Floor & Decor

another Buffett darling

By Manuel Maurício

July 1, 2022

Symbol: FND (NYSE)

Share Price: $62.96

Market Cap: $6.66 Billion

I’m looking at yet another stock that Buffett bought recently. Ok, maybe it wasn’t Buffett himself. Maybe it was one of his portfolio managers, Ted or Todd.

And yes, it’s another retailer tied to the housing industry. This means that it should be moderately cyclical. But hey, there’s money to be made in cyclical companies too. We just need to buy them at the right price.

Let’s learn about the business and then we’ll come back to the valuation:

Business

Floor & Decor is a specialty retailer of hard surface flooring and related accessories. If you need flooring, Floor & Decor is the place to go.

There are plenty of flooring product sellers in the US, but none quite like Floor & Decor. The key difference is that F&D has significant quantities of everything it sells in stock. Home Depot, a comparable company, will have 5-10 boxes of each SKU (Stock Keeping Unit). That’s not enough to complete most projects.

The company has 162 warehouse-format stores in the US. Each store has, on average, 72.000 square feet. The average retail space for Home Depot or Lowe’s dedicated to flooring is about 5.000 square feet.

This is a considerable advantage for Home & Decor. Especially for the professional installers as they can’t afford to wait for several weeks for the product.

American families were fans of carpets for many decades. But that has been changing in recent years. The tastes now demand hard surfaces and buyers are willing to invest more money on premium flooring.

This has led to the flourishing of several solutions, the most popular one being luxury vinyl tile (my architect friends would hate it). Basically, it can imitate whatever material you want it to. Wood, ceramics, concrete, you name it.

Segments

60% of the sales go to homeowners with the remaining 40% to professionals. But from those 60%, 45% were referenced by a pro. That means that the professionals account for 85% of the business. The management understands the value added of selling to the pros: 59% of them are enrolled in Pro Premier Rewards Program and spend 3x more than the non-pros.

So, the company maintains dedicated sales teams for the pros, giving them credit, rewards, education, etc. Of course, it’s not just Floor & Decor that understand this. Its competitors also treat their pros well, but they don’t have the assortment that Floor & Decor has.

DESIGN SERVICES

And then there are the design services where the company employs its own designers to help the clients make the right choices. Having worked in the construction business myself, I understand the patience needed to do this job “Oh, let’s go with the grey tiles. No, better with the blue ones. Dark or light? But what if we go with wood instead?“. This can go on for hours.

The good part about this is that the average ticket for the clients who use the design services is usually 2 times higher than the regular customer.

And of course, just like many other large retailers, the company has its own proprietary brands with higher margins.

It’s using a strategy with opening price > good > better > best product. This drives revenue and margins up.

And it’s also expanding into its competitors turf with the adjacent categories – vanities, kitchen counters, bathroom fixtures.

What about eCommerce, you might ask. Isn’t it a threat?”. I don’t think so. Right now, online sales represent 16% of the total revenue. But people like to look at the colors live, touch the products, and see the reflections on different angles. That can’t be done on a screen so I wouldn’t be too worried about online competition.

