Ferrari,

a fundamental analysis!

March 12, 2019

SHARE PRICE: €115,65

MARKET CAP: €21,54B

1. INTRODUCTION

I don’t consider myself a motorhead but ever since I knew that Ferrari was a public company, I don’t know why, but my heart started racing. In fact, it’s ticker is RACE, perfectly evoking the company’s spirit. As always their website is my first pit stop.

2. BUSINESS OVERVIEW

2.1. COMPANY PRESENTATION

Ferrari is an Italian luxury sports car manufacturer known by its red colored supercars and its prancing horse badge. Its first car was produced in 1947 after Enzo Ferrari left Alfa Romeo’s racing division to found his own racing team, the Scuderia Ferrari.

In 1960 Fiat bought a 50% stake in the company and in 1988, following the death of Enzo, Fiat increased its interest in the company to 90%. The other 10% remained with Enzo’s son, Piero Lardi Ferrari.

In 1997 Ferrari bought 50% of Maserati from Fiat and set up a new factory just for its engines. Meanwhile, in 2005, Maserati was re-acquired by Fiat, but Ferrari continued to manufacture its engines. In 2015 Fiat Chrysler spun off Ferrari making it a completely independent company.

The company’s history is just fascinating. You can read more about it here or just go to youtube and search for a documentary on the company.

Before going any further, I think we should just stop for a second and look at this car. What an amazing piece of automotive art.

2.2. LARGEST SHAREHOLDERS

With 23,5% of the company, the largest shareholder is the Agnelli family through its holding Exor. Giovanni Agnelli was one of the original founders of FIAT in 1899 and the family has stayed in control of it ever since. They are also the largest shareholders of other well known companies like the football club Juventus and The Economist, just to name a few.

I like to see that Enzo’s son Piero Ferrari still holds his 10% stake.

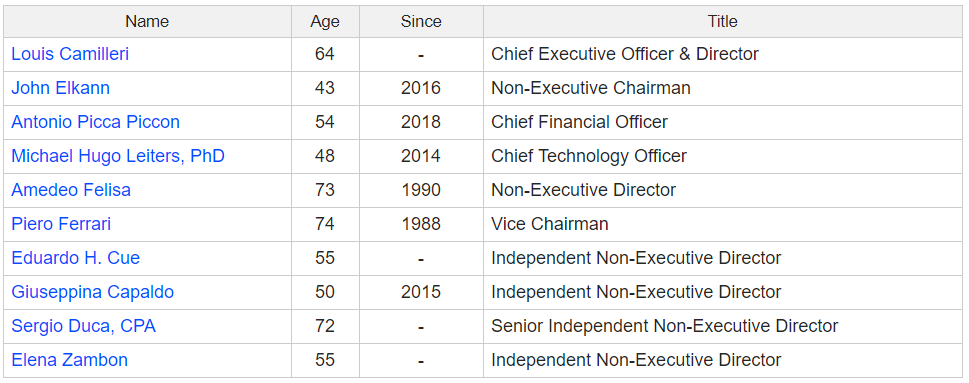

2.3. MANAGEMENT TEAM

After the death of the legendary CEO Sergio Marchionne last year, Camilleri ascended to the top position in the company. He was previously the CEO of Philip Morris International. I think its funny to see that Camilleri was faced with the need to go from regular cigarettes to electronic ones in PMI and he is now facing a similar situation in the auto industry.

3. HISTORICAL CONTEXT

3.1. LONG TERM CHART

The share price has gone up quite well since the IPO and is now at €115,6.

Ferrari’s shares are traded both on the NYSE and on the Borsa Italiana. For the sake of simplification I’ll be considering the price in euros because the company presents its results in euros.

