Five Below

a fundamental analysis.

17/04/2020

Ticker: FIVE

Exchange: NASDAQ

Stock Price: $84

Market Cap: $4,7 Billion

Note: This post is best displayed on a computer.

It never ceases to amaze me when I hear great investors like Charlie Munger say “You only need one good investment in your life“. Wouldn’t it be great to find a compounder early on and just stick with it for decades while your wealth grows effortlessly?

Of course it would…. but I see two major problems with that. The first one is knowing which company will be the compounder and the second one is having the conviction to hold it, come what may.

May I remind you that Amazon has had several drawdowns of -94% in 2000

…and another 61% in 2008…

…before becoming this monster?

Would you have held to it? I doubt it. Do you know who has? Jeff has.

Having said that, there are industries that lend themselves to being a nursery for compounders. Software is one of them. The other one is retail. Don’t get me wrong. Retail is one of the hardest businesses around. There are plenty of stories of retailers that went bankrupt. Competition is fierce (which usually leads to low margins) customer taste is ever changing and there aren’t that many barriers to entry. BUT, when there’s a combination of 1) strong unit economics, 2) sustained growth and 3) masterful execution, beautiful compounders can arise.

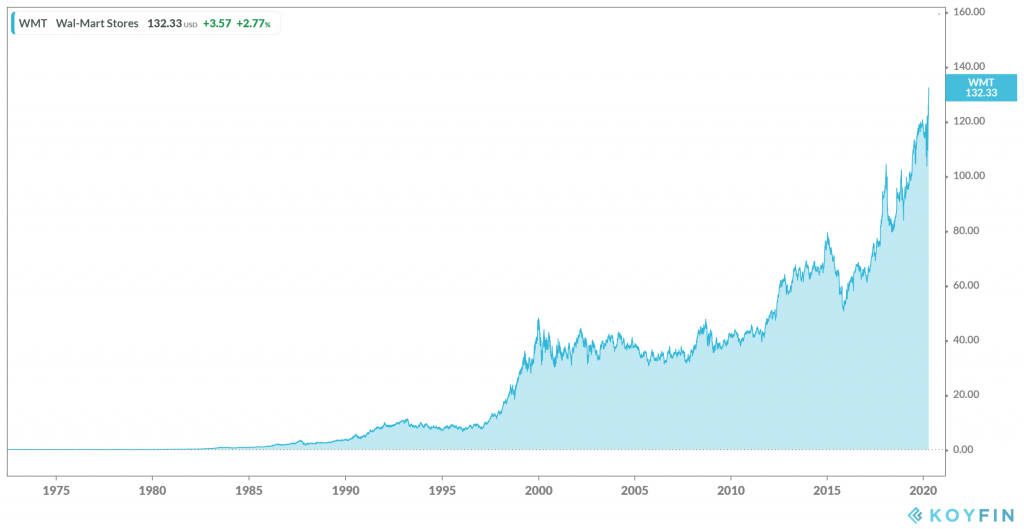

Just look at Walmart…

…or Costco…

…or Dollar General.

It almost makes me forget about Toys R’us, Macy’s or Blockbuster.

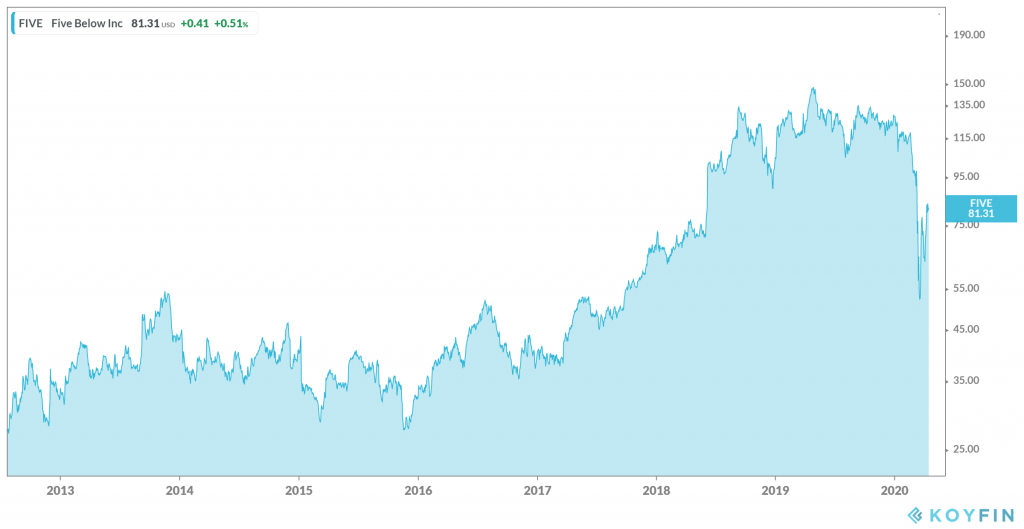

The Business

I first heard about Five Below on the “Invest Like The Best” podcast. The guest was Chris Bloomstran from Semper Augustus (highly recommend his letters). He talked about several retail concepts that he owned (Costco and Dollar General) and when the host asked him to mention one company that he would like to own, he struggled to mention Five Below like if it was a secret. I remember him saying that it had great unit economics, but he had never bought because it was way too expensive (PE=40). Since that episode was aired, the share price came down from the $140’s to $50 and now back to the $80’s. This goes to show the importance of a Watchlist. What I’m trying to figure out today is if this is a fair price or not.

