Changes in Working Capital

What it really means

On Part 1 of this series, we’ve taken a look at the difference between regular Working Capital and Non-Cash Working Capital, negative Working Capital and the working capital management.

Today we’ll be talking about a concept that was really hard for me to understand at first, so take your time reading this article and come back to it as many times as you’d like until you really get it.

The concept we’re looking at today is the Changes in Working Capital that are needed to calculate the Cash Flow from Operations and ultimately, the Free Cash Flow of a company.

To calculate these, I’ve seen a lot of people subtracting the working capital for year 1 from the working capital for year 2. I used to do the same thing myself. But THAT’S NOT HOW IT WORKS.

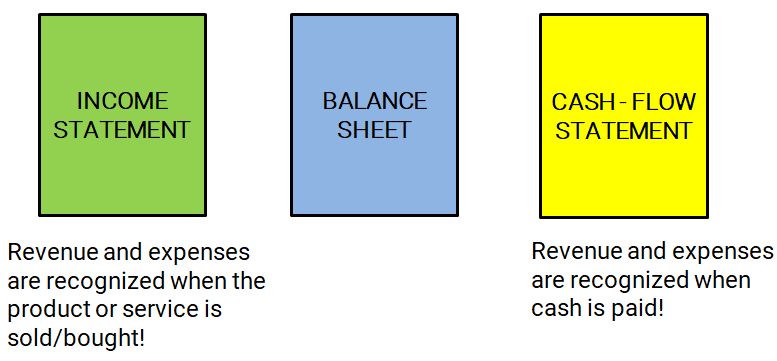

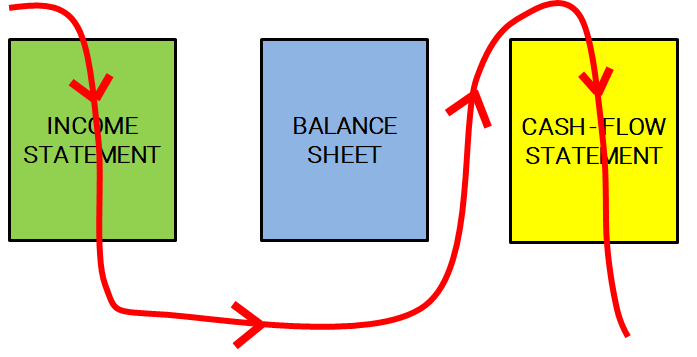

If we want to understand what the Changes in Working Capital mean, we first need to understand the relation between the Income Statement and the Cash Flow Statement. The Income Statement follows the accrual basis of accounting while the Cash-Flow Statement follows the cash basis of accounting.

Under the accrual basis, economic events are recognized by matching revenues to expenses at the time in which the transaction occurs rather than when payment is made or received, whereas under the cash basis, revenue and expenses are recognized at the time cash is received or paid out.

What this means is that when you sell something to a customer and invoice your customer, you will have to record it on the Income Statement immediately. That doesn’t mean that your customer has actually paid for the good sold.

Let’s say that you allow your customer to pay you within 30 days. In 30 days time he will wire you that amount. That is when you must record it on the Cash Flow Statement. This means that the Income Statement might not be telling the whole truth about a business.

That’s why the Statement of Cash Flows was introduced back in 1987.

To – among other things – let investors know what had been paid for and what hadn’t been paid for in cash in a given period of time.

For those of you who are just starting lo look at financial statements, here’s a quick (and very rough) explanation of how the first part of Cash Flow Statement works.

After arriving at the Net Income on the Income Statement, there are some adjustments that need to be made to find out how much cash the company is really making. Those adjustments take place on the Cash Flow Statement.

Back to our subject, here’s HOW IT REALLY WORKS:

First of all, we are talking about non-cash or operating-working-capital here. I’ve talked about this in Part 1 of this series so if you’re not familiar with it, I suggest you go and read it first.

