CTT

the first approach.

By Manuel Maurício

April 16, 2020

Symbol: CTT (Euronext)

Share Price: €3,44

Market Cap: €514 Million

Introduction

The high-level story goes a little something like this: In 2018, Steven Wood, an American fund manager, started building a large position on CTT. In April 2019, he got a sit on the board of directors, he immediately kicked out the CEO and hired a new CEO who he trusted. Over the following year, the entire Board of Directors was replaced.

Steven was also the responsible for hiring the star operator Manuel Molins to head the Spanish operations. Apparently, Steven Wood has been orchestrating the turnaround himself, bringing CTT to the new century. If you read the letters he writes to his shareholders, you’ll soon be asking yourself “is he really talking about CTT?”.

Let’s try to figure out what he has been seeing that others have been missing.

Vanishing monopolies

With 500 years of existence, CTT is the oldest company in Portugal. The story is long so I won’t go over it here. What’s important to know is that in 2013, the Portuguese Government decided to float CTT on the Lisbon Stock Exchange for a total consideration of €909 million. Today, the company is valued at €514 Million and in the meantime it issued dividends in the amount of €344 Million.

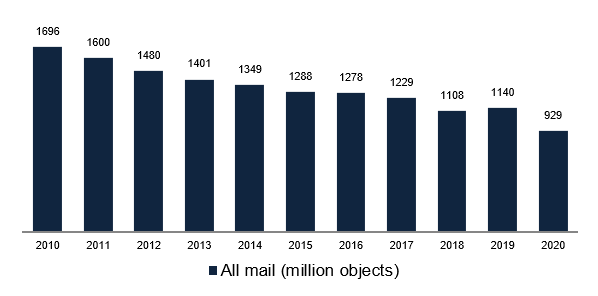

As everyone knows, the traditional mail has been in secular decline for many years. CTT is no exception.

Given its long history as the sole mail provider, CTT is the Universal Service Provider of postal services in Portugal. What this means is that it’s bound by a contract with the State of Portugal to guarantee that the Portuguese population gets access to regular old-fashioned mail, everyday, wherever they are, at affordable prices to everyone.

Different countries will have their different criteria for their USP’s, but they’re usually based in 3 criteria: density, quality, and price.

This obligation arises from the social need of the populations to have access to postal services and it must be met by regulation because it’s often done at a loss. You see, the last mile delivery business is based on economies of scale and route density. If a postal service is forced to keep its offices open in a rural area just to deliver one letter per week, it will obviously lose money.

This leads to a conflicting situation between profitability and the social benefit that the Universal Service is meant to provide. Although CTT doesn’t disclose its USP numbers separately, it has been quite vocal about it operating at a loss.

In the past, banks, government agencies, and utilities were the main clients of the postal services, but now everything is done electronically (when was the last time you filled your Income tax declaration by hand?).

For CTT (and all the other European postal services) to keep providing the Universal service, changes must be made. Different countries will need different solutions.

Some USP’s have been subsidized by the tax payers (Spain), some have allowed to increase their prices, some have been allowed to decrease the frequency of the service in rural areas (Italy), some have shrunk their footprint.

After a unilateral decision by the Portuguese Government to extend the previous contract until the end of 2021 due to the pandemic, we should be close to seeing CTT and the government finally struck a deal.

It’s not clear to me what CTT is going for, but I get the sense that it’s looking to get approval to raise the prices. I’m not sure if this is in its best interest as it may lead to even lower volumes, thus aggravating the problem, but I trust that the management and board of directors knows what they’re doing.

Adapt or die

To guarantee their survival, postal services across the globe have been forced to diversify their businesses. Given their large footprint and proximity to the populations, they have been offering adjacent services such as banking, financial services, and partnering with the eCommerce giants (Amazon, Alibaba, etc).

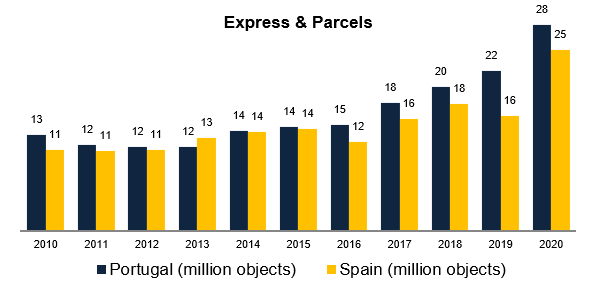

CTT is no exception. In 2005 it bought the Tourline Express, a Spanish express & parcel distributor, in 2015 it launched the Banco CTT, and it has been selling public debt for many years.

