking at are the operating metrics; how many nights were booked on the platform, how many guests, etc…

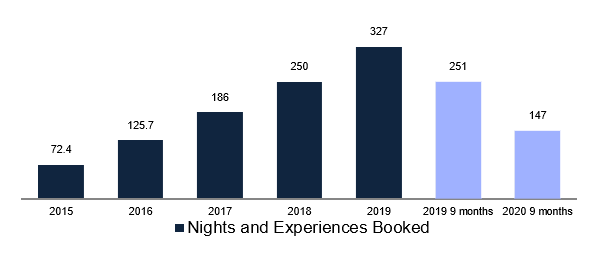

I hope that the following charts aren’t confusing. What we’re seeing in dark blue is the Nights and Experiences booked in the full years going up until 2019. In light blue we’re seeing the first 9 months of 2019 versus the first 9 months of 2020.

So, if we focus on the growth rate up until 2019, we can see that the company has been growing its bookings, on average, by 46% per year for the past 4 years. Obviously, during 2020, the number of bookings has gone down dramatically.

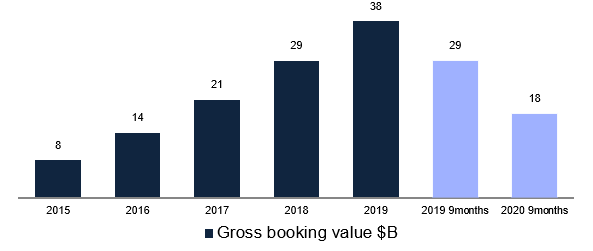

The Gross Booking Value (GBV), which is all the cash that was spent on Airbnb by its guests, has seen the same trend, growing by 47%.

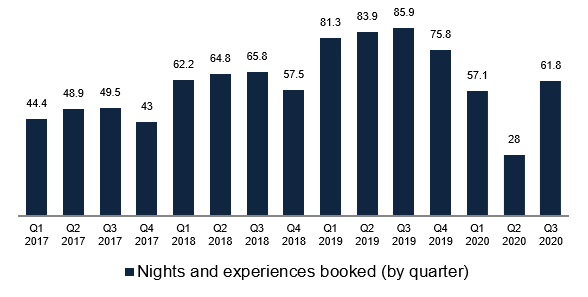

If we add some granularity to the above, we can see that, unsurprisingly, there is high seasonality to this business with the 4th quarter being the weakest one, and the first three quarters usually being the strongest ones.

Financials

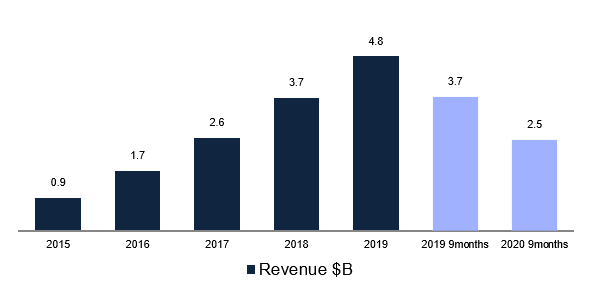

Following the above, revenue has been going up at a 51% annual rate.

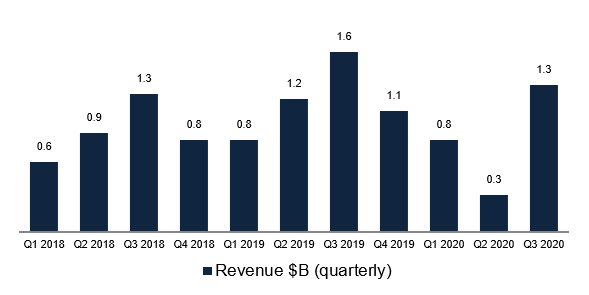

And again, if we look at the quarterly revenue figures, we can see that, although the first three quarters of the year are similar in bookings, because the revenue is recognized on the date of the check-in, the third quarter is the strongest one.

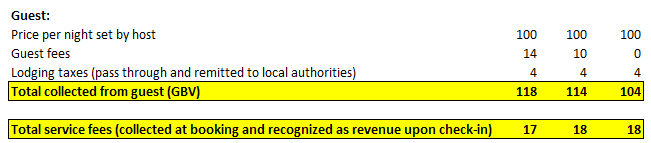

By the way, according to the American standards, the company recognizes only the net fees paid for its service, not the Gross Booking Value. For example, if I list my home on Airbnb for $100 per night and the company charges $3, it will only recognize those $3 as revenue.