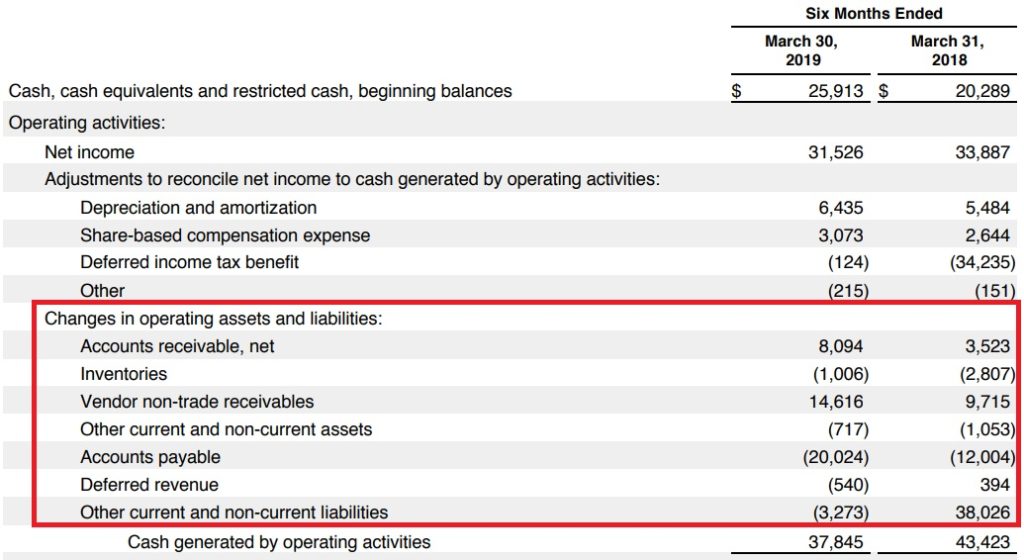

If you notice, you’ll never find changes in cash or changes in short-term debt on this section of a company’s statement of cash flows. As an example, here’s Apple’s cash-flow statement:

Notice that it states “Changes in OPERATING assets and liabilities”? No mention of cash or debt.

So before explaining how we should calculate these changes, let’s first understand how they are generated with a couple of examples:

Let’s say that a beer company sold 100 beers to a restaurant on the last day of the year. On that day, the beer company made a sale and invoiced the restaurant. But although the restaurant has made a purchase, it will only pay that amount at – let’s say – the end of January.

That amount will be recognized on the Beer Company’s Income Statement as Revenue and it will also be recorded on the Balance Sheet as an Account Receivable. Again, looking at the Income Statement alone isn’t enough.

And that’s why you calculate the CHANGE in Working Capital on the cash-flow-statement. Because that increase in Accounts Receivable represents cash that the company hasn’t actually received.

Let’s look at another example: Inventory.

Let’s say that an ice-cream company, while preparing for summer, has ordered 4 times as much ice-cream as in the previous period.

Until the company sells that ice-cream, the income statement won’t be revealing anything. On the balance sheet though, the company will record a larger inventory.

To buy that inventory, cash had to be paid. The company had to record that amount on the Cash Flow Statement. Hence the changes in inventory on the Cash Flow Statement.

So what we’re realizing here is that whenever a company buys more inventory, it uses cash that has to be subtracted from the Net Income on the Cash Flow Statement.

Let’s now look at another component of the working-capital. The Accounts Receivable. If the Accounts Receivable are growing, that means that the company has recorded a sale but no cash has been paid yet.

Which in turn means that there will have to be an entry on the Cash Flow Statement deducting that amount from the net income. This happens because in the income statement, the net income was calculated assuming that this amount had been paid for. Poor Income Statement! He doesn’t have a clue.

Now off to the liabilities side of the Balance Sheet:

Remember the restaurant who bought all those beers at year end? Because it didn’t actually pay for those beers, it recorded that amount on its balance sheet as Accounts Payable.

