AutoZone

vs O'Reilly

By Manuel Maurício

July 30, 2021

Symbol: AZO (NYSE)

Share Price: $1625

Market Cap: $35 Billion

Business

A few weeks ago, I wrote about O’Reilly Auto Parts, an auto-parts retailer that had become a 200-bagger.

Today I’m doing a comparative analysis with its largest competitor, AutoZone.

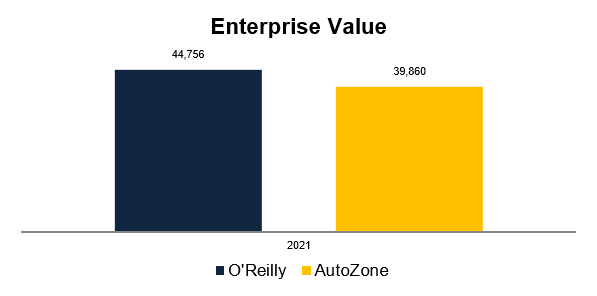

As always, the first thing I’ll want to be doing is to compare their relative sizes. First through their Enterprise Value (total value of the company).

O’Reilly is valued a bit higher than AutoZone…

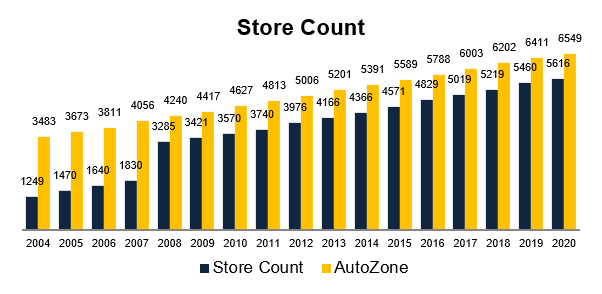

…let’s look at the store count.

Interesting.

AutoZone has more stores than O’Reilly, yet it’s worth less.

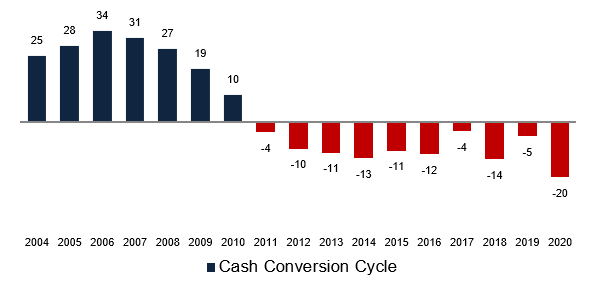

AutoZone also has a negative Cash Conversion Cycle…

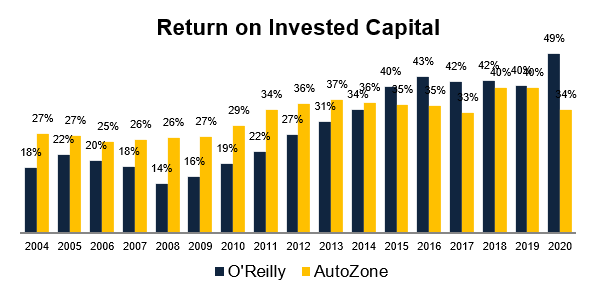

…which has led to great Return on Invested Capital.

O’Reilly has been managing to get higher returns on its investments. That could be the reason for the difference in valuation.

When I first started learning about investing in stocks I would hear more experienced investors talk about great businesses and great management teams.

I was eager to learn how to measure that quality. I was looking for formulas, specific data, and other hard facts.

At some point, after reading a lot of Annual Reports, I understood that a lot of things can’t be measured, but there’s some things that, when you see them, you just know you’re looking at an exceptional business.

Just read this quote by the CEO of Autozone a couple of years ago:

“Our primary focus has been and continues to be that we ensure every incremental dollar of capital that we deploy in this business provides an acceptable return, well in excess of our cost of capital.”

You might find this weird, but, to me, this sounds like a symphony by Beethoven. Note that the CEO didn’t talk about growth, he didn’t talk about margins, he didn’t talk about a whole bunch of other things, and, at the same time, he talked about all of them.

What he said was exactly what we want to be hearing from the managers of our companies.

In the end, what really matters is that every new dollar that is invested in the business provides an acceptable return to the shareholders – Return on Incremental Invested Capital. Probably the most important metric for any business.

