Alphabet

Q3 2020

By Manuel Maurício

October 04, 2020

Introduction

On the first time I looked at Alphabet, its shares were trading at $1126.

On the second time, the shares were trading at $1184.

On the third time, the shares were trading at $1260.

Today, the shares are trading at $1713. This means that I’ve missed a 52% gain or an annualized rate of return of 29%.

Let’s update some of Alphabet’s metrics and then let’s look at its valuation. If you’re new to All in Stocks and you’d like to better understand Alphabet/Google, you can read all my previous write-ups HERE.

Fist of all , I want to be looking at how the different segments are behaving:

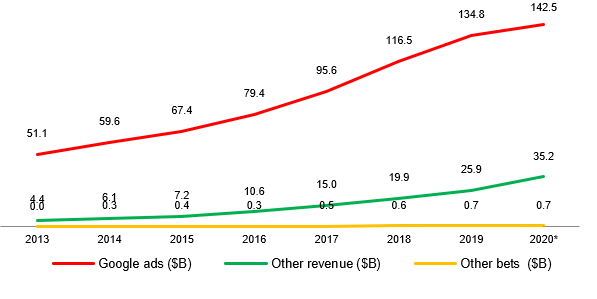

Google’s major source of income is still the advertising business, but the “Other Revenue” (in green) has been picking up pace recently. Let’s break this down even further, this time without the revenue coming from the Google Search or the Google Properties revenue.

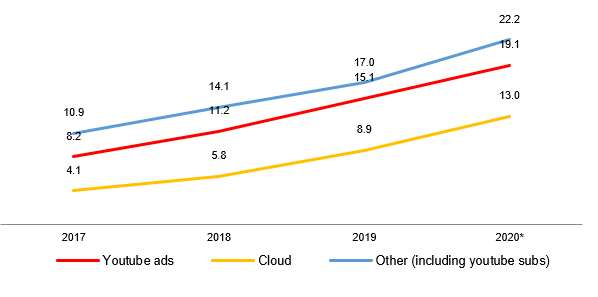

It seems that the only way is up. All the “minor” segments are growing at a very good pace, especially the cloud business (in yellow) which is expected to grow by 46% this year alone.

From these three segments, the one I have less faith in is the YouTube subscriptions. We’re just at the start of the streaming wars; Netflix, Disney, Amazon, HBO, Spotify, etc are all spending huge sums to get subscribers. On the other hand, I expect the Cloud to grow for many many years. The Cloud is much more stickier than the streaming subscriptions. On the 4th quarter, Alphabet will report it as a new segment so we’ll have detailed information to look at.

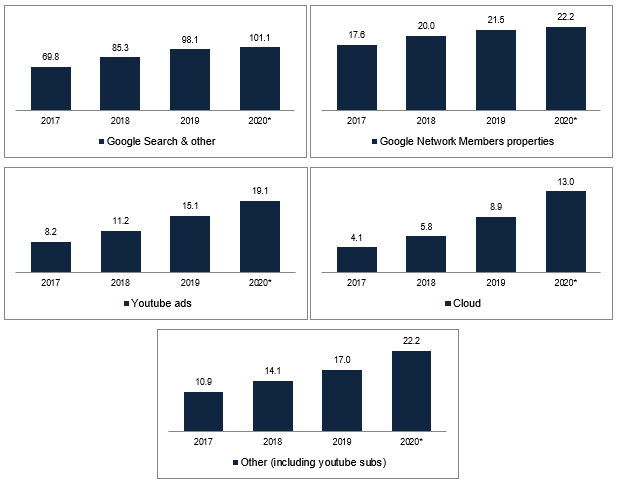

Here are all the segments in one picture:

These charts are so steady that they’re almost boring.

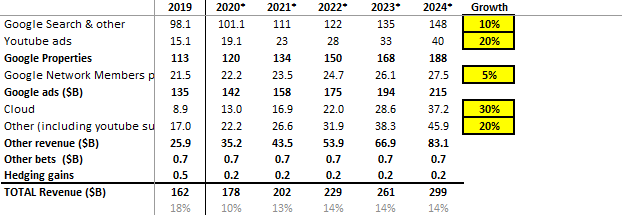

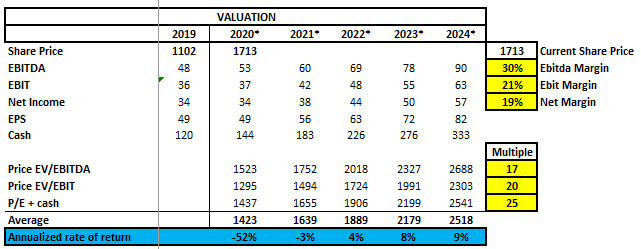

Below is my attempt at valuing Google in 5 years from now. I start by projecting conservative growth rates for each segment (see yellow boxes), then I apply adequate margins, and finally I use very conservative valuation multiples.

For instance, although the revenue coming from Google Search has grown 19% in 2019, I estimate a future growth of 10%. Although the Cloud business has grown 46% in 2020, I project a 30% growth.

Summing it all up, I get to an overall growth rate of 14%. As a sanity check, in 2019 revenue grew by 18%, so 14% doesn’t seem unreasonable.

With very conservative assumptions, I see an Annualized Rate of Return of 9% in 5 years from now. That’s not bad, but hardly the returns I’m looking for.

Of course, one could argue that I’m being too conservative; that Waymo will be worth $100 Billion, that the Cloud and YouTube will grow faster, that the Pixel phone will sell like hot buns… All of that might be true, but as you should know by now, I prefer to play it safe rather than paying too much for expected future growth.

And yes, you might be thinking that I own Facebook but I don’t own Google. I guess I’m just not feeling it with Google. It doesn’t have Mark Zuckerberg at the helm. Say what you want, Zuckerberg is Facebook’s moat. I’ve been reading about how Google has become so big that it’s becoming harder for it to stay the nimble, innovative company it has been in the past. Don’t get me wrong, this might possibly be the best business in the world. But at this valuation, it’s just not for me. Whenever something bad (but temporary) happens to Google, whenever everyone is freaking out, that’s when I’ll be thinking of buying it.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.