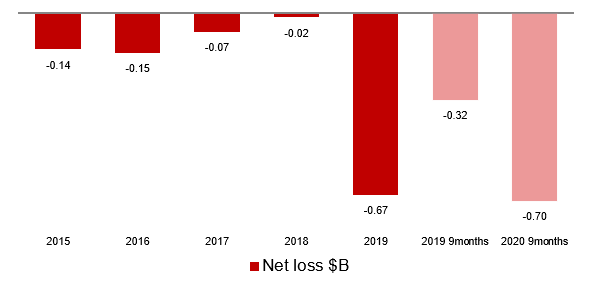

One of the metrics I was most eager to see was the profit, the net income. As we can see from the image below, the company hasn’t turned a profit yet; if we were to look at the trend shown in the chart, it seemed that it was about to turn a profit in 2019, but then it sunk even deeper as the company increased its spending in both product development and sales & marketing.

I went to check what kind of margins Booking Holdings was able to get when it was getting the same revenue, and much to my surprise, Booking has been profitable all along. Not only that, but the net margin was in the mid 20’s. One could argue that Booking had no competition and things were easier back then, but still…

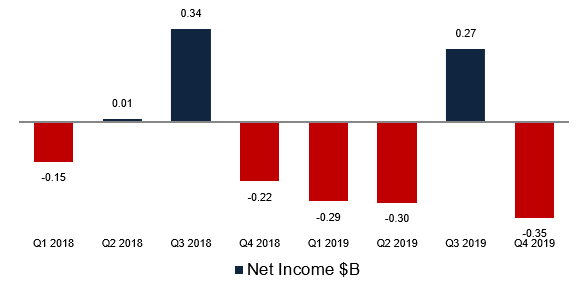

If we zoom in into the quarterly numbers, the accounting rules create a funny effect where the third quarter is usually the most profitable one. I mention this because in future analysis, investors should be aware of the seasonality of the business and how it affects the financials.

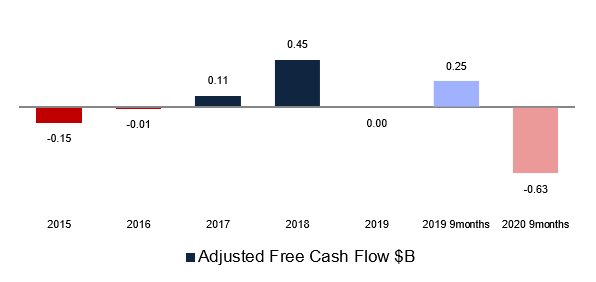

BUT – you know this, I always like to compare the profits to the cash flows – the company has actually generated cash in 2017 and 2018. How is this possible? Well, there’s a few items that make it so, but the company doesn’t make it perfectly clear what they are.

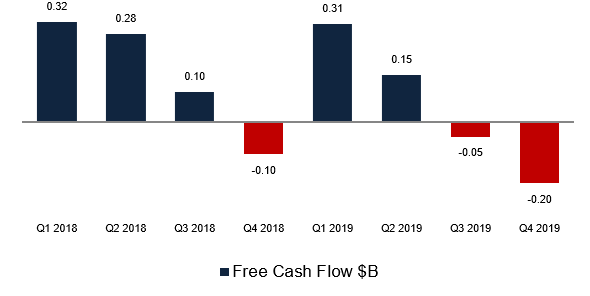

If we look at the cash flows on a quarterly basis, we can see that, unlike the accounting profit that is recognized at the check-in date, most of the cash is actually generated in the first quarters of the year, which is when people make their bookings.

From the time when the guests make their bookings to when they check-in, the company holds the money, float! And if the CFO is smart enough, he can juice its earnings by investing it wisely.

In fact, that’s exactly what the company had in mind when it created its own internal hedge fund.

*Note be taken that the company recognizes the cash that is paid by the guests and owed to the hosts under the Cash Flow from Financing Activities, so that number isn’t actually represented in the charts above. If it were, we would be seeing a much more cash generative business.

Balance Sheet

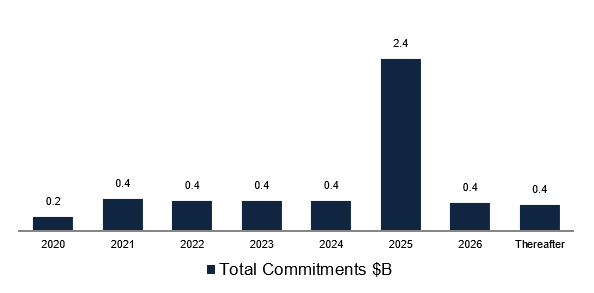

Airbnb raised debt twice in April, 2020. $1 Billion at 11% (with a conversion option) and $1 Billion at 8.5%. None of these are cheap loans, which goes to show the risk that the lenders see in Airbnb’s ability to service the debt.

