JnJ,

Q1 2019 - Results

1. PREVIOUS ANALYSES

I’ll start by reading my previous analysis so I can get in the “zone”…

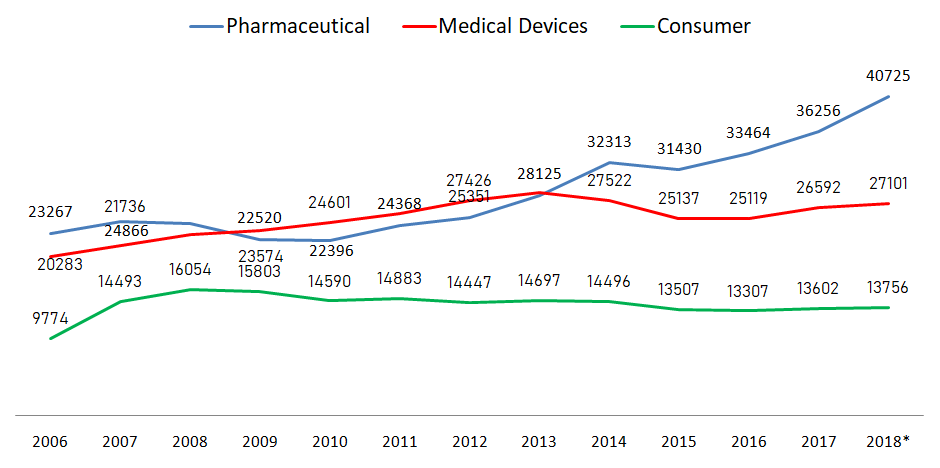

Ok, it’s done. I’ve used the average growth rate for the last five years to make some estimates about the future earnings of each segment. The pharma business has grown at 7,5% yoy; the Medical Devices segment has grown at 1,6% yoy and the consumer business has lagged behind with negative growth.

Let’s see how things are evolving…

2. RESULTS

3. ANALYSIS

3.1. Revenue

Revenue has stayed flat at $20B. I think that if the company had wanted to keep this number flat on purpose, it wouldn’t be able to do it with such accuracy.

3.2. Net Income

Net income under GAAP measures has declined by 14%…

But the company doesn’t like GAAP measures so it provides us with its own adjustements.

If we take the adjusted net earnings, we can see that they were flat from 2018 first quarter.

Let’s now take a look at the three different segments.

3.3. Pharmaceutical

The “Pharmaceutical” segment, JnJ strongest segment, as grown by 4,1%. If we don’t take the foreign currency translation into account, this segment would’ve grown 7,9%. (5 year average growth is 7,5% so this is in line)

3.2. Medical Devices

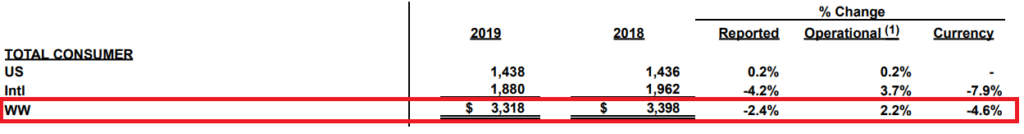

The “Medical Devices” segment revenue has decreased by 4,6% mostly due to the foreign currency translation. If we don’t take the foreign currency effects into account, this segment would’ve decreased by -1%. (5 year average growth is 1,6% so this one is lagging behind)

3.3. Consumer

The “Consumer” segment revenue was down by -2,4%, again due to the foreign currency translation. If it wasn’t for that, this segment would’ve grown 2,2%. (5 year average growth is less than 0% so this one is a bit better than I would expect)

5.1. OVERVIEW & CONCLUSION

5. OVERVIEW

Johnson & Johnson still is one of the best companies out there but due to its size and predictability, it is hard to find any market inefficiencies here. At a PE of around 25 (GAAP) or 17 (non GAAP), this company isn’t exactly cheap.

As always, I’ll be following it from a far and I will read the quarterly results as they come out but I don’t think I’ll be writing about it again until the 2019 full year results are announced.

5.2. CONCLUSION

This section will be available to paying subscribers in 2019 when we launch the Portfolios.

Don’t forget to check our other analyses.

If you want more, join us at our new:

6. DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.