ASML

the most important company in the world

ASML

the most important company in the world

By Manuel Maurício

September 2, 2022

Symbol: ASML (ASML)

Share Price: €472.2

Market Cap: $190 Billion

By employing the brightest minds in the world, all pushing technology to the boundaries of physics, ASML has turned itself into the sole manufacturer of the most advanced machine humans have ever created.

A friend of mine who lives in Eindhoven is constantly telling me that I should be looking into ASML (the company’s headquarters is located in Veldhoven, a small town just outside Eindhoven). He knows several people working at the company and, according to them, there’s no other company like it in the world. I’ve looked at its valuation several times in the past and was quick to dismiss it. But now that the stock price has come down 46%, and since I’ll be in Eindhoven in the last week of October, I’m ready to take a look at it.

Process

If you’re familiar with the tech industry you might’ve heard about Moore’s Law. It roughly states that the power of computers will double every two years. But Moore’s Law isn’t a real law. Humankind must work to accomplish it. One way to do it is by reducing the wavelength of the light used to print the transistors onto silicon wafers. Complicated? A little bit. But let me explain:

To understand ASML and how it’s helping fulfill Moore’s Law, one needs to understand photolithography. Photolithography is the process through which “small patterns are etched on semiconductor materials such as silicon by the manipulation of light“. Basically, a light beam is projected through a “mask”. That mask contains the circuit pattern that will be “carried” by the light (just like when you put your hand in front of a light source, it will be projected on the wall as a shadow). Through the use of water or mirrors, the beam of light is shrank and focused onto a photosensitive silicon wafer (hence the name Silicon Valley).

By doing this, the transistors (miniscule electrical switches) are etched onto that wafer. After doing this several times you get the chips used in your phone.

ASML designs and manufactures lithography systems, metrology and inspection systems, and computational lithography systems. Let’s just focus on the lithography systems as these are ASML’s most important products.

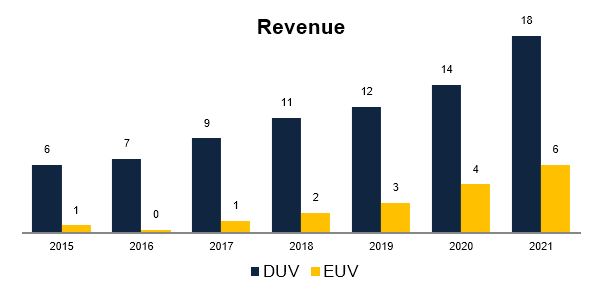

The company manufactures both traditional Deep Ultraviolet machines (DUV) as well as the cutting edge Extreme Ultraviolet machines (EUV). The most advanced chips are manufactured with EUV whereas simpler microchips are manufactured with DUV machines. The DUV machines are the workhorses of the industry. In fact, most of the chips that are built today are done so in DUV machines.

But it’s the EUV machine that makes ASML interesting.

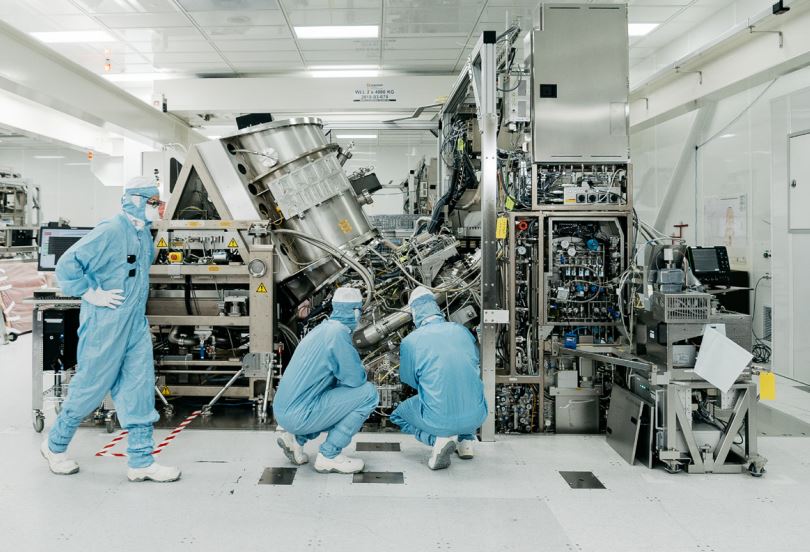

Each EUV machine sells for more than €150 million, and is the size of a bus. It needs 40 containers and 3 cargo airplanes to be shipped.

