Altri

don't miss the forest for the trees

By Manuel Maurício

February 25, 2022

Symbol: ALTR (ELI)

Share Price: €5.38

Market Cap: €1.1 Billion

The opportunity

It looks like Altri is spinning off the remainder of its stake in the energy business Greenvolt. According to my fellow podcaster and subscriber Gonçalo Garcia, this might lead to an attractive valuation of Altri’s stock post-spinoff.

One way to play special situations like this is to buy Altri now, wait for the market to realize how undervalued Altri’s stock will become, and then, hopefully, sell the stock when it becomes fairly valued.

Another way to play it is to wait until Greenvolt is spun off (offered to Altri’s shareholders). Theoretically, Altri’s shareholders won’t have much interest in Greenvolt’s stock so they should be selling it quickly after the spin-off. This selling pressure should lead to a stock price decline which could create a good buying opportunity for investors interested in Greenvolt.

But in any of these two situations (and I suspect there more ways to play this), investors need to learn about both businesses in order to answer questions such as “if all of these possibilities fail to materialize, will I be happy holding these stocks for several years?” and “will my downside be protected?“.

On this write-up I won’t be answering these questions just yet. I’ll be making a short introduction to the world of paper and pulp production instead. In the coming weeks I’ll be digging deeper into both Altri’s and Greenvolt’s businesses.

How to invest in cyclical companies

I’ve been aware of Altri’s existence for a few years. I knew that it produces paper pulp, that it’s led by competent leaders, and that it’s mildly cyclical.

Cyclical businesses are one of the fastest ways for investors (both newbies and seasoned) to lose money. Unlike with other types of companies, with cyclical businesses investors must get the timing right, and that’s not easy.

The way you’ll typically want to invest in cyclical companies is by buying them at the bottom of the cycle, when manufacturing plants are closing and investors’ sentiment is in the gutter. Counter-intuitively, this is when the Price/Earnings ratio is usually at its highest (because Mr. Market is already foreseeing a shift in the cycle). Then you’ll want to sell them at the top of the cycle, when the PE is at its lowest (because Mr. Market is already waiting for the profits to go lower).

In commodity industries, since the individual companies have no control over the price of their end-product, they must be on a constant pursuit of operating efficiencies to lower their costs or else they’re out of business. This makes it so that you’ll typically want to invest in the lowest cost producer. In Europe, that’s Altri. At a global scale, it’s the Brazilians.

I love to study new industries, but commodity producers can be high maintenance stocks given their dependency on the dynamics of the entire ecosystem of competitors, regulation, and related costs. This makes it so that, not only does it take time to understand the overall picture, if you’re investing in these stocks for the long run, it will take a lot of time and mental bandwidth to follow everything that is happening across the industry.

That’s why it helps to invest only when things can’t get any worse. You might miss a few developments, but because they should be good developments, it won’t matter that much if you miss them.

But as I mentioned, I’m not looking at Altri because of its long term prospects. I’m looking at it because it’s spinning off the remainder of its energy business, Greenvolt.

Let’s dive in into the industry dynamics:

How paper is made

Paper is made out of paper pulp which, in turn, is made out of wood. There are two major types of wood: Softwood (like pine) and Hardwood (like Eucaliptus).

Softwood has long fibers and makes for more robust paper. It’s used in cardboard and other types of paper that need to be strong.

Hardwood has shorter fibers and makes for smoother paper with good absorption. It’s used for writing paper and for personal higiene paper.

We’re going to be focusing on Hardwood as it’s the fibre with which Altri works.

After cutting down the trees and shipping them to Altri’s plants, the bark will be removed from the wood logs which will then be grinded into wood chips.

Those wood chips will go through a chemical process at the end of which the pulp will come out looking like a rough thick sheet of white paper. Those sheets will be baled and shipped so that Altri’s customers can use them to make their end products (tissue and writing paper mostly).

This process also creates two by-products that are used to generate energy: Biomass, which is composed of the bark, branches and leaves; and black liquor, a gooey stuff that, when burnt, will create steam to power the mill.

They call this carbon-neutral renewable energy… and it is. But that doesn’t mean that it’s good. The endless extensions of Eucalyptus and other mono-cultures are bad for the biodiversity of ecosystems. But I digress. Let’s get back on the horse.

Industry

The majority of the paper pulp produced around the world is used in a verticalized (or integrated) manner, meaning that it’s produced by the paper manufacturers themselves, meaning that it won’t be bought or sold anywhere.

