Coima Res

a fundamental analysis

By Manuel Maurício

December 04, 2020

Symbol: CRES (BIT)

Share Price: €6.18

Market Cap: €222 Million

Introduction

I don’t usually take requests for write-ups, but after Lorenzo Biagiotti – my only Italian subscriber – told me about Coima Res, and after looking at the buildings the company owns, I’ve decided that I wanted to spend some time learning about REIT’s in general and this company in particular.

An introduction to REIT's

Coima Res is an office Real Estate Investment Trust (REIT) from Milan, Italy.

A REIT is a special type of public company that owns and manages real-estate. There are several types of REIT’s, the most popular ones being office, health, housing, mortgage, industrial, and storage REIT’S.

Unlike regular companies, REIT’s are exempt from paying income taxes. They’re also required to distribute a great part of their income as dividends. In Italy this percentage is 75% whereas in the USA it’s 90%. So basically REIT’s are pass-through vehicles for people looking to invest in real-estate without the hassles of actually owning and maintaining a building.

Because of this, if a REIT wants to grow, it can’t do it by reinvesting the profits. It has to raise debt, issue shares, or raise rents (limited upside).

This makes it so that we can be seeing REIT’s paying out dividends while raising money through debt issuance or share issuance. This also means that they will be slow growth vehicles.

This fact alone puts me off because I prefer to invest in companies that are able to get high returns on invested capital and actually re-invest that capital. But, hey! I don’t want to be shunning away an investment opportunity just because of my first impressions. Let’s dig in and try to figure out if this is a business for the All in Stocks Portfolio or not.

There’s lots of jargon in the REIT’s world. I’ll do my best to explain as I go along. If you have any doubt, just say.

Business

Coima Res was created in 2015 with the purpose of owning the best office buildings in Milan, specifically in the Porta Nuova district.

The Porta Nuova district is one of the most prestigious business districts in Europe, comparable to the City in London, Wall Street in NY, or Saldanha in Lisbon, AH! I’m sorry. I couldn’t help it.

Porta Nuova is owned by the Qatar Investment Authority, which is also the largest shareholder in Coima Res (40%). The Qataris acquired their stake in COIMA in exchange for a portfolio of Deutsche Bank branches spread across Italy. The company has been slowly disposing off these branches to focus on Porta Nuova.

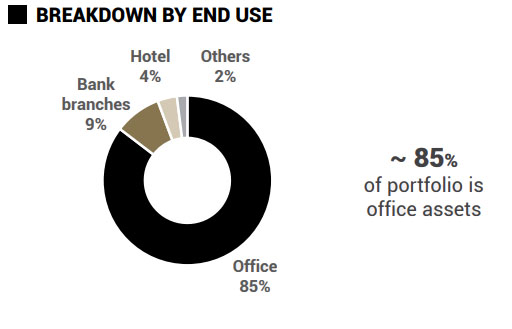

Today, Coima Res is composed of 9 real estate properties, mostly office buildings in Milan, and 58 bank branches in the north and center of Italy. 90% of the portfolio is in Milan, 50% in Porta Nuova, and 85% is office.

Putting a value on the assets

One way to value buildings is by calculating the Net Operating Income (NOI) and then divide it by an adequate Capitalization Rate (Cap Rate). This sounds harder than it is. I’ve explained it before when I looked into Keck Seng, but to spare you the trouble of reading that all over again, here’s a short explanation:

The Cap Rate is just the yield expected for that building. For instance, let’s say that you’re buying a house that has on lease for €20K per year and the direct costs of maintenance and bills are €2K.

The Net Operating Income for the house would be €18K (20 – 2 = 18). Let’s say that you want to get 5% out of it per year (that’s the Cap Rate, the yield). You would then divide the €18K by 5% to get to the Buying Price of €360K for the whole house.

Fortunately, in Europe, REIT’s must carry the assets on the balance sheet at current market prices. These prices are determined by independent appraisers.

That makes our job much easier than if we were to check the prevailing cap rates for every single building. The last appraisal was done in June, which led to some impairment charges, but in the third quarter there was no further devaluation of the assets.