Five below is a discount retailer that sells “value” items to pre-teens and teenagers for less than $5 dollars. What do they sell? Selfie sticks, fidget spinners, candy, basketballs, nail polish, board games, etc… It’s “a wonderland of things no one needs“.

It’s noisy and fun. It’s like a treasure hunt. It’s an experience. Unlike other retail concepts where you go to when you need to buy something, you go to Five Below if you want to see what’s hot and new.

Suzanne Kapner, from the WSJ wrote that Five Below “is the place to come to find things you didn’t know you wanted“.

“We create demand selling discretionary goods. In layman’s terms, we sell stuff that nobody really needs. And we want you to buy it all the time” Five Below founder Tom Vellios

Five Below is a creation of Tom Vellios and David Schlessinger. Both of them had previously founded Zany Brainy, which went bankrupt after the acquisition of the rival Noodle Kidoodle. You can find the story here (paywall protected). Vellios was CEO until 2018 when he stepped down, became Chairman of the Board and handed the helm to Joel Anderson, who was the head of Wallmart.com until he joined the company. Vellios still holds a minor stake in the company.

Here’s a link with a lot of photos where you can see all the things the company sells at its stores.

Warning: Undefined array key "cat" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 176

Warning: Undefined array key "tag" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 177

Warning: Undefined array key "css_id" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 200

Deprecated: preg_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /home5/manuelbean/public_html/wp-includes/formatting.php on line 2431

Recent

Did I mention that retail is hard? It is. Especially physical retail. That’s where these guys are doing things differently. Today retail is about the experience, not just about the price. If you want price, you can shop online. Here’s one of their commercials to show you what I mean.

Before we go any further, let me call out the elephant in the room. One of my main worries when I first started looking at Five Below was its name and its seemingly inability to raise prices. Luckily the company is tackling just that with the Ten Below concept. It is still just a section inside their regular stores, but I believe that the future for the company will be to replace the Five Below concept for the Ten Below.

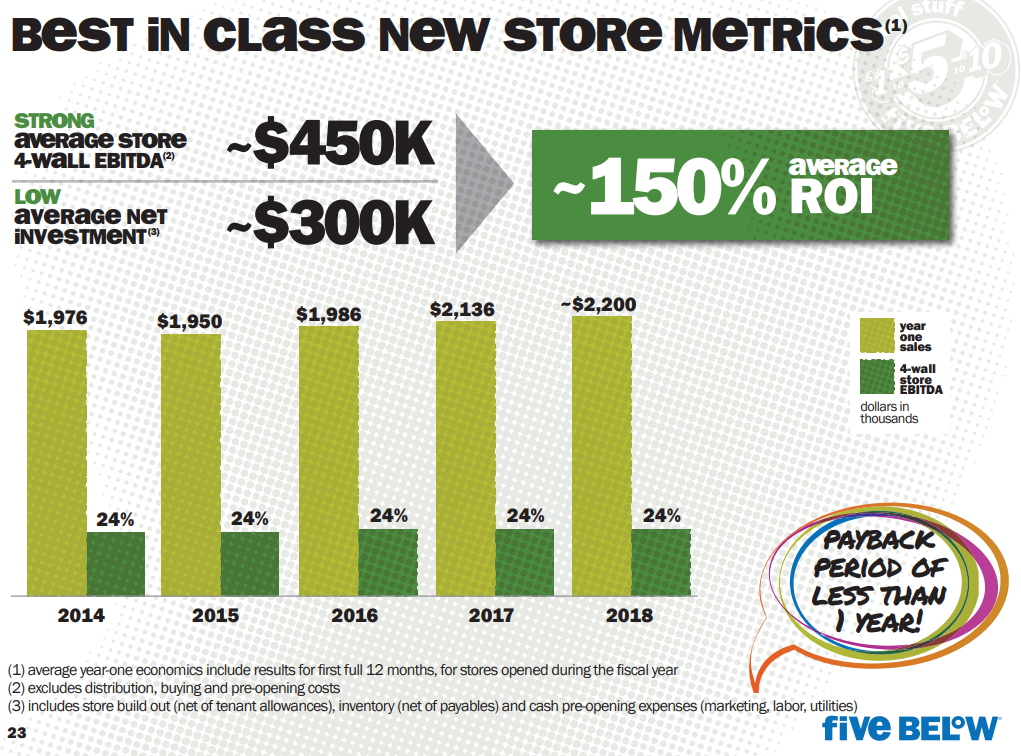

Unit Economics

What the company tells us in the slide I’m posting below is that it costs them about $300 thousand to open a new store which will sell $2,2M on the first year and will generate $528 thousand in 4 wall EBITDA (this is just for the store without taking into consideration corporate or distribution costs). This means that there is a 176% Return-on-Investment. This is IMPRESSIVE. With these Unit Economics, what the company should be doing is to open as many stores as it can. And that’s exactly what its doing, as we’ll see in a second.

I just want to pause here because there are several things that don’t seem right. Take a look at the picture below taken from the last quarter earnings release.

It states that the new stores achieve aprox. $1,8 million in the first full year, while the image from the presentation above stated $2,2 million. Then, 24% of $2,2M is a 4-wall EBITDA of $528 thousand, not $450 thousand as stated above. I’m not sure if I’m misunderstanding something, but something’s not right. Let’s proceed.

