Apple,

Q2 2019 - Results

May, 06 2019

1. Context

I was out of the office for the most part of last week, exactly in the middle of the earnings season. This was a mistake and I must remember not to repeat it.

One of the companies releasing its earnings report was my old friend Apple. This was the first company I’ve analysed for AllinStocks and I’m curious to see what has happened since the beginning of the year. First of all I’m going to read my first analysis.

2. RESULTS

And now I’ll read the earnings release.

3. POSITIVES

3.1. Services, iPad and Watch sales are up

It seems that the bets the company has been making are paying off.

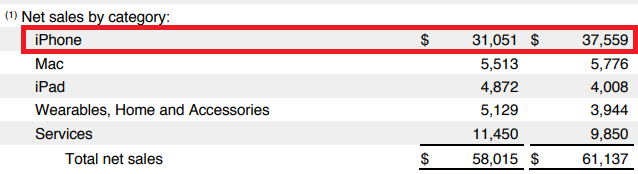

Ipad sales grew 22%, Wearables sales grew 30% and Services sales grew 16%.

Let’s keep in mind that the Service’s gross margin is 64% while the products gross margin is 31%. Although this is great especially because this segment has been growing to reach 20% of total sales, its growth has been slowing down in recent quarters.

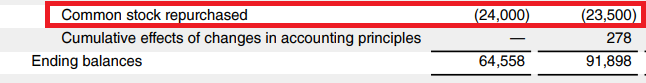

3.2. Number of shares outstanding

The number of shares outstanding has gone from 5 billion a year ago to 4.7 billion this quarter.

The company has spent another $24B buying back its own shares and has put in place a new massive $75B share repurchase program.

3.3. Agreement with Qualcomm

It’s also good to see that Apple and Qualcomm have reached an agreement and ceased all litigation.

4. NEGATIVES

4.1. Total sales are down

And now is where things fall apart for Apple. Total sales went down by 5%…

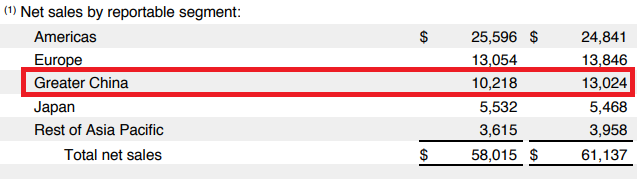

…in part due to a slowdown in China which saw its sales decrease by more than 21%…

… and in part due to a decrease of 17% in the iPhone sales. This is a never-seen massive drop. Apple stopped releasing the number of iphones it sells, but if we bare in mind that the new iPhones (especially the X) are way more expensive than the previous generations, we can deduct that the decrease in iPhone units sold was M-A-S-S-I-V-E.

4.2. Earnings and cash are down

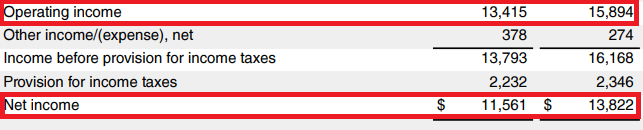

Consequentially, the operating income was down by 23% and the net income was down by 20%.

While cash from operations was also down by 13% and FCF by 12%.

5. OVERVIEW & CONCLUSION

5.1. OVERVIEW

There’s no way to hide the dirt under the rug. A decline of 17% in the company’s main product line is a massive blow to Apple’s business. As I’ve said on my previous analysis, Apple has become a mature company still highly dependent on the iPhone sales and if the other segments aren’t able to counter this decline, Apple’s investors will be in big trouble.

Don’t get me wrong, I’m liking what I see regarding the diversification away from the iPhone, and with 1,4 billion active devices out there the company has huge potential, especially in the Services segment.

Just look at what happened to Microsoft after the decision to put all the chips in the cloud-based-products back in 2014. It has tripled in price. I’m also a big believer of the potential of the watch in healthcare but until all of this plays out, the company is still a smartphone company, the competition in the smartphone arena is fierce and I see a lot of people just switching to cheaper, somewhat equivalent phones.

As if this wasn’t enough, the stock price has gone up by more than 32% from my first writing and the company’s prospects are now much worse. Apple is shifting its focus from a smartphone company to a services company and although one might argue that this is a huge avenue for growth given the number of iPhones out there, I’ll be staying on the sidelines until I see more juice being squeezed out of the “Services” segment.

5.2. CONCLUSION

This section will be available to paying subscribers in 2019 when we launch the Portfolios.

Don’t forget to check our other analyses.

If you want more, join us at our new:

6. DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.