Medley #7

Naked Wines, Pandora, Crocs, HomeServe

By Manuel Maurício

May 20, 2022

One of the activities I enjoy is too quickly look at a bunch of companies just to get the big picture and make a decision to pass or to dive deeper. Maybe I like it because I love to learn about new businesses or maybe it is just because it satisfies my short attention span. Either way, it’s a nice exercise.

Below I’m writing about a few businesses that have come to my attention recently. As in prior medleys, I’ll be missing a lot of stuff so if you have any insights please share them on the Forum.

Naked Wines

Naked Wines has one of those unique business models that I suspect can make it a multibagger.

With traditional online wine clubs, subscribers pay a monthly fee for the opportunity to buy wine at wholesale prices. I thought Naked Wines was a similar concept, but it’s not. It’s more like a crowdfunding platform for smaller wineries.

Just like in a traditional club, customers (called “Angels”) pay a $40 monthly subscription fee and gain access to limited editions of wine at discounted prices. But Naked doesn’t recognize that as revenue since it isn’t a non-refundable fee. It’s more like an advanced payment. And Naked uses that subscription fee to fund small wineries giving them the capital they need to purchase the land, grapes, machinery, etc. Naked also handles all the marketing stuff (bottling, design, advertising, distribution…). The wine makers just need to focus on making great wine with the assurance that Naked will buy it.

At any point, the Angles can use the prepaid fee to buy wine. That’s when the company reports it as revenue. That’s why Naked has consistently higher Free Cash Flow than Net Income (if you’d like to know more about these concepts, you might be interested in joining my new Investing Course that is coming out in June. Pre-register here to get an early bird discount).

This is a nice way for wine enthusiasts to find less mainstream wines and for smaller winemakers to raise capital and sell their wine.

Naked Wines is registered as a winery itself. This is important because in the USA the law contemplates 3 tiers of distribution to get the wine to the customer: 1) producers, 2) distributors, 3) retailers, and only then the 4) client. With Naked Wines, there’s only the producer and the client (this is what the company says, but Naked Wines is in between the producer and the customer so I think they’re just replacing the distributors and retailers – for a smaller slice of the pie).

All of this is enabled by technology. Naked knows what each customer likes and it will fund the winemakers whose wines are more in demand. Also, because the platform has some elements of social media, winemakers can talk to their end buyers and understand what they like and dislike.

Naked has so much data on its customers that it knows that customers who, after filing a complaint receive a free bottle as compensation, are more likely to stick around for longer. That’s why customer service employees can give perks like free bottles to unsatisfied customers – all enabled by tech and data.

As always, the business comes with some risks. One of the criticism that I’ve found is that this model works for lower quality wine (or cheap prices) and at some point customers will want to go up the quality scale and leave Naked Wines. My question was, why should this model work only for lower quality wine? Well, it turns out that Naked Wines buys the wine and ages it on its facilities. Higher end wine usually needs to be aged for longer. That means capital invested for longer periods of time which means worse economics.

Another complaint that I’ve seen being thrown around is the fact that the company is trying to educate its clients that cheap wine can be good in an industry where higher prices are usually perceived as a synonim of higher quality. I think this is a so-so argument. There are obviously good wines in the entire spectrum of prices.

