Facebook update

the most painful stock to own

Facebook update

the most painful stock to own

By Manuel Maurício

July 29, 2022

I’ve said it before and I’ll say it again, Meta is probably the most painful stock to own. The company is constantly being bombarded with attacks from the authorities, attacks from other media, attacks from competitors… it’s as if the company has a bullseye attached to its back.

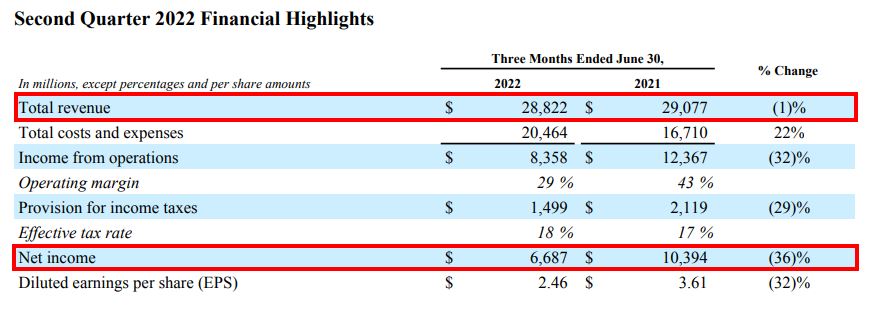

Add to that the fact that this was the first time in Facebook’s history that the revenue declined and you’ve got yourself all the ingredients for “weak hands”.

Is this the first sign of decline or is it just a temporary issue?

Let me just say that if we were to look at the revenue on a constant currency, it would actually be up +4%. You might say that I’m trying to present the information in a way that favors my view as a shareholder, and… you’re right 😒.

The truth is that Facebook is going through one of the worse periods in its history. Proof of that was the tone of the conference call. Mark Zuckerberg said that the outlook for digital advertisement is looking worse than it did in the previous quarter.

So, let’s look at the headwinds that the company is facing right now:

#1 user interest is shifting to video

With the rise of TikTok, people are shifting their attention to short-format video. Just like what happened with Snap and Stories, Meta has launched Reels to fight TikTok. I’ve heard rumours that Meta’s algorithm isn’t nearly as good at recommending content, but I guess it’s just a question of time until they get it right.

The issue with video is that it’s harder to monetize. So, the company has been forced to spend more to go after a lower-margin product. Seen through this lens, it’s not a great deal – although it’s already a $1B business – but Facebook couldn’t just sit back and let TikTok steal its users.

Although Reels isn’t as good from a dollar perspective as Feed or Stories, the company will be pushing Reels as it’s a good mechanism to keep people engaged with Meta’s apps.

Mark mentioned on the Call that Artificial Intelligence will be recommending more of what users see on their feed. Currently that accounts for 15% (a bit more on Instagram) and it should go up to 30% in the coming year. This means that users will see more content from people that they don’t know. I welcome this change…I guess.

#2 Apple changes are hurting the business.

Regarding the Apple privacy changes, Meta is looking to grow more first-party understanding of what people like.

If you’ve been following me for some time, you know that I’ve been waiting for Meta’s initiatives regarding e-commerce to come to life. It looks like many of them are now gaining traction. It’s crazy to learn that 40% of the advertisers are using click-to-message services and that this is already a multi-billion dollar business. I believe this could be massive.

But this gets me wondering. Could there be a future where Meta’s platforms have the best features, the best technology, the best Artificial Intelligence, but that doesn’t translate into more users on its platforms? There’s a strong likelihood of that happening.

Either way, I like to see the company advancing in e-commerce.

A PERSONAL ANECDOTE

I just recently began to advertise on Facebook and Instagram and, although a Facebook marketing employee told me that they’re still having trouble with targeting, and although I had never advertised before, I was pleased with my results. I had been told by a marketing expert that each lead (email address) would cost me around €50, but it cost me around €3.

I like to think that Facebook will come out of this even stronger than before as it has the dollars to spend on Artificial Intelligence. If this is just wishful thinking on my end, only time will tell.

#3 The Metaverse might be a flop

Then, there’s the Metaverse. Horizon – the social metaverse platform – is coming to a device near you. This means that it won’t just be available through Oculus Quest, but also on your laptop or phone. This should drive faster and wider adoption of the metaverse.

But of course, the company is spending billions of dollars on an unproven new business. And whereas Facebook had little competition on the social media segment, here it’s competing against giants like Apple, Microsoft, and eventually Google.

And as if the bad news weren’t enough, Sheryl Sandberg, the long term right arm of Mark Zuckerberg, will be saying goodbye to the company soon.

CONCLUSION

All of this to say that the company is going through a really tough time and that today, more than ever, Meta’s future isn’t clear. No one can tell you if what we’re looking at is temporary or if we’re witnessing the decline of a great business.

As a long-term shareholder I am obviously biased. I choose to highlight the good and pay less attention to the bad. I believe that Reels will actually benefit the user engagement in Meta’s platforms and that the company’s initiatives regarding e-commerce and the monetization of WhatsApp will be massive.

That’s why Facebook will be kept in the Portfolio.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.