Glacier Media

a media business turning around

By Manuel Maurício

January 07, 2022

Symbol: GVC (TSE)

Share Price: CAD$0,42

Market Cap: CAD$56 Million

Everyone knows that print newspapers are a dying industry. But beyond that, many media companies have been successful in shifting their businesses to online.

The first time that I came across this transition was through a deck by MineSafetyDisclosures.com about the The New York Times . The author spelled out why he believed that The New York Times was getting even better than before by going digital.

That stuck to my head. Recently I’ve read two different investors who I admire write about media businesses that are in the midst of a turn around. One of them was Lee Enterprises by Kuppy and the other one was Glacier Media by Clark Square Capital. I chose Glacier media for two reasons. First, it’s cheaper than when I found it. Second, insiders have been buying.

When investing in declining industries, investors must be pretty sure that they’re investing in great managers and capital allocators. The emotional strand created by the continuous inflow of bad news can take a toll on you.

You also want a business with little debt as the decreasing cash flow would be used to pay down debt and wouldn’t flow into your pockets.

Let’s check how Glacier Media stacks up.

“Charlie and I believe that papers delivering comprehensive and reliable information to tightly-bound communities and having a sensible Internet strategy will remain viable for a long time” – Warren Buffett.

Segments

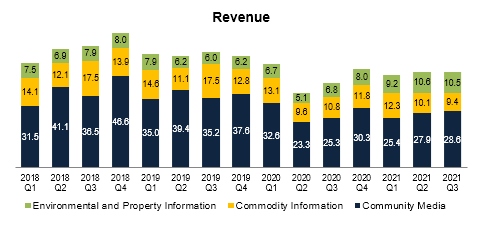

The company reports under 3 segments: Community Media; Commodity Information; and Environmental and Property Information.

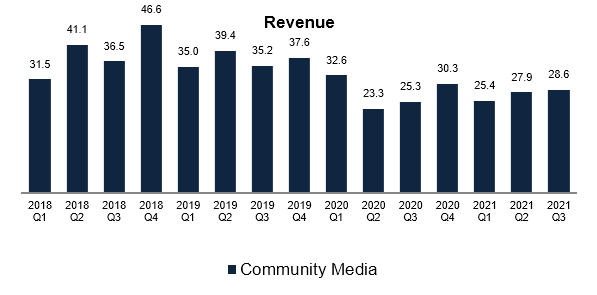

Community Media (58% of revenue) – The company owns several local newspapers (I count 70) as well as digital newspapers and online classifieds. Unlike national newspapers, local newspapers can still be good businesses as they’re often the only source of information people have about their cities and regions. The management will keep milking the print newspapers while re-investing those cashflows into the digital business.

Unfortunately the company doesn’t break down what revenue comes from print and digital media.

My fellow investor Clark Square Capital estimates print to be around $66M in 2021 and digital $52 million. I’ve tracked his math, and although there’s a fair amount of assumptions behind it, I believe that he shouldn’t be far off from the true breakdown.

That means that – as the digital media business is growing at 20% year-on-ear – Glacier Media is nearing the inflection point where digital becomes bigger than print. Digital also comes with much better margins so profitability might look much better soon.

