Cogstate

a fundamental analysis

Symbol: CGS (ASX); COGZF (OTC Markets)

Share Price: AUD$0,62

Market Cap: AUD$105 Million

Cogstate: Share Price History

Source: Google

By Manuel Maurício

August 07, 2020

Business

Every intelligent investor who is worthy of that name should aim to add some multibaggers to his or her portfolio. I believe that Cogstate is well-positioned to become one.

Cogstate makes computerized cognitive tests with the goal of assessing people’s cognition. At first sight these tests look like they could’ve been created by a first year coding student. And that’s true. So what makes this company so special?

The traditional way to assess a person’s cognitive ability is through pencil and paper tests. Your doctor will lay out several items on the desk, a pen, a pair of glasses, a matchbox and a clip. He will then ask you to move one object. After a few seconds he will ask you to move that object back to its original position.

Another famous test is the International Shopping List Test. Your doctor will give you a shopping list with several items to memorize and after some minutes he will ask you to name those items. There are many other pencil and paper tests. Some will test memory, others speed of thought, others attention, etc.

But despite the fact that these tests have been widely used for decades, they have several problems. First, you can’t take them by yourself, they must be administered by someone else. Second, it takes time to administer these tests (+1 hour) and to compile the information from all the screened patients. Third, the fact that a human is administering them might lead to different interpretations which is something you don’t want if you’re doing a large clinical trial. Fourth, there might be practice effects (the more you take the test, the better you get at them). This will lead to longer breaks before retaking the tests.

Cogstate’s tests can easily tackle all those problems at once. Here’s an example:

“Have you seen this card before?”

It seems easy to replicate right? That’s what I thought at first. But it turns out it isn’t that easy. To be able to serve as a tool for assessing cognition on a clinical trial or at a doctor’s practice level, the technology must be well validated and it’s efficacy has had to be peer reviewed and published in scientific journals. In other words, you need the scientific backing. Not to mention the relations with the large pharma companies (which Cogstate has).

Cogstate has been involved in thousands of academical studies and clinical trials. What you see on the video above might seems like a simple app (and it is, sort of), but in fact it’s highly validated technology. It’s so sensitive that it can detect early signs of cognitive impairment well before any other test.

And the good thing is that it tackles all of the issues that a pencil and paper test can’t. You just need to login to Cogstate’s website, access one of their tests and voilá. You can take the test by yourself, be done after a few minutes (not hours), it’s completely automated and safe from varying interpretations, and you can take it as many times as you’d like without the risk of practice effects.

It’s such a simple technology that during this whole time when I was researching the company I was asking myself how can we still use the pencil and paper tests in an era when cars are driving themselves?

“Cogstates goal is to make assessment of cognition as simple as taking your temperature.” Brad O’Connor, CEO

Segments

As in so many other microcap companies, Cogstate’s history is full of progresses and retreats. Over the years, the management has made several bets that proved unsuccessful, only to fine tune them later on. Today, Cogstate reports its numbers under 3 different segments: Clinical Trials, Healthcare and Research.

Segment Contribution to Revenue

Source: Company data

Clinical Trials – This is segment under which the company works with pharmaceutical and biotech companies to support clinical trials that seek to study the impact of new therapeutics on Cognition. This has been the dominant segment since the foundation of the company.

Healthcare – Apart from the clinical trials, Cogstate’s tests can also be used by doctors to assess a patient’s cognitive abilities. On top of that, Cogstate is also developing some partnerships to make its technology available to the end consumer through a simple product called Cognigram.

Research – In order to get the much needed accreditation and scientific recognition, the company supports several research studies and academic collaborations. It prides itself of having been involved in over 1.800 academic research studies.

Partnership with EISAI

Cogstate has recently announced that it has entered a partnership agreement with the Japanese pharmaceutical company Eisai. Eisai is launching its “NouKnow” digital tool for self-assessment of brain health based upon Cogstate’s technology. (NouKnow can be translated into “Know your Brain”). Under the 10 year agreement, Eisai will market Cogstate’s cognitive assessment tools to physicians and end consumers in Japan. This is a major step for Cogstate.

A few years ago, due to the strong possibility of a new Alzheimer’s treatment coming out, Cogstate’s management thought that it would be a good idea to start marketing its products to doctors as well (the Healthcare segment), thus setting the stage to become the default test when a new Alzheimer’s disease treatment was discovered. You see, although today everyone tests for cholesterol, before there was a treatment for it, no one bothered to test. The same is happening with Alzheimer.

Cogstate thought that it could grow the Healthcare segment internally by setting up its own sales team and going directly to market, but as many things microcap the strategy didn’t go according to plan and when the Clinical Trials segment went through a rough patch due to the cancelation of several Alzheimer studies, Cogstate had to cut costs, fire its sales team, and pivot to partnerships like this.