Both these loans reach maturity in 2025. In the meantime, the company will have to pay $200 Million per year in interest (and some principal). For a company that, in its best year, generated $600 Million in Cash from Operations, that’s nothing to sneeze at; especially given that things aren’t looking good in the next couple of years.

On top of this debt, there is also a serious tax issue. Because the company operates in so many different countries, it has a hard time keeping track of every tax law it must abide to. In September 2020, the company received a notification from the IRS for an additional tax income expense for the year of 2013 of $1.35 Billion dollars. The company currently has $0.3 set aside for this matter, so there’s about $1 Billion missing.

I believe that the debt and this unexpected tax expense is forcing the company to go public sooner rather than later. The fact that they’re pushing for an IPO during the greatest pandemic ever raises my eyebrow.

Fees and Competition

One of the important things about Airbnb and its competitors is the fee structure for both the hosts and the guests. The companies may change their fees in the future so the current analysis may be rendered useless, but we’ve got to work with what we’ve got.

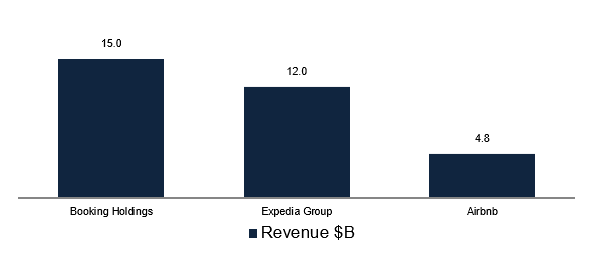

Although there are many websites that offer similar services, the ones I find to be the most relevant competitors are Booking.com and VRBO (part of the Expedia Group, and twin of Home Away), both of which are much larger than Airbnb.

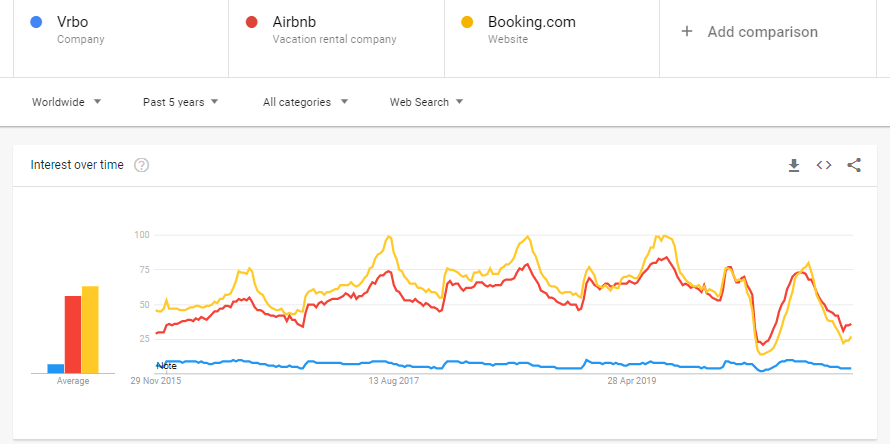

Here’s how they compare in Google searches over the past five years.

While Airbnb and Booking.com have been head to head, VRBO clearly has nowhere near the brand recognition of the other two (we must not forget that Expedia Group has several other platforms such as Hotels.com or Trivago).

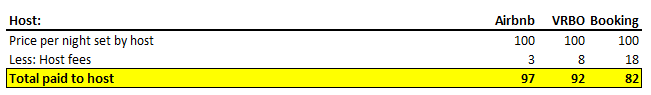

Now, the fee structure. If you’re an host, Airbnb charges you a 3% fee, VRBO charges you an 8% fee, and Booking charges you an 18% fee.

From the guest’s perspective, Airbnb charges up to 14% in fees, VRBO bewteen 6% to 10%, and Booking 0%.

What we’re seeing here is that Airbnb’s fee structure is optimized to attract hosts, while booking’s is optimized to attract guests. VRBO stands in the middle. I’m not sure we can say that one is better than the others.

By the way, VRBO has yet another fee option where hosts don’t pay the 8%, but an annual subscription of $499. I couldn’t find this info anywhere on their website so I registered on their platform and had a little chat with the customers service.

James, the customer’s service guy, was reluctant to tell me about the subscription option. I asked why they didn’t list it clearly on the website to which he replied “this is an internal process which means that all customers that want to list their property and have a question about it, they need to contact us directly” and “alternatively, you can search on Google and you will find it on other websites“. Say what?! Why do they do this? I feel I’m missing something important on their strategy. Why would they have a product that they’re not advertising? If any of you knows the reason, I’d be delighted to hear.

So, the question that’s probably on everyone’s mind is, which marketplace is the best?