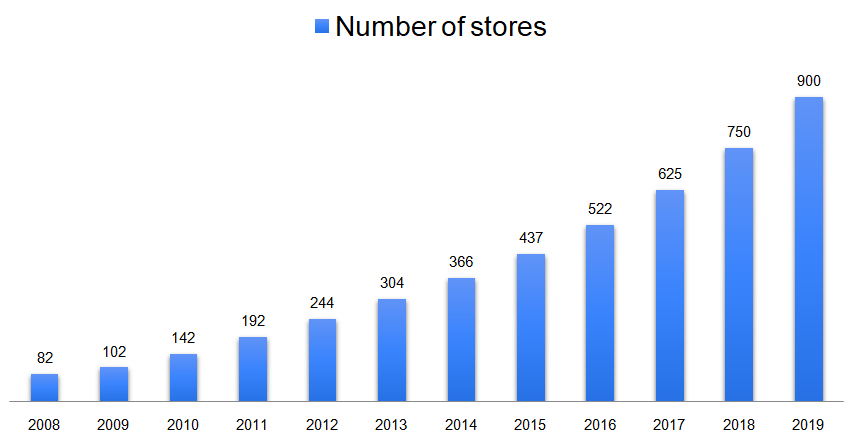

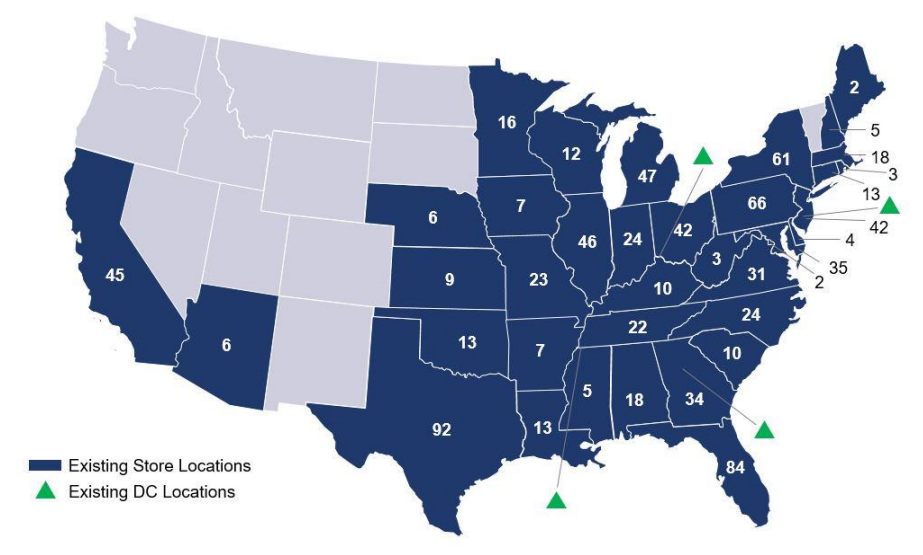

The number of stores has grown from just 82 in 2008 to 900 at the end of 2019. (Note that the fiscal year for Five ends on February 1 as many other retailers). The company believes there is opportunity for 2500 stores in the US alone.

Store growth is THE key drivers for growth and it’s highly dependent on distribution capacity. Without a great distribution network, the company can’t expand. That’s why the proper way to tackle growth is by clustering stores. Given that FIVE sells things for such low prices, it must be able to service as many stores as it can with each distribution center. So having all of the stores on the East Coast and open a new one on the West Coast doesn’t make much sense unless you plan to open many more. So supply chain and distribution are key aspects of this business.

The company was born in Philadelphia and has rapidly expanded along the East Coast. It is now tackling the West Coast and given that it needs distribution centers for that, it has just finished building a new DC (Distribution Center) in Texas. (Texas is that big state right in the middle/bottom of the map with 92 stores).

The CEO has said in December 2018 that he planned to open a new Distribution Center every year for the ensuing 4 years.

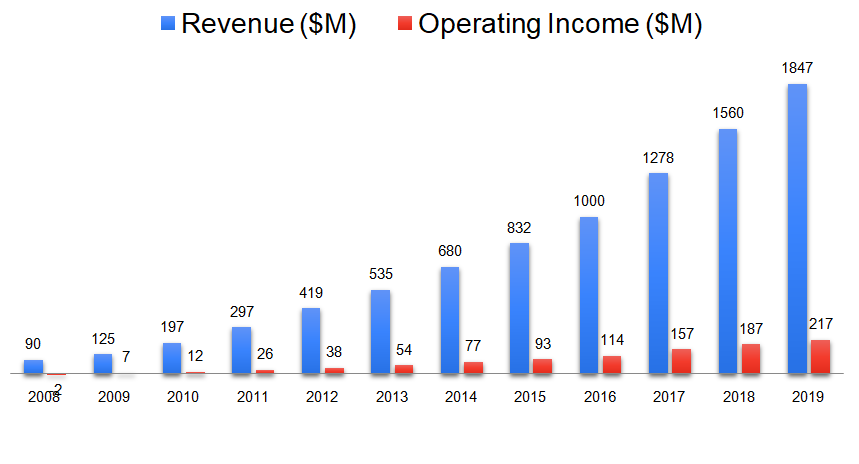

This physical growth translates into revenue growth as well. Since the company went public in 2012, its revenue has compounded at 24% annually.

But novice investors can be fooled by the Revenue growth that can be driven by new stores (often unprofitable) while the core business is slowly dying. That’s why Same-Store Sales Growth (or “comparable sales” or just “comps”) is one of the most important metrics to look at when you’re analysing a retail business.

