Amazon

2019 Q3 Results

October, 30 2019

TICKER: AMZN

ISIN: US0231351067

SHARE PRICE: $1.761,45

MARKET CAP: $873B

INTRODUCTION

Amazon is, without a shadow of a doubt, one of the best businesses I have seen in my whole life. No wonder Berkshire has bought a piece of it (I suspect they are still buying).

I have already looked at it a couple of times before so I recommend you to read those write-ups here and here. If you like to study companies, you will like to read them.

Since my last write-up, the share price has declined 9%.

Nothing that should worry the long term holders of this stock.

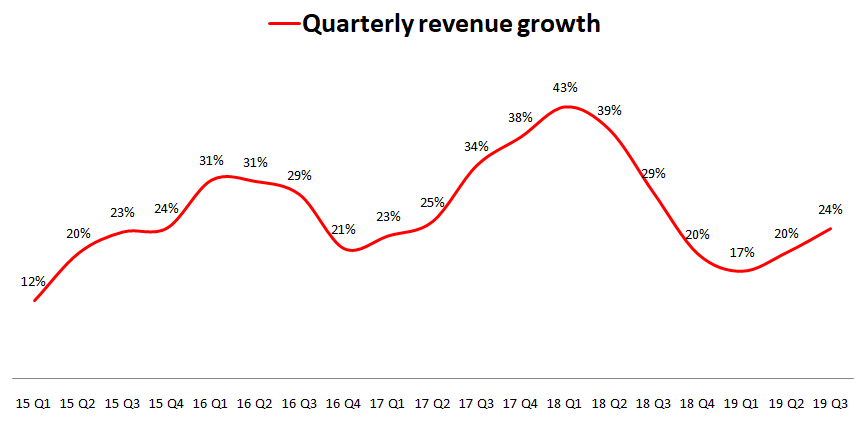

Meanwhile, the net sales have grown by 24% compared to last year’s figures.

Which means that we are seeing revenue growth increasing after a slowdown in 2018.

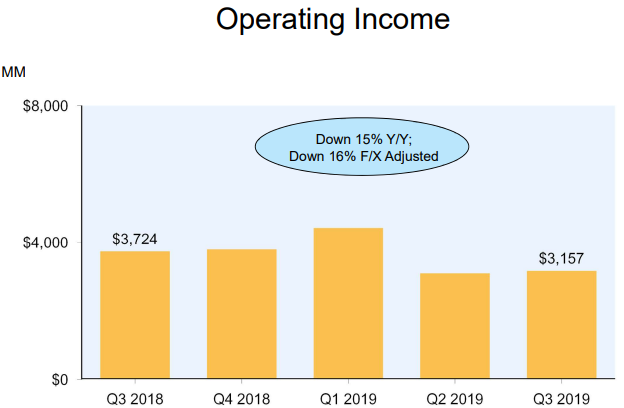

And here is the reason the stock was down after the earnings release. Due to the MASSIVE logistic effort to make one-day-shipments a reality, the operating income was down from a year ago. As Amazon ramps up its efforts for better and faster delivery, especially in the holidays season, this should continue in the upcoming quarters.

It’s funny how the market thinks about these things. (Remember that the stock was down about 5% after the earnings release).

This is what I wrote on my previous analysis about the matter:

On the earnings call, the CFO said that they are now working towards reducing the regular two-day shipping program to a one-day shipping program for the Prime members.

This will require some extra investment but I consider it to be one of the great news this quarter. Amazon is still a customer centric company and whenever and wherever they can improve their customer’s experience, they will do it.

Mr. Market is a bit like me when I think about exercising. I love the idea of being fit but it’s very hard to actually put in the effort in order to achieve my goals. Fortunately Jeff Bezos isn’t anything like me and he is putting in the effort needed to make Amazon even better.

The FCF TTM which is the accumulated Free Cash Flow generated during the past 12 months has decreased a bit.

And this is due not only to a lower Cash-from-Operations but to higher Capital Expenditures as well.

The company hired 100.000 new employees in Q3 alone (!) mostly for fulfillment and transportation roles while also growing its fleet of last-mile delivery trucks. (The moat is getting wider and deeper by the day.)

One of Amazon’s businesses that I’m always eager to check on is its advertising business. I remember it not growing as much as expected on Q1 but it seems to be picking up now.

This is just massive growth. Even in Q1 and Q2, this business grew 34% and 37%!!! It grew 44% in this quarter alone. Google and Facebook – Watch out!!!

Now, a fun exercise:

How much would you pay for a digital advertising business that is generating $13B and growing at 44%? Well, Facebook’s net margin is 30% and Google’s net margin is around 22%. Let’s say that’s Amazon can achieve 25%.

Let’s also say that Amazon’s advertising business will grow slower than before, like 35% annually. In 2024 it will generate $63B in revenue and net profit of $15B.

What kind of multiple do you think a business like this would get? Let’s apply the same multiple as Facebook to stay on the safe side. This would be 25 today. Using these conservative assumptions, this business alone would be worth $377B, give or take. And I’m not even accounting for the cash it will generate in the meantime.

I thought it would be a good idea to see at what rates the other businesses have been growing.

It seems that Amazon is already reaping the benefits from the one-day-shipping effort with online sales growing 21% in the third quarter.

Third party sellers are also growing A LOT! 27% to be exact.

Strangely enough (or maybe not) the cloud is slowing its growth. Yeah, I know, 35% is still massive growth.

On the Q3 conference call, the CFO said that this segment’s operating margin has come down from 31% to 25% mostly due to costs related to sales and marketing, and to a secondary extent, due to infrastructure.

Another great detail is that he also said that they are always looking for ways “to continue to pass along price reductions to customers”. This is the Costco playbook all over again.

Here, let me remind you of how good that playbook is:

They are trading pricing for longer term contracts with their customers and that shows on a small forgotten line in the latest 10Q. They have $27B in future commitments for AWS, up 54% year-over-year.

Unfortunately they lost the JEDI contract, a $10B contract with the US Department of Defence to Microsoft and that’s a pity.

Subscription services are growing at 34%!

It seems that the venture into physical stores (Whole Foods) hasn’t been a great success so far, but I would say that this takes time and sooner or later they will get it right.

What I love about Amazon is that it doesn’t settle. They are always looking to improve the customer’s experience and the operations supporting that experience.

For a brief moment there, Mr. Market thought that higher costs were a bad thing. And they can be, but they can also be a great shovel used to dig a much deeper and wider moat.

Amazon is still Amazon. Forfeiting benefits in the short term in order to reap much higher ones in the future. This is one of the best companies ever. So the big question is: Can this amazing company be a good investment for a small private investor? Is it cheap? Or because we are infinitely smaller than Warren Buffet, we should focus on other companies?

That information will be available to the subscribers of the new All in Stocks Research Service. You can know more about it by clicking the link below.

6. DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.

Warning: Undefined array key "cat" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 176

Warning: Undefined array key "tag" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 177

Warning: Undefined array key "css_id" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 200

Deprecated: preg_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /home5/manuelbean/public_html/wp-includes/formatting.php on line 2431