eCommerce

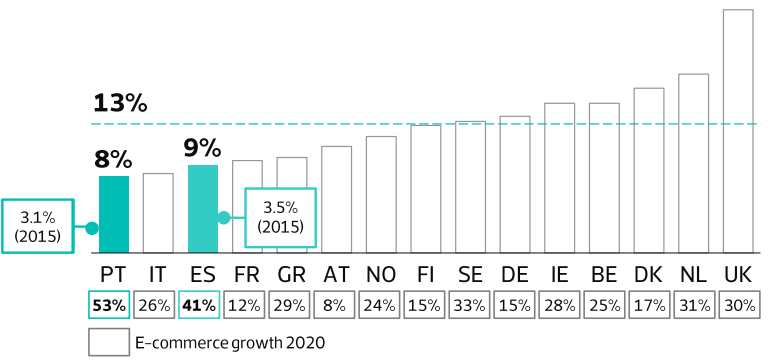

I had the feeling that CTT was late to the party when it comes to eCommerce and parcel delivery, but it turns out that it wasn’t CTT who was late to the party, it was Portugal.

Unlike the UK, the Netherlands, or other European countries where online shopping has been widely adopted, the Portuguese people have taken their time to adapt to the new technologies. In fact, we might be looking at the chicken and the egg problem.

For instance, Amazon has yet to enter the Portuguese market with a dedicated app, team, and resources. That may have led to a slow adoption of eCommerce, and consequently, a slow adaptation from the postal and logistics companies. Instead, Amazon and Alibaba opted for partnering with CTT for their distribution in Portugal.

This is the part where I must mention that over the past year I’ve been ordering many things online, mostly from Amazon, and all the parcels arrived on time or sooner than expected.

This is due to the fact that, in recent times, CTT has been investing on the CEP (Courier, Express, and Parcel) business.

The company has been improving its fulfillment and sorting centers, it has been increasing the number of lockers for Pick-up and Drop-off of parcels, improving its distribution to focus more on the Express & Parcel segment, it has launched dott.pt, nicknamed the “Portuguese Amazon”, it now allows for anyone to create their own e-shop much like Shopify, among many other initiatives.

On top of this, it is also betting big in Spain with a new management team hand picked by Steven Wood, headed by Manuel Molins, who was responsible for the success of SEUR and CORREROS EXPRESS. When the new management came in, the Spanish operations were so bad that the company had even lost Amazon as a client. It now seems that things are getting back to “normal”.

So, a lot of things are happening inside CTT right now.

The question investors must ask themselves is whether the growth in Express & Parcels will be enough to offset the decline in traditional mail.

The issue with the Express & Parcels is the last mile in areas with low density. That’s where CTT’s competitive advantage may lie.

The fact that it already has a large footprint, coupled with a potential favorable new contract with the Government to subsidize the USP, will allow CTT to keep its retail locations at no cost (sort of), thus gaining a big advantage over its competitors.

Capital Allocation - Divide to conquer!

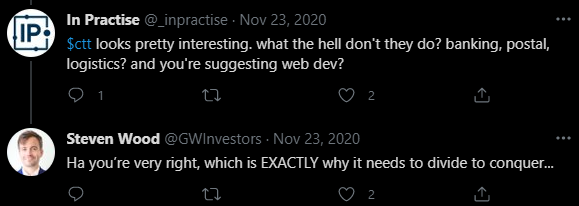

It’s clear that the company’s strategy is to spin-off or sell its non-core assets and focus on the Express & Parcel business. Here’s a tweet by Steven Wood illustrating this point:

I have not delved deep into the Banco CTT as it remains outside of my circle of competence, but it’s apparent that Steve and the Board have thought about taking it public through an IPO. The problem is, would investors buy it? Maybe a strategic buyer would want it. Maybe we’ll find out one day.

And then there’s the massive real-estate that has been appraised at €200 million. The management has been talking about ways to monetize it. On the latest call, the CEO mentioned that the company was consulting with the regulators and the government to proceed with the operation in an efficient tax manner.

I believe that he’s looking to spin it off through a vehicle similar to a REIT (Real-Estate-Investment-Trust), where CTT would leverage the real estate with debt and issue a special dividend to themselves that would be used to invest in the Express & Parcels segment or to buy back its own shares.

Just read this quote from the CEO regarding monetizing the real-estate:

“We progressed a lot in the last few months because we are in the final stages of submitting the transaction to the relevant regulators. And we also have to submit the transaction to the concession grantor, just to make sure that the transaction doesn’t jeopardize other bigger things for us.”

What could be bigger than divesting €200 million euros worth of real estate when you’re a company with a market cap of €500 million? Could he be talking about the bank? Humm…

Financials

I haven’t talked about the financials much as I’m not really sure if the past financial metrics can be extrapolated into the future.

Take the USP for example. Will CTT be able to renegotiate with the government? If so, in what terms? Will it be raising prices or getting a subsidy? Either way, let’s take a look.

