Mama Mancini's

Q2 update

Mama Mancini's

Q2 update

By Manuel Maurício

September 15, 2022

Mama Mancini’s results came out yesterday and they didn’t surprise me. If you’re new to Mama Mancini’s, check out my previous posts.

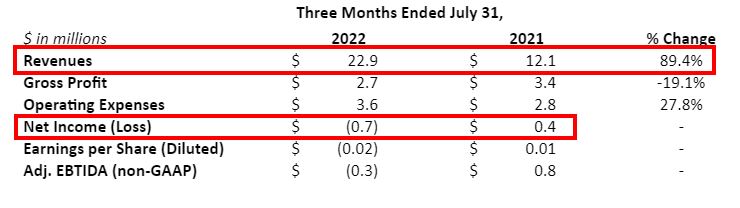

Revenue went up 89% driven by the recent acquisitions of T&L Creative Salads and Olive Branch.

Gross margin went down from 28% to 12%. The margin compression was driven by inflation of raw materials, packaging, and freight costs as well as lower margins in the newly acquired businesses.

The management mentioned that they are seeing the price of chicken go down which helps the margins as they’re not lowering their prices as much as the underlying raw materials. This squares with what Carl had told me a few months ago. Let’s see if it’s enough for the company to return to profitability in the coming quarters.

In other news, the company now has a new CEO and a new CFO. I’ve asked Carl (the previous CEO) to introduce me to them and he told me that he felt it was a little too early as they are still getting accustomed to their jobs. I agree with him.

With a new management team comes a new motto: Mama Mancini’s wants to become the “one stop shop for best-in-class deli(catessen) solutions“.

I still don’t have an opinion on the new management team. The CEO comes from the giant Mondelez and the CFO had been in Richemont and more recently in De’Longhi. They seem to be experienced, but they aren’t as incentivized as Carl was (because he owns the majority of the company). I’ll be giving them the benefit of the doubt for a few quarters as Carl is still the Chairman.

But they’ve been shaking up things already. They have created additional space in the packaging room for dedicated production of Meatballs in a Cup and Meals for One and they have been introducing a new system of updating the costs of raw-materials almost instantaneously so that every single sale meets their required margin profile.

A note on funding

The company recently raised $1.18 million through a private placement of Convertible Preferred Stock. Although they mention that the proceeds will be used for working capital, I believe they will be used to retire debt.

Conclusion

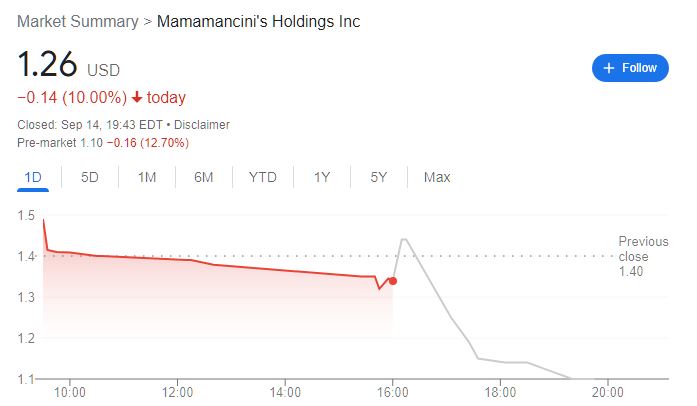

There’s no big news this quarter. It’s a matter of waiting for the business to keep growing, the input costs to start lowering, and we should see the company go back to profitability. It’s interesting to note that there was no analyst on the conference call (which I like) and Mr. Market really didn’t like the results.

The stock was down 10% yesterday and is down a further 12% pre-market. This would be a very good opportunity to add to my position if I hadn’t already invested 10% of the initial funds in the Portfolio.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.