Cambridge Cognition

is it better than Cogstate?

By Manuel Maurício

June 16, 2021

Symbol: COG (AIM)

Share Price: £1.44

Market Cap: £45 Million

Introduction

I’ve been wanting to research Cambridge Cognition for almost a year now as it’s the direct competitor to Cogstate in a global duopoly.

In this period I’ve followed it from afar, but I never really dug deep into it.

With the recent approval of Aducanumab by the FDA, I thought this would be a great time to do it.

For all this time I’ve dismissed Cambridge because I was being influenced by the views of other investors who referred to it as being the lower quality business when compared to Cogstate. With deeper insights I figured out that that assumption might not be true at all.

In some ways Cambridge is better than Cogstate; in other it isn’t. Before we find out which is which, let’s take a birds eye view of both businesses.

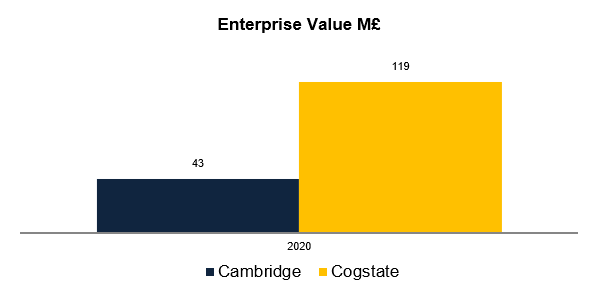

The first thing I want to be doing is to compare the size of both companies. First through their Enterprise Value…

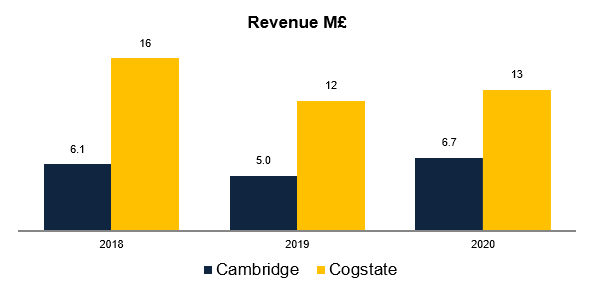

… and then through their revenue.

It’s obvious that Cogstate is the largest of the two with double the revenue and almost three times the Enterprise Value.

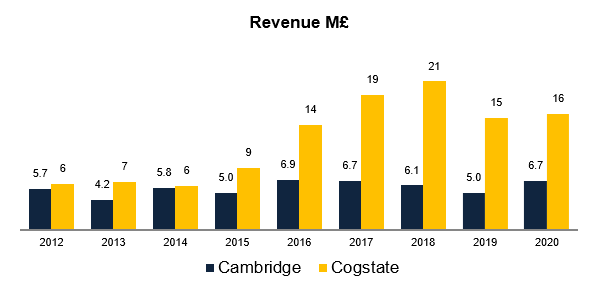

If we zoom out a little bit we can clearly see that since 2015/16 Cogstate took off whereas Cambridge has remained more or less stagnant.

But despite the poor performance, recent events have led the share price of Cambridge to go up by 7 times…

… and Cogstate’s by 4.5 times.

You don’t see many megacaps go up 4 or 5 times in a year. That’s why I love microcaps (in case you hadn’t noticed).

How I wish I had gotten my hands onto these two one year ago!

But it’s no use to cry over spilled milk. I’m happy I got to Cogstate when I did.

