Dillard's

an infinity squeeze?

By Manuel Maurício

November 18, 2021

I first wrote about Dillard’s back in October of 2020 when the stock price was $46.17.

Today the stock is at $352, meaning Dillard’s has become a 7-bagger in one year.

It looks like Ted Weschler, one of Buffett’s lieutenants, has made a killing on this stock. He has turned $25 million into $350 million in the last year alone!!!

Back then, the bull thesis was composed of two parts: 1) the continuous sale of under-performing stores at a premium to book-value together with steady share repurchases, and 2) a short squeeze in the making.

I’ve been scratching my head about what drove the recent price surge.

After taking a look at both Dillard’s and its competitors, it appears to have been fueled by a combination of 2 factors:

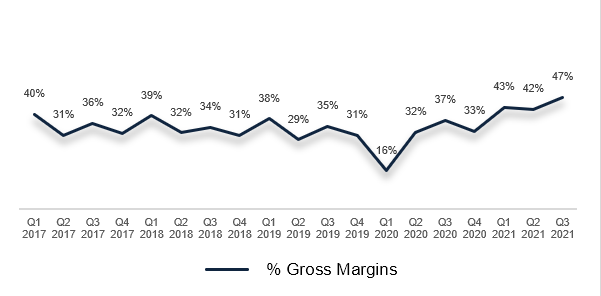

The first factor is the increasing gross margin and the second is the short-squeeze.

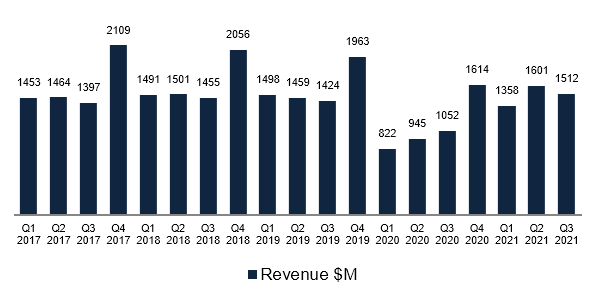

The higher gross margin has been a result of the pandemic.

Higher demand and lower supply have led to inventory management optimization and some pricing power resulting in lower markdowns.

Is this situation going to last for long?

Probably not.

I think this is just transitory and once things get back to normal we’re going to be seeing gross margins and revenue growth go back to pre-pandemic levels.

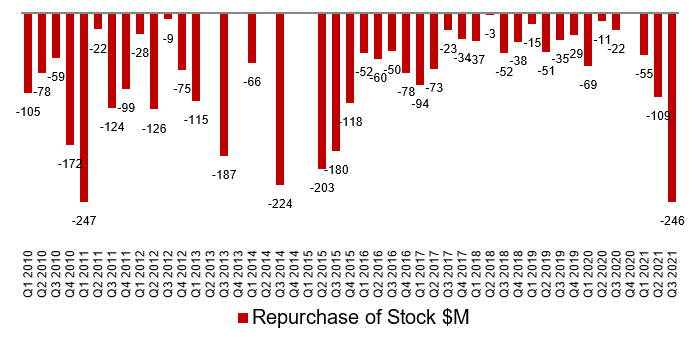

But interestingly enough, despite the recent increased performance and share price appreciation, the company has been increasing its share buybacks.

Analysts estimate earnings-per-share of $35 for 2022 and $16 for 2023.

If they’re right, the stock is currently trading at a forward PE multiple of 10x for 2022 and 22x for 2023 (Free Cash Flow would be a better metric, but there are no estimates for it).

With that said, I’m having a hard time understanding why the management is still aggressively buying back stock after a 10x run up in the stock price.

I guess they still feel it’s undervalued? Maybe they want to keep the short squeeze going?

Insiders own a big chunk of the company and they should be happy to see the share price go up.

But the business generates strong cash flows and doesn’t have a lot of growth prospects so they should be interested in keeping the stock price low in order to repurchase as many shares as they can. Especially so when there are rumors that the management wants to take the company private one day.

Maybe the management’s incentives are tied to share price performance?

I went looking and the stock compensation is negligible in relation to their salaries and fortunes.

Maybe they really do think that the stock is undervalued.

Or maybe they’re just getting a kick out of fueling an infinity squeeze. I know I would.

CONCLUSION

If I were to bet on the main reason for the recent share price surge, I would bet on the short squeeze thesis. Yeah, the margins and cash flow have improved, but I don’t think that’s reason for a 10x!

And even after spending $246 million in buybacks on the third quarter alone, the company still has $620 million in cash so we should expect more repurchases.

The current short interest is around 12% of the free float so we could be seeing the share price climb even higher then the current $352.

How much higher? I don’t know. I wouldn’t be surprised to see the stock at $500 or more.

*Free Float: available shares in the open market that are not owned by insiders

I’m not interested in participating in this story, but the voyeur inside me will definitely keep waiting to see how much money Ted will make on this bet alone.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.