Let’s look at the properties one by one:

CORSO COMO

TENANT: Accenture, Bending Spoons

OCCUPANCY: In Construction

VALUATION: €191M

OWNERSHIP: 36%

VALUATION COIMA: €68M

TOCQUEVILLE

TENANT: Sisal, others

WALT: 1.6 years

OCCUPANCY: 100%

VALUATION: €59.1m

OWNERSHIP: 100%

VALUATION COIMA: €59.1M

MICROSOFT:

TENANT: Microsoft

WALT: 3.2 years

OCCUPANCY: 100%

VALUATION: €99.2m

OWNERSHIP: 84%

VALUATION COIMA: €83M

GIOIAOTTO:

TENANT: QBE, NH Hotels

WALT: 4.7 years

OCCUPANCY: 100%

VALUATION: €82.6m

OWNERSHIP: 88%

VALUATION COIMA: €73M

PAVILLION:

TENANT: IBM

WALT: 7.3 years

OCCUPANCY: 100%

VALUATION: €72.7M

OWNERSHIP: 100%

VALUATION COIMA: €72.7M

VODAFONE:

TENANT: VODAFONE

WALT: 6.3 years

OCCUPANCY: 100%

VALUATION: €211M

OWNERSHIP: 50%

VALUATION COIMA: €106M

MONTE ROSA:

TENANT: Techint, PWC

WALT: 3.2 years

OCCUPANCY: 90%

VALUATION: €61M

OWNERSHIP: 100%

VALUATION COIMA: €61M

PHILIPS:

TENANT: Philips

WALT: 5.7 years

OCCUPANCY: 100%

VALUATION: €62.5M

OWNERSHIP: 78%

VALUATION COIMA: €49M

DERUTA:

TENANT: BNP Paribas

WALT: 5.3 years

OCCUPANCY: 100%

VALUATION: €46M

OWNERSHIP: 100%

VALUATION COIMA: €46M

BANK BRANCHES:

TENANT: DEUTSCHE BANK

VALUATION: €65M

WALT: 6.5 years

OCCUPANCY: 93%

OWNERSHIP: 100%

VALUATION COIMA: €65M

TELECOM ASSETS:

WALT: 12.2 years

VALUATION: €57M

OWNERSHIP: 14%

VALUATION COIMA: €8M

Pretty outstanding buildings, pretty outstanding occupancy rates, and pretty outstanding tenants, 2 thirds of which are investment grade (which means there’s little chance for them to default on their rents). This is very important, specifically in a situation such as the one we’re living in right now.

COLLECTIONS

Proof of such quality is the fact that, so far in 2020, the company has been able to collect 98.8% of rents versus 99.6% in the prior year. The company has limited exposure to the type of tenant that is suffering the most with this pandemic, Retail and Hospitality. The only client that is giving the company some headaches is NH Hotels, but the exposure to that client is very limited (4% of rents).

LIKE-FOR-LIKE GROWTH

On top of that, the company has seen a like-for-like rental growth rate of approximately 2% this year, mostly due to a renegotiation of the contract for the Gioiaotto building for an additional 6 years, at a 44% premium to the previous terms. Again, this goes to show the importance of having the best assets on the best location.

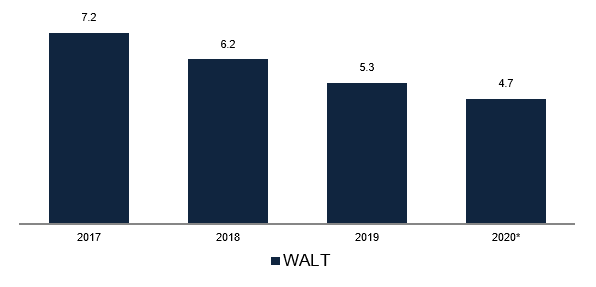

WALT

The Weighted Average Lease Term (or WALT) is just a fancy term for the average duration of the contracts with the tenants. Among all the different REIT’s, the Industrial, Office, and Health are usually the ones with the longer contracts. The shopping and residential ones are the ones with the shortest contracts.

The Office buildings’ leases typically have contracts spanning from anywhere between 5 and 10 years. In the case of COIMA RES, the WALT is 4.7 years, down from 5.3 one year ago.

Financials

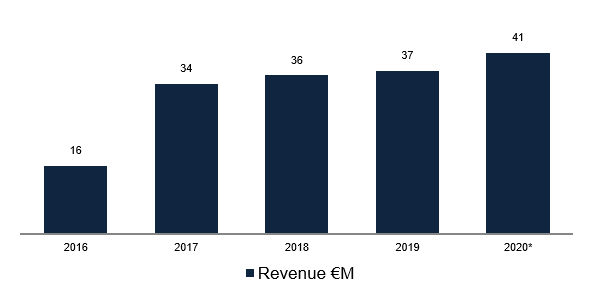

The company has been growing its revenue since it went public, and 2020 is no exception.