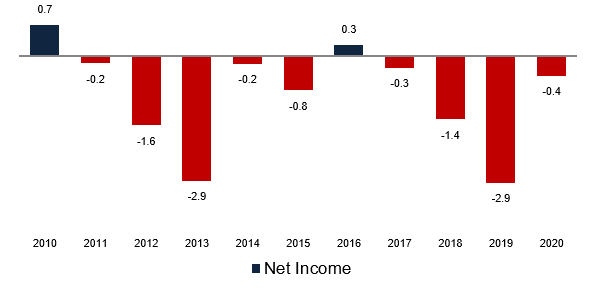

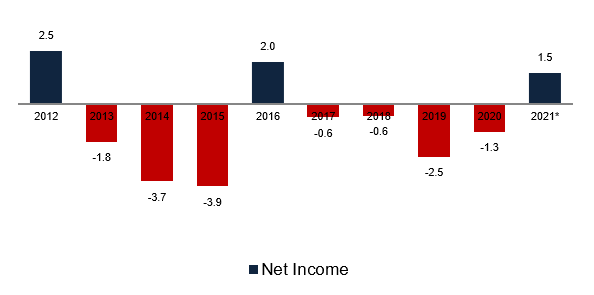

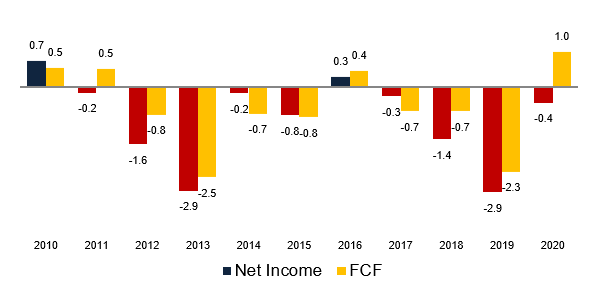

While we’re at it, let me show you the net income for Cambridge over the years.

Ouch! It hurts just to look at it.

To be fair, Cogstate hasn’t been much better.

So how exactly do they differ?

Cambridge Cognition was born inside Cambridge University as a research entity 30 years ago.

Like Cogstate, it develops and markets solutions to assess brain health, more precisely digital cognition tests.

Also like Cogstate, it caters to the Academic world where it supports scientific studies, it works with pharmaceutical companies in the development of new drugs through clinical trials, and it also has a healthcare segment that – just like Cogstate – hasn’t been a big contributor of revenue so far although that might be about to change if Cambridge lands a similar deal to that of Cogstate and Eisai.

But there are differences between the two as well, and I must tell you it isn’t easy to find them. You can read all the filings you want, it’s pretty hard to understand the differences of software and services of companies that serve other companies (B2B). I’ve had that same problem with Aspire Global.

Because of its origins, Cambridge Cognition has been more focused on the academia and in developing groundbreaking, tailor-made solutions. To put it in simple terms, Cambridge Cognition is the company to go to when you need a solution that doesn’t exist, whereas Cogstate offers an off-the-shelf solution (more limited in scope). Also, while Cogstate is more focused on Alzheimers Disease, Cambridge supports many other fields of research.

Although one might think that this bodes well for Cambridge (and it does), Cogstate’s focus commercialization has led to the higher revenues we’ve seen previously.

OK, but how exactly do they differ?

Although Cogstate is far ahead in what relates to commercialization, Cambridge is years ahead in what relates to technology. In fact, as far as I’ve been able to gather, Cambridge is years ahead of anyone else in the industry.

CANTAB, its core product, is the world’s most sensitive and most validated digital cognitive assessment being able to detect the faintest early signs of dementia. But that’s not all.

Ever since 2015, Cambridge has been leading the research on wearables, mobile and voice based testing. These three are the future of cognitive assessments.

Through voice detection Cambridge will be able to detect subtle changes in mental state such as dementia or depression.

This reminds me of the book Homo Deus by Yuval Noah Harari, where he illustrated a future filled with algorithms that will be way better at diagnosing certain diseases than human doctors. Algorithms will instantaneously have access to our entire clinical history and that of our relatives, and will be able to detect subtle changes in our mood or cognition fed by biological sensors, be it through the skin, voice or camera.

The tests done on wearable devices take into account heart rate, movement, light, mood, and the algorithms that take all of it into account. On top of this, because we’ll be wearing these devices at all times, the algorithm will be fed real-time and continuous data whereas today the tests are few and far between.

