DaVita vs Fresenius

2 sides of a duopoly

By Manuel Maurício

May 06, 2022

I had 2 goals for this week: First, I wanted to get to know DaVita’s largest competitor Fresenius. Second, I wanted to understand the reimbursement dynamics in the USA.

I spent Monday and Tuesday learning about the reimbursement dynamics and on Wednesday I was prepared to dig into Fresenius.

I downloaded all the financial data and I began reading the Annual Report. What I saw was a health care conglomerate with segments spanning from dialysis treatments to the construction of hospitals in emerging countries. I wasn’t too enthusiastic about it.

On Thursday I had to attend to some personal matters so I wasn’t able to dig deeper into it. It was only today that I discovered that there are two companies named Fresenius. The “mother“, which was the one I was researching, and Fresenius Medical Care, the one that I should have been researching 🤦♂️.

Fortunately, I never intended to do a deep dive on Fresenius so all I had to do was to take a high level look at the financials and read the latest Annual Report and the latest Conference Call transcript to get up to speed.

If you haven’t read my previous write-up on DaVita, I strongly recommend you to do so by clicking here.

Fresenius

With 4,092 clinics, Fresenius is the largest dialysis services provider in the world. It provides treatment to about 9% of the global dialysis patients, and in the US it has a market share of around 38%.

The company also develops and manufactures dialysis machines and disposable products. In this segment Fresenius has a market share of 35%.

In the USA – which is where Fresenius is comparable to DaVita – services represented about 91% of revenue while products represented 9% in 2021.

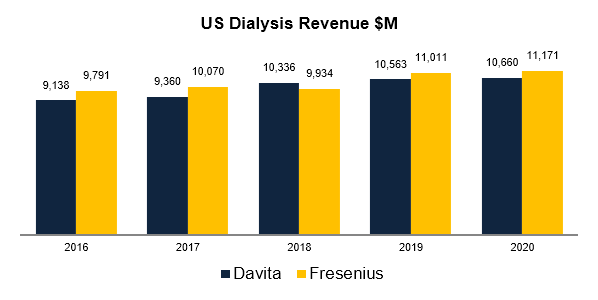

Although Fresenius has a market cap of €17B compared to Davita’s $10B, when we compare the US dialysis revenue for both companies we see that Fresenius is just slightly bigger than DaVita.

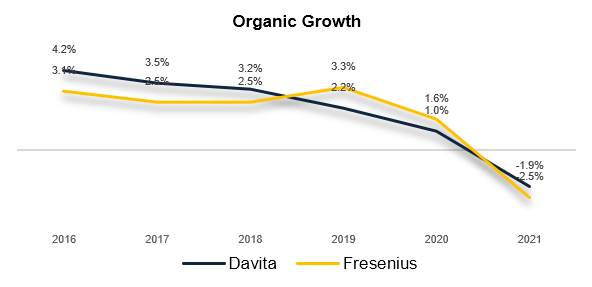

Both companies have followed the same trend for organic growth in recent years and it’s not a pretty one. It’s still not clear to me what was driving this downward trend prior to the pandemic.

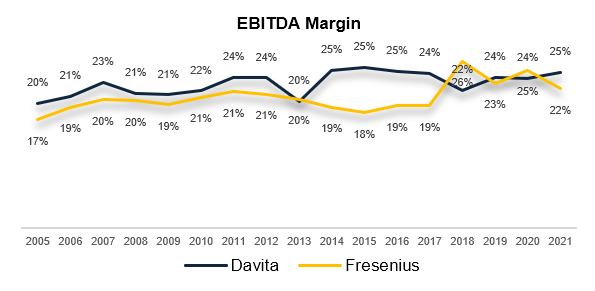

DaVita has had better margins than Fresenius in most of the past 15 years, but recently they’ve been pretty neck to neck.

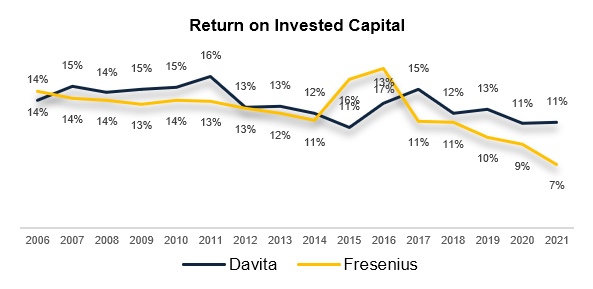

When we look at the Return-on-Invested-Capital we see that they’ve been going down (especially for Fresenius). Not only that, but at low double digits, they’re not that good.

Both companies have “stretched” balance sheets, meaning that they have fair amounts of debt.