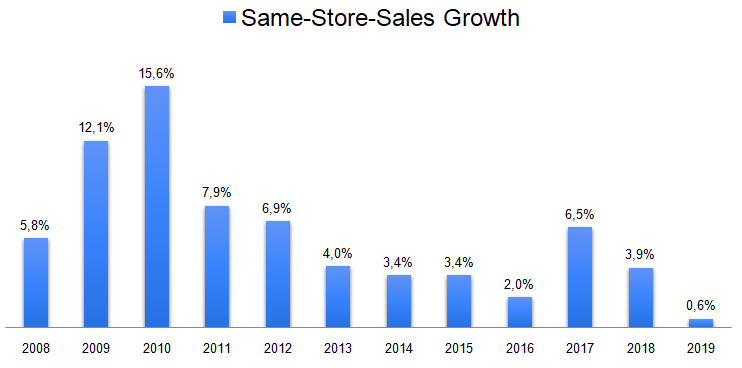

For all of its life, Five’s SSS growth has been positive, and most of it is due to increased transactions, rather than price increases.

I can’t stop to notice how low comps were in 2019. 0,6% compared to a healthy 3,9% in 2018. Unfortunately the management didn’t present a reasonable explanation for it on the Earnings Call. This is something I would like to understand better.

Having said that, I would expect it to change with the current situation. If we look at the years of the Great Financial Crisis, we can see that SSS grew a lot. That’s when this super discounters are most needed. We can also see the effect of the bankruptcy of Toys R’us in 2017 when comps were 6,5%.

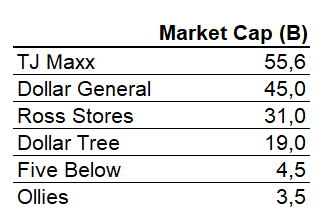

Comparative Analysis

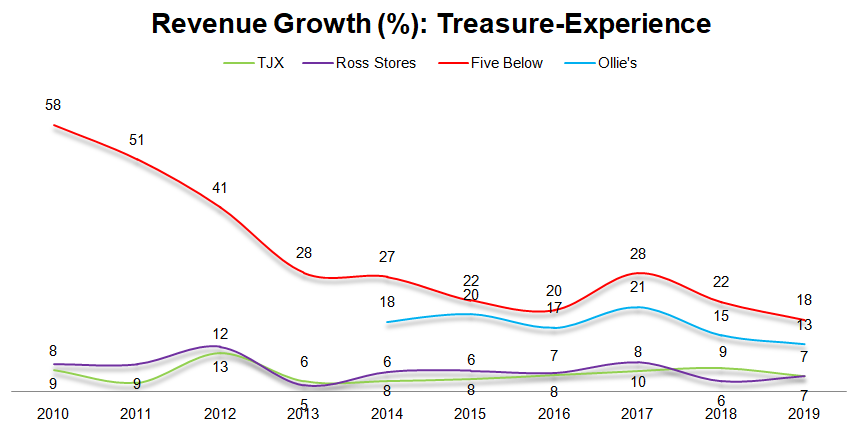

Instead of looking at Five Below by itself, a good way to understand the business is to compare it to its peers. I’ve opted for 2 different groups of peers. The Dollar Stores (or Discounters) and the Treasure-Experience stores. Both these groups are discount models, but they’re somewhat different from each other. The Dollar Stores are akin to grocery stores or supermarkets. That’s where you go if you need to buy a carton of milk or a razor blade. The Treasure-Experience stores are slightly different. You may find clothes there, or flower vases or even furniture. I would say this is the most comparable group to Five Below, but it’s for grown ups, not kids.

Note that although these concepts are more or less similar, there is no direct comparable to Five Below. “It has positioned itself not to compete directly with any other concept out there”. It’s like a mix of Dollar Stores with Toys R’us. I would say that the most comparable concept might be Ollie’s Bargain Outlet.

“Our two founders, David Schlessinger and Tom Vellios, created a great concept. It was, and remains today, unduplicated” Five Below CEO Joel Anderson in 2017

Warning: Undefined array key "cat" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 176

Warning: Undefined array key "tag" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 177

Warning: Undefined array key "css_id" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 200

Deprecated: preg_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /home5/manuelbean/public_html/wp-includes/formatting.php on line 2431

Recent

Now is the part where I get into the weeds and it might get boring for some of you. If you’re not into technical stuff, just skip this part and go straight to the Valuation and Conclusion down below.