Supply Chain and Distribution

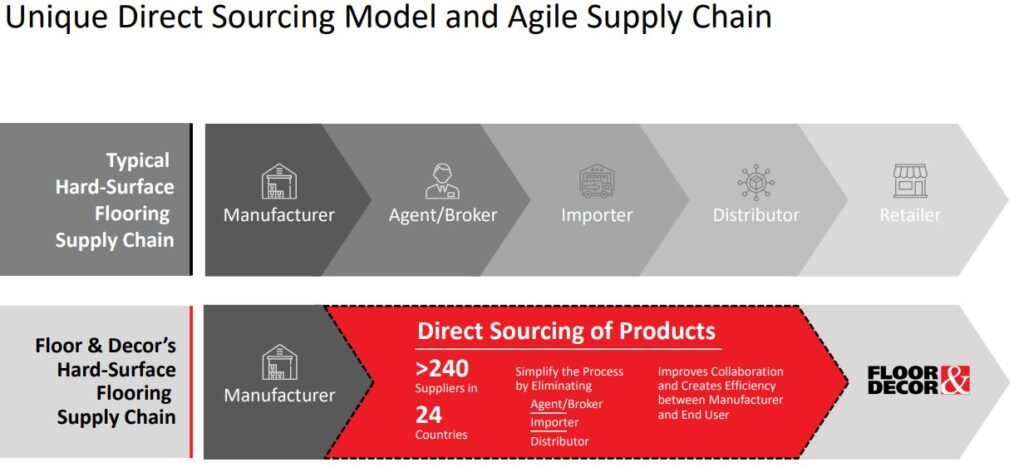

A typical low-scale retailer buys from distributors who bought from importers who bought from brokers who bought from the manufacturers. A lot of mouths to feed.

Floor & Decor sources its products directly from the manufacturers. This reduces costs and allows Floor & Decor to have the best prices.

In 2021, the company bought from 240 suppliers and no single one represented more than 10% of sales.

The large scale also allows Floor & Decor to gain market insights that the smaller players just can’t get. You see, those smaller players shifted away from having the inventory in house to become simple showrooms with little inventory available for delivery. Customers would need to wait for their products to be delivered at a later date.

Floor & Decor took advantage of that void in the market.

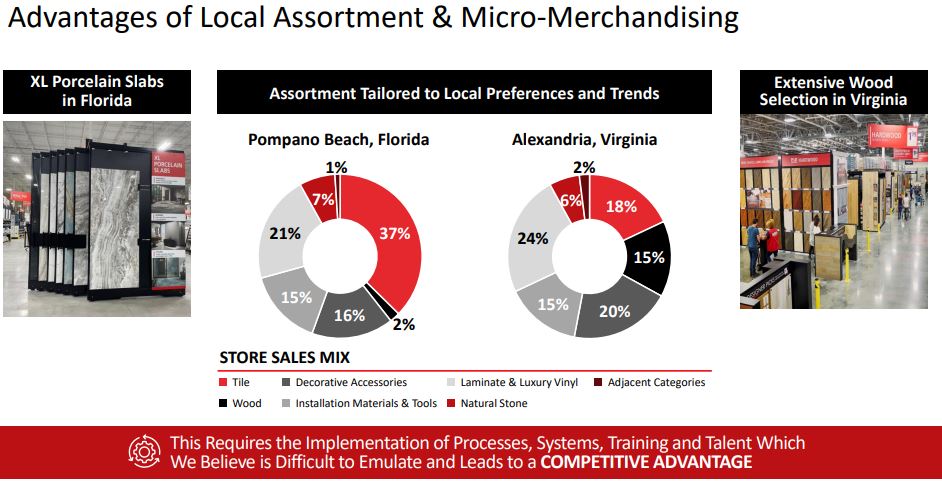

So Floor & Decor is able to understand that customers in Florida want XL porcelain slabs whereas customers in Virginia want wood tiles. The company will then adapt each store and inventory to the particular needs of its markets.

Sales and Margins

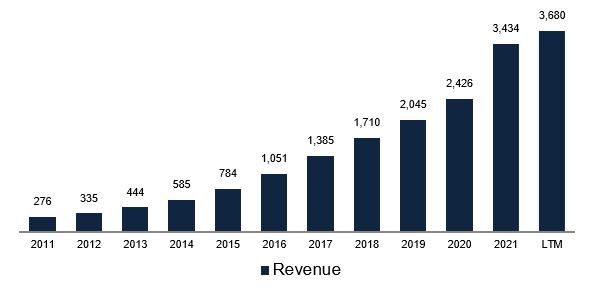

Turning now to the financials, the revenue growth over the years has been fenomenal.

But as with most retailers, it’s easy to mask declining demand by opening more and more stores. That’s why we should be taking a peak at the Same-Store-Sales growth.