But there are some paper producers who produce more pulp than they need and there are also pulp producers that don’t manufature paper (like Altri). Both will sell the surplus pulp on the open market, hence the name market pulp to identify the pulp that is bought, sold, and transported all over the world. The market pulp is estimated to account for 40% of the wood pulp produced every year.

The largest producers of market pulp are Brazilian companies. Of particular relevance is the giant Suzano, which after merging with Fibria back in 2018, now accounts for roughly 30% of the global market. Altri represents 3%.

Because they’re the largest and cheapest producers, the Brazilian companies export to Europe, US, and China whereas the European companies usually sell to European clients only.

The total consumption of hardwood market pulp is around 38 million tons and this number is expected to continue to grow for the foreseeable future. Yes, I know, when we think of paper, our minds tend to focus on writing paper alone which has been in decline for many years. But there are plenty more applications for paper – tissue paper used for personal higiene, cardboard paper for e-commerce, dissolvable pulp for clothing and so on. Paper has never been so in-demand.

Even after including the shipping costs to send the pulp across the ocean, Brazilian pulp is cheaper than Portuguese pulp.

Now, I know that looking at the chart below for the first time can be a bit difficult, so here are a few tips: This chart represents the market price of paper pulp (both softwood and hardwood) bought and sold in Europe. These prices would change materially if we were looking at prices in China (because of shipping costs).

From left to right you’ll find the cheapest to the most expensive producer (Brasil is the cheapest producer while Japan is the most expensive – focus on the light green bars). The width of each bar represents the amount of tons produced by each country. The height of each bar represents the average production cost of each country.

Both Brasil, Chile, and Uruguay have structural advantages over every other countries because their climates allow for the eucalyptus trees to grow in just 7 years whereas in Iberia it takes 10 to 12 years for an Eucalyptus to reach maturity. Other types of wood (especially softwood) can take up to 30 years or more to reach the maturity needed to make pulp.

Depending on the shipping costs (which are dependent on the price of oil and other macro factors), some of the producers will shift their relative positions in the chart above. For example, in previous years Indonesia was at the right of Iberia, meaning that it was more expensive for European clients to buy pulp form Indonesian mills. Then, due to shipping costs changes, Indonesian pulp got a lot cheaper. This is a stark example of how hard it can be to invest in these businesses and how investors must keep a close eye on every other player.

Something to watch out for when you’re investing in commodities are the shifts in capacity from your competitors. If the producers on the left side of the chart increase their production (which they are doing), the producers on the right side will become too expensive and will be forced out of the cost curve (aka close doors).

Part 1 conclusion

Now we have a bird’s eye view of the paper pulp industry. There’s plenty more to learn, but I’ll be talking about it as I expand on Altri’s business in the coming weeks.

I’m counting on writing about Altri next week and then about Greenvolt in the subsequent week.

As always, if you’d like to chat about Altri, the spin-off, or any other related topic, just head over to Altri’s section of the FORUM and speak your mind.

I would also like to invite you to fill the short survey form below. It helps me understand what you like and dislike.

Thanks!

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.

Altri

Altri is Europe’s lowest cost producer of hardwood pulp, especially so its Celbi factory in near Figueira da Foz (which which is close to my hometown of Coimbra).

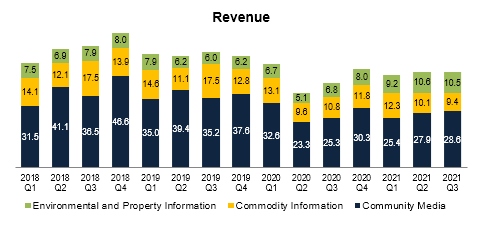

The company reports under 2 segments: Pulp and Energy (Greenvolt).

Within the pulp segment, the main types of pulp are for tissue (), Printing and Writing, and Caima produces mostly dissolvable pulp for the Chinese clothing industry.

As mentioned previously, Altri sells the paper pulp to European clients, but it also sells the dissolvable pulp to Chinese clients to use in the manufacturing of clothes.

As many other pulp companies, Altri produces more energy than it consumes. It sells that energy to the grid.

Geo

End market

Forest

Factories

Annual production

This market consists of facial, bath, and toilet tissue, paper towels, and napkins. Thus, it’s very stable.

New factory in Galicia

The Spinoff

Risks

- Bugs and plagues

Conclusion

Bugs and plagues.

Fotos das wood chips e da pulp.

Glacier Media won’t be entering the Portfolio at this time.