Medley

#2

By Manuel Maurício

June 26, 2020

Introduction

This week I’m doing something different. As part of my investment process, I spend a lot of time on quick and rough analysis of a lot of companies. I don’t write about most of them because they’re not worth the time, but today, instead of a full write-up on one company, I’ve packed together some companies that I’ve been looking at recently.

Before we start, a word of caution is of the essence. With these quick pass throughs I’m looking for clear signs of outstanding performance or just plain ol’ cheapness. There’s no way I can understand a company or a new industry just by spending a few hours (or even a whole day) looking at them. This will almost certainly lead to great misses, but that’s fine. What one must worry about is minimizing the errors of commission, not the errors of omission.

As I’m increasingly wary of where we are in this long cycle, I am starting to look at more defensive plays (no, I’m not trying to predict the economy). Therefore, the packaging industry seemed a good place to start.

This industry is characterized by the relatively high capital intensiveness (building and maintaining factories doesn’t come cheap) and somewhat low returns on that capital given the commodity-like aspect of it that drives down the margins. That’s why these companies make use of so much debt. At first this doesn’t sound exciting right?

But there are other factors that come into play. These companies are also very recession resistant, and for the most part, they’re cash flow machines. That’s why Private Equity firms like this space so much.

I’m also writing about an asset-light microcap with a big moat. I got interested in that one because a fellow investor is going activist on it and he intends to kick the board of directors out and replace them for young, success thirsty directors. I’m a sucker for activist plays.

To finalize, there is a peculiar company whose business I don’t love, but that it’s so cheap that it’s impossible not to take notice.

Let’s start.

Aluflexpack

(AFP: CHf 330 Million)

I first heard about Aluflexpack from Pedro Baldaia. You can watch our conversation HERE. Aluflexpack is a manufacturer of flexible aluminium packaging for a variety of well-known brands such as Ferrero and L’or, as well as the pharmaceutical industry (blister foil packaging). This is a market that is growing nicely as of lately.

The company is a spinoff from Montana Tech Components AG which is still its major shareholder with 53% of the shares outstanding. The proceeds of the 2019 IPO in the Swiss Stock Exchange were used, among other things, to ramp up production capacity over at its Croatian plant from 100 million stand up pouches per year to 1 Billion pouches, so an increase of 10x. I’ve been trying to figure out how this increased production translates into revenue, but with limited success so far.

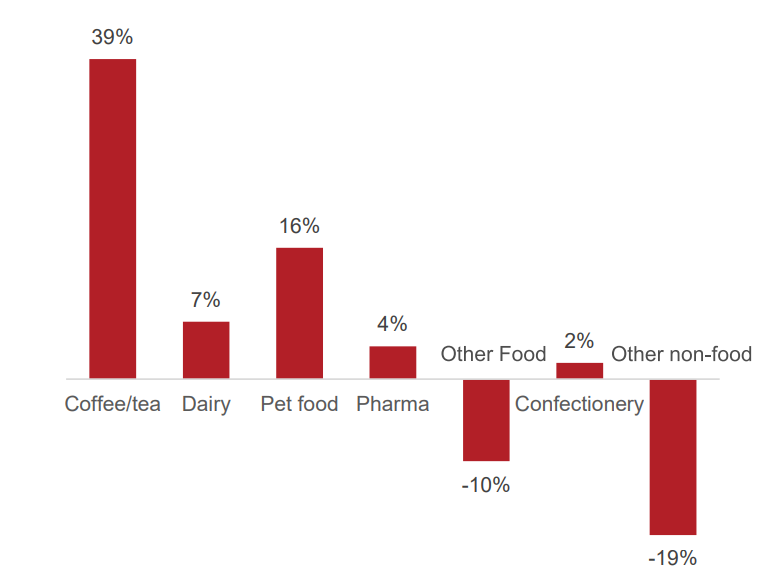

I’ve been critical of the amount of coffee capsules we at home consume and the need to think of better packaging or better recycling. I’ve been drinking L’or café and go figure, their capsules are manufactured by Aluflexpack. So this is a case where I am critical of the product and at the same time I recognize that if I have noticed that L’or capsules are much better than others, the company that is manufacturing them might be making money, right? And that’s exactly what has been happening. Aluflexpack operates under 7 segments, the “coffee/tea” segment being not only the strongest one representing 19% of the total sales, but also its fastest growing segment in 2019 (+39%).

End market growth rates (in % yoy)

Source: Company presentation

There are many packaging companies in the world. At first one might think that this is a commodity-like business where it doesn’t really matter who is making the packages. But it turns out that it isn’t quite so. At least, not in every case. When a client – usually a big packaged food name – chooses its supplier, it will likely stick to it as long as the supplier delivers. This is something I have already talked about in the Facebook Group (the free one) before.