Segments

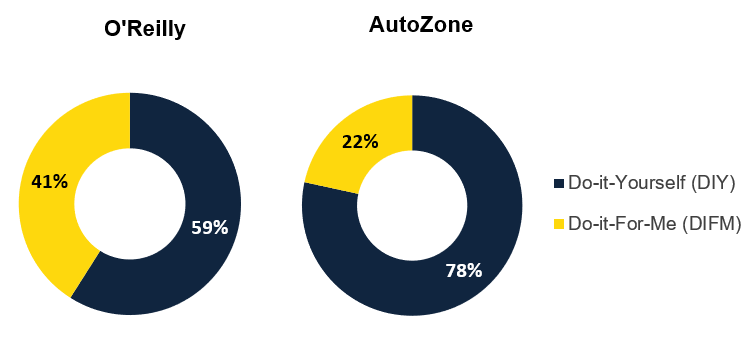

It’s when we break the revenue down into type of client that we begin to understand the differences between these two businesses.

While 41% of O’Reilly’s sales are into the Do-It-For-Me channel (the professional mechanics), for AutoZone that’s just 22%.

This makes a huge difference in both businesses.

Let’s start by the beginning. AutoZone has been regarded over the years as the industry leader.

It pioneered the Supply Chain financing, where, to get longer payable periods from its suppliers, it used its size and strong balance sheet and went directly to the suppliers’ banks to negotiate financing terms on their behalf.

This way the suppliers were able to sell AutoZone, get the money from the bank today with a little discount (banks got to eat), and AutoZone would pay the bank directly a few months after.

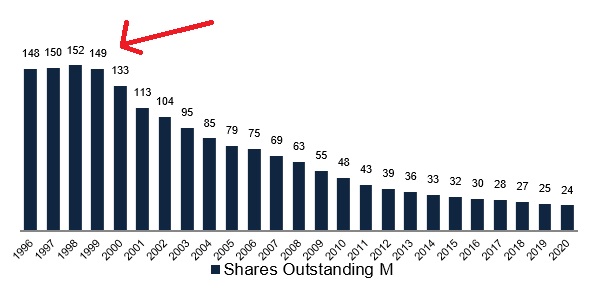

Not only that, but AutoZone pioneered the massive share buybacks as well. Both if these characteristics were followed flawlessly by O’Reilly.

Because historically AutoZone has sold primarily to the DIY market, the need for fast deliveries wasn’t as important as for O’Reilly. The regular American can wait a couple of days for a part, but not a mechanic.

This, in turn, dictated the distribution model for both companies. To serve the professionals, O’Reilly had to build the Distribution Centers and Hub-Stores that allow it to deliver parts everyday and, sometimes, multiple times per day to its stores.

AutoZone, on the other hand, delivers 3 times a week to its stores. It has been building Hubs and Mega-Hubs in an attempt to get to the same everyday deliver model of O’Reilly.

But it has had to correct course a few times as it wasn’t being capable of pursuing O’Reilly without sacrificing margins.

Way back in the day, while O’Reilly was investing in its distribution network, AutoZone had higher Free Cash Flow so it started buying back shares much earlier, in 1999…

…whereas O’Reilly would only start its share buyback program in 2010.

The industry is roughly 1/3 DIY and 2/3 DIFM, so this difference in exposures to the different markets can be seen as a half-full or half-empty glass kind of thing.

According to some sources, the big 4 players in the industry account for a 40% share in the DIY segment and 20% in the DIFM segment.

The DIFM market is stickier, more predictable, and more fragmented than the DIY market. But it comes with with lower margins.

The fact that AutoZone still has a lower share of its revenue coming from the DIFM can be seen as a plus as it still has a lot of room to grow. On the other hand, the company has always been lagging O’Reilly.

Income Statement

So how does all of this reflect on the financials?

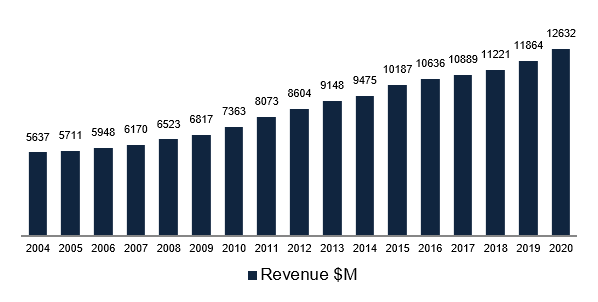

As expected, the revenue has been going up since, like, forever.

