Altria

Q3 2020

By Manuel Maurício

November 9, 2020

Introduction

I know what you’re thinking. Why do I keep looking at Altria? The number of smokers in the US has been in constant decline for decades, there’s a virus out there affecting our lungs, and the company has made terrible Capital Allocation decisions when it bought Juul and Chronos.

I know all of that, but just here me out.

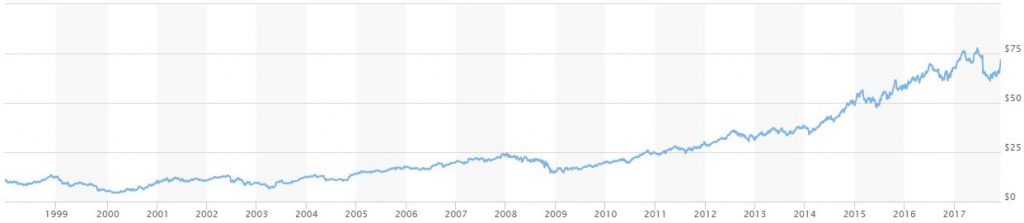

In 2000, the stock price dropped by -66%.

In 2003, the stock price dropped by -51%.

In 2008, the stock price dropped by -41%.

And if you had held on to the stock through those periods, you would’ve earned multiples of your investment.

In fact, Altria has been the best performing stock in the USA since 1968.

And with a dividend yield of 9,2% and a Price-Earnings ratio of 10, it’s currently cheap as cheap can be.

Altria has been able to offset the decline in the number of smokers by raising prices every-single-year.

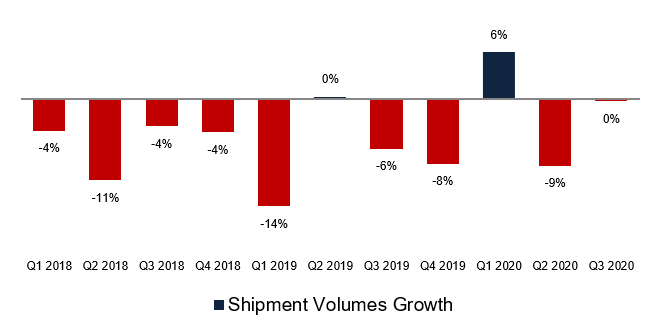

Every quarter, when the results come out, there’s just a few metrics I want to look at. The growth in shipment volumes is the one I look at first..

The biggest concern regarding Altria is if the company sees a decline in the volume sold as it has seen in 2008/9 which reached a staggering -12%. Interestingly enough, the there was almost zero decline in the third quarter of the year. At home, people smoke more.

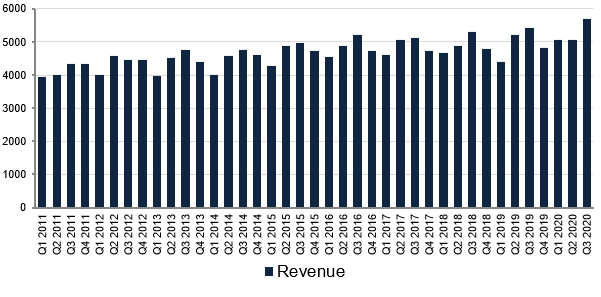

Then, of course, I’ll be looking at the revenue figure to see if the company has been able to keep raising prices…

Yup, the same old formula: volumes down + price increase = Higher revenue.

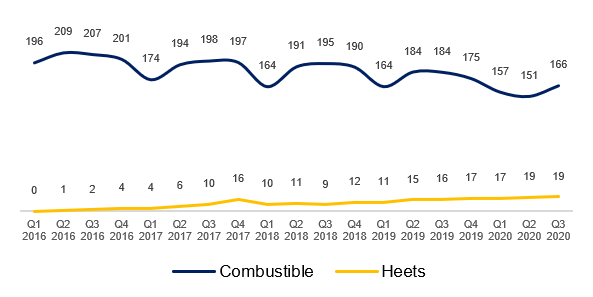

And then I’ll want to take a look at its sister Philip Morris International and how the Heets’ sales are going (the Heets are the small cigarettes that go into the iQos device).

I was hoping to see a quicker increase in the adoption of the iQos/Heets, but then again, it’s still not present in all markets, and each country is obviously unique. Unfortunately, in the USA, the iQos is still pretty much zero, even after one year of being launched.

FINANCIAL ENGINEERING

Now to the fun part. What attracts me to Altria is that there is huge potential to unlock shareholders’ value, but the fact that certain traditions are so ingrained in a company’s culture prevents those in charge from making bold moves.

Altria is a Dividend Aristocrat, a company which has been raising its dividend for more than 25 consecutive years. If investing were a religion, Altria’s dividend would be Christmas. It’s untouchable. And that’s what bothers me. So much shareholder’s value could be unlocked if the management were to just switch to buy backs. Such a move would be talked about for many decades to come. It would also probably get the CEO and the Board of Directors in serious trouble.

With almost $30 Billion in debt, Altria already has a GIANT debt burden. But more debt could actually be beneficial to the shareholders. You see, even with today’s huge debt load, the company is leveraged at 2.7x Debt/EBITDA. It could lever up to 3x DEBT/EBITDA, and use the proceeds to buy back stock at these depressed prices.

With this move, it would be raising an additional $3.7 Billion dollars, which, at today’s prices would translate into a reduction of 98 Million shares, or 5.3% of the total shares outstanding. Those $3,7 Billion could be raised at – say – 5% interest rate (the current combined interest rate is around 4.2%). This would mean that the company would be paying interest on that new debt of $182 Million per year.

BUT, if the company were to buy back those 98 million shares, it wouldn’t have to pay dividends on those shares. This would mean that the company would be saving $337 Million in dividends. If we subtract one by the other, the company would be saving some $155 Million without touching the dividend (per share).

This way, it could free up capital to – buy back more shares.

Although this is a theoretical exercise, it goes to show what could be done if a contrarian CEO or Board of Directors were to take over.

I’m not buying Altria for the Portfolio, but I will keep following it. To end this post, I’ll leave you with a quote by none other than good ol’ Warren Buffett.

“I’ll tell you why I like the cigarette business. It costs a penny to make. Sell it for a dollar. It’s addictive. And there’s fantastic brand loyalty.”

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.