FitLife Brands

a fundamental analysis

By Manuel Maurício

February 05, 2021

Symbol: FTLF (OTC Markets)

Share Price: $20.9

Market Cap: $22 Million

Introduction

As some of you might’ve noticed by now, I favor simple businesses over complicated ones. My first thoughts when I first looked at FitLife Brands a few weeks ago were “Here’s something easy to understand, trading at a very cheap valuation (5 times earnings). On the other hand, it’s also a pretty indefensible business.”

This week I’ve decided to dig in and see if my fears were warranted.

Before I proceed, I would like to thank Maarten Pieters for helping me understand the story.

Business

FitLife Brands sells nutritional products such as protein powder, energy drinks, and weight loss supplements under a few different brands such as iSatori, NDS Nutrition, or Energize.

The first thing that comes to mind is: Energy drinks can be great businesses, but protein powder seems like a lousy commodity business. And it is.

Anyone can outsource the production to contract manufacturers, design a cool label, and start selling. These businesses are purely marketing plays. So why on Earth am I looking at FitLife? Because it’s very cheap.

Financials

The current CEO got on the Board of Directors after he bought a significant amount of shares back in 2018. A while after, the previous management resigned and he took over as CEO and Chairman.

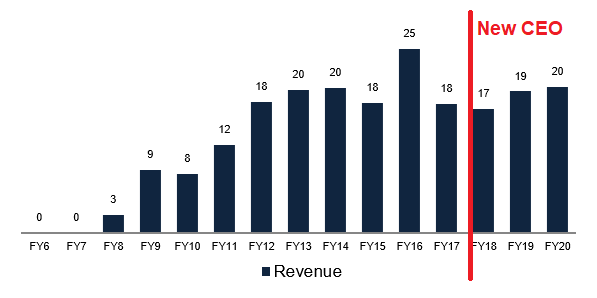

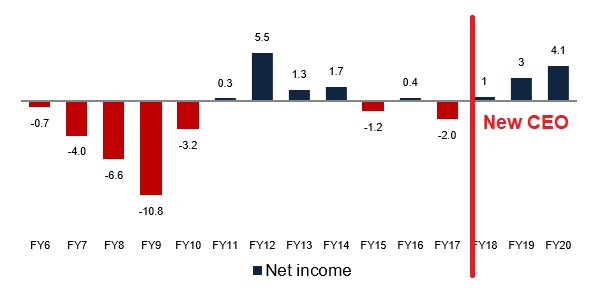

As with other companies that I’ve been writing about recently, we can clearly see the transition of CEO’s reflected on the financials.

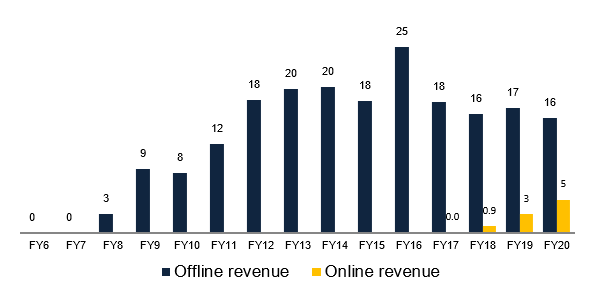

I’m not going to say that all the revenue growth is the work of the CEO, but he has been responsible for the transition to online sales while the offline sales have been somewhat flat.

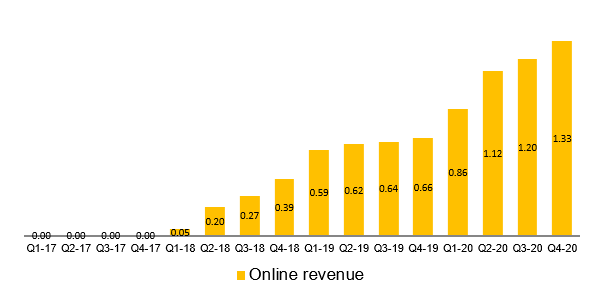

And if we zoom in on that, we can see how impressive the growth has been, especially since the pandemic broke out.

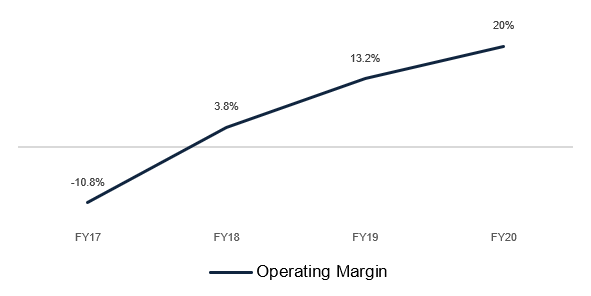

Not only did the CEO got the revenue to go up, but he also cut costs and streamlined the operations, thus raising the operating margin to 20%…

…which, in turn, has led to rising (and positive) profits.

