Altri

ex-dividend

By Manuel Maurício

May 18, 2022

I’ll be selling both Altri and GreenVolt today so if you’re not interested in the pulp industry, you might want to skip the next section and head straight to the conclusion.

From yesterday onwards, buying shares of Altri doesn’t come with the right to the cash dividend nor to the GreenVolt shares – that’s called the ex-dividend date.

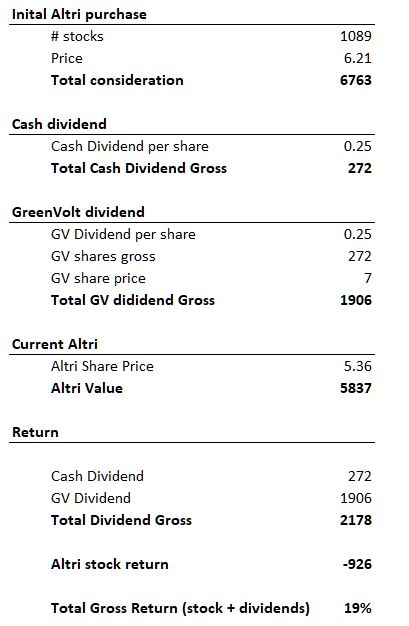

But the Portfolio has received 272 shares of GreenVolt (gross), which, at the current share price of €7, amounts to €1.906. I’m considering the gross amounts since I don’t factor in taxes for the Portfolio, but individual investors should consider returns net of taxes.

The Portfolio will also be receiving €272 in cash dividends on the 24th of May. If you sum up the two, you get €2.178 in total dividend consideration.

The Big Picture

Since this is a commodity business, I’ve been trying to get the big picture of who is opening new factories, who is closing old factories, who is selling to whom, and who is buying from whom. So I called Altri’s Investor Relations.

I’ve noticed that they don’t have the full picture of the sector all the time. They also gather bits and pieces here and there. I’m posting the relevant facts below as bullet points:

- China has a great deficit of pulp (because they don’t have forests) and a great surplus of paper so the cycle of paper is highly influenced by China buying paper pulp from Latin America and selling paper to Europe.

- Because of the “COVID19 zero cases policy”, China isn’t buying pulp. Chinese ports are closed so pulp can’t get into China.

- Every region in the world is increasing the pulp consumption but China.

- Latin America wants to sell to China, but they can’t.

- The Chinese paper isn’t getting to Europe so the local manufacturers are benefitting.

- Europe is like an island – at the beginning of the year, 80% of the supply is already contracted. It’s very hard to get in in the middle of the year.

- Inventories in European ports are at historical lows.

- When restrictions in China are lifted, we should be seeing restocking.

- To deliver pulp to Europe, the transportation fees have increased a lot.

- The European market has benefited from the difficulty to get pulp and paper (from China) to Europe. Navigator is gaining market share.

- Many of Altri’s customers have gained market share because there are no Chinese paper sellers.

I asked Altri why Latin America producers aren’t flooding the European market: - Bracell, owned by the Chinese, has a new viscose plant in Brasil that has been operating since the fourth quarter of 2021. Viscose is used to make dissolving pulp which is then used to manufacture clothes.

- They started production right when China stopped buying and shipping costs increased dramatically.

- Bracell had originally planned to sell its production in the open market to China, but due to the pandemic they haven’t been able to do so. Oddly enough, they shut down their new plant for maintenance work recently.

-

Because they’re not selling what they planned to Chinese customers, they’re going to integrate it into the RGE group earlier than expected, meaning that they won’t be selling their production in the open market anymore.

- Altri isn’t really sure why Bracell hasn’t come to Europe because Bracell hasn’t disclosed it.

- Altri suspects that, it’s hard for Bracell to suddenly start selling to Europe because Latin American manufacturers had the ships contracted at a set price and now to come to Europe they must pay spot prices which are much higher.

- And it looks like the shipping prices are going even higher.

- Right now it isn’t easy to move big loads around the world.

- Graphic paper demand (used in magazines) had been declining for the past 7 years, but the trend inverted in the last 2 years.

- During the pandemic several of the graphic paper manufacturers closed doors or converted into packaging manufacturers (China is also out of the picture). Suddenly demand goes up and the price of graphic paper goes up dramatically. Digitalization is going to accelerate.

Altri is paying more for wood but selling electricity at a higher price.