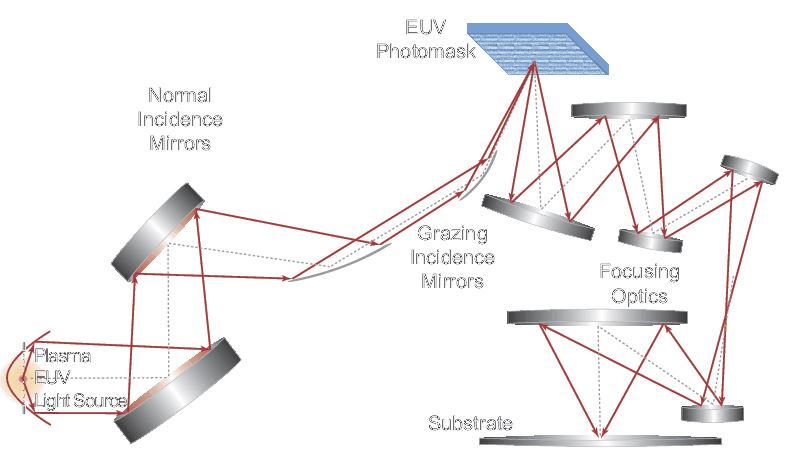

It’s probably the most advanced machine ever built by mankind. It uses the same basic principles of photolithography described above, but taken to the extreme.

In order to shorten the wavelength, droplets of molten tin arehit by laser beams, twice. The first, low energy laser, shapes the droplet into a “cookie”. The second high energy laser blasts the droplet to create a beam of high energy plasma. That beam will then bounce off a few of the most flat mirrors ever created (by Zeiss) to etch the most miniscule transistors onto the silicon wafer. Because the EUV light is absorbed even by air, all of this must be done in a vacuum. This video explains it much better than I can. Do check it out.

A brief history of ASML

In 1984, Philips and the chipmaker ASM International created a new company to pursue the development of lithography systems for the chip industry. That was the birth of ASML.

In 1995, ASML went public in the Amsterdam and New York stock exchanges. After investing heavily on R&D and acquiring some lithography companies, ASML grew to become part of an oligopoly with its peers Nikon and Canon.

But it wasn’t until the 2010’s that ASML would plant the seeds for the monopolistic position that it enjoys today with the introduction of the EUV technology. At first, no one in the industry really believed in such technology, but in 2012 ASML was able get its largest clients – Intel, TSMC, and Samsung – to invest in the development of the EUV technology. They knew that the DUV machines were reaching their limits and a partnership was the only way forward.

With this Customer Co-investment program, ASML raised €3.85 billion by issuing 23% newly created shares. Intel got 15% of the company, TSCM 5% and Samsung 3%. The 3 companies also committed to funding R&D in the coming years.

In 2013 ASML acquired its supplier Cymer for its light source technology. This acquisition was crucial for the development of EUV. Finally, after decades of delays, in 2016, the first EUV was shipped out of the factory.

The co-investment example stated above goes to show the importance of relationships in this industry. The technology is getting so complex that it’s impossible to do it alone. With only 3 major clients, 2 of them accounting for 67.2% of sales, ASML can only move forward with their help.

The same happens with its suppliers, many of whom work exclusively for ASML. That’s why it’s so hard for Canon and Nikon to compete. All together there are 4.700 suppliers, with 800 of them accounting for 70% of total spend. From this, around 200 are critical suppliers, accounting for roughly 92% of product-related spend.

With its eyes in making Moore’s Law a reality in the future, ASML is already working on its next platform, known as “High Numerical Aperture” machines. They will allow for 1.7x smaller features and 2.9x increased density compared to the current EUV technology. ASML expects to start high-volume manufacturing in 2025-26. And just like before, ASML needs its clients to believe in the technology.

The company says that it has received orders for 5 prototypes and Intel should be looking to be the first to get its hands on one of those machines so it can start to think of competing with TSMC, which is way ahead of it (exactly because it invested in EUV machines before Intel).

All of these customer relationships, suppliers relationships, R&D investment, go to show the huge barriers to entry that ASML has carved around itself.

Would you have made money?

As an aside, both TSCMC and Intel sold their stakes in ASML back in 2017, with Samsung being the only one to retain half of its original stake. If you look at ASML’s stock chart, the decision to sell was a big mistake. But back then there were lots of development issues around EUV and it was far from guaranteed that the tech was going to work especially for high volume manufacturing.

This goes to answer those who say “Oh, if I had bought ASML back in 2017, I would be rich by now”. Even the most informed players in the industry sold their stakes so it was really hard to buy ASML stock at that time. To further illustrate my point, here’s a great article from 2014 about an industry insider saying that EUV would never work.