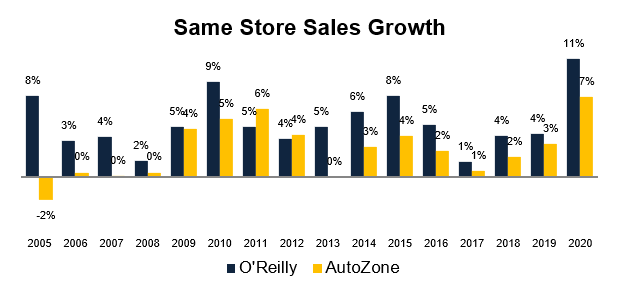

And although the Same Store-Sales growth has been positive for each of the past 15 years (except for 2005), O’Reilly has had consistently better Same-Store-Sales Growth.

I’d like to tell you that I know why this has happened, but truth is I don’t.

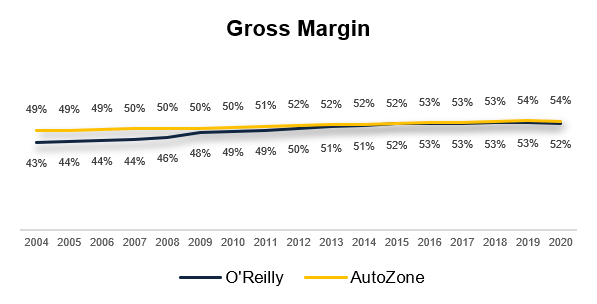

The gross margins are pretty much the same even while O’Reilly has a larger skew to the lower gross margin segment, the DIFM.

This is interesting.

How can O’Reilly get the same gross margins as AutoZone while its revenue is skewed to a more lower-margin segment?

Again, I don’t have the answer to this question yet, but this is probably one of the reasons why the market ascribes O’Reilly a higher valuation multiple.

It’s pretty interesting to see how, not only do these companies get better payment periods as they grow, but they become more efficient too.

They can exert more power over the suppliers to get better terms and dilute the fixed costs they grow their footprint. This is called having operating leverage.

Of course, these are not tech companies, but if you’re patient, this is the type of business that will make you waelthy over the long run.

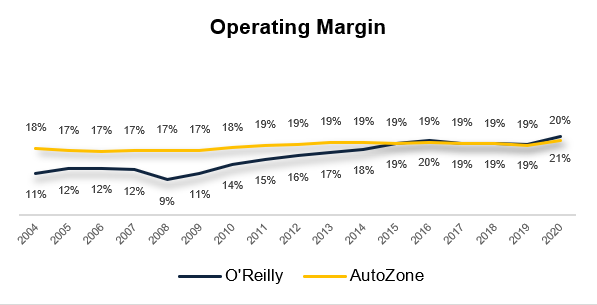

Note how O’Reilly’s margins were considerably lower than AutoZone’s until they started to inflect up back in 2009/2010 after the big acquisition of CSK. There are scale advantages to this business.

Balance Sheet

When you look at AutoZone’s balance sheet you’ll notice that it has negative equity. I believe I’ve mentioned this before, but I can’t remember where. The first company that I encountered with negative equity was McDonald’s.

At that time I was a bit confused. How…how… how could it be a going concern? It was bankrupt.

But the reality is that these great businesses can keep running without shareholder’s equity. Think about it, they’re so good that the shareholders don’t even need to put capital into the business.

That was a bit of an exaggeration. What has happened with McDonald’s is exactly what has happened with AutoZone. Both companies have been buying massive amounts of shares with debt or suppliers funds.

So long as the businesses keep running, there’s no problem. Only in the unlikely event of a liquidation would the shareholders be called to put more capital into the business. But nobody’s expecting that to happen.

With that out of the way, the interest coverage ratio is at 12x. For such a stable business, this is perfectly Ok.

One word on the negative Cash Conversion Cycle that makes these businesses so appealing. If the company were to stop growing, especially if the same-store-sales would stop growing, we could be seeing the Cash Conversion Cycle act as a negative.

In fact, with the slowdown in March and April of 2020, the company had to fund working capital because of the slow growth. It raised debt. At some point things go back to normal, but it will be interesting to see what will happen many years from now when the market share is exhausted.

Risks

- Major risks for AutoZone are its higher skew to the DIY market, which is the most easily disruptable segment by the pure online players such as Amazon.

- The electric vehicles are a trend to keep in mind as the number of moving parts on an EV is much lower than on an internal-combustion-engine vehicle.

- The EV’s are also much more sophisticated than regular ICE cars, which will probably lead to more maintenance work done in the dealerships in comparison to independent mechanics.