Under the agreement, Eisai made a $1M upfront royalty payment to Cogstate and invested $1,9M in Cogstate shares. Eisai will be funding all future product development needs for Cogstate solutions for the Japanese market. This is already happening. Cogstate’s tests were only available for laptop or tablet. Eisai is currently funding the adaptation to mobile phones.

On top of that, Eisai will set up a commercial team in Japan, thus sparing Cogstate the headaches of having to sell the product. Eisai is widely known in Japan for its Vitamin-B complex Chocola BB so it already has a network to reach its consumers. Japan has a very old population and Eisai is trying to create the need for regular cognition tests not only for the elderly, but also in periodic corporate health check ups. You can already check some of Eisai’s advances here.

The agreement has an initial term of 10 years with performance milestones to keep the exclusivity on years 5 and 8. After all the costs, both companies will share the profits 50/50.

The clinical trials segment isn’t covered by this agreement so Cogstate will still be able to keep pursuing this segment in Japan independently from Eisai.

Eisai and Biogen

Now this is where it becomes interesting. Eisai is Biogen‘s partner in a new Alzheimer’s therapeutic called Aducanumab (A-du-ca-nu-mab). Biogen is a $44 Billion market cap biotech company known around the world as the company that is leading the Alzheimer’s research.

After dropping its development of Aducanumab back in March of 2019 due to poor early results, Biogen went through the results of the clinical trials and reached the conclusion that the patients who were administered the higher doses of the drug showed signs of improvement. Based on those findings, Biogen has filed for an approval of the drug with the US Food and Drugs Administration (FDA). That process is now pending.

If the FDA approves it, it will be the first Alzheimer’s treatment to get approval in almost 20 years. It will be a game changer. The rest of the pharma industry will follow Biogen’s steps and develop their own treatments based on the B(eta) Amyloid hypothesis, which in turn will lead to many more clinical trials.

Following this submission, the FDA has 60 days to accept the filing which will start a review of the application. The FDA will then have 6 months to complete the review and get to a conclusion (March 2021).

Given that Eisai has already chosen Cogstate as its preferred technology partner, there is a strong possibility that Cogstate will sign a partnership with Biogen for the US.

Although Buffett’s Berkshire Hathaway made a bet on Biogen, it’s anyone’s guess if the FDA will rule in favour of the drug or not so investors shouldn’t be counting on it to make investment decisions. But it’s important to understand the HUGE potential of such a ruling.

It would mean that further trials would have to be done and above all, it would mean that every single patient wanting to apply for insurance paid medication would have to be screened and take regular tests. Cogstate is clearly the best positioned company to serve this new market. If that were to happen, we would be talking about a huge success story.

Partnership with ERT

As if all of this wasn’t enough, in July 2020, the company announced a partnership agreement with ERT, the world leader in endpoint data collection, where Cogstate’s technology will be deployed on ERT’s technology platform.

Just so we can get a feeling for what this might mean to Cogstate, in 2019 75% of all US drug approvals came from ERT-supported studies. Unfortunately for us investors, the terms of the agreement haven’t been made public yet.

Bill Gates. Really?

And for the cherry on the top of the cake, earlier this year the company has announced (on a footnote on one of its filings) that it has signed an agreement with the Alzheimer’s Drug Discovery Foundation (ADDF) where the ADDF will co-fund the development of a voice-based smartphone application for both the Clinical Trials and Healthcare segments with $1,4 Million.

This funding has been awarded through ADDF’s Diagnosis Accelerator in collaboration with Leonard Lauder (founder), Bill Gates and others.

Management and Ownership

The high insider ownership is one of the major reasons I was first attracted to Cogstate:

Martyn Myer – Cogstate founder and largest shareholder with 13% of the company.

David Dolby – Son of Ray Dolby, the inventor of the Dolby Surround. David Dolby suffered from dementia late in his life and the family has since been active in funding treatment for the disease. The family owns 13% of the company and has recently increased its position.

Alan Finkel – Chief Scientist of Australia. Owns 5,3% of the company.

Eisai – Biotech company. Owns 7% of the company.

Richard Van Der Broek – A well-known biotech fund manager. Owns 2% of the company.

Brad O’connor – Brad came on board as a CFO back in 2004 and has been the CEO since 2005. He owns 4% of the company. You can watch one of his latest interviews below.

The insiders own about 38% of the company, and if we take into consideration Eisai and the Australian Ethical Fund’s stakes, the free float is just 38.4%.

Apart from this already large stake, several directors have been buying stock on the open market recently (more on that later).

Financials

As mentioned previously, back in 2018/19, many clinical trials that were looking to find a new treatment for the Alzheimer’s disease were cancelled and the company felt that hit. The whole industry went through a weak patch.

