McDonald's,

Q1 2019 - Results

May, 07 2019

1. CONTEXT

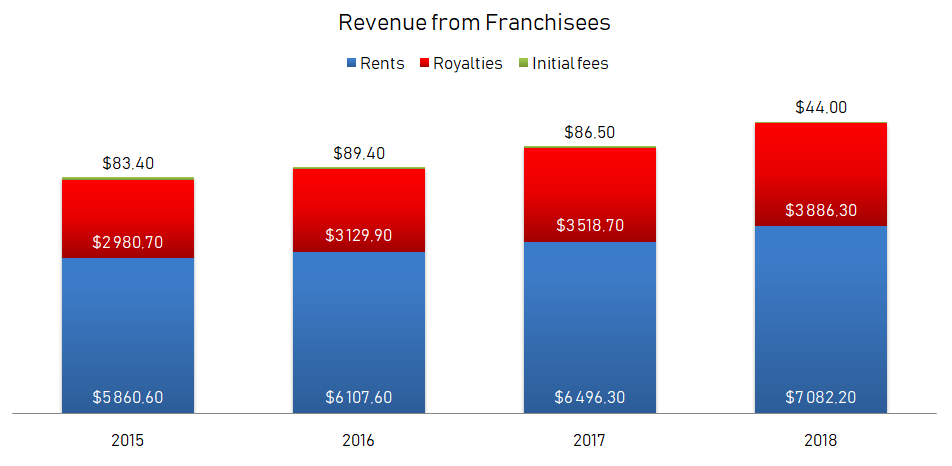

I remember enjoying getting to know the intricacies of the McDonald’s business. I remember the peculiar fact that McDonald’s is probably the largest real estate company in the world earning most of its money from the rents the franchisees pay the company.

Nice, hã? Here is my first analysis in case you’ve missed it.

2. RESULTS

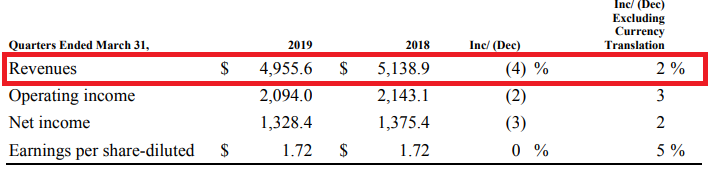

And here are the Q1 results:

There are a lot of points that can be seen both as positive and negative depending on how you look at them. I’ve decided to count most of them as positive given the negative impact of the currency exchange.

3. POSITIVES

3.1. Revenue was up and down

What I mean by “up and down” is that revenue was down by -4% from a year ago but if we look at it on a constant currency basis, it was up 2% .

3.2. Operating income was up and down

Again, both the operating income and net income were down from a year ago but if we exclude the foreign currency translation, both of them went up by 3% and 2% respectively.

Although the net income was down 3%, the EPS remained flat due to the continued repurchase of shares.

3.3. System wide sales are up

Again, on a constant currency basis, the system sales were up by 6%, which is amazing for a company as large as McDonald’s.

3.4. Comparable sales are up

Global comparable sales, one of the most followed metrics in the retail business, was up by 5,4%. This means that, although total sales are decreasing due to the closure of company-owned restaurants, the company has been able to attract more customers or raise the prices of its products.

3.5. Tech acquisition

The management team is also investing heavily on modernizing its restaurants and a proof of that is the recent acquisition of Dynamic Yield, a company dedicated to bringing the power of AI to the retailing business by predicting what type of food the clients prefer at a given time of the day or even recognizing a customer when he or she walks to the self-order kiosks.

The company has said that although they are buying the company, they won’t be their sole client. Dynamic Yield will be working with other companies as well.

4. NEGATIVES

4.1. Revenue and income was down

As I’ve said on the beginning of this write-up, although I’ve counted them as positives, both the total revenue and the operating and net income could be counted as negatives.

4.2. Debt was up

And while we wait for the 10Q to come out, the company tells us that the debt was up this quarter and a proof of that is a 16% increase in the interest expense.

I would like to see the company paying down debt, not raising it especially because we’re talking about a mature company in a challenging industry.

5. OVERVIEW & CONCLUSION

5.1. OVERVIEW

As most of the companies I’ve been analysing since the Q1 results came out, there isn’t much change here from my first analysis.

Mcdonald’s is a mature company on a very challenging industry which has been seeing profound transformations. A recent example of that was the discontinuing of the signature burgers due to a slowing down of the restaurant operations caused by these “fancy burgers”.

The management has been executing their plan efficiently by refranchising most of the stores leading to a more asset-light high-margin business, by modernizing the restaurants and by not being afraid of experimenting with new menus but the retail food industry is undergoing major transformations, be it because the young generations prefer other types of food or because the delivery apps have democratized the access to food delivery which was once only at the reach of the big chains or be it because we can buy good food in a lot of places these days.

Having said that, all of this could be counterweighted by a really low price but unfortunately that’s not the case here. At a forward 2019 PE of 25, I don’t find any market inefficiency that I could exploit in order to get a good return on my investment.

In the meantime, I’ll keep following McDonald’s. Who knows, I might one day get it cheap.

5.2. CONCLUSION

This section will be available to paying subscribers in 2019 when we launch the Portfolios.

Don’t forget to check our other analyses.

If you want more, join us at our new:

6. DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.