eXp World Holdings

the conclusion!

By Manuel Maurício

July 23, 2021

Last week I brought you eXp World Holdings, a real-estate brokerage company growing at 115% year over year.

I had became fascinated with the virality created by its Multi Level Marketing model, but something smelled fishy. Or may I say, different than usual. So I decided to dig deeper.

I invited Sean Iddings, the guy who alerted me to the opportunity, for a chat. Sean is a great guy and he accepted my invitation right away. You can watch the recording below.

But our conversation still wasn’t enough to convince me. I’ll tell you why. First, there’s this cult-like atmosphere surrounding the company; maybe it’s because everyone in the company is a salesman so everyone will try to sell you the company.

Second, the financials aren’t easy to understand. I mean , at first they are, but then they aren’t; specifically how the treatment for the Share Based Compensation interacts with the rest of the financials.

Tricky Financials

If enough agents decide to be paid in stock (read my previous post), the company then has the obligation to issue those shares. But only after 3 years, and only if the agents choose to sell the stock.

According to one source, the agents won’t be the “owners” of the stock until they wish to sell the stock. So, the whole “with eXp you own a piece of the company” suddenly doesn’t seem quite so.

But if they don’t sell the stock, the company doesn’t have to issue the shares. There’s a line on the Balance Sheet called “Accrued Expenses”.

This liability might never be paid as only 25% of the agents choose to get 5% of their compensation in stock and there’s no guarantee that those agents will be with the company after the 3 years needed to gain access to the stock, nor that they will want to sell their shares.

On top of this, the same source states that it’s not that easy to sell the stock. Those agents wanting to sell the stock will have some costs (up to $1000 no matter how many shares they’re selling). This reminds me of Sprott’s Physical Gold Trust that will allow investors to redeem the units in the Trust for physical gold, but it makes it so hard that it dis-encourages investors from doing it.

* Sprott just bought our holding Uranium Participation Corp and turned it into a similar Trust.

All of this could actually be good for shareholders. Liabilities that don’t need to be paid are great liabilities, but some reason I’m not liking it.

Given that I’ve heard all of this from one single source which might be wrong, I’ve contacted the company to confirm this information. I’m waiting to set up a call with the IR team.

On top of this, the more productive the agents, the worse it is for shareholders as the highest producing agents (ICON status) won’t actually be bringing in money. The company relies on unproductive agents to be profitable.

And then, the current policy is to buy back all of the shares that have been issued so far as a way of offsetting the dilution created by all of this offering of shares – without caring about the valuation at which they’re buying those shares. I like managers and directors that treat their shares like gold.

INABILITY TO INTERNALIZE THE FINANCIALS

It wouldn’t surprise me if tomorrow there was a short report accusing the company of loose accounting. And I wouldn’t know how to act. I still don’t fully understand the financials.

* A short report is a report accusing a company of malpractice.

When I say that I don’t understand the financials, I mean I don’t understand how all of the different parts will interact when something different than usual happens.

This situation reminds me of Ryman Healthcare, a company that I’m still very fond of (and might revisit soon); a company that I envision growing and growing for many years, but one that has such peculiar – and hard to understand – financials, that I’m not able to gain enough conviction to build a position (at least not at these prices).

To be fair, I get no bad vibes coming from Ryman as I do from eXp.

COMPENSATION RED FLAGS

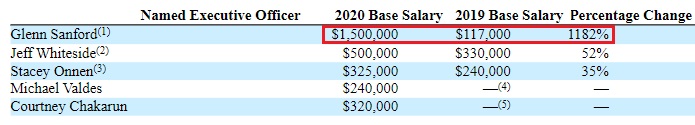

On top of it all, the CEO – who is also the Chairman of the Compensation Committee – has increased his salary by more than 10x in 2020. Among the reasons given, this one stands out: “to incentivize Mr. Sanford’s continued service as CEO and to align his compensation with the Company’s growth and profitability goals“.

I thought that owning 30% of the company was enough alignment. I would prefer to see him lower his salary to $1 as other high profile CEO’s have done.

As if this wasn’t enough, the CEO was also awarded 2 Million options (to buy shares) on the 29th of July of 2020 for no apparent reason. Some of these options will vest monthly and some quarterly as long as the revenue is growing by, at least, 30%.

Note that it isn’t growth in profits or cash flow. It’s Revenue. It doesn’t matter if the company is profitable or not – Glenn will get his money.

And he has also been selling shares consistently. All of this combined is a big red flag for me.

Conclusion

As you might’ve noticed by now, I started looking at this company with a lot of enthusiasm, but that seems to have weared off.

As with other companies that I’ve written about here on All in Stocks, there’s a big chance that we’ll be seeing eXp grow and grow and grow. That’s what my research has led me to conclude.

This is where less demanding investors would probably take the leap and buy eXp. But not me. Not now, at least.

There’s just “too much hair” around this one. For now, it’s a NO from me.

I’ll be talking to the Investor Relations department soon and if I find something new, I’ll let you know.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.