Aspire Global

and the iGaming Industry

Part 3

By Manuel Maurício

February 26, 2021

Introduction

On this write-up, I’ll be talking about the iGaming industry from a geographical point of view, then I’ll be talking about the ins and outs of the industry, and at the end I’ll be making some estimates and a rough attempt at valuation.

I must thank João Fernandes and Bruno Costa for putting me in contact with 2 industry experts.

One of these experts runs a B2C operation in Portugal and the other is the CMO of a medium sized B2B and B2C company. Remember, the B2B is the Business-to-Business company that provides the platform whereas the B2C is the Business-to-Consumer, the online casino or sports betting operator.

The iGaming industry

States across Europe, Latin America, and the USA have understood that they will benefit the most if they regulate the online gambling industry rather than just to ignore it. This way they get good tax income while believing that they’re in control of the rules. That’s why we’ve been seeing a wave of regulation in the past few years.

But the regulation is a double edged sword. It creates opportunity, but it also limits the amount of money that the iGaming companies can earn because there are strict rules for how much a player can gamble, how long he or she can play, etc, etc.

Europe

Europe is the most mature market of all (I’m not counting any Asian country here). Despite its maturity, some European countries are still tweaking their existing regulations or even regulating online gambling for the first time.

The trend has been in favor of stricter rules and increasing the gaming duties (taxes).

For instance, in Spain the regulation has become tougher and tougher for the iGaming companies. Spain will eliminate the traditional welcome bonus for first time gamblers (very important) and the sponsorship of football clubs will end this year.

Italy has the harshest regulation. Two years ago, it prohibited any and all advertising for online gambling. This has led to 40% of the online gambling being done through unlicensed platforms (via VPN, a technical feature that allows personal computers and smartphones to pretend they’re in a country where they really aren’t).

Because these unlicensed platforms are usually headquartered in tax-havens such as Malta or Curacao, they pay very little taxes and the Italian government gets no share of it.

In Sweden the regulation is pretty harsh as well. The platforms can’t be too different from one another, the tax burden is very high leaving the operators with razor thin margins. That’s why they choose the platforms from a price point of view when they want to operate in Sweden.

Both in Sweden and in Spain, following the pandemic and the fact that the hardcore gamblers are in a delicate situation, the governments have passed even tougher restrictions.

Germany has dropped the cap on licences in January 2020 and it’s expected to become the largest online gambling market in Europe soon. Aspire has been working to enter the Germany market as soon as it opens.

What these examples of extreme regulation lead me to believe is that, at some point, the European legislators will understand that the regulation is working against them instead of benefiting them.

It’s very easy to access a foreign, unregulated iCasino or sports betting platform and gamble away. It also makes it riskier for the player given that there’s no assurance that he or she will ever get their money back. But hey, they’re gamblers, that’s what they do, take risks.

I believe there’s a good chance that we’ll be seeing some European countries loosen up a bit on the regulations to harness more of the euros that are currently being siphoned to the tax havens.

USA

The USA is the most exciting opportunity today for any iGaming company. In 2018, the Supreme Court repealed the legislation that prohibited sports betting in the country. It’s now up to the individual states to pass their own regulation with 21 states having already legalized it, and many more to come. It will be the largest regulated market in the world.

Aspire knows this and that’s why they bought Pariplay. As mentioned on Part1 of this series, the US regulation doesn’t allow for companies that operate in gray markets to get a license. It happens so that Aspire still operates in some gray markets, so they bought Pariplay because Pariplay already had a US licence.

The opportunity is so big that Aspire is currently looking to open an office in the country.

Latin America

In Latin American countries online gambling has been booming recently. There’s a big push from brick-and-mortar casinos to get licenses to go online. Not only that, there’s a lot of foreign companies that are trying to get on board.

But Latin America isn’t for rookies. It might not be that easy to establish a solid business there.

There are serious cultural differences that will make many of these companies to just throw in the towel and retreat back to Europe or the USA.

Having lived in Brasil myself, and having been through such a situation, and having seen other Portuguese companies go through the same situation, I understand this very well (more on this later).

What makes Aspire different...

Over the past three weeks I’ve been finding more and more companies offering Player Account Management platforms (PAM). They’re like mushrooms, they’re everywhere.

Both experts told me that, in what relates to iCasino, there’s very little difference between the best platforms. Yes, some will have some features that others won’t, but it’s very difficult to say that there’s one that is better than the other in absolute terms.

My biggest question then was “What makes a platform provider different?”, what makes an operator choose one in detriment of the others?

Here are the 3 main reasons one of the experts I’ve talked to identified for choosing a platform:

1st reason: Relationship between the platform provider and the online casino. Ok, I think this goes without saying, not a big surprise here, and not something that individual investors can work with.

2nd reason: Geographical reach. The number of countries in which the platform already operates in and the countries where the platform is licensed to operate in. Aspire Global stands on very good footing regarding geographical reach. The company has licenses all across Europe, Africa, and now the USA and Latin America.