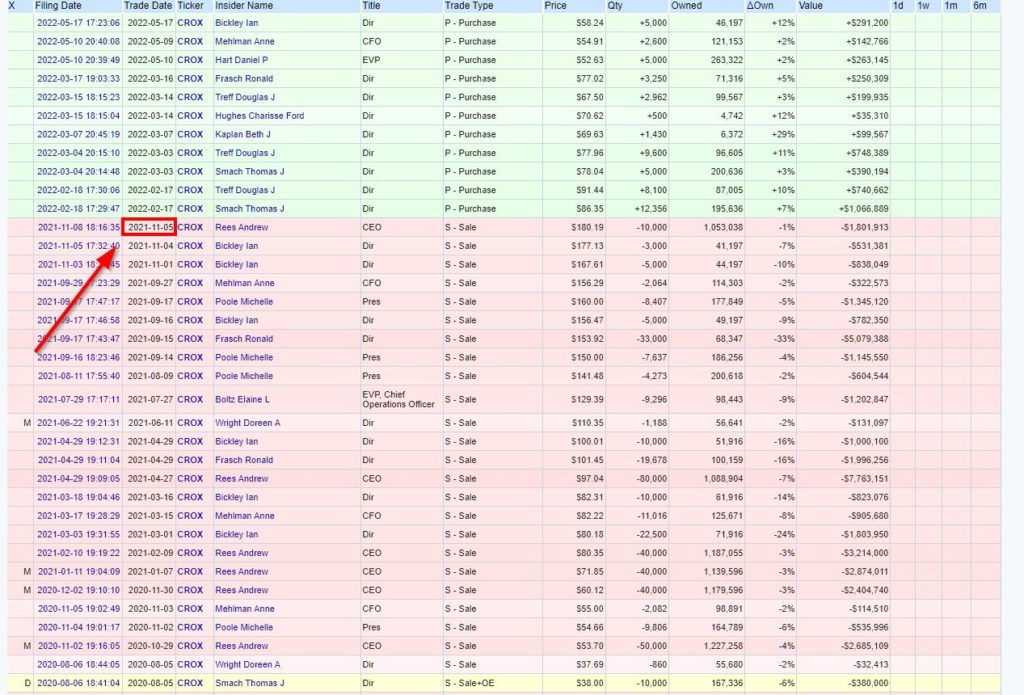

I’m posting a chart for the more data driven readers to show the level of information that the company has on its customers and their behavior. After the first years where there’s high churn, the customers that stay usually stick around for a long time.

I’m not making an attempt at figuring if the stock is cheap or expensive as this is a subscription business. This is relevant because Naked is still spending a lot to attract customers so it’s loss making. That’s why someone trying to value it should have a very good understanding of the business before making adjustments to the numbers and estimates for the future.

But I can tell you that I like the business model and I’ll start following the company. I’ll write more about it as I get to know it better.

Pandora

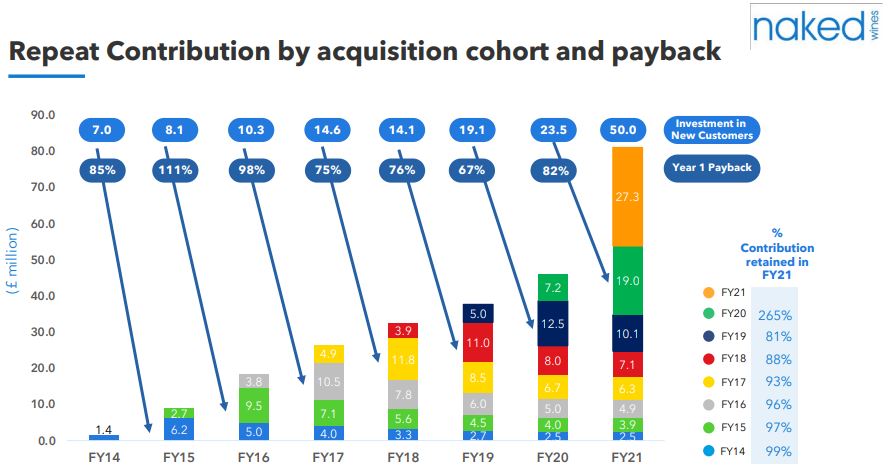

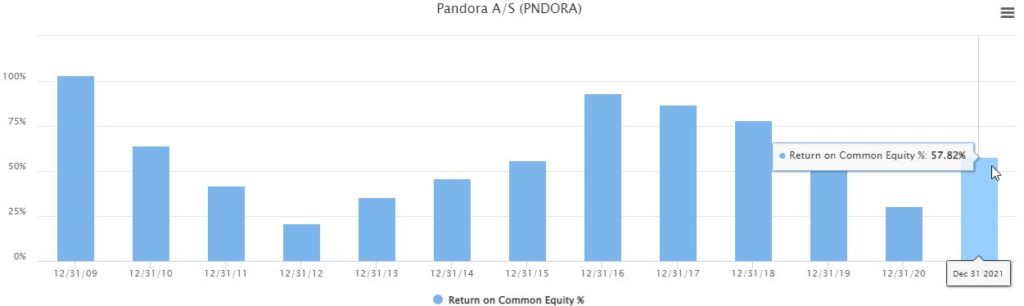

I would never have looked at Pandora if it wasn’t for its stellar Return-on-Equity. The lowest it got was 21% back in 2012 – in a company with very little debt. In fact, it’s much higher than its competitors Tiffany or Louis Vuitton Moet Hennessey (owner of Dior, Fendi Bulgary, among many other luxury brands).

Pandora’s brand has become synonymous of charms and bracelets. In fact, critics say that it’s just a bracelet and charm company (which constitutes 70% of revenue). I’m obviously weary or investing in jewellers in times of high inflation because they carry high inventory. But Mr. Buffett, who knows a thing or two about business and inflation, has bought several jewelers over the years such as Borsheims or Helzberg.

The truth is the company hasn’t grown a lot since 2017.

But what most growth investors nowadays fail to understand is that it isn’t growth that drives value. It’s high Return-on-Invested-Capital combined with great Capital Allocation. So, if the company is able to generate high amounts of cash and allocate it wisely, shareholders can be nicely rewarded.