I don’t anticipate any of the two having trouble servicing their debt, but they don’t have the availability necessary to make investments (organically or acquisitions) if they need to.

On the other hand, there’s no more big competitors to buy on the dialysis side and the demand is pretty stable so I don’t see them needing large amounts of cash going forward.

While DaVita chooses to buyback shares, Fresenius opts for issuing dividends. I prefer DaVita’s strategy as the stock is very cheap.

Reimbursement shennanigans

To understand DaVita (and Fresenius) we need to understand how it makes money. DaVita performs the dialysis treatments and then charges the payors under pre-determined rates.

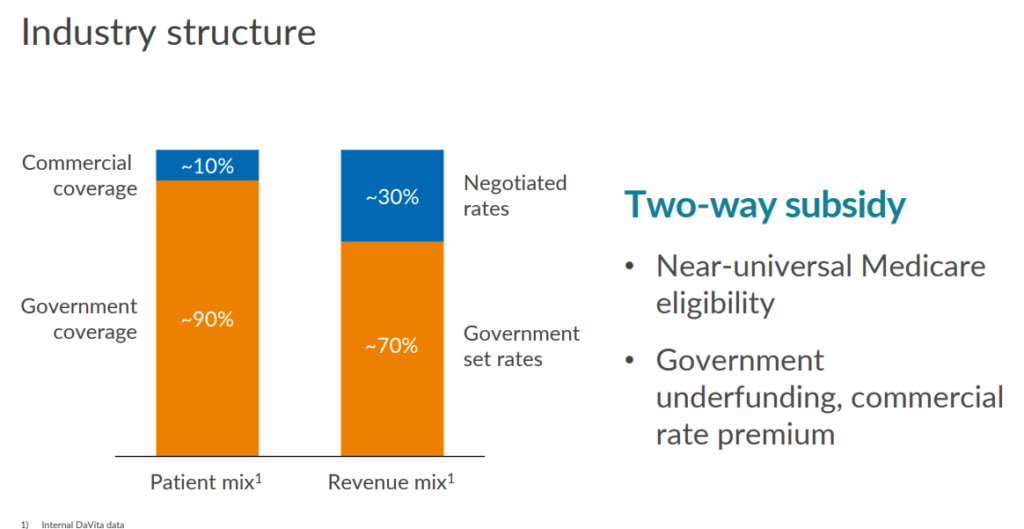

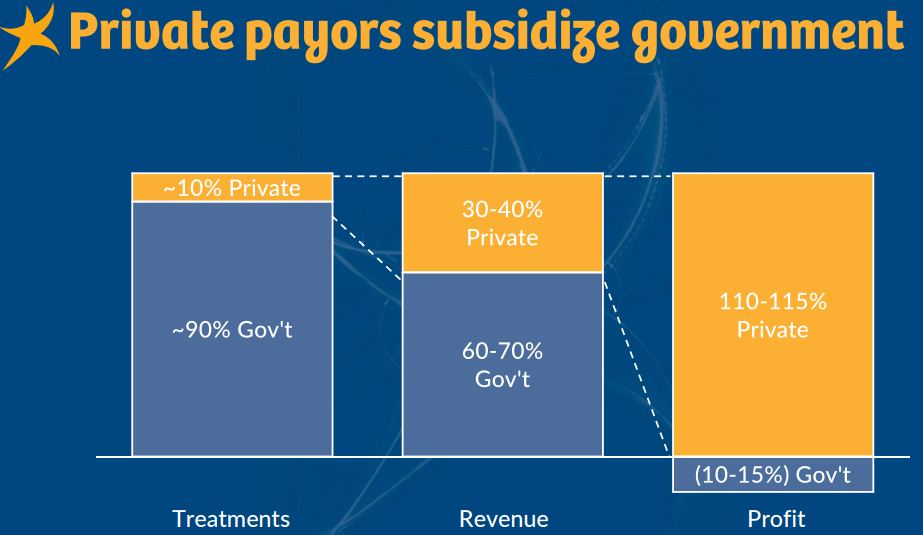

Although Government coverage accounts for 70% of revenue…

… DaVita alleges that it loses money with Medicare. It’s the commercial payors that account for all the profits.

Medicare also covers dialysis treatment even for the patients with private insurance – including those with insurance paid for by their employers. But it does so only after 30 months. It’s in those 30 months that DaVita makes its profit.

Those insurance companies must negotiate rates with DaVita and Fresenius. And guess who has the leverage on those negotiations?

That’s right, the dialysis companies.

Some studies allege that DaVita gets paid around $250 from Medicare compared to $1,000 per dialysis treatment by the commercial insurers. A patient gets, on average, 136 treatments per year so we’re talking about $34.000 for Medicare against $136.000 for the commercial insurers.