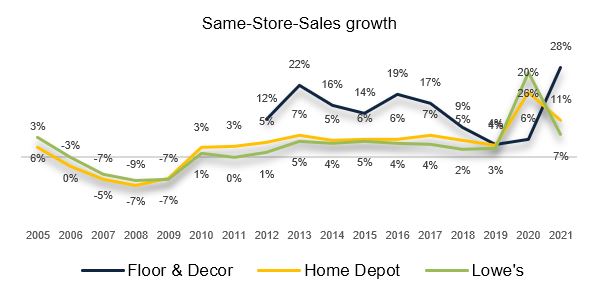

I like to look at the SSS growth over an entire cycle but Floor & Decor went public in 2017. So, I’ve added Home Depot and Lowe’s to the chart below. Although the Great Financial Crisis was exactly that – Great – it’s important to understand how the consumer patterns change over the cycle.

Apart from the recent years ,which were impacted by the pandemic, the considerably higher SSS growth for Floor & Decor reflects its early stage of development. As its stores mature they will still be increasing sales at a higher rate than those of more mature businesses.

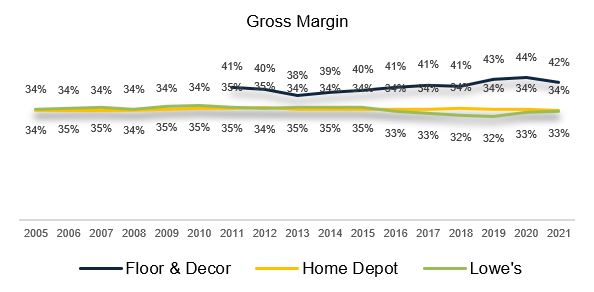

On the margin side, although Floor & Decor has the higher gross margin…

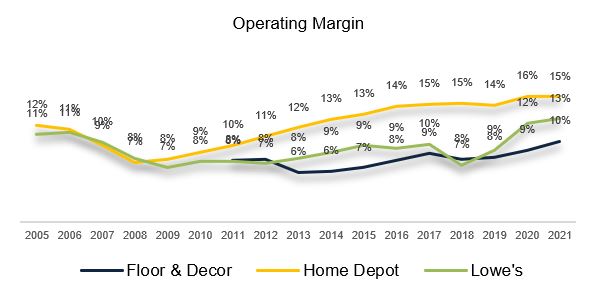

It has the lower operating margin of the 3.

This tells me that the operations aren’t as well oiled as those of its competitors, especially Home Depot.

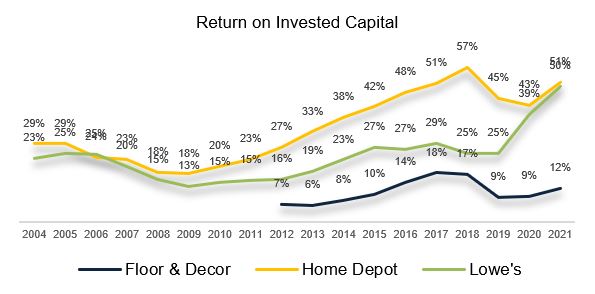

Unsurprisingly, this also translates into lower Returns on Invested Capital.

The question then becomes – will Floor & Decor be able to catch up with Home Depot or Lowe’s?

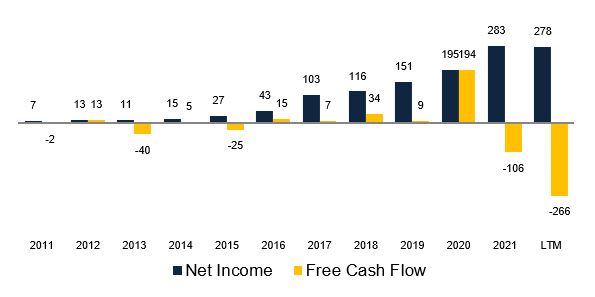

If we look now at the Free-Cash-Flow conversion we can see that, unlike Home Depot, the company has been reinvesting most of the profits back into the business thus getting a much lower FCF than Net Income.