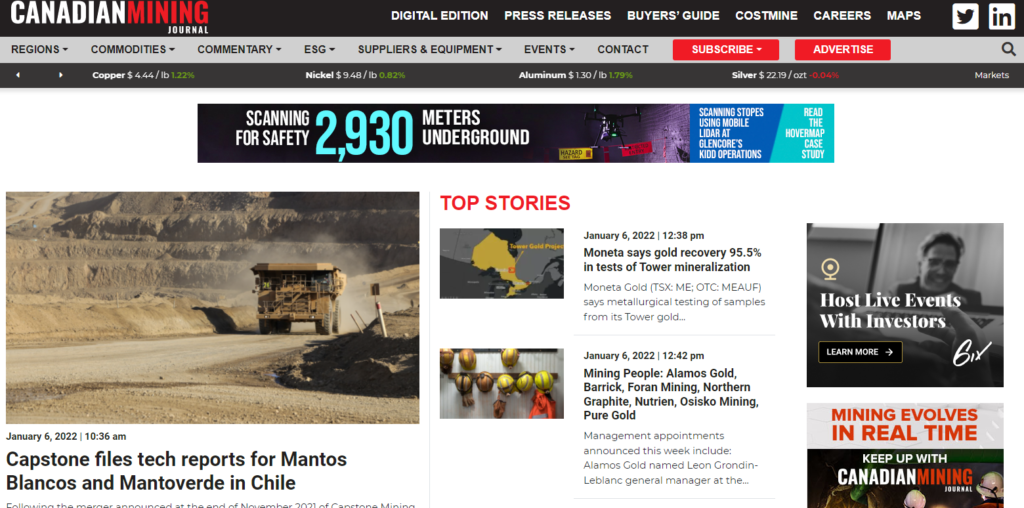

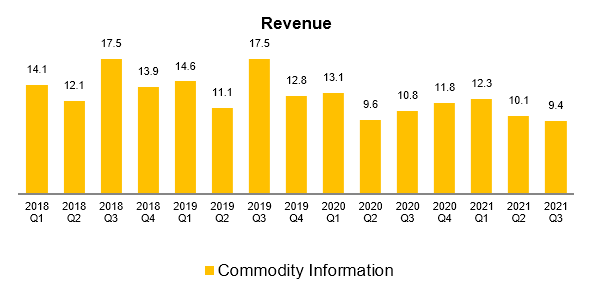

Commodity Information (22% of revenue) – The company operates a few publications for the farming and mining industry. Glacier also runs trade shows – I never thought of trade shows as a business, but I guess someone has to run them.

Commodity Information (22% of revenue) – The company operates a few publications for the farming and mining industry. Glacier also runs trade shows – I never thought of trade shows as a business, but I guess someone has to run them.

The commodity business seems to be the most volatile of the three due to its dependency on oil prices and foreign policy (trade wars).

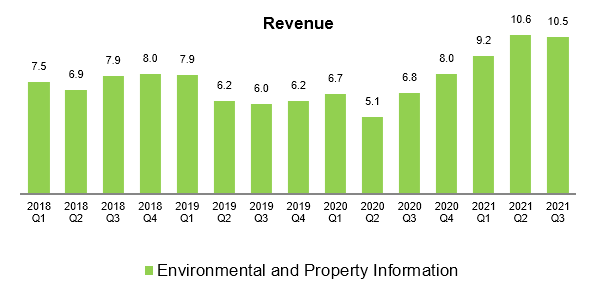

Environmental and Property Information (20% of revenue) – Under this segment the company “provides environmental risk data and related products for commercial real estate properties across North America. This information is used by environmental consultants, CRE brokers, financial institutions and insurance companies to identify and assess environmental risks around commercial real estate transactions.” It reminds me of when Buffett bought Sanborn Maps.

Also here the company doesn’t distinguish the Environmental Information from the Property Information businesses. This would be an important disclosure because Glacier owns and operates REW.ca , Canada’s largest real-estate marketplace (similar to Zillow in the US). These businesses can fetch really high valuations.

“The company is working to reach the point where increases in the revenue, profit and cash flow from its data, analytics and intelligence products and digital media products exceeds the decline of its print advertising related profit and cash flow.” – Glacier Media

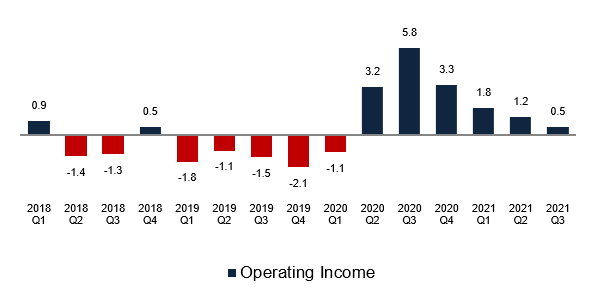

As with many turnaround stories the problem with analyzing Glacier Media starts when we try to gauge its profitability.

