LendingTree,

a fundamental analysis!

July 26, 2019

TICKER: TREE

ISIN: US52603B1070

SHARE PRICE: $346,7

MARKET CAP: $5,2B

July 26, 2019

TICKER: TREE

ISIN: US52603B1070

SHARE PRICE: $346,7

MARKET CAP: $5,2B

1. INTRODUCTION

There is this new company in Euronext Lisbon called Raize which I think has as similar business model to LendingTree. As I want to have a good understanding of the industry before I dive into Raize, I’ve decided to look at LendingTree first and then I’ll go on and look at some others.

First things first. Let’s visit the company’s website.

Well, I can only access the corporate website, not the regular one. Is it possible that the company has it blocked to people outside of the US?!?

2. BUSINESS OVERVIEW

2.1. BUSINESS DESCRIPTION

LendingTree is America’s leading online marketplace for financial services. Basically, through its different online platforms, it connects people or companies who need cash (borrowers) with institutions that are willing to lend them money in exchange for a pre-set interest rate (lenders). For doing this, the company typically receives an upfront fee even if the loan doesn’t come through in the end.

LendingTree doesn’t lend money nor does it go through the applications in depth. After a quick check, it matches the applicant with up to five different lenders who will then compete to get the client. They will make their own research on the client and decide whether or not to lend the money.

This is a major difference from Raize’s business model which is (still) a peer-to-peer lending platform who goes through the applications in-depth and actually approves the loans that will later be met by several individual investors, not institutions.

LendingTree is a roll-up, which means it grows by acquisition of smaller players. This way it has been able to grow its services which now include “mortgage loans, mortgage refinances, auto loans, personal loans, business loans, student refinances, credit cards and more”.

The company unifies all of its businesses in one platform called “My LendingTree”. So here is another big difference to Raize. While LendingTree has a lot of different “verticals” or business lines, Raize is currently only working with small and medium business (SMB) loans.

The image below explains rather well LendingTree’s business model:

2.2. LARGEST SHAREHOLDERS

I was surprised to see that Liberty, John Malone’s company is the largest shareholder in LendingTree. For those who are not acquainted with John Malone, I highly recommend the reading of “The Outsiders” or “Cable Cowboy“. There you will find that John Malone is one of the greatest living CEO’s and capital allocators.

Lebda, the founder is the second largest investor with a 13.3% stake.

2.3. MANAGEMENT TEAM

And he is also the CEO. So far, so good.

3. HISTORICAL CONTEXT

3.1. LONG TERM CHART

The stock price is now $346. This is equivalent to say that an investor who had held his stock since the IPO, in 2008, until today, would’ve benefited from a 40% CAGR. Not bad ein?

3.2. MARKET CAP AND SHARES OUTSTANDING

Over all these years, the number of shares outstanding has grown a bit (up 4% yoy) and the marketcap – like the share price – has been on the rise.

The company is now worth $5,2B.

3.3. SALES - OPERATING INCOME - OPERATING MARGIN

LendingTree has been able to grow its sales at a CAGR of more than 40% for the past eight years, having reached $765M in 2018. Unfortunately, the operating margin trajectory hasn’t been so clear having reached the 7% mark in 2018.

The largest expense LendingTree has is “Selling and marketing” so this is the number we should be looking at in the future.

3.4. SALES BY GEOGRAPHY

LendingTree operates in the US only.

3.5. SALES BY SEGMENT

The company reports its revenues in two segments: Mortgage and non-Mortgage.

Sales from the non-mortgage segment have been rising hard to double the amount of the mortgage sales in 2018. This is mostly due to the company’s acquisitions of several other complementary businesses.

3.6. NET INCOME

Like the operating income, the net income has also been highly erratic throughout the years. In 2018 it was 13% and analysts expect it to be $62M in 2019. I’m not sure how that is possible given the fact that the company has just released its H1 results and the net income was $13,5M.

3.7. CASH FLOWS

On the other hand, the FCF tells us another story. The company has been generating good amounts of cash and the CAPEX is very low compared to the cash from operations.

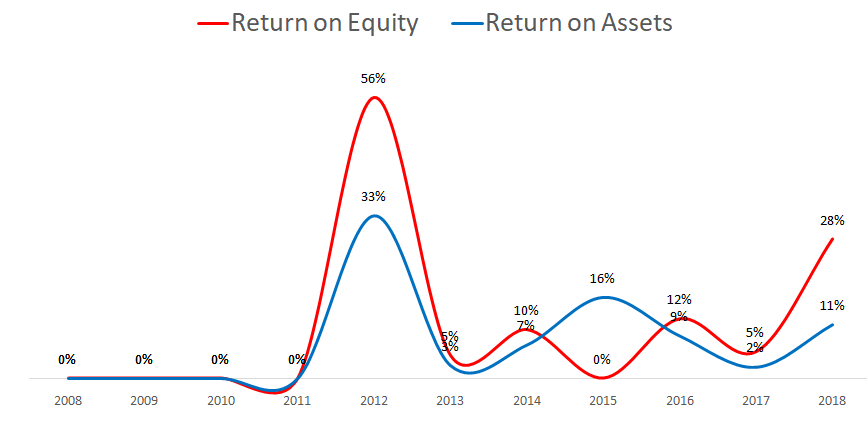

3.8. PROFITABILITY RATIOS

Because the profitability ratios are derived from the net income, they too have been quite erratic along the years. In 2018 the ROE was 28% and the ROA was 11%. Both were at good levels but the question is if they can go on like this or if we’ll be seeing a decrease as in past years.