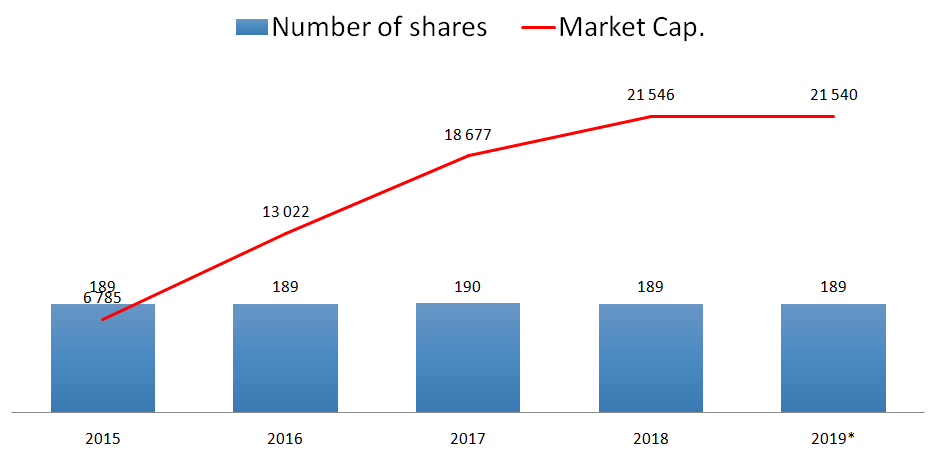

3.2. MARKET CAP AND SHARES OUTSTANDING

The number of shares has been stable since the IPO but the market cap has more than tripled. The company is now priced by Mr. Market at €21.540M.

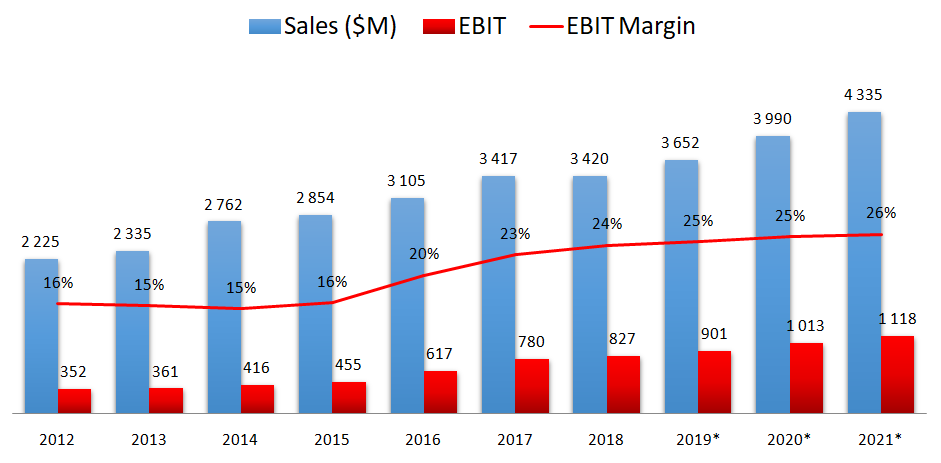

3.3. SALES - OPERATING INCOME - OPERATING MARGIN

Sales in 2018 were €3.420M, flat from the previous year, but Ferrari has managed to raise the operating margin to 24%, thus reaching operating income of $827M.

In case you’re not completely baffled by what we’ve just seen, let me put this into perspective.

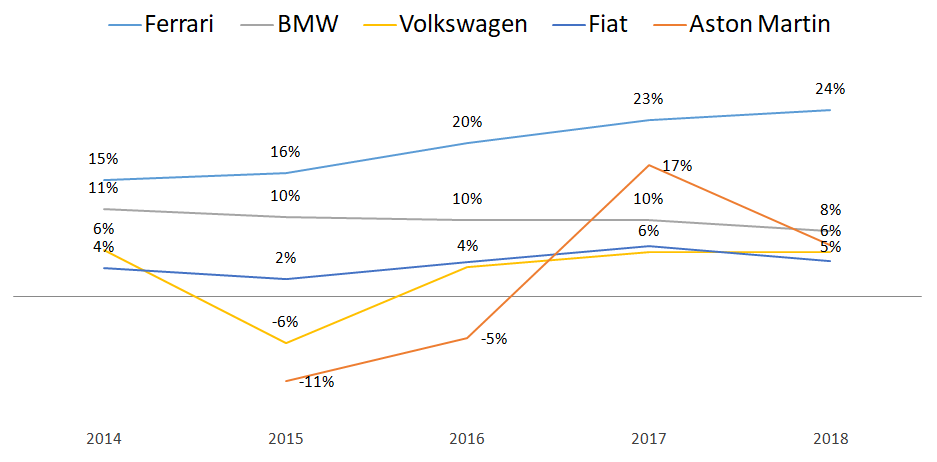

These are the operating margins of just a few automakers:

There is no other car manufacturer that can get even close to Ferrari’s operating margin. Ferrari is on a league of its own. It is something between an auto maker and a luxury brand with tremendous pricing power.