The products Aluflexpack makes are cheap and “insignificant” from a customers point of view, but at the same time they are crucial to the good functioning of the customer’s operations. Think about that coffee capsule back there. In theory, it doesn’t matter who makes it. The reality is that if L’or is happy with Aluflexpack, the risks of switching to another competitor are far higher than the potential cost advantages.

Turning now to the financials, after raising €140 Million in the IPO and investing it in the new facilities as well as in the acquisition of the Turkish Arimpex, the company still has $12 Million in net-cash (cash minus debt), which is a rarity for such defensive companies who can handle high amounts of debt. In 2019 it has grown 9% and it’s still unprofitable, but that should change soon, given that the capital investments have already been made. This reminds me of Mama Mancini’s story.

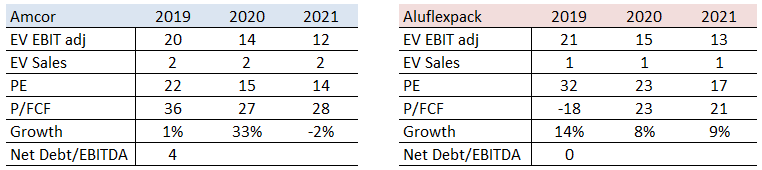

One of the most comparable companies is the Australian Amcor (US$15,8 Billion), which I have used as a reference to understand what kind of margins and returns Aluflexpack may be getting in the future.

Valuation Ratios

Source: AiS estimates

Conclusion:

I’ve been exchanging some emails with Pedro about this one and I might be missing something regarding the new production facilities and the future revenues, but I don’t see a strong undervaluation here. Yes, the fact that the company has zero net debt will allow it to raise debt, buy other companies, pay down debt with the newly acquired cash flows, rinse and repeat, but still, I’m not feeling the love.

Owens-Illinois

(OI: US$1,34 Billion)

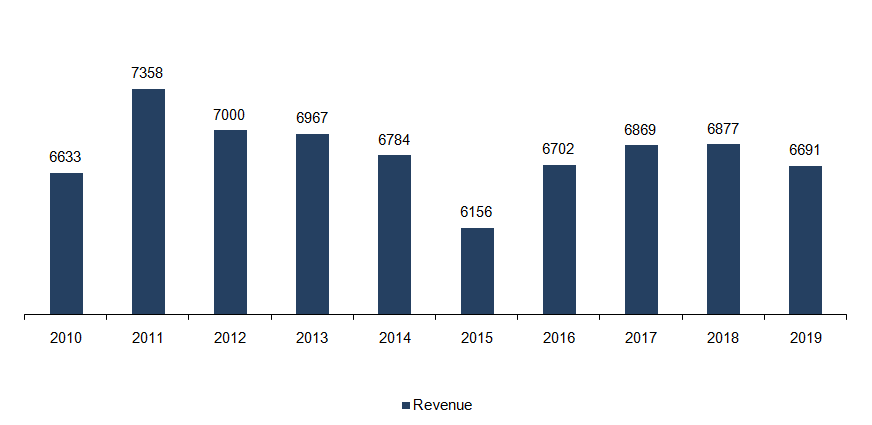

I first got to know O-I from my mentor Gary Mishuris. He has done extensive research on it so I decided to take a look. Owens Illinois is one of the largest manufacturers of glass products (i.e. bottles, jars, etc) in the world. It has no growth (a stalwart), but it’s a very stable business that generates a lot of cash. At a forward EV/EBITDA of 6x and Price/FCF of 3,7x, it seems to be very cheap right now.

