Medley

#4

By Manuel Maurício

August 21, 2020

Introduction

After coming back from holidays, I’ve taken some time to update my notes on some of the companies that I had previously profiled. I’ve picked 3 companies to write about: One Hospitality Group because my friends over at Horos Asset Management have added them to their International fund; Redishred because I like it and it seems cheap; and Pax Global, because, well because it’s still very cheap.

One Group Hospitality

(STKS: US$2,05 )

I liked STKS from the minute I found it, but due to my “feeling” that we were at the top of the economic cycle, I felt it wasn’t the best time to invest in it. (I claim no foresight into the pandemic or the economy).

Recently, my fellow investors over at Horos Asset Management have built a stake on the company. I hold them in high regard so I decided to take a fresh look at it.

In case you don’t remember or haven’t read my original write-up, STKS is a restaurant chain that focuses on high energy dining. They call it VIBE dining. It’s like going out to party on a restaurant. I love the concept.

At the time of my first write-up STKS was pursuing an asset-light franchise model when suddenly it bought Kona Grill, a sushi restaurant chain that was going through bankruptcy reorganization. I didn’t really like this acquisition because Kona Grill’s restaurants are usually located in suburban areas, which doesn’t really rhyme with VIBE dining, but I’m slowly thinking that I might not be seeing the whole picture.

Recent developments:

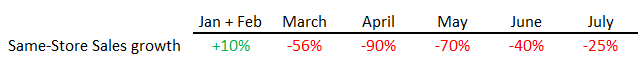

The start of the year was going really well, with Same-Store-Sales (SSS) growing 10% (which is amazing), until the virus struck and, as many other restaurant businesses, STKS was forced to close down its restaurants, furlough its employees, reduce costs, yada yada yada…

In order to offset the loss of clients coming in the door, the company had to improvise and find ways to make money in any way it could, be it by online ordering or take-away.

At the end of the first quarter, the SSS were down by -14% (!). Here’s the evolution of the SSS so far.

It seems that after the trough in April, things are gradually getting better, right?

Conclusion:

After going through the most recent financials, my opinion of the business hasn’t changed much (apart from getting a better understanding about the Kona Grill brand). Manny Hilario has been doing a great job and now, more than ever, that counts.

On his latest conference call he mentioned something that stuck with me. He mentioned competitors are opening their restaurantsand doing the exact same thing they were doing before, or worst, waiting for things to go back to normal, “not getting into the game”. But things have changed. And Manny has been able to adapt quite fast, be it by building tents, betting on the online marketing, setting up patio parties, you name it. I like his nimbleness.

When I first looked at STKS, I was worried about an economic slowdown. Well, here it is. Now, one could argue that the share price is low and if the company gets back on its tracks until the end of the year and keeps delivering the good results it was delivering prior to the pandemic, there is a lot of upside. I agree.

What I don’t know for sure is if there won’t be new shelter-in-place measures in the USA. As far as I can tell, there’s a lot of people out in the streets again, businesses are opening up and we’re slowly getting back to a new normality. But this is the first time we go through a pandemic and there’s no playbook.

The way I see it, the most likely scenario for the next few months/quarters is that some regions of the globe will open up, then due to focalized resurgence of infected people, some regions will close again and then open again and then others will close, and so on and so on. Add to this the fact that there is also a strong possibility that we’ll be going into one of the worst recessions/depressions/whatever-you-want-to-call-it of our lives.

If all of this might seem gloomy to you, it’s because it is. But there is also the probability that the world is getting back to normal quite soon and everyone will be partying by the end of the year at STKS’ restaurants. Given the unpredictability here, I’ll be fine watching from the sidelines.

Redishred

(KUT: CAD$0.53)

I’ve got to be honest. After getting back from holidays, I took my time to get up to speed on several companies and at some point I decided that it was a good time to revisit Redishred. I started by updating the Excel file I keep on the company. I keep a very detailed Excel file for almost all the companies that I like and some of these files aren’t exactly what you would call well organized.

To make a long story short, I’ve spent 2 days updating and organizing it, reading the latest conference call transcripts, reading some new articles from fellow investors until I realized that the second quarter results should be out soon. I sent an email to the CEO and after about half an hour he replied with an invitation to join the earnings call on the coming wednesday.

Given my lapse, I’m not going to update each and every metric (as I had planned) and I’m just going to make a quick recap of the most important metrics and next week I’ll come back to it again if needed.

I like Redishred’s story. I first looked at it back in 2019 when it was trading for CAD$0,94 and then again at CAD$0,9. It’s now trading for $0,53.

And for those of you who don’t fully appreciate the power of well executed boring businesses, here’s the chart for Boyd Group, a car repair-shop consolidator.

I’ve shown you Boyd Group, but I could’ve shown you the chart for Envirostar or Waste Management, all industry consolidators.

The company has faced two major headwinds recently: The COVID-19 and the depressed paper prices (remember, the company sells the paper after shredding it). I believe both of these headwinds are only temporary.