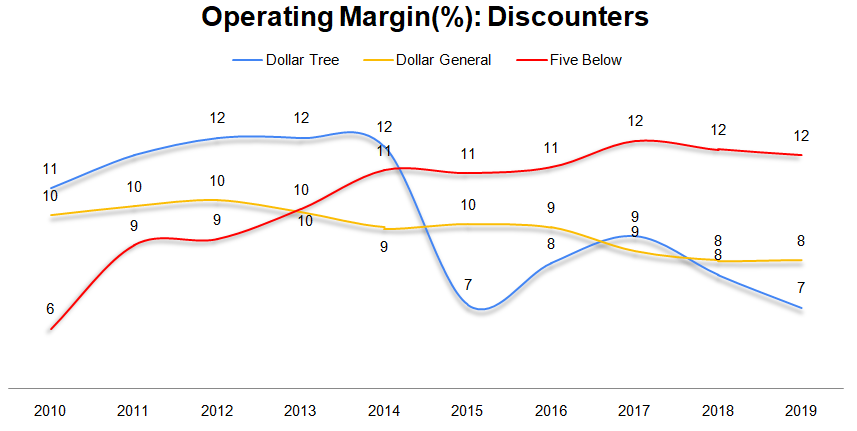

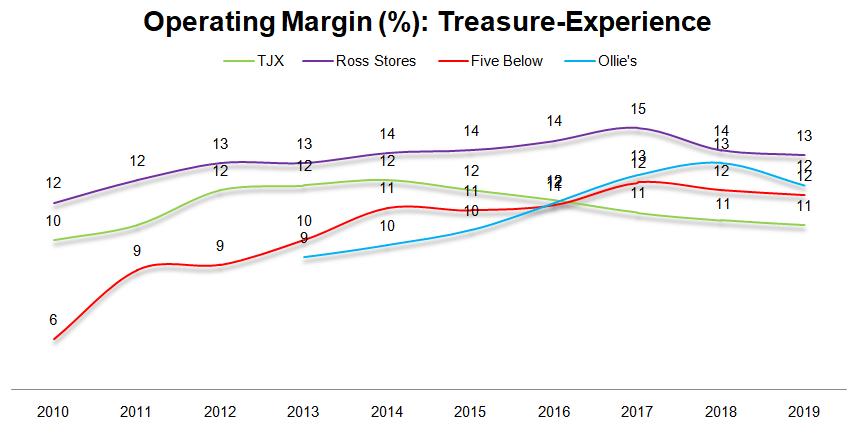

First and foremost, I’m looking at the operating margins. I could be looking at the net margins, but I find this to be a “purer” metric without the interferences of how the businesses are funded. Feel free to disagree.

What I see here is that FIVE has much higher margins than the Discounters and more or less the same as the Treasure comps.

What I also take from these 2 charts is that the margins for the Treasure-Experience lot have been growing, which goes to show the popularity of these concepts.

Inventory

Similarly to the Same-Store Sales, you can’t look at retail without looking at the efficiency metrics.

One of the most important skills in retail is the inventory management. That’s what they do, right? Buy and sell stuff. The ones that manage it the best will come out on top. Inventory is also the reason why many retailers fail.

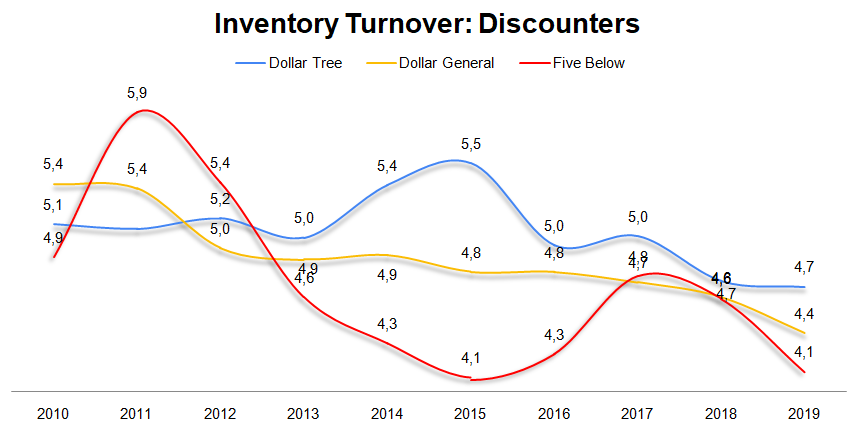

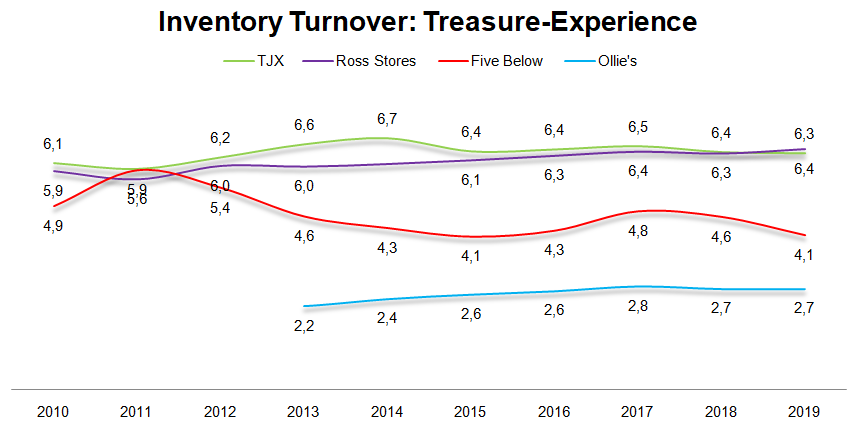

One way you can assess the quality of inventory management is by looking at the Inventory Turnover. This is an efficiency metric that tells us how many times the company has “turned” (or sold) its inventory in a given year. The higher, the better. (The inverse of this is the Days Inventory Outstanding which tells us the number of days it takes for the company to sell its inventory. The lower the better).

What I see in the Discounters group is that FIVE is the worst at managing its inventory. Dollar Tree turned its inventory 4,7 times in 2019, Dollar General 4,4 times and Five 4,1 times. It’s not a huge difference. I think the reason for this is that Five sells “disposable” things, not essential goods.

Comparing it to the Treasure-Experience folks, I’ve got to say that TJ Maxx and Ross are very good at turning their inventory. This can happen for 1 of two reasons. They keep a much lower inventory in relation to sales or they are better at selling it.

Here’s a link with pictures of Ross Stores in case you want to better understand what they sell. And here’s one for TJ Maxx.

Ollie is the worst of both groups at managing its inventory. I’ve heard rumours that its inventory is so bad that most of it should be written off.