3.9. BALANCE SHEET

Regarding the balance sheet, the current ratio has been declining in past years and is now 0.7, indicating low liquidity.

And the debt-to-equity ratio is 1. Not good but not alarming either.

Now is the time when I usually look at the Net Debt/EBITDA ratio but I’m becoming more suspicious of EBITDA as a proxy to cash flow. Because each company makes so many adjustments to the EBITDA, I’m trying out a new metric: Net Debt/Cash from Operations.

From this point of view, the debt level – at 2,2 – together with the low CAPEX requirements, is manageable.

I’ll give it a thought if I should go on with this ratio and what are its implications.

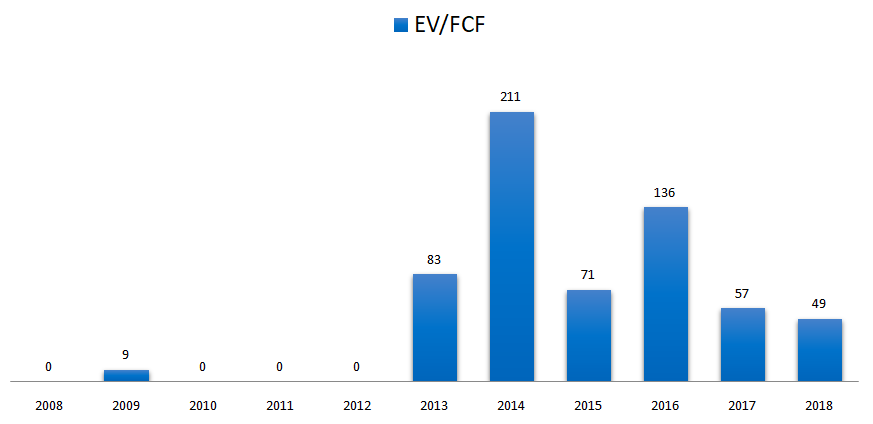

3.10. PRICE RATIOS

Although the share price and the market cap have been rising for many years, the sales multiple has actually been decreasing which means the sales figure as been rising fast.

At a valuation of EV/Sales of 6,7 and an EV/FCF of 50, investors are expecting that LendingTree will become the Amazon of credit. Looking at it through traditional metrics, we can safely say that this company is way overvalued.

4. GAINING PERSPECTIVE

4.1. INDUSTRY AND STRATEGY

This is a very interesting industry and one that is only taking its first steps. These are asset light companies with no need for stores across the country so they are highly scalable. Traditional banks and financial companies aren’t exactly known for their ability to quickly adapt to changes and are relying more and more on these kinds of business to bring them clients.

One might think at first that there are no barriers to entry and I would agree. There might be some regulatory barriers but I don’t think they are high enough to block newcomers into the industry. Having said that, there are some competitive advantages to being the first or the largest. Given that LendingTree is the largest company, it can outspend its competitors when it comes to marketing and advertising (very important), and it can also grow by acquisition of smaller competitors, just like it has been doing for years.

Over the years the company has relied on its mortgage business to bring in the most dollars but management was quick to realize that this business will be highly impacted by rising interest rates. That is why they’ve decided to spread their “verticals”, the insurance business being one of the most important of all because it’s a much more stable business. That’s why they’ve recently bought QuoteWizard, one of the largest insurance comparison marketplaces in the U.S..

4.2. SEASONALITY

Depending on the segment we are looking at, there are different types of seasonality to LendingTree’s revenue. The mortgage business, for instance, is obviously directly linked to the housing market. Interest rates also have a significant say.

4.3. TYPE OF PLAY

LendingTree is a growth play.

4.4. RISKS AND COMPETITION

There is a lot of competition given that there are no real barriers to entry. There might be barriers to success but anyone can create a marketplace for selling insurance or credit cards.

The biggest risks I see here are:

High dependency on external factors (economy, interest rates, etc) and cyclicality, although the company is already taking steps to diminish them (with the insurance business for instance).

The possibility of regulatory changes.

The possibility of a larger fish coming into play (Google for instance).

Given the aggressive acquisition strategy, there is always the risk of a failed acquisition.

Concentration of Network Partners (lenders).

5. OVERVIEW AND CONCLUSION

5.1. OVERVIEW

Overall, LendingTree is a great business and I can see it growing to be much larger than it is today. In fact, I can see this company growing and growing gobbling up the smaller players that cross its way. The valuation? Too high for me. I won’t even try to estimate its future earnings or price this time. This analysis served just as an introduction to the industry and as I said in the beginning, my true reason here is to figure out if Raize can become a multi-bagger or not.

Do you agree with me? If you’d like to discuss this and other stocks with us, join our community:

5.2. CONCLUSION

This section will be available to paying subscribers in 2019 when we launch the Portfolios.

Don’t forget to check our other analyses.

6. DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.