3.5. SALES BY GEOGRAPHY

Europe and the Middle East are the company’s strongest geographies and I’m really surprised to see that China is such a small market for Ferrari. This can mean that the potential for growth is still huge or just that chinese people don’t really like Ferraris.

3.5. SALES BY SEGMENT

As one would expect, their largest segment is the “Cars and spare parts” followed by the Sponsorship, Commercial and Brand.

They also make engines for Maserati but that accounts for just 8% of the total revenue.

3.4. CAR UNITS SHIPPED

Being a luxury car manufacturer, Ferrari isn’t as exposed to the economic cycle as other OEM’s (Original Equipment Manufacturers).

I’ve pulled up the numbers of cars sold or shipped since 2001 just to look at how the company has sailed through the rough waters between 2008 and 2010 and as we can see there were less cars sold, but not that many, and in 2011 the company was already shipping record numbers again.

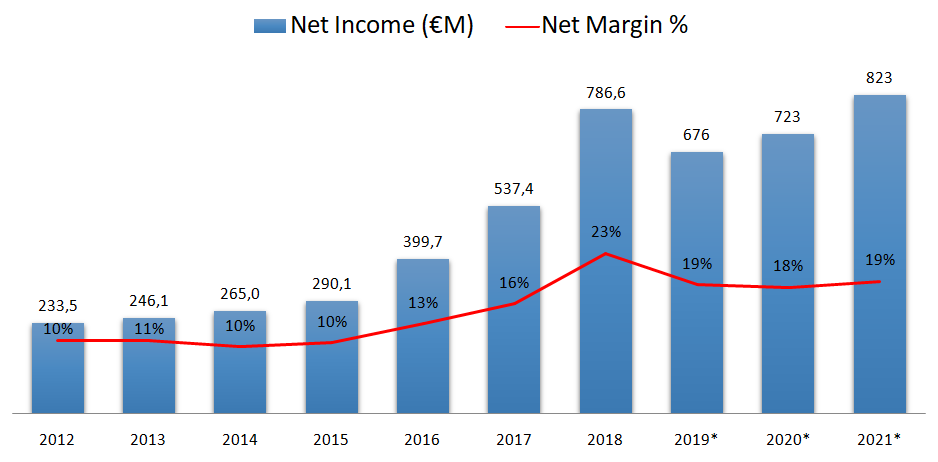

3.7. NET INCOME, NET MARGIN

Net income for 2018 has reached an all time high of €787M with the net margin reaching 23%. This spike is due to an Italian tax regime that benefits companies with high spending on patents, trademarks, etc. In 2018 the company recovered these benefits relating to the last three years, and that’s why the estimates for the next years are lower than the actual numbers in 2018.

But even excluding 2018 from our analysis, net margins of 16% are unheard of in the auto industry. The typical net margin for an automaker stands around the mid single digit.

3.7. RESEARCH AND DEVELOPMENT

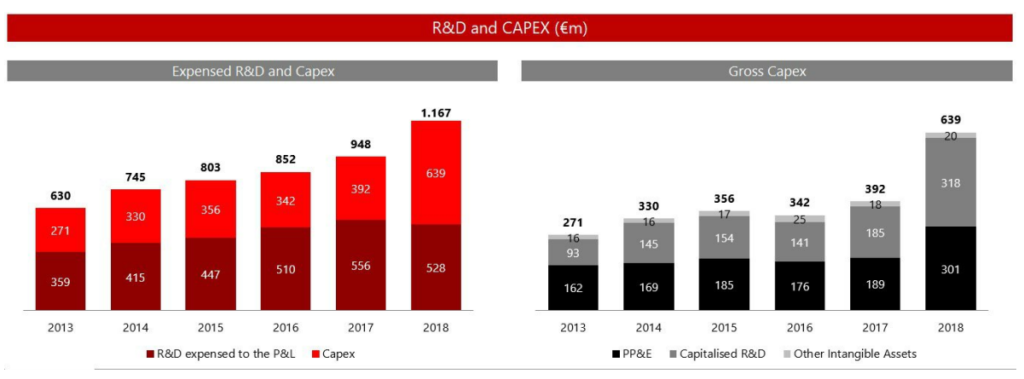

It’s no news that the car manufacturers are undergoing a strong technological transformation due to the electrification of their new vehicles.