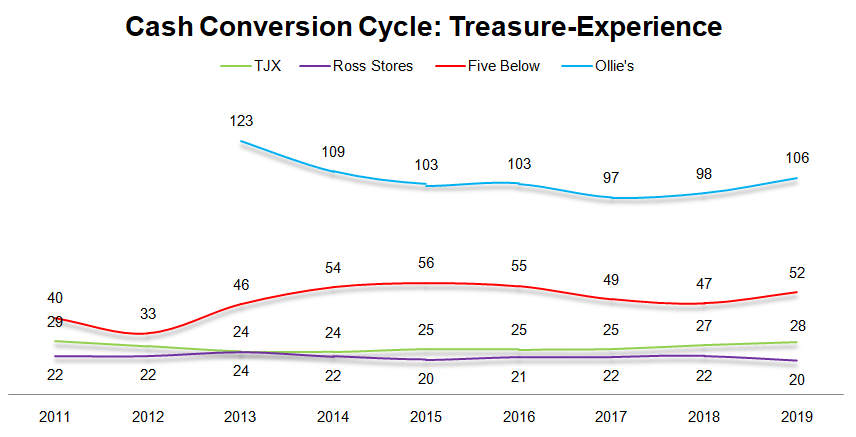

Cash Conversion Cycle

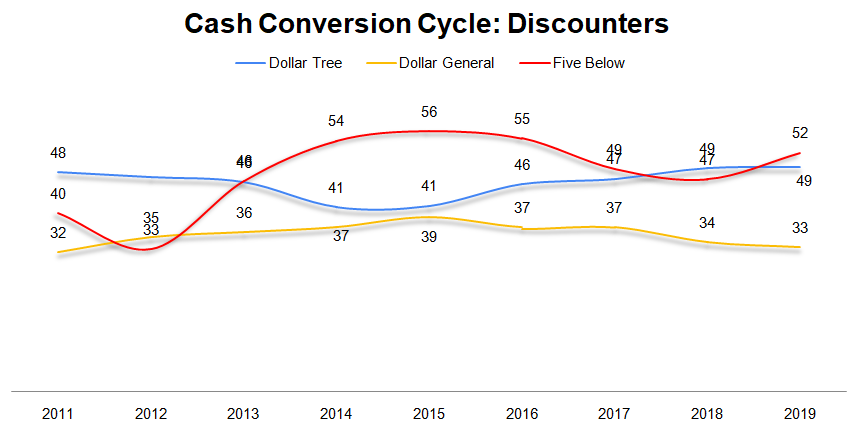

If you’ve never heard about the Cash Conversion Cycle, this is “the metric that expresses the time (measured in days) it takes for a company to convert its investments in inventory into cash flows from sales”. The lower the better. It means that the company takes less time between buying inventory and collecting cash from its sale.

With 52 days of Cash Conversion Cycle, FIVE has been the worst of the Discounters against 49 days for Dollar Tree and 33 for Dollar General. This is due to – in the most part – the fact that it takes longer to sell its inventory.

Comparing now the Treasure-Experience peers, Ollie’s is just pitiful while TJX and Ross are…damn… really good. Their Cash Conversion Cycle is 20 and 28 while FIVE’s is 52, almost double.

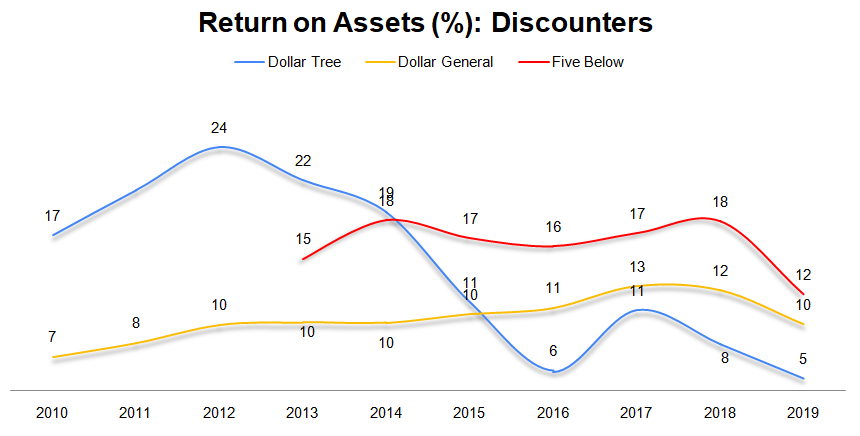

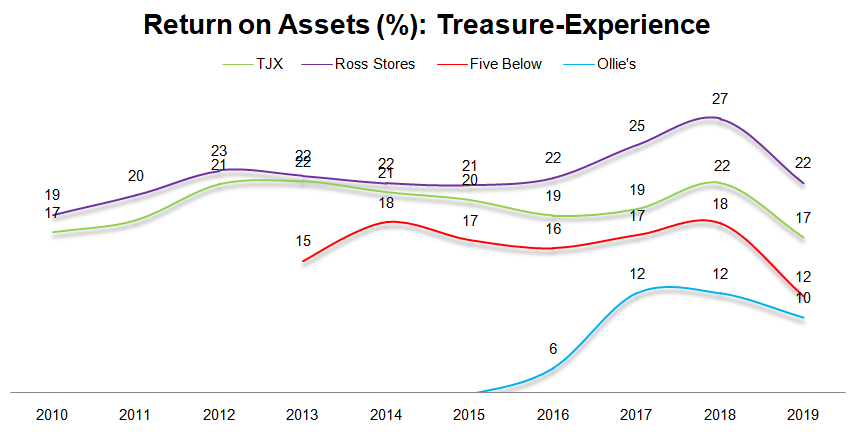

Return on Assets

Another great ratio that helps us understand the profitability of a retailer is the Return-on-Assets. This is a result of the combinations of both its margins and its inventory turnover.