Even TSMC is known for famously saying that it would never do EUV. That lasted until Apple told TSMC that it had to do it and Apple would fund it. TSMC suddenly became EUV’s strongest believer.

How are the financials of a monopoly?

Now that we have a broad understanding of the business, it’s time to check if ASML’s technological power is reflected in the financials.

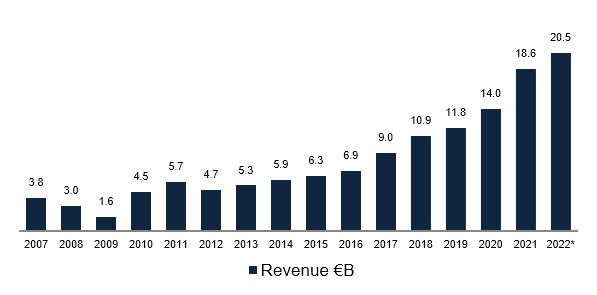

As expected, the revenue has been trending up for many years, with a special acceleration point in 2017.

That’s because, although 2015 was the year when the company first shipped its brand new EUV machine, it wasn’t until 2017 that ASML really ramped up production.

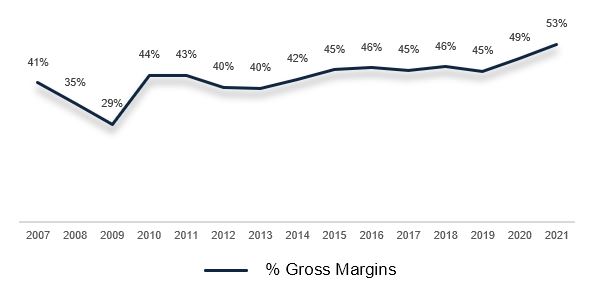

If we look at the gross margin, an indicator of pricing power (or at least some cost advantage), we can see that it was flat (but relatively high for an equipment manufacturer – Boeing has gross margins in the teens) between 2015 and 2019. I was expecting to see the gross margin go up over the years.

Now, this could mean 1 of 3 things: 1: that the company doesn’t really have much pricing power; 2: that the pricing power is only in the EUV systems which didn’t comprise a big percentage of revenues up until very recently; or 3: that ASML isn’t exerting its pricing power in an attempt to encourage the adoption of EUV technology.

And of course, in 2020 and 2021, the margins ticked up, but my guess is that’s due to the pandemic and the huge growth in demand – a transitory issue.

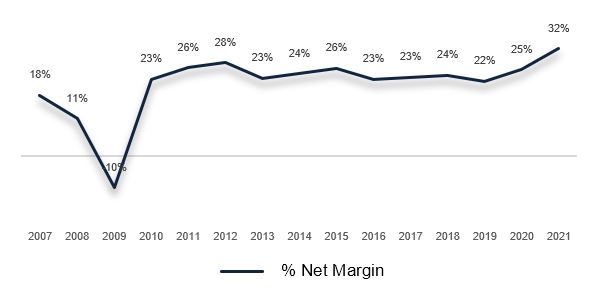

Not surprisingly, the net margin has followed the exact same pattern as the gross margin…

…leading to good (not great) Returns on Equity.

I must confess, I was expecting higher Returns on Equity for a monopolistic company. Again, maybe with the scale up of the EUV technology – which is where ASML in truly a monopoly – the ROE will go up.