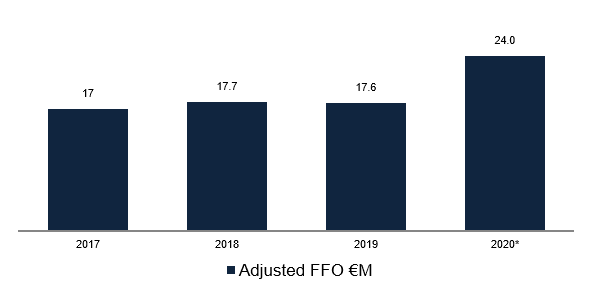

Regarding the profitability, instead of looking at the Net Income, which includes the sale of assets and other extraordinary items, the Funds From Operations (FFO) is the industry metric for assessing the profitability of the underlying business.

All in all, the company has been growing at a moderate pace (it’s a REIT), while divesting the bank branches and putting money to work in the Porta Nuova.

Balance Sheet

As much, if not more important than the revenue or the profitability right now, is the balance sheet. It’s no surprise that real-estate is often bought with the use of high amounts of debt. REIT’s are no different. And in times like these, the strength of the balance sheet is one of the most important things investors should be looking at.

I don’t want to be exhaustive here, but I believe that mentioning some rules of thumb regarding debt may be helpful for those who want to do their own research. Writing it down will also be helpful for me in the future:

LOAN-TO-VALUE RATIO AND INTEREST COVERAGE

The first metric we should be looking at is the Loan-to-Value ratio. This is a general measure for how indebted a REIT is. It compares the amount of debt to the value of the assets bought with that debt. The lower the better. The current Loan-to-Value ratio is 39%, which I consider good; not great, not bad, just good.

We’ll also want to see ample Interest Coverage. This ratio tells us how many times the company’s profits are able to pay for the mandatory interest payments. At 3.7x, and bearing in mind that we’re talking about a stable business, I consider it to be at a sound level.

DIGGING DEEPER INTO THE BALANCE SHEET

But these metrics alone aren’t enough. If we want to sleep tight while our money is invested in companies with high levels of debt, we’ve got to dig deeper and understand how things can go wrong.

In broad terms – and not only for REIT’s – companies should always try to match the type of debt with the useful life of the asset that is being financed.

If an asset is expected to last for 5 years, the debt should mature in 5 years. If the asset is expected to last for 30 years, the debt should mature in 30 years.

Given that the assets owned by COIMA are buildings, we’ll want to see a higher percentage of long term debt rather than short term debt. Also, the debt maturities should be spread out over many years and we don’t want to see any maturities in the near term.

We’ll also want to see a higher percentage of fixed rate debt as opposed to variable rate debt. If interest rates go up (not likely in the near future), a company with a high level of debt will be making much less money, not to mention that it may not even be able to pay for the interest charges (the same is applicable to a regular person when he or she applies for a mortgage to pay for their house).

It’s easy for management teams to use short-term debt with lower, variable, interest rates just to boost earnings, but that can be dangerous.

If, for any reason, there is a credit crunch when the time to refinance that debt comes, the company can be left in a delicate situation, and the stock price would surely reflect it.

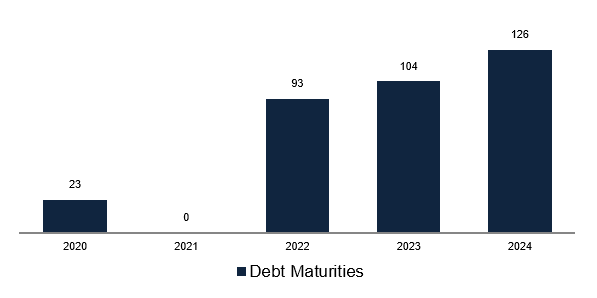

If we look at COIMA’s maturities, we see that the average maturity of the company’s loans is 2.9 years, which is too short.

In fact, the company has a €23 million loan maturing in December 2020, for which it has been negotiating an extension of the maturity, but I haven’t found any news that the company has been successful so far. It’s not usual for companies to wait until so close to the deadline to refinance their debt. Investors should watch out for this.

Having said that, I believe that they’ll be OK because the company still has €50 million in the bank and it was recently granted a Revolving Credit Facility of €10 million, but it goes to show the perils of short-term debt to finance long-lived assets.

Also, all of COIMA’s debt is variable, which is something that we don’t want to be seeing. As a mitigating factor, 89% of the debt is hedged against interest rate rise through derivatives, but even those derivatives have their own risks.

Thoughts on the future of the office space

The COVID-19 has changed the world, there’s no escape from it. But calling out the death of office work is obviously an overreaction.

Although there will be a shift in how employers and employees see working habits, I don’t believe that everyone will be working from home or coffee shops in the future. I also don’t think that things will go back to how they used to be.