So if Accounts Payable grows -as was the case-, that means that there was a cost recorded on the income statement that hasn’t yet been paid for in cash. If, on the other hand, Accounts Payable decreases, that means that cash was paid to a vendor or supplier but didn’t go through the Income Statement because it had already been recorded as a cost.

We haven’t talked about Deferred Revenue yet but this is cash that has been paid by customers but can’t yet be recognized on the Income Statement because the services or products associated with it haven’t yet been delivered. It’s basically a pre-payment made by the customers (think insurance or a magazine subscription that you pay at the start of the year).

When Deferred Revenue grows, that means that there was cash coming in the door but wasn’t recognized on the Income Statement. Again. This must be recorded on the Cash-Flow Statement.

Now that we’ve looked at some of the entries affecting non-cash working capital, let’s try to sum it all up:

When those ASSETS INCREASE, that means that CASH DECREASED. Cash was used to increase the assets.

When these same ASSETS DECREASE, that means that CASH INCREASED. Cash was freed up.

Let’s look at Apple’s Statement of Cash-Flows again:

As we can see, the Accounts Receivable decreased by $8.094B, the Inventories grew by $1.006B, the Vendor non-trade Receivables decreased by $14.616B and the “Other current and non-current assets” grew by $717M.

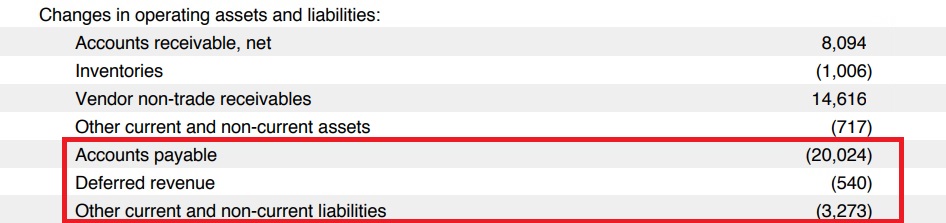

Now let’s look at the Liabilities:

When those LIABILITIES INCREASE, that means that CASH INCREASED. The company hasn’t yet paid for those liabilities (although the income statement says it did).

When these same LIABILITIES DECREASE, that means that CASH DECREASED. The company had to pay what it owed, thus reducing cash.

*Note that these assets and liabilities we’re talking about here are just the ones considered to be a part of the non-cash working capital.

Apple’s Accounts Payable decreased by $20.024B, the Deferred Revenue by $540M and the Other current and non-current liabilities by $3.273B.

The total change in operating current assets was $20.987 while the total change in operating current liabilities was -$23.837B. This means that the resulting change in working capital was -$2.850B which in turn means that the working capital has increased.

Look at it this way:

- If the change in Working Capital is NEGATIVE, this means that the Working Capital has INCREASED, reducing the Cash Flow. The company used more cash.

- If the change in Working Capital is POSITIVE, this means that the Working Capital has DECREASED, increasing the Cash Flow. The company was able to use less cash.

As a rule of thumb, investors will want to see receivables decreasing and payables increasing. That would mean that the company was getting better at collecting, while at the same time, deferring the payment to its suppliers to a later date, thus improving its working-capital.

So here you have it. If after reading this article you’re still confused, don’t worry. You can come here as many times as you want until you really understand it.

And if after reading it a few times you still have some doubts or some suggestions you’d like to make, you can join our Facebook Group by clicking the button below and we can discuss it there:

It’s time to wrap it all up. We’ve already learned what is working capital, non-cash working capital, negative working capital and now we’ve learned what the changes in working capital really mean.

In the next articles I’ll be talking about sources of working capital, working capital in growth companies, key working capital ratios when analysing companies and more…

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.

Warning: Undefined array key "cat" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 176

Warning: Undefined array key "tag" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 177

Warning: Undefined array key "css_id" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 200

Deprecated: preg_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /home5/manuelbean/public_html/wp-includes/formatting.php on line 2431

Recent

[the_ad id='17156']