Growth and Valuation

Now, would I like to own these businesses? Yes, I would. For the right price.

Not only do these companies still have a lot of room to grow in the US, but both of them are expanding into Mexico and Brasil.

Having lived and worked in Brasil myself, my expectation in relation to “western” companies expanding into Brasil is always pretty muted.

I have nothing against Brasil. In fact, I love the country. It’s just that there are cultural, economic, and infrastructural differences that are usually forgotten to the dream of the potential riches the country offers.

I’ve seen it myself, this is usually recipe for disaster.

In this case of auto-parts retail I don’t think it will be a disaster, but it will take time for it to move the needle.

Having said that, the US market is still pretty fragmented, especially the DIFM segment.

The question now becomes, at what price would I like to buy these businesses?

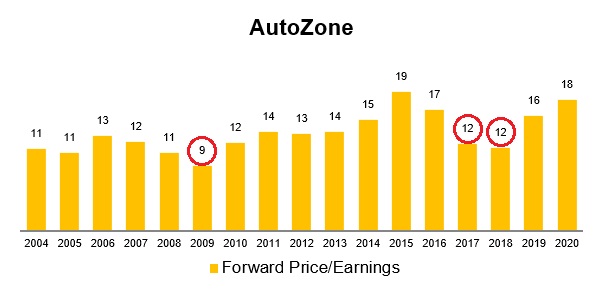

I don’t actually have one target price in mind, but I would like to buy them at historically lows so all the worries about Amazon and the Electric Vehicles would become irrelevant.

How often do these opportunities come by?

Every once in a while.

Just recently there were two good opportunities. The COVID-19 crash (obviously) and back in 2017 when the Same-Store-Sales growth declined to historical lows for the whole industry.

Everyone attributed the slow growth to loss of market share to Amazon when in fact it was due to two consecutive warm winters.

Looking back now, it’s impressive how such high quality businesses have traded at such cheap valuations.

And the question that arises is, what type of returns would investors have gotten if they had invested in AutoZone or O’Reilly back in 2017?

If you had invested in AutoZone back in 2017, when Mr. Market was selling it cheap, you would’ve enjoyed a Compounded Annual Growth Rate of 34%…

And if you had invested in O’Reilly instead, your returns would’ve gone up to 36%.

These are amazing returns. At 35% per year, you double your money every 2 years!

This has been achieved by the combination of growth, share buybacks, and multiple re-rating – the stuff of multibaggers.

WHAT ABOUT THE FUTURE? WILL WE SEE THIS KIND OF RETURNS GOING FORWARD?

Autozone has grown stores at an average of 4% per year for the past 10 years. For O’Reilly that has been 5%. Add to that SSS growth of 3% for AutoZone and 4% for O’Reilly and we get 7% and 9% growth.

Let’s say that growth will be 8% and the margins will remain at 12% for the two companies.

Both companies have reduced their share count by 6%, on average, for the past 6 years.

In 5 years time, we would be seeing AutoZone get $138 in EPS and O’Reilly $40.

If we apply the historical average Price/Earnings ratio of 14x for AutoZone and 19x for O’Reilly we would get to a share price of $1935 for AutoZone and $753 for O’Reilly, leading to annual rates of return of 3.5% and 4.8%.

These returns hardly excite me.

Can these companies do better than this? Yes they can.

I might’ve been too conservative in my growth, margin, and multiple assumptions. On top of that, both companies own a fair percentage of their stores (around 40%). They could do a sale-and-leaseback deal and repurchase more stock… but I would be surprised if they would beat my estimates by a lot.

Conclusion

AutoZone and O’Reilly remind me of Aercap and AirLease. Both are better than the other in certain aspects, but you could’ve closed your eyes a few years back and invest in both and still do ok.

What made me invest in Aercap was the capital allocation strategy vs the growth strategy for AirLease.

In relation to AutoZone and O’Reily, I prefer O’Reily just because of its more developed distribution network and skew to the DIFM market.

But AutoZone will certainly get it right eventually, and both strategies have delivered spectacular returns for the shareholders.

If I were to invest in these companies, I would wait for them to trade at historically low PE ratios. I would also make sure that the reason for the undervaluation was transitory and not permanent.

Holidays Notice

On the next couple of weeks I will be on holidays so I won’t be writing about new companies.

Since we’re in earnings season, I’ll be posting short updates to the companies in the Portfolio in the Facebook Group.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.