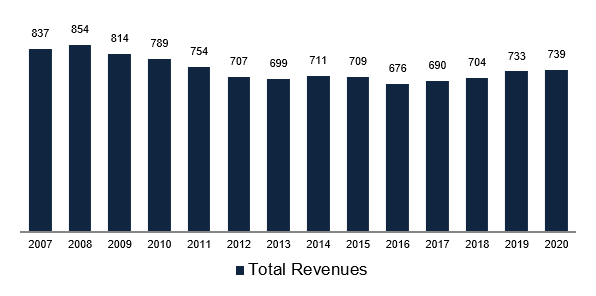

After consistent drops in revenue during the Great Financial Crisis, the company has been able to hold on and even increase its revenue going up to 2020.

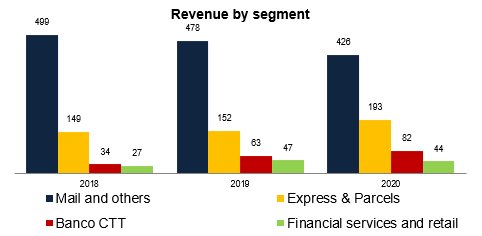

My instinct after seeing that light growth in revenue would be to look at it segment by segment, but there have been so many restatements that comparability prior to 2018 is limited.

What we see from 2018 onward is the traditional mail declining and the Express & Parcels and Banco CTT growing. The Financial Services has been steady for some time.

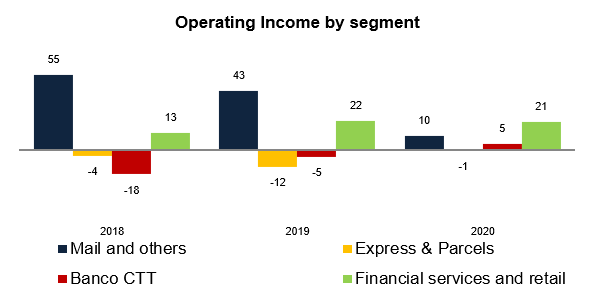

Actually, the “Financial services and retail” segment was the best contributor for the profits of CTT in 2020 (!) As mentioned previously, Banco CTT has finally reached profitability, and the “Express & Parcels” seems to be on the brink of becoming profitable.

* Missing from the chart below is the contribution of the “Central Structure” to the operating income, which is massively negative.

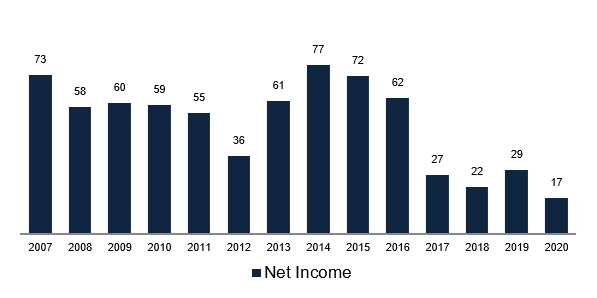

If we take a step back and look at the Net Income we can clearly see a dramatic fall in profits in 2017. This was due to the inability to control costs related to the regular mail and “Express & Parcels” segments.

I have yet to understand the wide variation in profits over the years. I suspect that the high profits reported in 2013-2016 were achieved through unsustainable cost-cutting.

Valuation

It all comes down to estimates and valuation, right? A possible approach to valuation could be through a Sum of the Parts.

Let’s take the management’s guidance for 2021 of €50 million in EBIT and subtract €10 million that I estimate will be coming from the Banco CTT. That will get us to €40 million in EBIT in 2021.

According to the management, the real-estate is worth €200 million, the bank has another €212 million in equity, so that’s €412 Million. The current market cap is €515 million so Mr. Market is saying that the operating business is worth roughly €100 Million, which equates to an EV/EBIT of 10x.

PostNL is trading for 12x right now, so from that point of view CTT is slightly cheaper. But these multiples tell us very little. Without having a pretty good idea of where the business is heading, they’re meaningless.

Risks

- No guarantee that the negotiation of the USP contract will be successful

- Increased competition in the Express & Parcel business

- Turnaround story with high degree of uncertainty

Conclusion

I must confess that for the most part of the week, I was bored to death. But then I started thinking about it deeper:

How has Steven Wood found out CTT? And how did he know the current CEO months before building his stake? And how has he been given carte blanche by the other major shareholders to make so many changes? I have not mentioned it yet, but he has even messed with the compensation scheme for the executive directors (from EBITDA related goals to FCF per share, which I applaud).

On one of his letter he mentions one anchor investor in his fund that made the investment possible. I wonder who that is?

Speculation aside, if Portugal and Spain keep increasing their eCommerce penetration to levels similar to other European countries, and if CTT can do a good service, we could be in the early innings of a long runway for CTT.

I’ve emailed the Investor Relations department to arrange for a meeting and they have already replied saying that they’re in a quiet period before posting results (which is weird because the results won’t come out until 3 weeks from now) but they will gladly do a call with me on the 10th of May.

I’ll come back to CTT if and when I uncover more relevant information to the thesis.

Further research material

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.