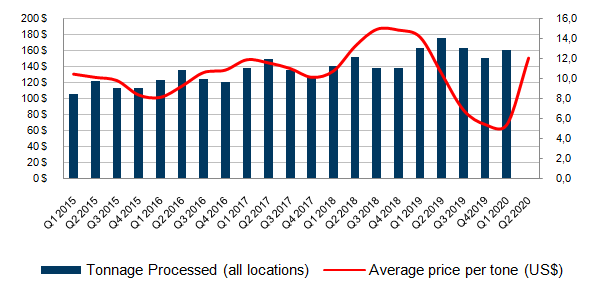

The paper prices are cyclical in nature so sooner or later they would have to go up again. After reaching a 10 years low at $67 per ton, the Sorted-Office-Paper price has surged to $170 and it’s now around $150. The 10 year average price is $135 and although the CEO is quite clear in saying that he doesn’t have a clue as to where the paper prices will go next, he believes that a “normal” price would be in between $100 and $150.

SOP price and Tonnage processed

Source: Company filings

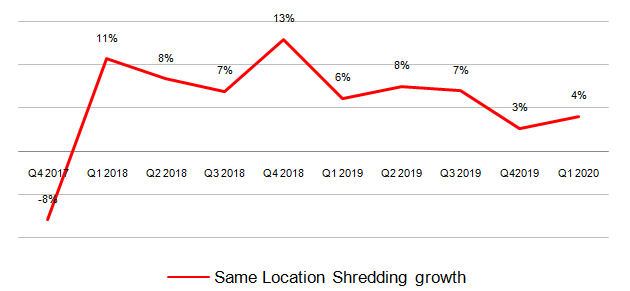

As in other retail businesses, especially those that are growing inorganically, one of the most important metrics to look at is the Same-Store-Sales growth. This tells us if the underlying business is doing well or not.

It took me some time to find this information. As I’ve mentioned in prior write-ups, the company reports so many metrics that it’s easy to lose track of where to find what. But I digress.

What matters is that the underlying business was quite strong until COVID-19 struck. The CEO has mentioned that April was a lousy month and SSS went down by about 40%, so the Q2 results should be disastrous. But what matters is the long term prospects for the business. And those were never better. You see, the company grows by acquiring smaller players. They’re all suffering right now. Most of the weaker ones will want out. Redishred is perfectly positioned to buy them.

On top of that, there have been several insiders buying shares and even the long gone founder of the company dropped by the latest Conference Call and mentioned that he was buying.

Conclusion:

I’ve always liked Redishred, and at these prices I’m liking it even more. I believe this is a company to hold on to for many years. It’s definitely not one of those companies that will triple in a matter of months as many that I’ve been seeing lately, but that’s ok.

I won’t be writing more about it for now. Let’s wait for next week’s release and I’ll come back to it then.

Pax Global

(0327: HKD$5,02)

Pax Global is that company that I can’t seem to shrug off of my shoulders. I’ve been having this ongoing conversation with Gabriel Castro (the expert on Pax) where I’ll send him something “against” Pax only for him to immediately send me something else validating his opinion. It’s a fun way to learn about a company.

Given his insistence, I’ve been talking to several analysts and the other day I had a very nice conversation with Farrukh Edgarov, an analyst who has been following the company and he told me that his biggest fear was that the company could stay cheap for 5 years and when it came time to rerate given such great fundamentals, some new tech would’ve taken Pax’s business. I kind of shared that fear, but there are now signs that the market is looking at this one after all.

Pax has released some tremendous results for the first half of the year. It seems that this is slowly going from a simple hardware chinese company to a SaaS fintech business, and we know what that means, right? It means that if investors put it in the same bag as the other fintech businesses, it could get super high valuations.

But hey, even without those fresh eyes looking at it, just look at old boring Ingenico, the largest player in the industry of Point-of-Sales devices. It trades for 46x earnings with negative growth.