ASML has a strong balance sheet

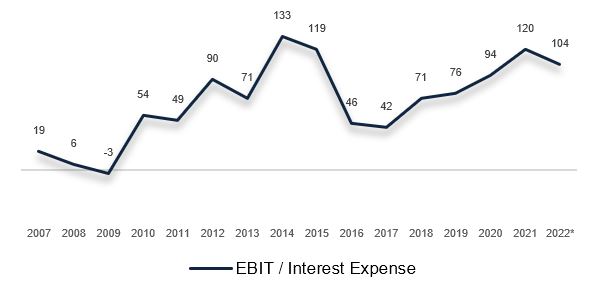

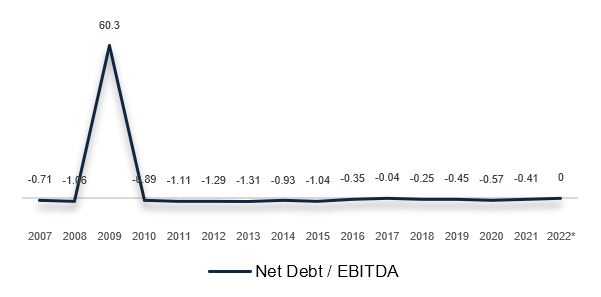

The company has a high EBIT/Interest ratio of 104…

…and zero net debt/EBITDA…

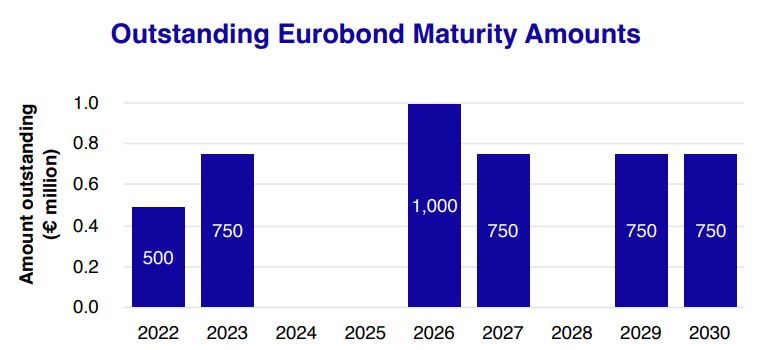

Also, it’s debt maturities are well spread over and are easily covered by cash flows.

…so from a balance sheet perspective we’re looking at a very strong company.

Capital Allocation

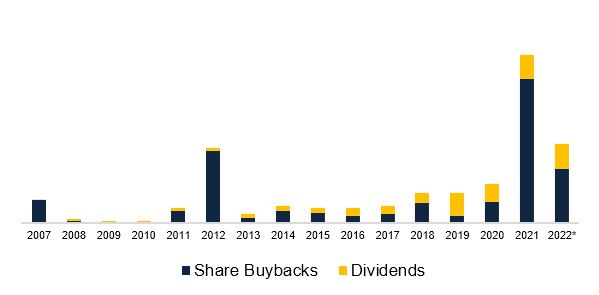

The strength of its balance sheet, together with the fact that ASML generates more cash than it needs, allow it to return cash back to the shareholders in the form of share buybacks and dividends.

It’s interesting to note that the share buybacks have ramped up exactly when the valuation was higher – a classical “mistake” in the corporate world.

I also dislike the combination of share buybacks with dividends. If the Board of Directors believes that the shares are undervalued (as is hinted by the share buybacks), why “waste” money paying dividends?

Management and Ownership

I’ve read only good things about the CEO, Peter Wennink. He’s been with the company since 1999, was CFO for a while and in 2013 he rose to top seat.

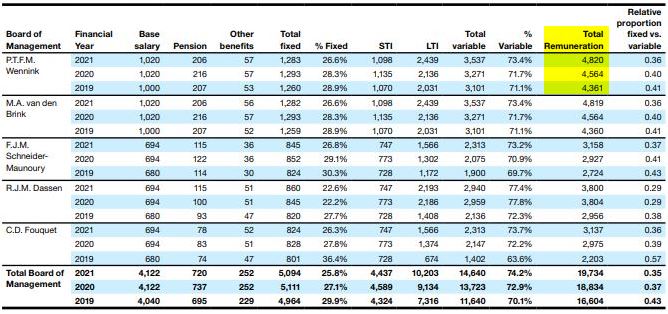

Wennink’s earned almost €5 million in 2021, with a base salary of around $1 million which is low compared to ASML’s net income of €5.9 billion.

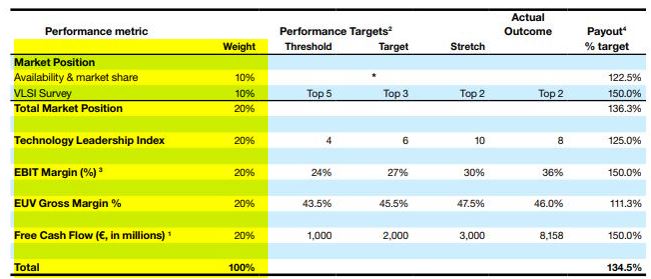

On top of the base salary, the management is eligible to earn both a short-term incentive (that can reach 80% of the fixed salary) and a long-term incentive (that can reach 120% of the fixed salary).

The short-term incentives are tied to operational metrics as well as financial metrics such as operating margin, gross margin, and Free Cash Flow.

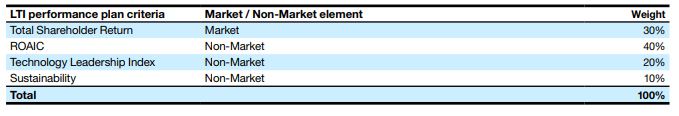

The long-term incentives are tied to Return on Capital, Share price appreciation, share price comparison with a group of peers, and finally, sustainability.

Overall the metrics underlying the compensation don’t shock me.