3rd reason: Which and how many payment processing options do they offer? I’ve heard Tsachi (Aspire’s CEO) mention this before. Different countries are used to different paying methods and as much as you try, you can’t beat deeply ingrained habits. In Brasil people are used to paying with a “boleto”. It’s like a paper receipt that they pay in specific shops (often lottery shops). It’s very hard to convince the Brazilians to pay with credit card whereas in Europe everyone uses credit cards. In Mexico, 40% of the population doesn’t have a bank account so they will top up their iGaming accounts in supermarkets chains like 7Eleven.

This makes it so that the platform providers must offer the operators a menu of payment options to choose from. Aspire is already used to all of these different options, so that’s a plus. I’m yet to understand if this constitutes a moat, or if other companies can easily do the same.

I will add a 4th point which Aspire’s CEO identified as their competitive advantage: Price. Or at least their pricing conditions. The fact that the company charges less than its competitors at the beginning and then gets a higher share of the gaming revenue is ideal for the operators. It also constitutes a risk for Aspire. If the gaming revenue goes down, Aspire’s revenue will go down in tandem.

Low barriers to entry

The expert to whom I talked who works for the B2B and B2C company told me that, in the beginning, his company was a pure B2C player, it had both Casino and Sportsbook, but then an affiliate asked if they could build a B2B website for him. That affiliate wanted to get into the business but didn’t have the technical knowledge to build it himself. Suddenly, this B2C company became a B2B company, providing not only the platform, but also design, maintenance, CRM, new games, and customer support.

The other expert mentioned that his casino runs on a lousy Spanish platform that gives him no control of the bonuses or free spins (this is very important for an operator), and on top of that he has to export the players data to Excel before entering it into a different email marketing provider to communicate with its clients. This is clearly old technology that won’t go very far. This same expert mentioned 3 different platform providers that I had never heard of.

Although anecdotal, these two examples illustrate how easy it is to build a platform and become a B2B provider. Sure, these platforms won’t be as good as the established and well-developed platforms, but there is clearly no barriers to the entry of competition.

Risks

Further regulation and taxes. Usually regulation favors the established companies. The problem with online gambling is that it’s online. The gamblers can easily access an unregulated casino using a VPN.

Highly competitive industry. As mentioned before, there are dozens of competitors, and as Aspire signs larger customers there’s the increased risk that these big customers use Aspire as a way of testing the waters just to build their own platforms as they gain confidence and market share.

Similarly, with the high level of mergers and acquisitions in this industry there’s a big chance that smaller clients get acquired by bigger companies who will ditch Aspire’s platform in favor of their own platforms. This has happened before with GAN, Aspire’s competitor.

As if this wasn’t enough, there’s the risk of higher taxes and gaming duties. Given the highly competitive environment, the pricing power of these companies is very limited, and more regulation and more taxes will hurt their profitability. We’ve been seeing that happen with Aspire’s margins.

Cyber Security, of course.

Valuation and Conclusion

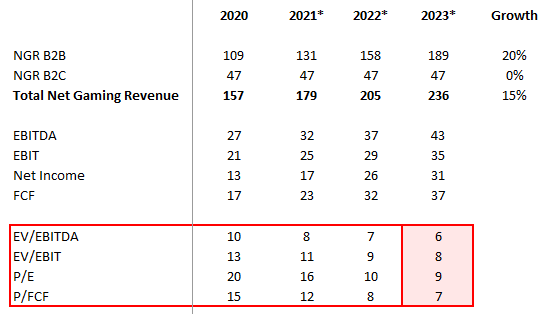

Let’s make some estimates for the next 3 years. Let’s say that the B2B segment will grow at 20% and that the B2C segment will remain flat. I believe these assumptions are achievable given the new verticals, the cross-selling opportunities, and the revenue coming from the new geographies.

Let’s also say that the margins will remain flat. The operating leverage will be dampened by higher taxes and gaming duties.

This means that, at today’s price, the stock is trading at 7 times the Free Cash Flow for 2023. This is obviously very cheap for a capital-light business growing at 15%. I would say that, even at twice the valuation it would be very cheap. This also means that we could be seeing the share price double or triple in the next 3 years or so.

Having said that, and having spent a good part of the past 3 weeks looking at the industry, I’m not buying Aspire Global today.

Don’t get me wrong, I can see how shareholders of Aspire Global may do very well in the coming years. I just haven’t been able to build the conviction to own it yet.

I see no differentiation between Aspire and its peers. Yes, the company has been executing quite well – although the growth has come exclusively from the acquisitions – and Aspire is entering a few new markets that will likely contribute massively to its growth, but I wouldn’t be comfortable owning such a low-barrier-to-entry business in an industry where the pace of change is so rapid.

But this isn’t the end of it. I’ll keep following the industry and if I find a company that is well protected from this constant level of change, one that has high barriers-to-entry while selling at an attractive valuation, you’ll be the first know.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.