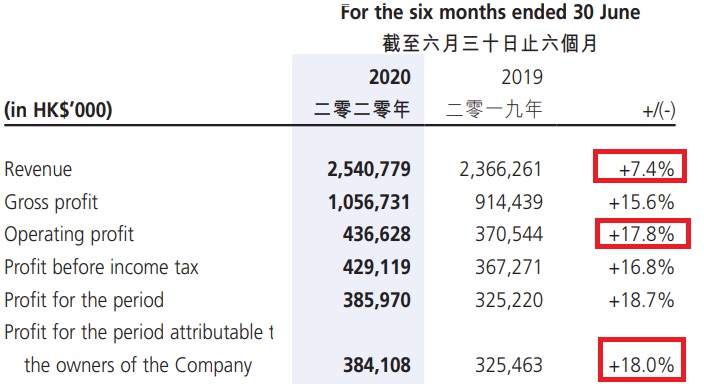

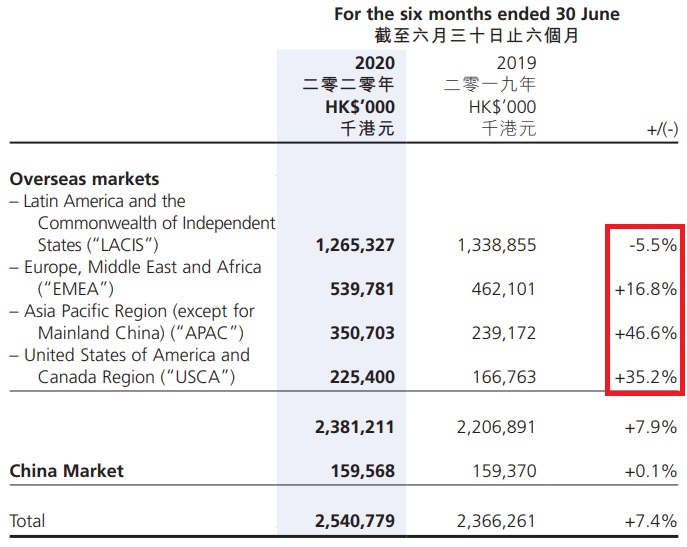

I thought that no one would be buying these terminals while the lockdown was in place, but I’ve been proven very wrong. Just look at these numbers.

While the revenue went up by +7,4%, the profits shot up by +18%! Damn it. In all fairness, the profit margin hike had a little help from the Renminbi devaluation, but that’s ok.

And better yet, this growth hasn’t come from Latin America, the company’s largest market. It came from Europe, Asia Pacific and the USA.

In fact, I don’t know if you’ve noticed, but Brasil – which is the company’s largest market – has been facing some issues with the virus thing. If the company is able to keep this growth rate and Brasil gets its act together in the second half of the year, we could be talking about amazing growth.

But as history tells us, growth for growth’s sake wasn’t working for Pax’s investors. It seems that what got the investing community all hyped up about Pax was the share buybacks, the 75% dividend increase and the fact that the company announced recently that it’s looking for acquisition targets in the West (software companies).

I liked what I’ve heard about capital allocation coming from the management. For instance, you might know already that I’m not a big fan of dividends so a 75% raise didn’t exactly got me fired up (I would rather have more share buybacks). But unlike other companies who set a fixed payout ratio to be followed no matter what, the management has said that it would keep assessing the best ways to return value to the shareholders. This is music to my ears.

What this recent price hike tells me is that the investing community isn’t as much a sleep as previously thought. It seems that it’s waking up to Pax story. And that’s a great thing.

My problem with Pax has always been the potential obsolescence of its machines (hello Kodak). Regarding the little ones, I can’t see why a smartphone can’t do the same thing. And it seems that Apple agrees with me.

I’ve been talking to several analysts about this and it’s apparent to me that I still have a long way to go before I can say that I fully understand the industry so the best thing for me to do is to keep researching.

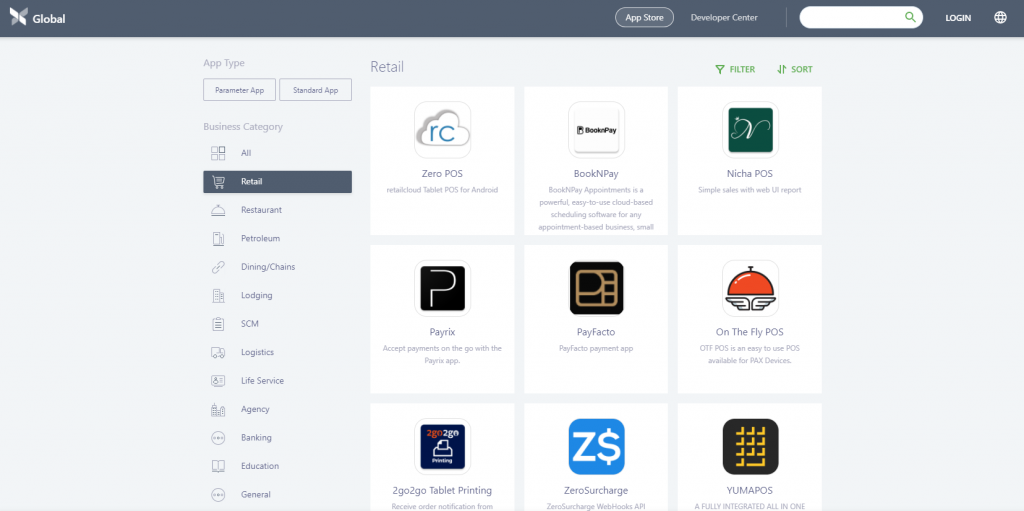

On top of the great results, the company had one card up its sleeve and it’s now actively marketing a SaaS platform, the PAXSTORE. As I’ve previously mentioned, I need to understand what this means and where it could take the company, but it’s apparent that this could be a game changer given that, unlike Ingenico’s, this is open source.

Conclusion:

Although the share price has shot up, at a PE of 7,4x (3,4x adjusted for the cash), with a pristine balance sheet and strong growth in the midst of the biggest lockdown in history, the company is still super cheap. I will be schooling myself about the payments industry before I come back to it.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.