But when I read Yuval’s book a few years ago, I thought this would be happening decades into the future. Guess what? Cambridge Cognition is doing it already.

Yes it will take time to perfect the algorithms, the devices, the laws, the databases and more, but it’s already here. This is actually a bit scary. If you’re a nerd like me and want to learn more about it, I recommend watching this video from 2016.

On top of the wearables comes the voice based tests. Neurovocalix is a voice based product that can run verbal cognitive assessments using a smartphone, web browser, or it can even call people directly.

The prototype was developed 2 years ago, 2 proof of concept trials (paid by major pharma companies) have been completed so far and another one is still ongoing. The company says that it has had great feedback and it’s now finalizing a full production version to launch later in 2021 which will be used in both clinical trials as well as healthcare settings.

I was just watching the Capital Markets Day presentation earlier today and the CEO mentioned that his talks with prospective clients all start with the voice based tests and then divert to the core product CANTAB, as it will take time for the pharma industry to get comfortable doing major clinical trials with such young technology.

He mentioned that the pharma companies will be starting with smaller trials and studies, possibly even without administering any drugs to the patients just to validate the technology.

Financials

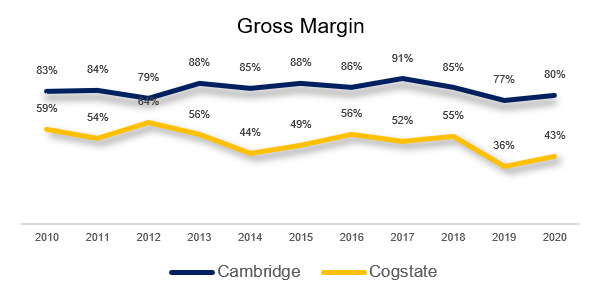

As we’ve seen previously, the company has been a losing money machine for the past 10 years and I believe that the past financials are of limited use for both Cambridge and Cogstate, but one metric might help us understand a little bit better the difference between the two companies, the gross margin.

On the Capital Markets Day, I submitted a question to the CEO about the differences of revenue growth between Cambridge and its competitors.

The CEO mentioned that “some of their competitors” (Cogstate) have higher revenue because they perform a lot of services that Cambridge doesn’t, such as rater training and on-site services.

Cambridge is more focused on selling software and limited high value services which are both higher margin. This is an important piece of information that I’ll be following.

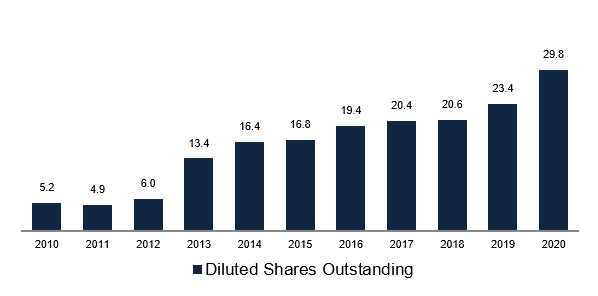

So, if the company has been a money losing machine for the past 10 years, how has it been able to remain a going concern? No creditor would risk lending money to such a business so there’s just one option left which is constant dilution through the issuance of new shares.

Balance Sheet and Free-Cash-Flow

In such a money losing business the strength of the balance sheet is paramount. As I’ve mentioned previously, the company has been funding itself through equity raises so there is no debt on the balance sheet.

But there’s huge negative working capital (the company owes its suppliers more than it’s owed by its customers). This will be especially important when it becomes profitable as it will generate more cash than profits.

And exactly because of that, it generated cash even while it was loss making in 2020 (if you don’t understand this and wish to, just tell me and I’ll be happy to explain).

At the end of the year, the company had £3 million in cash. I have no clue as to whether that’s enough to keep the ship afloat as the company is highly dependent on lumpy revenues, but I get the feeling that today’s Capital Markets Day presentation means that more dilution is coming.

A hidden treasure inside Cambridge?

