Gaia,

Q1 2019 - Results

May, 14 2019

1. CONTEXT

Gaia is one of those companies that is missing one single thing for me to become confident enough to buy it. The company is hailed by some as the next Netflix and while it has grown A LOT in recent years, last quarter Jirka the founder and CEO decided to slow things down to a 30% growth rate yoy and reach profitability earlier than expected. It’s amazing how these companies can have so much control over their financials.

That decision caught a lot of people by surprise and that’s why Mr. Market is still a bit suspicious about the company. At first Mr. Market was suspicious because it was growing a lot, now Mr. Market is suspicious because there was a deliberate decision to slow down growth.

Let me get into the zone by reading my first analysis and I’ll carry on afterwards.

2. RESULTS

And now I’ll read the press release and the conference call transcript.

Let’s look at the positives and negatives on this quarter and see where we end up at the end of this write-up.

3. POSITIVES

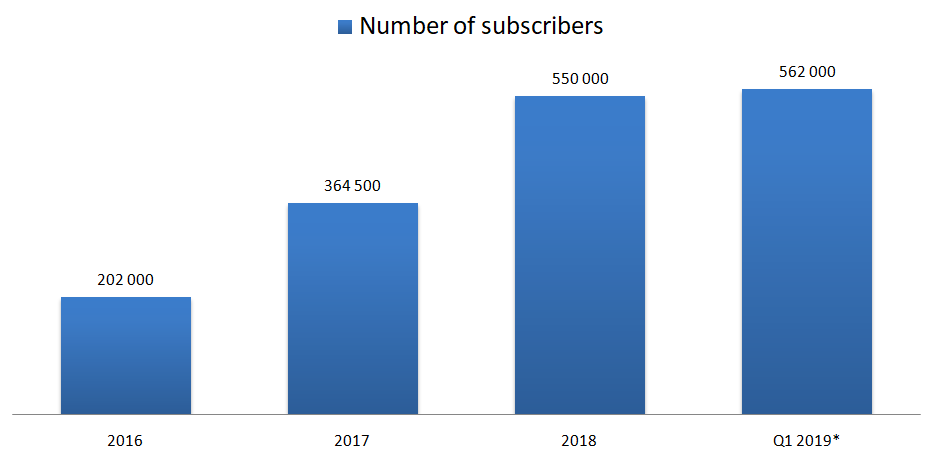

3.1. Number of subscribers was up

The first thing the company wants us to know once we’ve opened the press release is that the subscriber count is up 34% from last year.

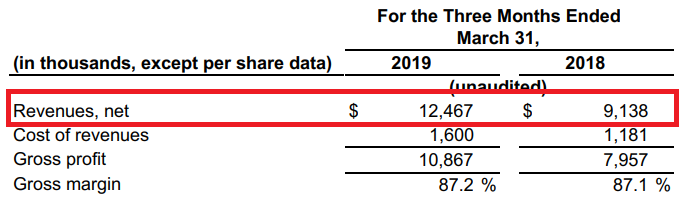

3.2. Revenue was up

And because the number of subscribers was up, so was the revenue. It rose 36% while it had been growing at 48% CAGR for the last 5 years and 55% in 2018.