As we can see from the image below, they are spending increasing amounts of cash on R&D in order to develop new hybrid technology for their cars.

3.8. CASH FLOW

And exactly because of those recent investments, the FCF has been decreasing.

3.9. SEASONALITY

There is some seasonality to Ferrari’s sales, the second quarter being the strongest one.

3.10. DIVIDENDS

Ferrari started paying a dividend back in 2016 and they’ve raised it every year until now. At the current stock price, the dividend yield is 0,6%, which is almost the same as nothing.

3.11. PROFITABILITY RATIOS

The return on equity is at levels I consider too good to be true because the equity is too depressed. The return on assets was 16% for 2018, which is amazing for an asset heavy company like Ferrari.

3.12. FINANCIAL RATIOS

The current ratio is very sound at 3,6 and the debt to equity is 1,4.

And because I think that a company’s equity is becoming a not-that-reliable measure, I’ll start to compare the Net Debt to the EBITDA figure.

A Net Debt/EBITDA of 1 tells me that the company’s balance sheet is very sound, and I also like that this number is aggressively decreasing. Just so we can get a means of comparison, the industry average Net Debt/EBITDA is 5 right now.

3.13. PRICE RATIOS

Ferrari has never been cheap. Not only compared to its industry peers but compared to the market in general.

Mr. Market is now very fearful of automakers, pricing them at an average PE of 7. Ferrari is trading at a forward PE of 32.

4. GAINING PERSPECTIVE

4.1. INDUSTRY AND STRATEGY

The auto industry is known to be a capital intensive industry with low margins and a high exposure to the economic cycle, but Ferrari isn’t your typical automaker. Ferrari is part an automaker and part a luxury retail brand with 41% of its customers owning at least two Ferraris, so I’m not sure I should compare it to the other automakers or to Hermes or Louis Vuitton.

Mr. Market is now really fearful of the auto industry in general. He thinks the electric disruption will lead to lower sales and that we’re reaching the the peak cycle. That is why he is offering us a lot of good companies on a silver platter.

But funny enough, he’s not thinking the same in relation to Ferrari.

Will the electric revolution affect Ferrari? We are already witnessing it happening. The FCF is decreasing due to higher investments in technology, but I don’t think that we will be seeing lower sales because of that. In fact, I think the hybrid and electric technologies might actually help selling more cars.

4.2. RISKS AND COMPETITION

The main risks I see for Ferrary are:

Risk of brand erosion.

Risk of competition: Lamborghini, Porsche, McLaren, Ford, Honda, Aston Martin, etc.

Risk of execution.

Risk of technological obsolescence.

Risk of exposure to Maserati sales.

4.3. TYPE OF PLAY

Although Ferrari is part of a cyclical industry, I consider it to be a growth company.

5. OVERVIEW AND CONCLUSION

5.1. OVERVIEW

I think it was Ben Graham, Warren Buffet’s mentor, who first said that a great company isn’t always a great investment. If you pay too much for a good business you might never see the benefits of higher sales and income translating into higher stock price.

Let’s say that Ferrari will be able to grow revenue at 7% yoy for the next 5 years and that the company can reach net margin of 21%. In 2023, its revenue will be €4,8B and the net income will be €1B. Even if we apply the historical PE ratio of 30 to that number, the company will be priced at €30B, and that represents a 7% CAGR.

To sum it all up, I think we’ve established that Ferrari is a great company with (hopefully) long years and decades of financial and operational strength ahead of it. This is a wide and deep moat company but unfortunately, at these levels, this would be a very emotional purchase, rather than a rational one.

I don’t know if we’ll ever see Mr. Market offering us this company at reasonable prices (let alone low prices), but if and when he becomes fearful, I’ll be greedy.

5.2. CONCLUSION

This section will be available to paying subscribers in 2019 when we launch the Portfolios. If you’d like to get early-bird conditions, please send us an e-mail.

Don’t forget to check our other analyses. If you want more, join us at our new Facebook group.

6. DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.