If we were to calculate the Free-Cash-Flow without the growth expenditures, we would see a very different picture. Floor & Decor should be able to generate strong cash flows when it reaches maturity.

Balance Sheet & Capital Allocation

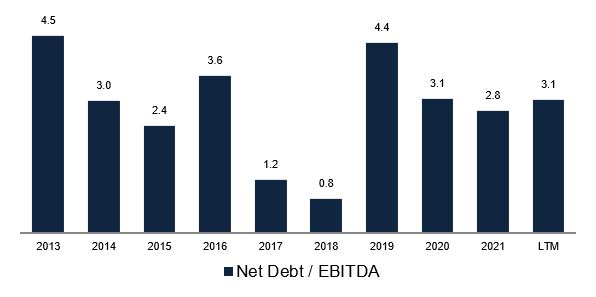

I usually don’t consider the leases as debt on my calculations, but when it comes to retailers, maybe I should. After all, with the average lease term being 11 years for F&D, this is an obligation payable and, as we’ve seen during the pandemic, it can break a company.

This means that the current Net Debt/EBITDA ratio is 3.1x – a bit stretched if you ask me. Home Depot has a leverage ratio of 1.8x and Lowe’s 1.9x.

The management’s priorities regarding capital allocation are investing in the business, be it organically by opening new stores and distribution centers as well as making acquisitions.

The management estimates 500 stores as their target and $17 billion in sales, meaning that they expect to grow sales per average store from the current $23 million to $34 million at maturity. This will help us with valuation in a minute.

Management and Ownership

As always, if you understand their incentives, you’ll understand their actions.

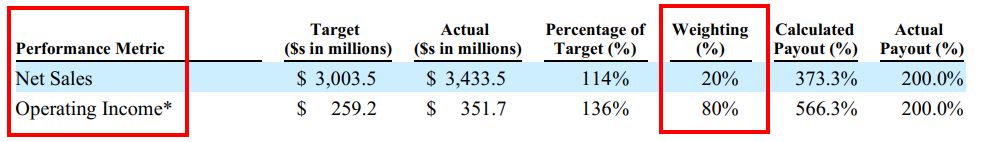

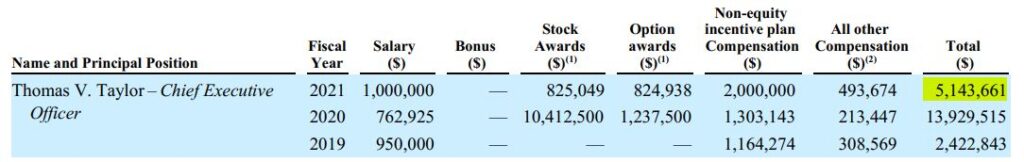

The variable compensation has two parts. The annual cash bonus and the long-term stock bonus.

The annual cash bonus is tied 20% to sales growth and 80% to operating income growth. Fair enough.

The long-term stock bonus is tied to Operating Income and Return-on Invested Capital of a minimum of 17%. I like this as it should keep the management focused on what matters most.

The CEO earned $5 million in 2021 while the company had a profit of $283 million, so a ratio of 1.8%.

If we look at Home Depot, the CEO earned $13 million, but the company had a profit of $16 billion. That’s a ratio of 0.08% so… maybe Floor & Decor is paying too much to its CEO?

Regarding ownership, Warren Buffett’s Berkshire Hathaway is among the largest shareholders with 5% of the company. The remaining top shareholders are all institutions. I’m not very fond of that.

Risks

- Being exposed to the housing market, there’s obviously some cyclicality to Floor & Decor although the great majority of its revenue comes from repair and remodel which should be less cyclical than the new construction segment.

- With such high amount of inventory, there is a significant risk of inventory obsolescence.

