Goodyear,

Q1 2019 - Results

May, 09 2019

1. CONTEXT

If there is something an investor must be aware of is the fact that a company can present its numbers in any way it wants and usually the chosen way is the one that favours the good things, not the bad ones.

When you first open Goodyear’s Q1 Press Release, the first thing the company states is “First quarter revenue per tire up 4%, excluding foreign exchange”. If you then go to the financial statements you will see that the revenue for the quarter was -6%. We’ll get to that in a minute. Let me give a quick look at my first write-up.

Ok, it’s done: Cyclical company with no pricing power, no differentiating product and no access to cheaper raw materials. Let’s go on.

2. RESULTS

One doubt that I had when I started learning about investing was “which document should I read?” It doesn’t really matter as long as you know how to separate the wheat from the chaff.

I always start by reading the numbers (the three financial statements) and then I’ll read the text (press release) and whenever I need to find more granular information, I’ll read the full report (10Q).

First Quarter Results – 2019 – Press Release

First Quarter Results – 2019 – Results

First Quarter Results – 2019 – 10 Q

3. POSITIVES

3.1. Revenue per tire went up

I’m going to take their lead and use this as the first positive point.

Humm, wait! Didn’t they say that the Average revenue per tire went up by 4% on the press release? This is a great example of how companies choose to highlight the information that is most convenient for them. They did say “excluding foreign exchange”.

4. NEGATIVES

4.1. Revenue went down

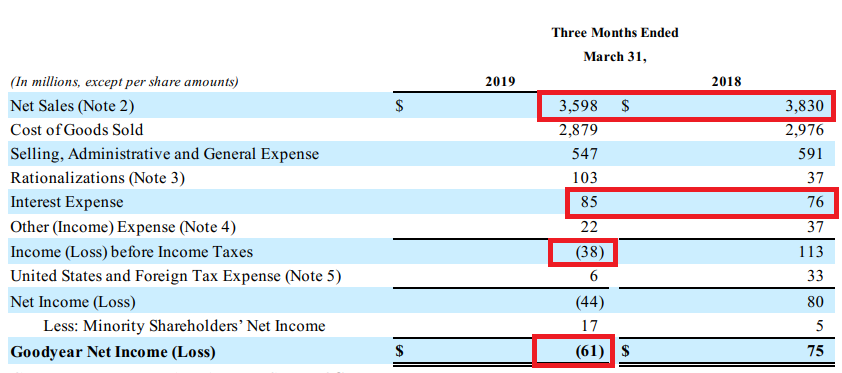

I’ll just post one image and write about it.

Revenue went down by 6%. I would say that people buy more tires in the spring/summer time so although I’ve said on my first analysis that there is no meaningful seasonality, I’m correcting that now.

4.2. Operating income went down

Due to the rising costs of raw materials, the foreign exchange rate and the lower revenue, the operating income went down by -32%…

4.5. Net income was negative

…and if that wasn’t enough, the company reported a -$93M charge related to the restructuring of two of its factories in Germany, leading to a negative -$61M net income.

4.6. Cash flow was negative

Well, but maybe the cash flow was positive….

Nop. Not even the cash flows from operating activities were positive.

4.7. Tire units volume went down

OEM’s unit volume went down by 7% representing weaker US sales and lower automotive production in India and China. Replacement tires were down by 1%, so in total, Tire Units sold went down by 2,6%.

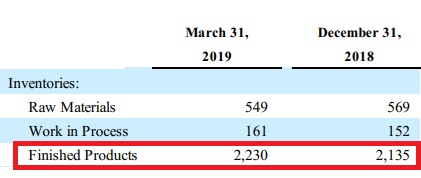

4.8. Tire units on inventory went up

…and because the company can’t sell the tires it manufactures, the inventory starts to pile up. I might be wrong but I would say we’re going to see price markdowns on the next quarters.

4.9. Debt went up

Top it all up, debt went up by 13% making the debt/equity ratio reach 1,35.

5. OVERVIEW & CONCLUSION

5.1. OVERVIEW

I can’t find one positive thing in Goodyear’s first quarter statements.

What we’ve got here is a company highly dependent on the economy, whose products aren’t any different from those of its competitors, a company with a long time trend of declining revenues, a company with significantly higher costs than its competitors due to higher labor costs and US laws (regarding chemicals, emissions, waste disposal, etc), and if that wasn’t enough, a company with increasing amounts of debt.

On my first write-up I’ve stated that I would consider buying Goodyear’s stock when the company presented net losses and although that time has come, I don’t want to buy it. I simply don’t see how this company can improve in the future.

5.2. CONCLUSION

This section will be available to paying subscribers in 2019 when we launch the Portfolios.

Don’t forget to check our other analyses.

If you want more, join us at our new:

6. DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.