And it happens so that the share price is trading at 10% Free Cash Flow yield. This to me screams “BUYBACKS”. Pandora could deliver extraordinary value to its shareholders if it were steadily reducing the share count (thus increasing the profits per share).

But unfortunately the management has committed one of the capital sins of the All in Stocks Investing Book by stating that “We will continue to pay out a dividend yield of 2% per year” – Ouch!

For those new to investing, this means that they’ll want to keep the dividend at 2% of the marketcap (the market value o fthe company which is dictated by the share price). If investors drive the share price up, the company will have to increase the dividend just to keep up with its 2% promise. This is obviously a failed strategy.

They could’ve stated a payout ratio (dividends compared to profits, not market value) of X%. Now, when they say that they want to keep the dividend at 2%, this tells me that they’ve been listening too much to their shareholders – who happen to be mindless institutions.

The rest of the profits are to be returned to the shareholders as share buybacks, which, at these prices, I applaud.

The company currently has a share buyback program of $3.3billion. If they keep up at this rhythm, they’ll be buying back 7% each year, which is nice.

Now to the risks. This short thesis by Victoria Hart raises some valid points. One of them is the likelihood that Pandora is “channel stuffing” – pushing inventory to their wholesale partners “falsifying” demand and inflating sales. If I’d ever invest in Pandora I’d need to be looking at these claims in greater depth. In fact, I’ll be doing it anyways as I’m a geek for these accounting shennannigans, even if I’m not investing in Pandora.

The truth is, for me, this company has a lot of fashion risk and is one of those investments that would need a high conviction on the product, which I don’t have currently.

On top of that, I believe this to be one of those businesses that a less able CEO could destroy in a heartbeat. Fashion brands can be very susceptible to fuck ups by management.

Which leads me to the next investment idea…

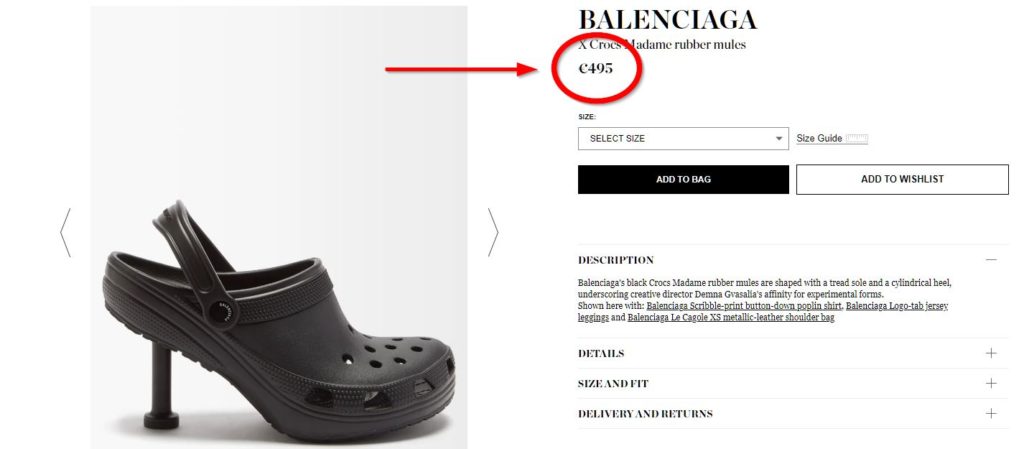

Crocs

Who doesn’t know Crocs? Although in my opinion they are the worse looking shoes ever made, the few friends I have who wear them tell me that they feel amazing. And children seem to love them too.

And to be honest, my opinion isn’t relevant. The truth is that they sell very well.

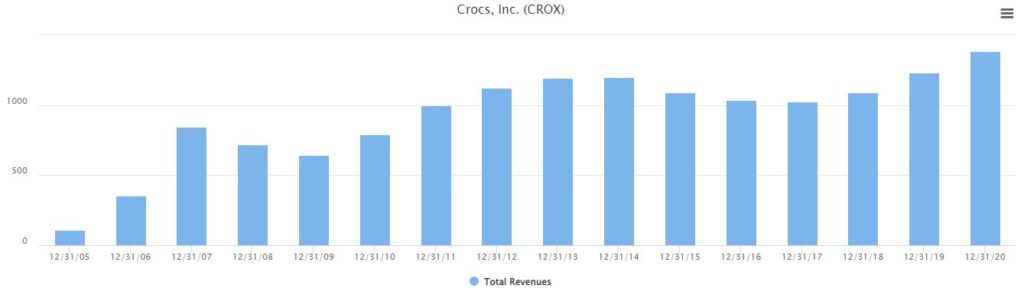

No, you don’t see explosive growth, but the company sold $1.4 billion dollars worth of Crocs in 2020. That’s a lot of shoes.