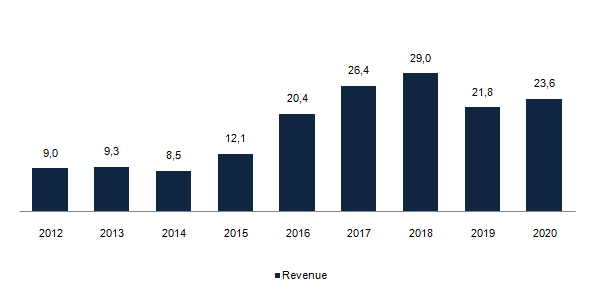

Revenue, US$ Millions

Source: Company data

But now, with the filing for approval of a previously discontinued drug, there is hope again. More important than the revenue itself are the signed contracts and the contracted backlog. Because the company recognizes revenue over the duration of the clinical trials (that can last for 4 years), at any given point in time, it will have made more sales than what is reflected on the revenue figure.

It’s not as if these contracts can’t be cancelled, but they represent the demand there is for Cogstate’s products. And it seems that the demand has never been higher. This tells me that pharmaceutical companies are coming back to the development of new drugs and consequently new clinical trials.

Sales Contracts, US$ Millions

Source: Company data

The image below shows the contracted backlog that will be recognized as revenue in the years to come. $15,4M of those $39M are expected to be recognized during 2021, compared to $11M back at the same time last year.

Backlog, US$ Millions

Source: Company data

Regarding profitability, for the past 9 years, the company has lost more money than what it has earned. This isn’t uncommon with microcaps and the “trick” is to get to them before an inflection point has been reached. When we finally see Cogstate showing consistent profits, the stock will likely be MUCH more expensive than today. Everything that is related to Biotech usually gets a high valuation from the investing community.

The CEO has recently guided for EBIT profitability in FY 2021 (June 2021). Let’s see if he’s able to do it.

Net Income, US$ Millions

Source: Company data

Balance Sheet and Funding History

At the end of June, the company had $10,6 Million in Cash & Cash Equivalents and virtually no debt. Without profits or debt, the company has been funding itself through equity raises (i.e. issuance of shares).

One of the biggest risks for microcap investors is share dilution. Although it’s common knowledge that a company’s share count is more or less insignificant, in the case of microcap companies, that’s not completely accurate. HERE‘s an article regarding this subject.

I usually don’t like companies that fund themselves through equity raises. I like a company that generates more cash than what it needs. But this time is different (did I just say that?).

In 2019 the company did a private placement of AUD$4M (US$2,7M) to an institutional investor. Then, it signed the deal with Eisai for AUD$2,9M (US$2M). At this point, the company had US$7,8 Million of cash in the bank. This could be considered enough.

But then the company did a 1 for 10 rights offering to existing shareholders, raising an additional US$2,7M. All of the directors exercised their rights (increased their stakes) at AUD$0,27 per share. A fellow investor who has been studying this company for some time believes this offering was “made up” so the insiders could buy more shares. It just wasn’t possible for them to buy such quantities in the open market given the low free float.

Competition

As far as I’ve been able to gather, the largest competitor is really the pencil and paper tests. Apart from that, there are several small companies (Cambridge Cognition being the largest one), but to my knowledge none that can compare to Cogstate. This is something I should be learning more about.

Risks

- New tech/competition

- Issues with the validity of the results

- Patent challenges

- Unknown random problems like funding (it’s a microcap)

Conclusion

This is the part where I usually make an attempt at estimating future profits and check if the downside is limited or not (if the downside is limited, the upside should take care of itself).

The company hasn’t yet been able to generate cash and it has had to “ask” its shareholders for funding. It’s like a start-up. It’s a story stock. The question I must ask myself is “Do I believe in the story?“. The answer is Yes. Yes, I do.

And yes, I must confess my ignorance regarding some aspects of this story. Why did all the clinical trials got canceled in 2018/19? Can that happen again? What percentage of the backlog is related to Alzheimer’s disease? How come Eisai is marketing Cognigram directly to the consumer instead of exclusively to medical doctors? What is the competition doing, etc, etc.

But although I still don’t have all the answers, I recognize that the opportunity is so big that it would be foolish of me not to invest.

My sources tell me that the number of clinical trials isn’t likely to go down from here. It seems they’ve reached the bottom. I’m not entirely sure of that and I must keep learning about the industry, but if that is true, we could say that at least $20M in revenue is guaranteed going forward. And given that one phase 3 trial can easily mean $10M in revenue for Cogstate, the upside is pretty big without even taking into account all the other irons in the fire.

With such high insider ownership, reduced free float, competitive positioning and industry tailwinds, we could be talking about a multibagger in the making. Another possibility is that Cogstate might be bought by Eisai.

Cogstate will be entering the Portfolio with a 5% stake (of the initial capital). I’ll be buying it sparsely over the course of the next 5 weeks, starting on Monday the 10th of August.

Further research material

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.