The business has been in constant restructuring as far back as I can tell so there’s new one-time restructuring costs every year.

Also, the margins of each segment have been hit both positively and negatively by COVID-19 and the related government stimuli. As if this wasn’t enough, the high amount of Joint Ventures, acquisitions, and divestitures makes this a game of guessing the true underlying economics of the business.

At this point, I can only guestimate the operating profit, but estimating the bottom line, the profits that will actually accrue to the shareholders, is still beyond me. And with so many Joint Ventures and minority interests that have a claim to that operating profit, looking at EBITDA or Operating Income seems to me like ignoring an important part of the equation.

Facebook and Google

But that doesn’t mean that we should stop here. Who knows if with a little more time and effort I won’t become comfortable estimating the profits and realize that this is indeed a great investment opportunity?

A recent and important change to the thesis comes from none other than the tech giants Google and Facebook. In an attempt to front run the Canadian regulation that is likely to impose some type of monetary compensation from the two tech giants for distributing news media, Google and Facebook have rushed to sign deals with a few Canadian media companies. Glacier Media is one of them.

There’s been some speculation about the amounts at stake here, but no concrete numbers have been posted. This could change a lot of things for investors in Glacier Media as the contracted amount should be pure profit.

Management buying

As I’ve mentioned at the beginning of this write-up, one of the baits that got me interested in Glacier Media was the fact that insiders have been buying shares recently. Obviously, one only buys shares when he or she believes that the share price will go up. So, if the individuals who are running the business are buying shares, one could guess that they’re seeing signs of an improving business.

After digging a bit deeper, I found that the management has bought shares of Glacier Media several times in the past 15 years at much higher prices and the stock price kept declining sooo…. this doesn’t reassure me that much.

One other point that could be seen as both positive and negative is the fact that Madison Venture Corp. owns a 53% stake in Glacier Media and the two companies share some of the officers (like the Chairman). Over the years there have been some transactions between the two companies, so there’s the risk of financial shenanigans, but from what I’ve been able to gather, this relationship with Madison has actually been beneficial to Glacier as Madison has been crucial in providing liquidity in times of distress.

There’s a very strong possibility that Madison makes an offer to acquire Glacier Media. That would be positive as Madison would have to pay up, but it would also cap the upside potential of this story.

Risks

- There’s a dispute with the Canadian Revenue Agency related to past years taxes. If the company loses the dispute, the liability will be $37 million. If the company wins the dispute, the gain will be $23 million. Remember that Glacier media is currently worth $56 million so the outcome of the dispute is massively important to the future value of the business. Although the management is confident on a positive outcome, I see it as a 50/50.

- This is a turnaround story. If digital media fails to gain traction, the company might not turn around.

Conclusion

Online newspapers and digital media businesses in general can be great businesses. They are capital light and revenues can be predictable (depending on the end customer). It’s important to note that Glacier Media also doesn’t have net debt on its balance sheet which is important in print newspaper businesses.

Having said that, I find it too hard to get the information needed to gain the conviction to buy and hold the stock.

The management doesn’t do Conference Calls and the little information provided on the filings is highly formatted so one must make a lot of assumptions that may or may not be accurate. To illustrate this, I’ve heard from a fellow investor that Glacier Media owns a very large amount of weather stations in Canada. Do you know how many times the company (briefly) mentions weather stations on their filings? Once or twice.

Although I believe that one of the ways to make money investing in stocks is to take small crumbs of information and be able to re-create the whole picture, there’s not enough for me to build conviction in Glacier Media right now.

I’ll keep following the company for a few more quarters. Going forward I’ll be watching the trend in revenue and margins for the community business (print and digital newspapers).

Glacier Media won’t be entering the Portfolio at this time.

Further research material

I would like to hear your anonymous opinion!

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.