- Due to the low stockage, Altri is paying more for the wood they’re importing. What was previously a mix of 60/30 for wood and transportation is now more like 60/70 in which the transportation has shot up through the roof.

- But they’re also selling electricity at a higher price.

Altri's new factory in Pontevedra

- Regarding the Pontevedra factory, although it isn’t official yet that Altri is going to be the selected company to operate it, the location was announced recently and Altri has been involved with the decision. They are in talks with the banks and with the local wood suppliers so they can be sure they’ll have enough wood for their needs.

- Regarding Ence’s closure, the Supreme Court said that it would consider Ence’s recourse and the final decision (whether the factory is going to close or not) will be … in November 2022.

Conclusion

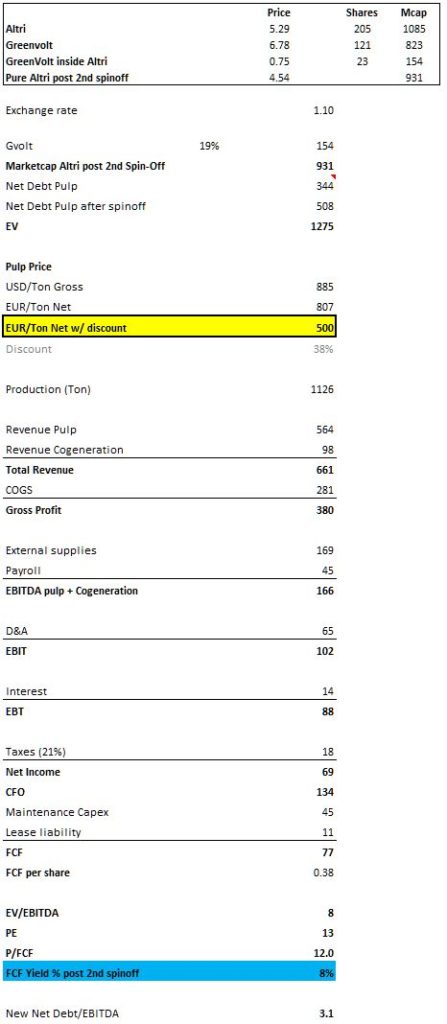

Having said all of this I estimate the mid-cycle yield on Altri’s shares to be around 8-10%.

This isn’t enough to get me excited. That’s why I’m selling Altri shares today. I am also selling GreenVolt as I don’t have a strong opinion about the business.

Now, it’s very likely that Altri might be having a spectacular year due to the higher price of pulp and also the higher selling price of energy, of which Altri is a net seller (it produces more than it consumes). Yes, costs will also increase, but they’ll likely be offset by the increased selling prices.

And if Mr. Market was blind to see GreenVolt’s spinoff as an opportunity when it was announced several months ago, maybe he will be blind to the cyclicality of Altri’s revenue (and earnings) and will throw the share price through the roof in the meantime.

But since I’m not in the business of guessing what the market will be doing in the next quarter, there’s no fundamental reason to be holding my shares. Yes, Altri is very well run and we might be seeing it being even more successful in the long run, but it’s not a screaming buy for me right now.

For now, I’m happy that it returned 19% gross to the Portfolio in just one month. Besides, I loved learning about the pulp industry. Who knows, some day I’ll get back to it.

I can’t wrap up without mentioning some technicalities. The cash dividend should only be hitting shareholder’s brokerage accounts on the 24th or 25th of May. That’s when I’ll add it to the Portfolio.

Now, regarding GreenVolt’s shares, Altri had to make an informed guess about who is a retail investor and who isn’t. This is important to calculate the taxes that Altri should retain (in the form of stock) and investors should be paying.

Right now, I believe that investors who own Altri through InterActive Brokers have already been awarded GreenVolt’s shares and can already trade them while investors using DeGiro will only be able to do so on the 25th.

I think Altri assumes that investors using IB are foreigners or institutions that don’t pay taxes on the dividends. This causes a weird situation where retail investors can already sell those shares through IB although the purchase price that will be considered for tax reasons will be the closing price on the 24th.

If that price is higher than today’s price, I don’t know how this should be reported to the Tax authorities as this will be considered a dividend (and not a share trade). Can dividends be considered negative?

Either way, since I’m no tax authority so investors should be talking to their tax advisors.

As a final note, I would like to thank Gonçalo Garcia once again for helping me with this one.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.