HireQuest

firing on all cylinders

By Manuel Maurício

May 13, 2022

HireQuest is firing on all cylinders.

*You can find my previous write-ups on HireQuest here.

Financials

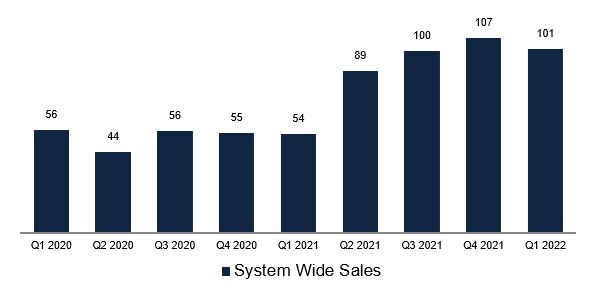

System-Wide-Sales have gone up 87% from a year ago while organic sales (without the effect of acquisitions) have gone up 35%.

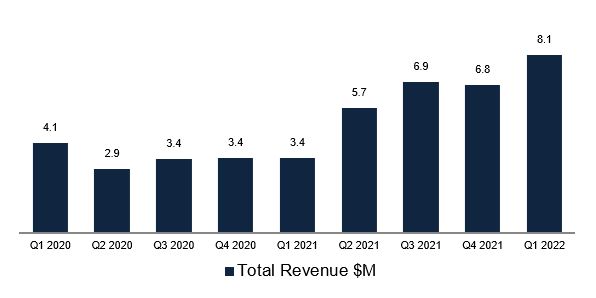

This has led the total revenue to go up by 138% while the organic revenue was up 30%.

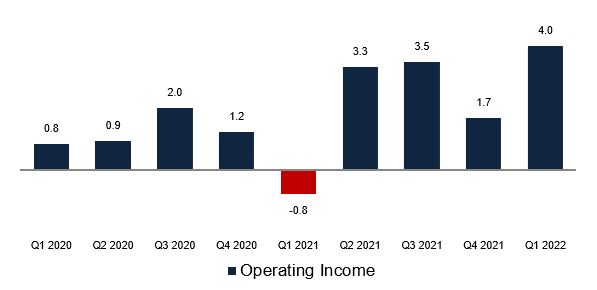

The Operating Income reach a record $4 million.

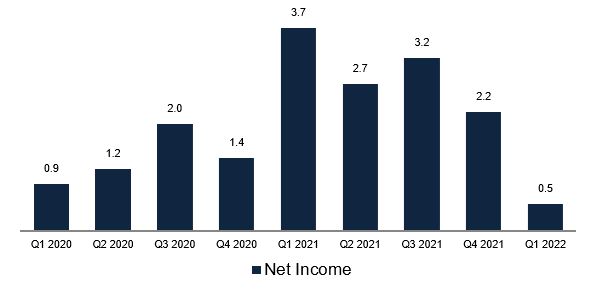

Unfortunately, that hasn’t flowed through to the net income due to a loss of $3.6 million resulting from the conversion of the acquisitions to franchises. I thought that they were selling the branches for, at least, the same price as they’ve been purchasing them.

I’ve asked the management about this and I’m waiting for a reply.

Acquisitions

The management has been busy acquiring competitors. In the first quarter alone they bought Temporary Alternatives for $5,25 million, Dubin Group for $2.4 million, and Northbound Executive for $11 million. The company still has $19.2 million available under the credit facility to make more acquisitions.

Having said this, they’ve been trying to sell the Dubin Group (as is their usual strategy) but there’s no buyer. Rick says that it’s because this was a bigger acquisition and there could be a buyer tomorrow. I’m not sure if I buy this argument given that they’ve re-franchised much larger chains before with no issues. This is a risk. As the company gets bigger and makes bigger acquisitions, the fewer buyers there are?

I’ve asked the management about it and I’ll get back to you when I hear from them.

Conclusion

As mentioned on my previous write-up, I expect to be owning HireQuest’s shares for many years.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.