To understand the point of view of the host, I called up an Irish friend who manages a few apartments here in Lisbon and asked him which of the marketplaces was his favorite. He told me that he is agnostic to that and that he uses beds24.com, a platform that aggregates all of the above. It’s called a property manager and there are plenty. When one of the apartments is rented on one of the marketplaces, these e-managers automatically block the dates on the other marketplaces.

To understand the point of view of the guest, I asked a bunch of friends about their loyalty and preference for Airbnb. Apart from the anecdotal evidence of bad customer service, all of them said that they had no loyalty whatsoever and that price and frequent client plans were the most important things for them.

The three marketplaces above target somewhat different audiences and I would argue that there is room for all of them. While Airbnb allows for hosts to list shared spaces such as extra bedrooms, VRBO only allows for entire properties to be listed. Airbnb targets a wider audience (younger or cheaper people will go for the shared spaces) whereas VRBO targets families or groups. I believe that Booking only allows for full properties as well. But Airbnb is listing luxury homes on a dedicated website whereas Booking is already listing private homes so, in time, I believe they will all look alike.

Management and Ownership

Airbnb was founded by two designers, Brian Chesky and Joe Gebbia. Later Nathan joined as Chief Technology Officer. Brian owns 15.4% of the Class B shares, Joe and Nathan own 14.2% each.

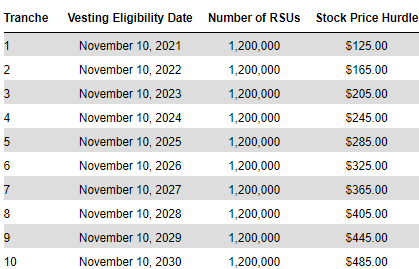

While Joe and Nathan both earn $400.000 in annual salary and up to 60% of the base salary in performance bonuses, Brian has lowered his salary down to zero, but he will still earn Restricted Stock Units, and the interesting thing is that these will vest (meaning that he will only be able to get the stock) at minimum stock price hurdles that imply that the share price must go up by 4 times in the next 10 years.

Risks

- Competition.

- Regulation. There’s different regulation in different cities and the company must comply with all of them.

- Technology. Reliance on Amazon Web Services and Google Maps, which is a competitor.

- Reputation. An important part of the business model is the trust people put on Airbnb. If for any reason that is affected, it may affect the whole business.

Valuation

Although the IPO price hasn’t yet been set, some sources talk about a valuation of around the $30-$35 billion dollars. That means that the company would be trading for 5.7 times 2019 sales. Is that a fair valuation? Too high? Too low? I’m still thinking about it. When the price is set, I’ll come back to this.

Thoughts

When looking into IPO’s (Initial Public Offering), I always like to know what the company is using the cash for. There are several reasons for a company to go public. For me, the best one is the need for cash to fund growth. The worst one is for early private investors to cash out.

In the case of Airbnb, the company is looking to fund the operations. I haven’t found evidence that the previous investors were cashing out, which is a good thing.

Airbnb offers a great service to humanity. I love it. It has changed the way I travel, and I love travelling the world. What it has achieved so far is no small feat. From the thousands of startups that bloom every year, it has been able to scale and dominate the world. From that point of view, it’s a great company. It’s founders did a terrific job. They are the thrust behind this company’s success.

I’ve been watching some of Brian’s latest interviews to understand where he’s leading the company. He has mentioned the Online Experiences as the fastest growing segment. They have sold $1 Million with only 400 experiences.

He also mentioned a lot more areas where the company can expand into: Educational experiences (watch out teachable.com), office spaces (cool), car sharing (not ride sharing as Uber), parking (humm), fresh food (uber eats?), dinner parties, dog sitting…

When I think of it, many businesses can be airbnbeable. Just like Facebook, when you have the users, adding more functionalities to the platform is easy.

Conclusion

And that makes it hard for me to put a price on it, to estimate its future cash flows.

I don’t doubt that Airbnb will be around 10 years from now, but an investor looking to invest in Airbnb must be able to – with a reasonable degree of confidence – answer questions like how sticky is this business? how loyal are the hosts and guests? will it be making a good profit in 5 years from now? and, is it cheap today compared to that profit?

As much as I like to use Airbnb, given that, right now, I can’t answer those last two questions with a reasonable degree of confidence, I’m not investing.

Having said that, I’ll leave you with this quote by the VC Fred Wilson, after he missed the opportunity to invest in Airbnb back in 2011.

“We made the classic mistake that all investors make. We focused too much on what they were doing at the time and not enough on what they could do, would do, and did do. I am proud that our portfolio is full of companies where we saw the vision before other investors did and backed a great team. But we don’t always get it right. We missed Airbnb even though we loved the team. Big mistake.” Fred Wilson, Venture Capitalist, 2011

Further research material

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.