Now, what all of this doesn’t tell us is that the great majority of the offline sales (80%) are made to one single client, GNC.

GNC is a retailer for health and nutritional products that has thousands of owned and franchised stores in malls and shopping centers.

This is obviously a big red flag. If something were to happen to GNC, FitLife Brands would suffer – as it did in the past.

As an example, a few years ago, GNC decided to reduce its inventory and FitLife had a rough year even while the ultimate demand for its products hadn’t changed.

Another recent example occurred in 2020 when GNC filed for bankruptcy after the lock-down affected the traffic in its stores. There was a big scare that GNC wouldn’t pay what it owed to FitLife and that it could be the end of GNC, and consequently affect FitLife dramatically. Fortunately, GNC came out of the bankruptcy process and paid most of what it owed to FitLife. This episode goes to show the perils of customer concentration.

Balance Sheet

When we look at the company’s balance sheet, we can see that there is no debt, and most of the assets are very liquid (cash + inventory + accounts receivable).

We can also see that the company has very little “Property, Plant and Equipment”. From that point of view, this is actually a great business. Because FitLife outsources all the production, it doesn’t need to own any factories or machinery. The flip side of it is that anyone can do the same.

Another good thing is that FitLife also has $28 Million in Net Operating Losses (NOL’s) that can be used to offset any taxable income in the future, thus reducing the amount of taxes it will pay.

Risks

- Competition. Anyone can build such a business.

- Customer concentration

- Amazon

- Health and safety issues with the product

The benefits of going online

Now, this is where it gets interesting.

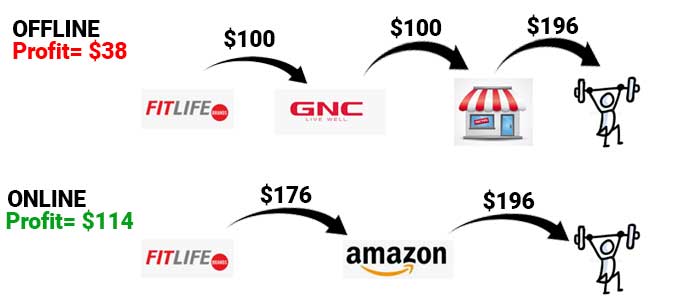

The shift from offline to online will bring MUCH higher profits. Although the management doesn’t disclose the margins for the two distribution channels, one could estimate something like 35-40% gross margin for offline sales and around 60-65% for online sales.

Not only this, but by selling online, the company can sell its products at the price which the physical stores were selling it, instead of the wholesale price. There is a double benefit to selling online.

Let’s say that FitLife today sells its products to GNC for $100 per unit (whatever that unit is). At a 38% profit margin, FitLife would get $38 in profit per unit sold.

GNC then sells the product to its franchisees. I’ve been told that GNC’s franchisees have 40% gross margins (not confirmed). Let’s say that GNC doesn’t make a profit by buying from FitLife and selling the product to its franchisees (it will only make a profit through 9% royalties). That means that the final price that the customer pays is $196 (100 / 51% = 196).

So, by selling online, Fitlife can, not only increase its margin from 38% to 65%, but also price its product at $176 instead of $100. That means that the company would be profiting $114 per unit instead of $38. WOW!

This is the benefit of cutting off the middleman.

Valuation

The company is expected to make a profit of $3.7 Million in 2020, or $3.1 per share. The shares are selling today for $21. This is a Price/Earnings of 5.3x (adjusted for the cash). Said in another way, if we were to buy the whole business, we would be getting a 19% return on our money. That’s very good.

Let’s say that the company doesn’t grow at all going forward. If it buys back its own shares at today’s prices, that would mean Earnings Per Share of $5.7 in 2022, or a Price/Earnings ratio of 2.6x.

Based on this alone, I don’t see how the share price can stay here in the 20’s range. We could easily be seeing the stock price double or triple in the coming years.

Conclusion

But do I feel comfortable investing in this company? Nop, not right now.

It is true that the online business is growing and that we might be seeing the profits go much higher in the future years. But I have no confidence whatsoever in the future of the company, especially when the product is so easy to replicate, and when the business depends so heavily on one customer.

Maarten was telling me how this stock had given him a return of 6x already and how undervalued and underfollowed it still is. That might be true, but Mr. Market seems to be embedding in the price all the risks that I’ve mentioned.

Now, if FitLife could market an energy drink with a strong brand, that would be a whole different story.

On another note, I’ve been finding several businesses that I don’t consider to be great business but that are very cheap. FitLife Brands is one of them. I’m considering buying a basket of these businesses, amounting to no more than 5% of the Portfolio, but I’ve yet to make up my mind.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.