Let’s say that you’re a car dealership owner and that you’ve invested $150K in buying that Ferrari and you’ll be able to sell it for $200K. Your margin will be 25% (50/200=25%) and your ROA will be 33% (50/150=33%). Because a Ferrari is an expensive item, that’s the only car you’ll sell for the entire year.

Now let’s say that you also have a grocery shop. You buy 10 Kg of onions for $5. Onions are an undifferentiated product so margins are low. Let’s say 4%. You will sell those 10 Kg for $5,21. You Return-on-Assets will be 4,2% (0,21 / 5 = 4,2%). Much lower than the 33% you would get by selling the Ferrari.

BUT unlike a Ferrari, you can sell 10 Kg of onions several times during one year, right? Right. Let’s say that it takes you 30 days to sell those 10 Kg. After 1 year, you will have sold it 12 times. That’s your inventory turnover. Your total invested capital was $5 and the actual amount of money you’ve made in profit was $2,53 (0,21*12=$2,53). Your Return-on-Assets was 51% (2,53 / 5 = 51%). Pretty neat hein?

That’s why margins should be put into context. Having low margins is no problem per se.

So how does Five stack up against its peers? Compared to the Discounters, its ROA is the best. Even while turning its inventory less times, the higher margins make up for it. In 2019, Five’s ROA was 12, Dollar General was 10 and Dollar tree 5.

Compared to the Treasure-Experience, it wasn’t so great. Ross Stores had an impressive ROA of 22, TJ Maxx 15 and poor ol’ Ollie’s 10.

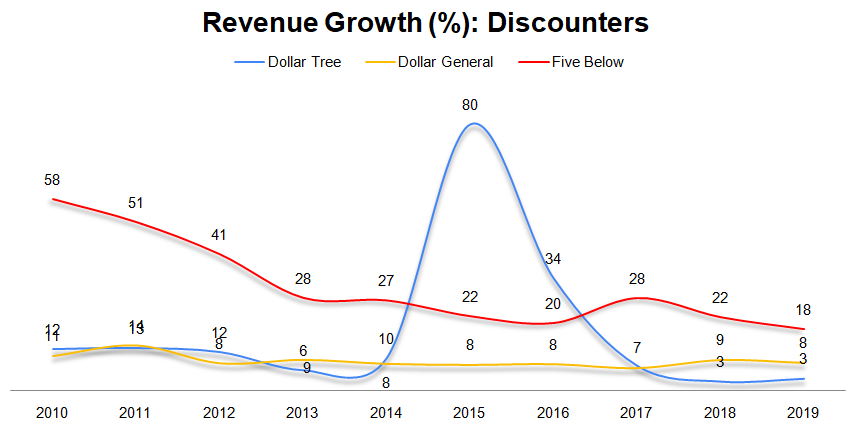

Growth

So how do all of these companies compare when it comes to growth? Well, FIVE is growing much faster than all the others.

What we must bear in mind is that the smaller you are, the easier it is to grow in percentage terms. If you own a store and you open a new store, you’ve grown 100% whereas if you own 100 stores and you open a new store, you’ve grown 1%.

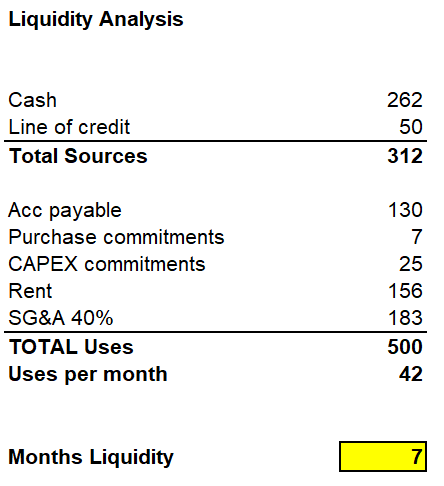

Balance Sheet

Right now, the company has no debt, it has $262M in cash, an undrawn line of credit of $50M and if it needs to, it can raise more cash, but I don’t believe that’ll be necessary given that it has 7 months of liquidity, including Accounts payable (that can surely be deferred), rent (that can surely be deferred), etc.

Five Below generally doesn’t compete with Amazon… They offer products that sell for prices below what the shipping cost would be from Amazon, which is why they have a minimal e-commerce footprint. To a certain extent they’re Amazon-proof.” Ken Perkins, president of Retail Metrics

Risks (or just things to bear in mind)

- Tariffs. 60% of the products Five sells come from China. Fortunately the company has been able to handle this quite well.

- Supply Chain. If the supply chain breaks, the company will suffer. That’s why they have more than 800 vendors.

- Bad inventory management

- Lack of insider ownership or controller shareholder which makes this a target for acquisitions or even shareholder activism (which would probably be a good thing). The famous activist investor Daniel Loeb owns a small piece of the company.

- Competition. There’s no real moat here. But then again. What’s Dollar General’s or Costco’s moat?

- Growth seems to be capped at 2500 stores. This isn’t really a risk, but it something worth mentioning.