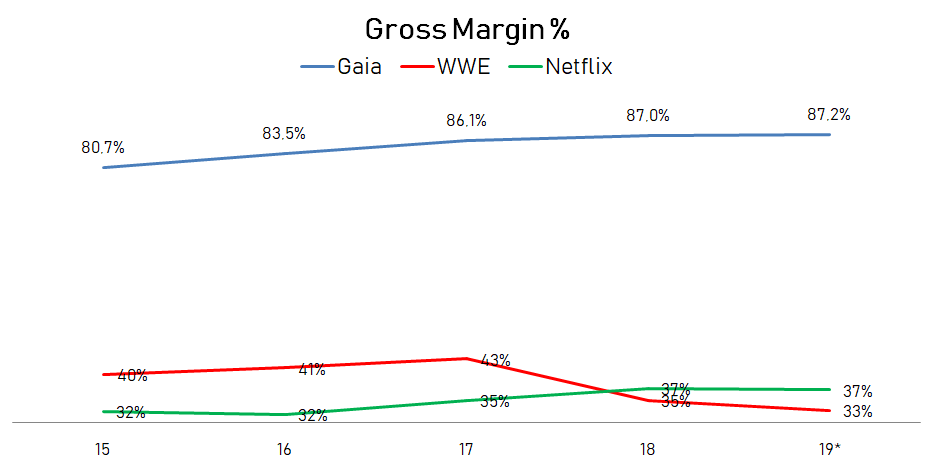

3.3. Gross margin was (slightly) up

At 87,2%, Gaia’s gross margin is impressive. Netflix’s gross margin is 37%!?!?! These guys can produce content at a fraction of their peers (if we can call them that).

3.4. CAC was down

The Customer-Acquisition-Cost as a percentage of revenue declined from 109% to 69%. As I’ve commented on the introduction, in the last quarter the company – Jirka – decided to slow down growth and turn EBITDA profitable by September 2019.

In parallel he also decided to bring up the ratio between the subscribers-lifetime-value and the cost to acquire that subscriber from 2:1 to 3:1 and is now targeting a 3,5:1 ratio for September as well.

3.5. Subscription price was up

The subscription price is one of the most important metrics for these content based subscription companies.

If the company can show that it has pricing power without turning up the churn, then we’ll know we’ve got a winner. For now, they’re raising the price to $11,99/month for new subscribers only. They will raise the price for everyone in 2020. I can’t wait to see what’s going to happen.

3.6. Gaia launches live events featuring world-renowned luminaries

Which is another way of saying that the freaks now have a church. I love this idea. I would L-O-V-E if Gaia ever turned itself into some kind of church. Those are amazing businesses.

Now on a more serious note, the company has set up a venue for 350 people on its Colorado campus to host live events with some of the best-selling authors in their community. This way Gaia can generate three different new revenue streams:

1. Tickets for the live events.

2. New premium subscriptions with access to the streaming of the live events. ($299/year).

3. Renting out the venue when the company isn’t using it.

I don’t think the new venue is already included on Google Maps but at least you can get a feeling for what their campus’s is like (just Google Gaia-Boulder-Colorado if you want to take a closer look at it).

3.6. Legacy DVD business was discontinued

Finally.

4. NEGATIVES

4.1. Slower growth

I would prefer if the management had stuck to its accelerated growth plans instead but to be honest I don’t see this one as a huge negative point.

Mr. Market is never happy when it comes to Gaia. On the one hand, if the company was still growing a lot, he would argue that it wouldn’t be generating profits. Now that the management team has decided to go with slower growth to reach profitability earlier, Mr. Market suspects something fishy is happening.

4.2. Management compensation

When we’re talking about microcaps, the management team is one of the most important things to keep an eye on. I don’t like to see that the compensation of the management team has doubled from what were already high salaries for a Microcap.

5. OVERVIEW & CONCLUSION

5.1. OVERVIEW

Although the management team is paying itself a fat check and has changed its growth strategy – slow growth reaching profitability earlier instead of fast growth reaching profitability later on – and although this was a bit of a shock to me at first, II’m not really worried about that.

I’m worried about the long term prospects for the company, more specifically about the competitors landscape. I’ve just recently seen a couple of ads on Facebook for a company in a similar niche fut unfortunately I didn’t keep the name. The ad said something about a big industry hot shot being behind it. I’ll try to track it down but I’m not worried with the small fish either…

I’m worried about the big boys (Netflix, Disney, Amazon, etc). They could squash Gaia in a heartbeat……….. but on the other hand, with so much competition coming into this space, buying Gaia would be a much quicker way to gain new subscribers and content….humm.

The thing is, I want to like this stock, I really do especially because its price has just fallen to $8,56 which marks a new year’s low, valuing the company at $153M. I’m not sure if I’ll ever buy Gaia but I will definitely keep following the company very closely. This is a great story and I’m dying to see how it ends.

5.2. CONCLUSION

This section will be available to paying subscribers in 2019 when we launch the Portfolios.

Don’t forget to check our other analyses.

If you want more, join us at our new:

6. DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.