As Charlie Munger likes to say “Never, ever, think about something else when you should be thinking about the power of incentives“. And that’s where this seemingly boring story starts to become interesting (and a bit dodgy).

The dialysis providers are incentivized to have the most patients covered by a commercial private insurance, not the state’s Medicare plan.

Enter the American Kidney Fund (AKF)

As is often the case in the USA, many large companies donate considerable amounts of money to non-profit organizations – because it’s tax-deductible.

DaVita and Fresenius are the largest donors of the American Kidney Fund – reportedly accounting for 80% of its revenue.

Whenever a patient comes to the AKF for help, the AKF offers to pay for their insurance premium (it’s a non-profit organization, it’s supposed to do good). The twist is that the AKF steers those patients into commercial insurance plans, not the Medicare plans, even if those plans offer no added coverage in relation to Medicare.

According to sources, for every dollar that DaVita and Fresenius donate to the fund, they will get $3.5 in return from private insurers. Ingenious, right?

There are also accusations that patients who are not treated in clinics owned by DaVita and Fresenius have been denied help by the AKF.

Essentially, the AKF is a commercial branch for DaVita and Fresenius.

So why don’t the law enforcers stop this conflict of interests? Well, because the AKF performs a much needed job – it helps people pay for their treatments.

There have been several attempts to cap the rates charged to private insurers at the same level as the Medicare reimbursement – which, according to DaVita, would erase the company’s profitability. But these attempts have all been unsuccessful as DaVita and Fresenius have poured large amounts of funds to lobbying and “education” initiatives with the veiled threat of closing clinics if the commercial insurance rates are capped. And who would want to be responsible for the death of thousands, if not millions, of people. It’s a rigged system.

This whole story is what made the famous investor Jim Chanos take the other side of the argument from Warren Buffett by betting against DaVita.

Recent events and expectations for the future

In recent quarters, both DaVita and Fresenius have been feeling the pressure of wage inflation and raw materials’ shortage.

Although both companies are cutting costs it’s apparent that they’ll be seeing margin compression as Medicare updates its reimbursement rates with a 2-year lag and the commercial insurers are on 5 years contracts that can’t be renegotiated before their terms.

On the flip side these headwinds will benefit the stronger players in the industry and it’s likely that we’ll see smaller operators closing doors or selling their clinics to the two giants – ah! the joys of capitalism!

On a longer time horizon, it’s clear that home dialysis will be an important part of the future of the industry. Costs are lower when patients are in charge of pinching their own arms and performing the treatments themselves. Of course, this will bring added challenges to both companies (like training), but they’ve been working hard on it. 15% of Fresenius dialysis revenue is already coming from home dialysis (13% for DaVita) and the company is planning on getting that number up to 25% by 2025.

Also, the health care system in the US has been moving away from fee-for-service reimbursement to pay-for-performance models. Both DaVita and Fresenius are trying out this new model in some of their clinics in partnership with public organizations. They’re incentivized to lower costs and they get paid part of the savings.

All of this to say that, although the demand for renal care will keep growing (as it’s related to other co-morbities that are on the rise such as diabetes and hypertension), the industry is always shifting in the background.

Conclusion

Which leads me to my conclusion. I obviously like DaVita (and maybe Fresenius). It’s one side of a duopoly with steady demand and low single digit growth ahead, buying back huge amounts of shares and is trading at a Free Cash Flow yield of 13%. It’s likely that shareholders will see double-digit returns going forward.

But as the destiny of both companies is so directly tied to politics, I need to follow them for some more time to make sure that I truly understand the industry. Any change to Medicare reimbursement rates or to commercial insurance rates could materially impair the investment thesis. Yes, both companies have a lot of leverage in the negotiations with politicians and private insurers, but it’s better to be safe than sorry.

DaVita isn’t entering the Portfolio right now, but it’s a top candidate for a future addition.

As always, I would like to ask you to fill out the survey below as it will help me better understand what you like and dislike about my work.

I also encourage you to post your questions and opinions on the Forum by clicking the button below.

Further research material

- Report to Congress – Outpatient Dialysis Services Kidney Dialysis Is a Booming Business—Is It Also a Rigged One?

- DaVita Inc.: Warren and Charlie’s Excellent Insurance Gambit

- DaVita encouraged some low income patients to enroll in commercial

- A Comparison of Payments to a For-profit Dialysis Firm From Government and Commercial Insurers

- THE DIALYSIS INDUSTRY IS SPENDING $111 MILLION TO ARGUE THAT REGULATING IT WOULD PUT IT OUT OF BUSINESS

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.