On top of this all, hiding inside Cambridge Cognition there’s a drug development business called Monument Therapeutics. I cannot talk much about it yet as it’s a bit of a black box. There’s virtually no information on it. I was alerted to Monument by a fellow investor and I asked the company about it during the Capital Markets Day presentation, but they chose not to answer. Hummmm……

What I know is that the management wanted to spin it out, Cambridge has gone from owning 100% of it back in 2019 to just 20% in 2020, and that Monument is targeting some pretty big therapeutic areas.

Can it be a huge success? Does the fact that Cambridge now owns just 20% of it changes Cambridge’s profitability for the better? I don’t know, but I intend to find out.

Valuation

pegar naquele relatório do TAm e ir por aí.

They will profitable from this point forward. Finger in the wind I reckon PBT of 500k next year, 1,250k the year after and over 2,500 k the year after that

Conclusion

As you might’ve noticed, I haven’t even tried to estimate future profits or putting a number on Cambridge as I have yet to understand many aspects of the business.

On the one hand, Cambridge Cognition has loads of data and its technology is the best in the world. That will certainly be of interest to the big pharma companies or even to the tech giants like Apple or Microsoft.

On the other hand, neither the technology nor the data have ever been enough for it to become a commercial success. I’ve read the Annual Reports going as far back as 2015 and even then the company was talking about shifting its focus towards sales growth.

But that hasn’t happened. I asked the CEO the reason for this (he’s been CEO since 2019) and he said that he felt that the company was focusing on the wrong things such as the healthcare business before there was even a therapeutic available (which there is now).

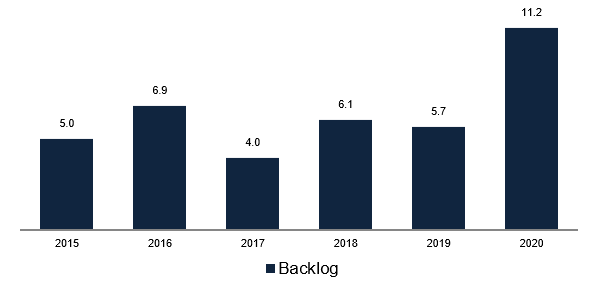

As of recently the company has been wining several big contracts and its backlog is higher than ever before. Add to that the fact that the pharma industry will be ramping up their R&D spend after the FDA lowered the bar so much with the approval of Aducanumab and we’ll probably be seeing Cambridge landing some big contracts.

I recognize that the technology this company has is more than enough to make this a huge success story (multibagger potential), but I’m still not there yet.

This is more of a Venture Capital play than a Value Investing play. There’s nothing wrong with that. It’s just that I’m not ready yet to take the leap. My next step will be to try to schedule a call with the management. As I’ve been trying to talk to Cogstate’s management for one year, I guess I’m going to need some luck.

By the way, to answer the question in the title, is Cambridge Cognition better than Cogstate? It might be, yes.

Two major tailwinds, the growth in demand for tech solutions for clinical trials and the increased spend in Central Nervous System disorders (CNS) by the pharma companies (behind oncology).

$1B growing at 17% yoy market.

Going forward, I expect the company to reduce its R&D spend and by growing its revenue, becoming profitable.

ver as options

Employees

Finalized the eCoa platform in H2 2019 which can open doors outside of the cognition market. Does Cogstate have an eCoa platform?

Digital phenotyping spin out.

The fact that Aducanumab is for the amyloid plaques and mild Alzeihmers Disease symptoms makes it so that Cogstate technology will be part of the clinical process…. 9 years or what.

Should we be expecting higher software and lower service mix going forward?

Recruitment will be more complicated?

insurances. Ler 40.

Mencionar que tentaram fazer direct sales nos US e montaram lá um branch, mas o sucesso parece ter sido limitado.

Mentioned healthcare as being their new focus in 2016, that they had the technology and Cogstate didn’t, and that they had to partner with larger companies to enter that market, but there doesn’t appear to have been made progress.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.