- There’s also every other risk associated with retail: increased competition, changing consumer tastes, supply chain issues, etc.

Valuation

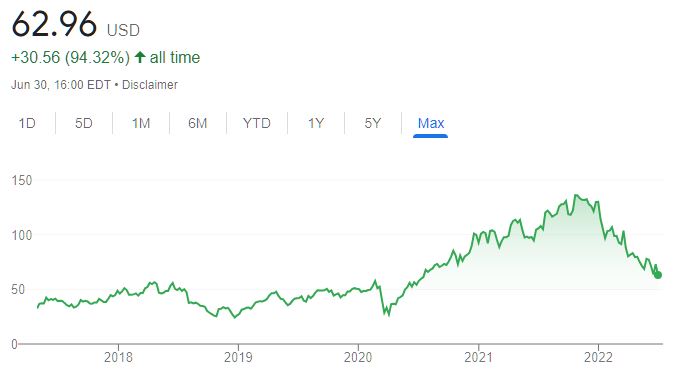

It’s just crazy how the stock was trading at 90x earnings just after the IPO.

Of course, even with profits 50% higher in 2019, the multiple compression led the stock price to go nowhere for 2 years.

Today the stock is trading at around 24x earnings. Is that too high, too low, or fair?

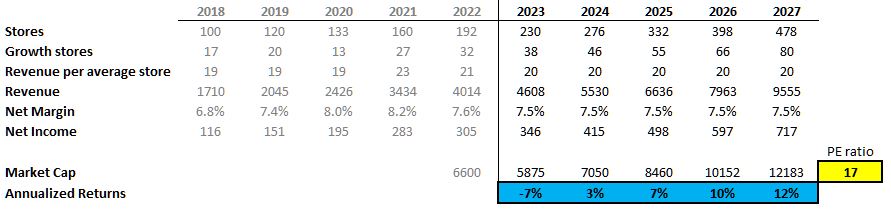

Let’s make some quick assumptions for the coming 5 years. Let’s say that the company will be able to grow sales by 20% per year driven by growth in the number of stores and in Same-Store-Sales.

Let’s also say that the net margin will be kept at 7.5% and the number of shares will remain constant. As the lowest Price-to-Earnings ratio of its history was 17x, let’s apply that multiple as well.

*click the image below to enlarge

This leads to an annualized rate of return of 12% in 2027. Quite good. I wasn’t expecting this. Of course, my assumptions will certainly be proven wrong, but this estimated return is enough to keep me interested.

Final thoughts and Conclusion

Just like with NVR or Richelieu Hardware, I think it’s fair to assume that Floor & Decor has been over earning in the past year.

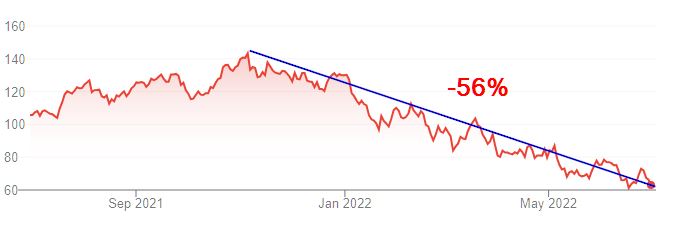

With the recent fears of higher inflation and interest rate hikes, the stock market has punished the stock.

The market is scared of the cyclicality with this name. The same happened back in 2018 when the stock price went down by 55%. These drops have been good opportunities to buy.

So, am I buying it now? I like Floor & Decor, but I’m not ready to buy it yet. To buy Floor & Decor I would need to look at the homebuilders first (I’ll be doing that soon), and then at Home Depot and Lowes. Only then would I be in a position where I could say that I understand the business.

Floor & Decor won’t be entering the Portfolio right now, but will be kept in my watchlist.

Have questions regarding Floor & Decor? Ask them here!

As always, I’d be very welcome if you could take the survey below. Thank you.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.