Have you got some of that...

...Anchoring Bias?

By Manuel Maurício

February 15, 2022

What would you do if the price of a stock that you own dropped 50%?

Would you sell?

Would you buy more?

You can say what you want, but…

I believe that you don’t know how you would react until it happens.

Investors who have gone through such event in the past will be in a better position to picture how they would react.

This is so because practice makes perfect.

But even so, having gone through one single event doesn’t make anyone an expert. Repetition would be needed. That’s how you become good at something.

The philosopher Allain de Botton has an interesting talk titled “Why you will marry the wrong person” where he makes the point that marrying someone is such an infrequent act that we’re more likely to fail than not.

This, however, doesn’t mean that we should just accept the “defeat” and not prepare for it.

Quite the opposite. We can and should do something about it.

What companies are good to buy?

A different but related question that I get from new subscribers is “What companies in the Portfolio are still good to buy?“.

This question is usually followed by “I think I’m going to buy the ones that are red” (the stocks that are down since I bought them for the Portfolio).

This is called Anchoring Bias. You bought the stock XYZ for $100 and if it’s now at $80, maybe it’s at an even better entry point.

All other things being equal, it makes logical sense.

But the world changes, and fundamentals change too (hopefully for the better). Not to mention that the investing thesis might’ve been wrong in the first place or it might have been broken in the meantime.

Another version of this is when you want to sell the stock, but you’re waiting for it to go up to the price that you initially paid.

I’m sorry to tell you this my friend, but it doesn’t make any sense. If you’re looking to sell, that’s probably because you recognize that that particular stock no longer offers the promise of a safe investment operation. If that’s so, it’s important to cut your losses immediately. You need to act cool! Act like Fonzy.

Drawdowns

Circling back to the initial question of this article, what would I do if a stock that I own came down 50%?

It depends. If the business had become better, I would definitely consider buying more. If the business had deteriorated in a permanent manner, than I would consider selling.

There’s still a third option which is to just hold the stock, without buying or selling it.

This is a good default option if you already own too much of that stock and buying more would compromise your diversification strategy.

You can also choose to do nothing if you have a small starter’s position and you’re waiting for the management to prove itself. I’ve got several of those in the All in Stocks Portfolio.

Having said that, the initial price at which I have bought the stock is irrelevant.

The stock doesn’t know that I own it.

One should evaluate the current situation to gauge the merits of an investment operation, be it to buy, sell, or hold.

Now, you don’t need to do extensive research all over again. If you’ve done your work right when you first bought the stock, you just need to distill it into one or two fundamental drivers (growth, margins, management, etc) and assess if the thesis is still intact.

If you have the money to average down, if you’re comfortable doing it, and if it doesn’t compromise your overall portfolio diversification strategy, you should consider buying more of it.

Just remember the math.

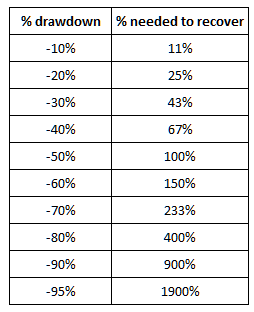

For a stock to recover from a 50% drawdown, it’ll need to go up 100% just to get to its initial price.

Although the table above reinforces what I’m trying to dismiss (the achoring to a previous price), it serves one point that I would like to stress:

At some point, the chances of a return to your initial buying price are just too slim. With a 50% drawdown a stock must double just to get to that initial price point. Although that’s perfectly possible, you’ll need to be very sure that the odds of it happening are high.

Conclusion

The investing merits of a stock have nothing to do with the price that you paid for it.

The fact that the share price is down says nothing about the investing merits of that particular stock.

It can now be more expensive or cheaper than before.

The investing merits of a particular stock depend on the fundamentals of the stock and the business.

Check Out The All in Stocks Subscription

Wherever you are with your investing – whether you’re still trying to work out what’s your style, or you’re already a proficient investor looking for those unique stock that go up 10 fold; if you’re serious about growing your wealth then you need to join the All in Stocks Subscription

The All in Stocks Subscription is the only place to get the training, support, feedback that you need to start getting great results investing in stocks!

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.