Valuation and Conclusion

Five Below has never been cheap. It’s PE ratio has been above 30 or 40 for most of the past 3 years. But now it’s priced at 27x. Is that cheap? Not usually. If you compare it to the slow growth comps, it’s trading for the same as Dollar General and the historical average for Ross Stores, so one could argue that it has never been cheaper.

But the thing with multiples is that they’re backward looking and not forward looking and like Phil Fisher used to say “what matters to an investor is the future”.

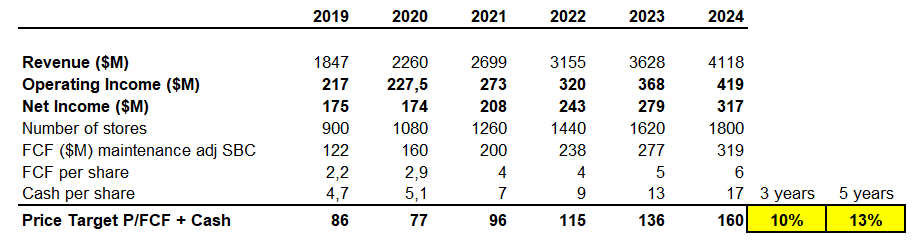

I’ve spent some time understanding the several inputs that drive this business forward. The most important of them all is the store growth. here’s the assumptions behind my valuation:

- 180 new stores for the next 5 years (it will probably be higher)

- 1 new Distribution center per year until 2022 to support the new stores

- Sales per new store go up 2% per year (given by the company)

- Sales and costs per mature store go up 2% per year

- Operating margin is 10%

- Capex per new store will go up 2% per year (given by the company)

- Capex per mature store stays at $70K

- Capex per Distribution Center is $50M (given by the company)

- Extra cash is assed back to the share price

- I don’t take into account the current COVID-19 situation (I know, I know)

- FCF multiple of 25x

After modeling all these assumptions, I get to a CAGR of 10% three years from now and 13% five years from now. I look for companies that can give me at least a mid teens annualized return (not to mention limited risk), but I also think I was too conservative on the store opening assumptions, so…

The thing is, will Five ever again come to this valuation? This is the type of company that stays expensive for a long long time. I’ll bet you we’ll see this company grow a lot in the future and its valuation will follow.

So why am I not buying it for the All in Stocks Portfolio just yet? For 5 reasons.

I am still struggling with the following 1) the breakdown of the capital expenditures in 2019 (I can’t seem to understand where all of that money went), 2) the discrepancy in annual sales figure for new stores that I mentioned back in the “Unit Economics” section 3) why same-store sales growth was so low in 2019, 4) At this price, it’s not a screaming buy (it was for a brief period when it came down to $50ish) and 5) I’m also not sure the management’s compensation is set up in the right way.

You see, let’s take Dollar General managers’ variable compensation as an example. The variable part of the comp is the biggest slice of the total compensation. 50% of that variable compensation is tied to EBITDA growth, which isn’t spectacular. You just need to cut costs and your EBITDA will grow. But then there’s another 50% that is tied to a Return-on-Invested-Capital higher than 19%. That’s great. That’s exactly what we, as shareholders, should be looking for in our companies.

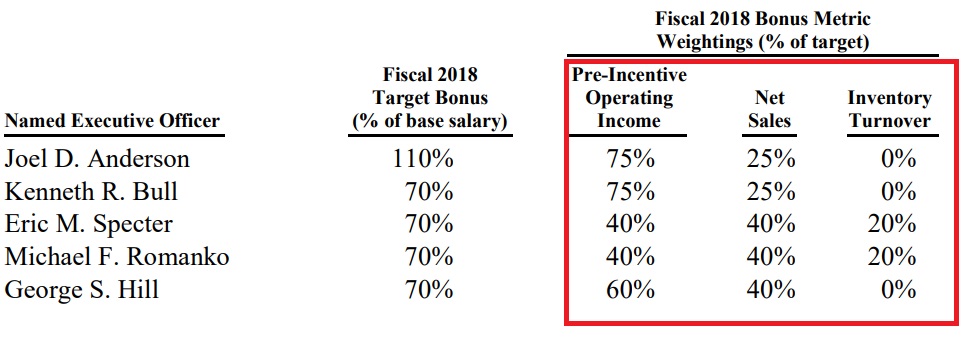

As we can see from the image below, the management team is compensated mostly on Operating Income growth and Net Sales growth. I’m happy to see that both the Chief Administrative Officer and the Chief Marketing Officer have a small part of their incentive tied to inventory turnover (and consequently to Return on Capital or assets) but not the CEO nor the CFO. If you think this isn’t important, when you make millions, the most important thing in your mind is “how will I keep making millions tomorrow”, and that might not be in the shareholder’s interest. Fortunately, the chairman is the founder and still holds a minority stake in the company, but I need to give this more thought.

I’m sending an email to the Investor Relations to see if they can help me out with points 1, 2 and 3 and I’ve also reached out to a fellow investor who knows the company very well to see if he can shed some light into these points.

Having said all of this, the question arises. Am I risking losing a great entry point on what can be a great company for what might be minor details? Yes, I am. I can’t help but to be rigorous.

Selected material for further research:

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.

Warning: Undefined array key "cat" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 176

Warning: Undefined array key "tag" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 177

Warning: Undefined array key "css_id" in /home5/manuelbean/public_html/wp-content/plugins/recent-posts-widget-extended/classes/class-rpwe-widget.php on line 200

Deprecated: preg_replace(): Passing null to parameter #3 ($subject) of type array|string is deprecated in /home5/manuelbean/public_html/wp-includes/formatting.php on line 2431