With the core market saturated, the management started looking for growth through acquisitions. In late 2021, Crocs paid $2.5 billion for HeyDude, a loafers company making $570 million in revenue. Some argue that was a bit too much and that’s likely the reason why the stock has been punished since. I haven’t seen them in Portugal, but it looks like they’re hot in the US.

As a general statement, I think I would give more credit to Pandora than to Crocs. Fashion risk is a real risk and I just think there’s more of it for Crocs than there is for jewellery, maybe.

I forgot to mention above, just like Pandora, Crocs is eyeing the Chinese market as its next big growth market. And what a market it is. If these companies are able to successful penetrate it, shareholders could be in for a double whammy of profit growth together with valuation multiple expansion – the stuff of multibaggers.

Now, Crocs also seems to be attractively priced at a Free Cash Flow Yield of 14%. I would like to see the company buying back shares at these prices. And they were doing it, but the HeyDudes acquisition was paid for with debt and now the share buybacks have to be put on hold to reduce debt.

I believe that some of the major reasons for the undervaluation is that the Free Cash Flow that I mentioned above was mostly driven by the pandemic. People were home and they wanted comfortable shoes so Crocs had a huge tailwind there. Will we be seeing it in the future? I would say that maybe we’ll see interest in Crocs diminishing and interest in HeyDudes increasing. Whether this is going to drive profits higher, lower, or flat, I couldn’t say.

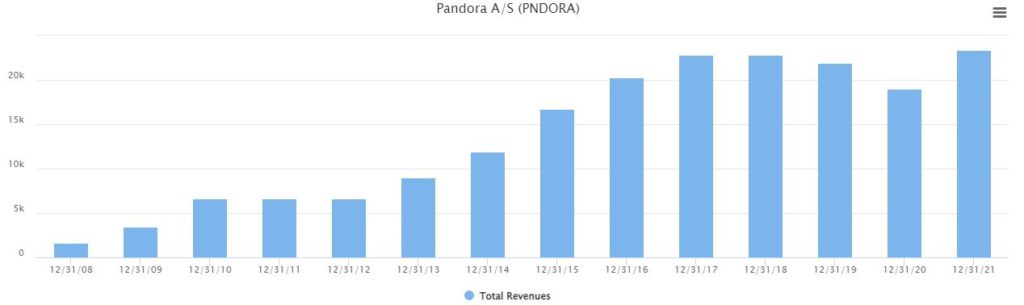

One interesting data point is the fact that the managers were buying shares up until the stock price reached its recent highs in November 2021, then they stopped selling, and now that the stock price is down, they’ve started buying again.

Overall, fashion is hard for me so I’ll take a pass on this one too, but I’ll be following it from afar.

HomeServe

HomeServe was brought to my attention by Ilídio Leal, who has been a subscriber of All in Stocks for a long time.

HomeServe provides home repair services to homeowners and installation of HVAC systems (air conditioning). Not only that, but it’s sort of an insurance company. Homeowners pay a monthly fee to cover for stuff like leakage, electrical or plumbing issues. And HomeServe also has several marketplaces aimed at offering these home repair services.

This looks like a capital-light business, with some float (money that clients pay in advance and the company holds in the meantime) and some protection against economic downturns.

The truth is that I have no knowledge of the insurance industry which seems to be the company’s largest segment. I would have to spend a few weeks learning about it to have an opinion. But then I found out that Brookfield Asset Management is buying the company so there’s no point in looking at it further.

A word for Ilídio, thank you for the tip. It looks like a fine business. I hope that you’ve made money on this one. Also, I’m sorry to have taken so long to look into it. However, I encourage you to send me more investing ideas. You can do it on the Forum.

Conclusion

I like doing these shallow dives. It allows me to get to know new businesses, find new ideas, and give you my opinion on a broader selection of companies. The plan is to dive deep into those that I suspect might become good investments and are within my circle of competence.

I am thinking of repeating this model next week, but I would like to hear your opinion so I would kindly ask you to fill out the form below.

I would also encourage you to give me your opinion on the Forum by clicking one of the following names:

The smaller the company, wait. Let me correct that. The younger the company, the more sure I need to be of the management’s incentives and the unit economics. Readers of my work don’t see the amount of time that I take collecting operating metrics numbers over the years. This can take days: Number of clinics, number of treatments, number of stores, Same Store Sales growth, number of square meters, sales per square meter, and so on and so on.

The Joint’s short thesis is a strong reminder that this work isn’t just some sort of whim os over-research from my end. If anything, I come out of reading it thinking that I need to be even more through on my research.

Next week I think I’ll be repeating this exercise. If you have any

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.