Good Company

=

Good Stock?

Manuel Maurício

March 15, 2022

“Apple is a great business. I can’t go wrong if I buy it, can I?“

and…

“We’ll all be flying more in the future. I think I’m buying Boeing“

These are the types of comments that I hear from novice investors. They believe that well-known businesses mean safe stocks.

If it were that easy we would all be Warren Buffetts.

Lesson number 1: A stock isn’t safe (or good) just because the business is well-known.

Take Tesco for example. Tesco is the leading supermarket chain in the United Kingdom. Everyone there knows it and you’ll see it in every city across the country.

But does that mean that it’s a good stock to invest in?

Of course not. Investors in Tesco have hardly broke even in the past 20 years.

By fostering the idea that a well-known business is automatically a good investment, investors are ignoring the two fundamental concepts of sound investing – Business Fundamentals and Valuation.

Lesson number 2: Even a great business at the wrong price will make you lose your money.

Likewise, a bad business at the right price can become a great investment.

Until you get this, investing in stocks will always feel like a casino to you.

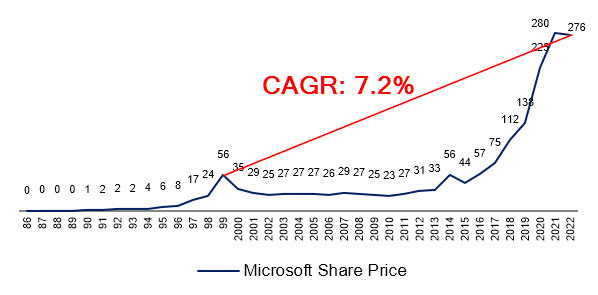

In the 90’s, Microsoft was regarded as one of the best, if not the best, businesses in the world.

But investors in Microsoft had failed to remember that even a great business can become a lousy investment if you overpay.

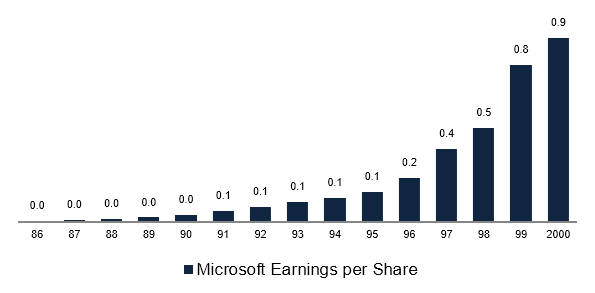

The following chart shows the rising Earnings-Per-Share of Microsoft in the years leading up to 2000.

Amazing business, right?

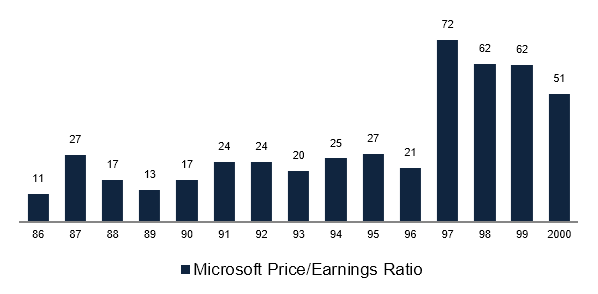

Most investors shared that opinion. So much so that they piled in and threw the valuation up to a mind-blowing Price-to-Earnings ratio of 72 in 1997.

At such valuation you’ve got to be very right about the earnings trajectory.

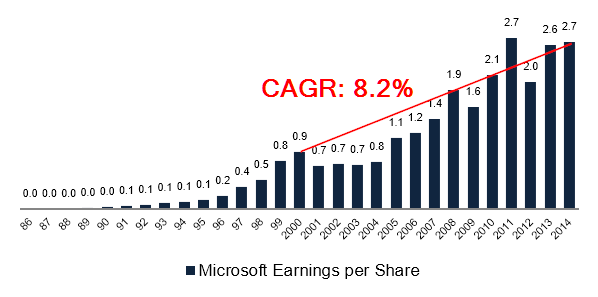

But the most interesting thing is that investors were right about the business trajectory. Excluding the immediate years after the dotcom bubble, Microsoft’s Earnings-Per-Share grew at an 8.2% compounded annual rate over the next 14 years.

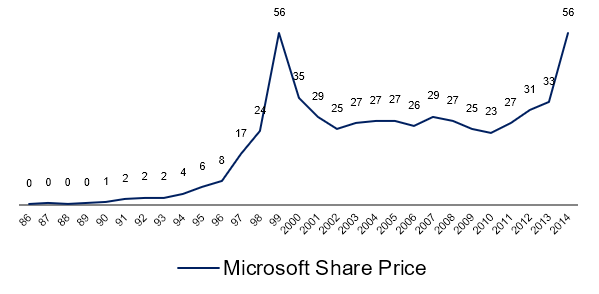

The problem was that they had overpaid for Microsoft in the late 90’s. And the price of that cheery consensus was 14 years of 0% returns (that’s zero percent).

Yes, if you were to keep your Microsoft stocks until the present day you would have gotten a 7.2% compounded annual return on your investment plus dividends. Fair point.

But how likely were you to hold on to a losing stock for 14 excruciating years?

Not likely, right?

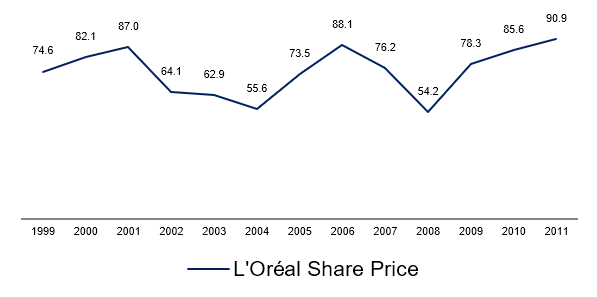

And yes, you might’ve listened to Terry Smith saying that you could’ve paid a PE of 200x for L’Oréal and still be getting a better return than the SP500 for the past I-don’t-know-how-many-years.

That is true, but between 2000 and 2011 L’Oréal’s stock price went nowhere.

Do you know why? Because in 2000 investors were willing to pay up to 61 times earnings for the stock, whereas in 2011 they were just willing to pay 21x earnings. The result were 11 years of lackluster performance.

In these two examples I’ve focused on great businesses. But there were many other well-known businesses that weren’t safe at all. Remember Kodak or Enron?

So, the next time you think that a stock is safe just because the business is big or well-known, you need to stop, do your research, and think about the stock’s valuation. Otherwise, you can be left holding a safe stock for years without seeing any return. Or worse yet, you’ll probably be selling it at a loss.

If you liked this article and want to stay in touch, do fill out the form below.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.