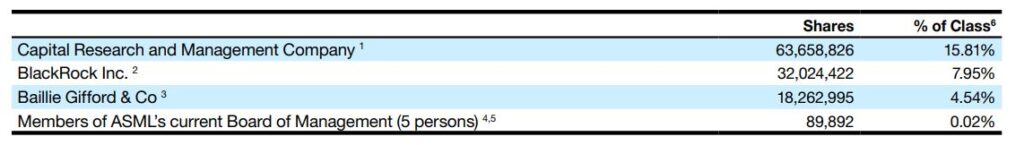

What I don’t like is to see so little “skin in the game”. The top 5 insiders own very little stock. If you’ve been following me for a while you know that I put a lot of emphasis on the amount of ownership by the top management (or Board of Directors) as they will be incentivized to treat their business as if it was their own.

Risks

Although we’re looking at a one-of-a-kind monopolistic company, there are quite a few risks to the business:

- The chip industry is highly dependent on the economy (making it cyclical). ASML is dependent on the capital investments of just a few chip manufacturers.

- The company depends on Zeiss as its only supplier of lenses, mirrors, and other important components. Due to the degree of specialization and technical customization of many of the parts, together with low volumes, it’s not always economical to source from more than one supplier. The company knows this and has several protocols in place to mitigate risks, but it’s still a major risk.

- Geopolitical risk. ASML depends heavily on its customer TSMC, from Taiwan. Currently the USA has been blocking ASML from selling the EUV machine to China. If China were to invade and annex Taiwan, ASML could suffer. On top of that, the USA could demand ASML to stop selling the DUV machines to China. It has just recently ordered Nvidia to stop selling AI chips to China. You might be asking yourself “what power has the USA to impose this blockage to ASML?”. It’s a long story, but suffice is to say that the EUV technology was first developed by the US military and is owned by EUV LLC, an American company. ASML was one of the first partners of EUV LLC and, kind of, licenses the technology from it so… it’s complicated. The DUV technology doesn’t belong to any one entity so I don’t know how easy it would be for the USA to have a say on a potential ban.

- Another important risk is the possibility of the CEO leaving. He has been there for long and a newcomer could make the wrong decisions.

- There’s also the risk of obsolescence of the lithography process (we’ve seen Google advancing quantum computing, and although we’re still years away from using a quantum computer on a regular basis, one never knows).

Valuation

At a Price/Earnings ratio of 37x ASML is optically expensive (you always need to compare what you’re paying with what you’re getting). The thing is, this is a one of a kind business – probably the most important company in the world. It should demand a high valuation. How high is the difficult part to answer.

First, let’s look at its valuation multiple over the years.

From the chart above, we can see that, not only has the company grown revenue and profits, but it has seen its earnings multiple expand from single digit back in 2012 to over 60x (!) by the end of 2021. The 40% drop since then doesn’t surprise me at all. Trees don’t grow to the sky. Right now, investors aren’t willing to pay so much for the future stream of profits.

At a PE ratio of 37x this suggests that investors won’t be benefitting from multiple expansion going forward and their (potential) returns will come only from the growth in profits. That’s already a bad place to start from.

Let’s do some quick math to find out what we can get from an investment in ASML: The management is guiding around €28 billion in revenue for 2025 with a gross margin of 55%. This would lead to around €9 billion in Net Income.

If we stay conservative and apply a Price/Earnings ratio of 30x to those profits we get to a share price of about €675. Add to that the cash generated in the meantime and the share price would be $750, leading to a CAGR of 13%.

I’m quite surprised actually. I thought I would be getting a low single-digit rate of return.

*CAGR: Compounded Annual Growth Rate.

Conclusion

I find it very interesting (and potentially dangerous) that the future of the digital world stands on one company alone. ASML might just be the most important company in the world. From that point of view, it should be the most expensive company in the world too. But it isn’t. In fact, although it’s selling for a high PE ratio, it might be attractively valued considering its growth prospects and its monopolistic position. There’s no doubt in my mind that we’ll be using more chips in the future.

But of course, I get to a double-digit rate of return based on the management’s guidance, and they may prove to be too optimist. The slightest change to those prospects (like a ban on DUV exports to China or an issue with one of its clients) would lead Mr. Market to overreact and throw the share price down by a lot. That’s when I’d be interested to buy ASML, when Mr. Market overreacts to some bad news.

ASML will not be entering the All in Stocks Portfolio, but I will keep following it.

I would like finish by thanking Rodrigo Gonçalves for helping me understand ASML’s technology. It’s a pleasure to have such knowledgeable and helping subscribers.

Have questions regarding ASML? Ask them here!

As always, I’d be very welcome if you could take the survey below. Thank you.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.