We’ll surely see a combination of different models. Some companies will allow for almost all of their employees to work from home, other will be using a mixed model where people go to the office for some days while working from home in the remainder of the week, and some companies will just require their employees to go back to working in the office full time.

Having said that, I strongly believe that the best assets in the best locations will always be in demand.

By coincidence, the other day I was watching an interview with Bruce Flatt, the CEO of one of the best companies in the world, Brookfield Asset Management, and he was mentioning the exact same thing as me (!). There will always be demand for the best buildings in the best locations.

In the current environment, office REIT’s, especially those which have high quality tenants such as COIMA’s, are somewhat protected. But that won’t last forever. Office REIT’s are lagging indicators of the economy.

Given their long term contracts, when the economy turns south, they don’t feel it immediately. Then, when they renew their contracts at lower rates and the economy starts to accelerate, they’re locked up to those lower rates. Investors should be aware of that.

Another issue that investors looking to invest in real estate must be conscious of is the number of similar buildings that are in the design phase or already in construction.

When an office building has been granted approval, even if the cycle has already turned and demand is no longer there, it’s unlikely that it will be stopped. Oversupply is a big risk and real estate has always been cyclical.

I don’t think that oversupply is a big risk for COIMA given that its buildings are located in the city center which obviously presents some growth constraints, but if I were to invest in the company, I would have to talk to local experts to get a sense of what the current landscape looks like.

Risks

- Higher vacancy rates

- Faster adoption of remote work

- Credit crunch baring the company to refinance its debt maturities

- Higher interest rates (not likely in the short term)

- Oversupply

Valuation

There’s a bunch of ways to value REIT’s. The Price-to-Net-Asset-Value (NAV), the Price-to-Funds-from-Operations, and the Dividend Yield are some of the most common ones.

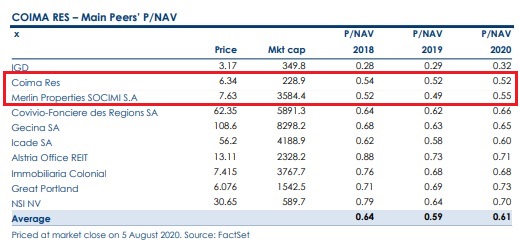

For unknown reasons, office REIT’s have always traded at a discount to NAV (which is a proxy to private market values). Right now, COIMA’s NAV is €12.1 while the share price is €6.2. This means that the P/NAV is 0.51x.

Merlin Properties, which is Spanish REIT with a stronger balance sheet but worst assets, is trading at 0.50x.

Pretty big discounts if you ask me.

The Dividend Yield is 4.3%. Merlin Properties is trading at a 4.6% dividend yield, and Vornado Realty Trust, which is an American REIT with great assets is trading at a 5.2% Dividend Yield. Let me remind you that Altria (the maker of Marlboro) is trading at an 8.4% dividend yield so, on a Dividend Yield basis, I wouldn’t say that these REIT’s are particularly cheap.

The current Price/FFO is 9.6x while Vornado is trading at 9.6x and Merlin at 14x. I guess that the disparity is related to the fact that Coima and Vornado are pure office plays while Merlin is more diversified.

Usually, I don’t care about what analysts say, but in the case of REIT’s, they are pretty good at forecasting results with high accuracy given the stable nature of the business. In a recent research note, one analyst forecasts FFO in 2024 of €0.68 per share. Lets say that, by then, Mr. Market attributes a 15x multiple, leading to a share price of $10.5. The stock is currently trading at €6.18. Not low enough to get me all excited about it.

IN THE LONGER TERM

In the longer term, if the interest rates go up, not only will COIMA’s profits be lower, but investors will also want to earn a higher return on their money (because the base rate is higher, everyone will want a higher return), thus lowering the prices of the stock (a higher dividend yield means a lower market cap). It’s a double whammy.

I don’t expect interest rates to be going up any time soon, but it goes to show what could happen.

Conclusion

As I suspected, Coima Res isn’t exactly the type of company I’m looking for.

A REIT is like a bond with some potential for capital appreciation. Maybe it’s more like a Preferred Stock.

In my opinion – and bear in mind that I’m fairly new to the REIT world – a REIT is a business for pension funds that need to generate yield, as low as it may be. REIT’s are yield plays.

If you look at them from a P/NAV perspective, it’s easy to find them attractively priced, but I’m not sure if Mr. Market will ever appreciate the full value of the assets as much as a private investor would.

All in all, I really enjoyed learning about REIT’s, and I will surely be paying more attention to this space going forward.

For now, I don’t feel that this is my type of business, nor do I feel comfortable enough with my knowledge of the industry to be investing in an office REIT right now.

Further research material

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.