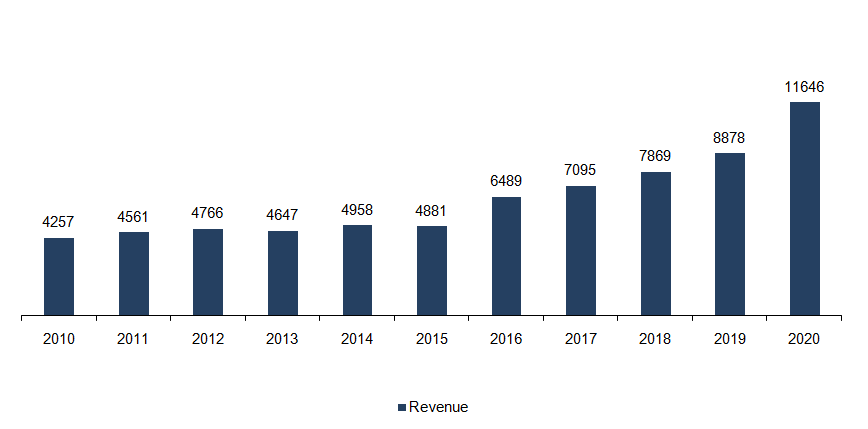

Revenue, $Million

Source: Company filings

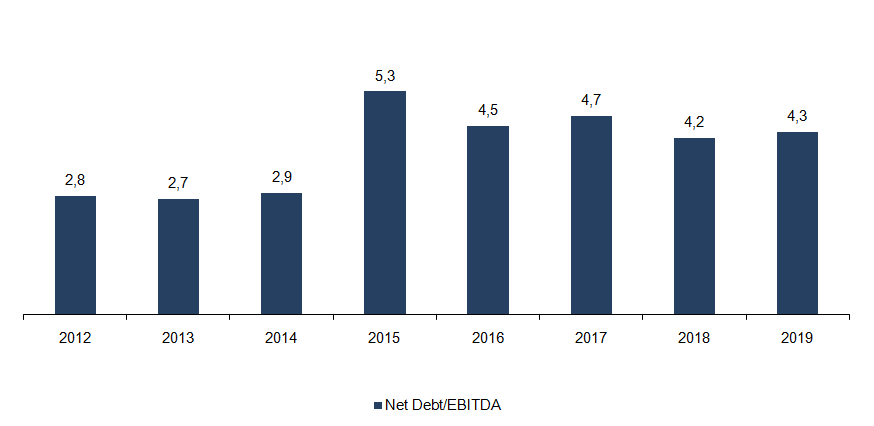

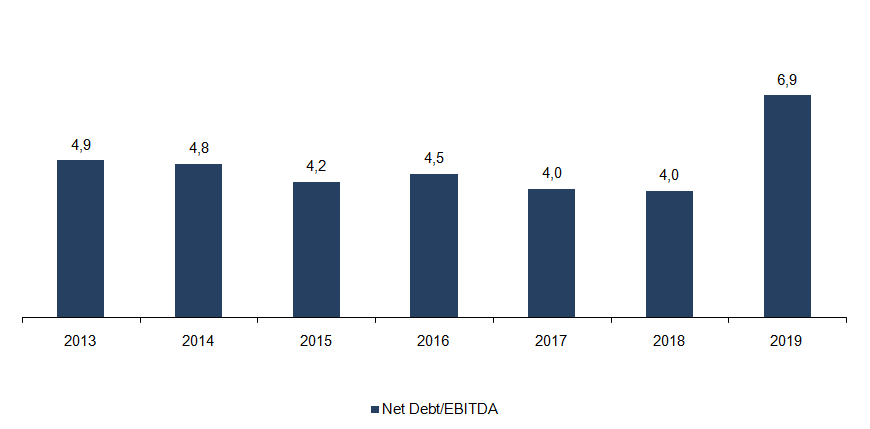

It’s cheap because it doesn’t grow and it has a “stretched” balance sheet. Add to this the fact that all of these packaging companies are cheap from a “value investor’s” point of view (aka low multiples). There is a mismatch of perceptions between retail investors like you and me and Private Equity firms (PE). You see, when these packaging companies are in private hands, they support a lot more debt than their public peers because “the market” thinks that 6x or 7x times Net Debt/EBITDA is too much. It can be. History is full of companies that went bankrupt because these PE firms had overleveraged them. But if for some industries a Net Debt/EBITDA of 3x is high, for the packaging industry, it’s fairly low.

Net Debt/EBITDA

Source: Company filings

Conclusion:

I don’t usually like to invest in no-growth companies, but that doesn’t mean that there isn’t money to be made. What matters here is the company’s ability to wear down an economic downturn and pay down its debt. If it’s able to do it, it should re-rate to a higher multiple. I’ll be doing a liquidity stress-test soon and if I reach any major conclusion, I’ll write about it.

Berry Global Group

(BERY: US$5,54 Billion)

One of the funds I follow closely is Turtle Creek Asset Management. These guys have achieved a 20% compounded annual growth rate since 1998. This is nothing short of amazing. In fact, I can’t think of anyone else right now that has achieved such returns. Berry makes plastic packaging such as yogurt containers, water bottles, shampoo bottles, etc. Yes, I hate what plastic is doing to our planet, but I’m here trying to understand if this could be a good investment, not if we should or shouldn’t use plastic.

The underlying business doesn’t grow and might even decline about 1% to 2% per year. That’s why Bery has a “buy & integrate” strategy that allows it to grow by acquiring smaller companies often at 8x to 9x EV/EBITDA, which Berry is then able to bring down to 4x to 5x due to synergies (greater bargaining power, cost cutting, etc).

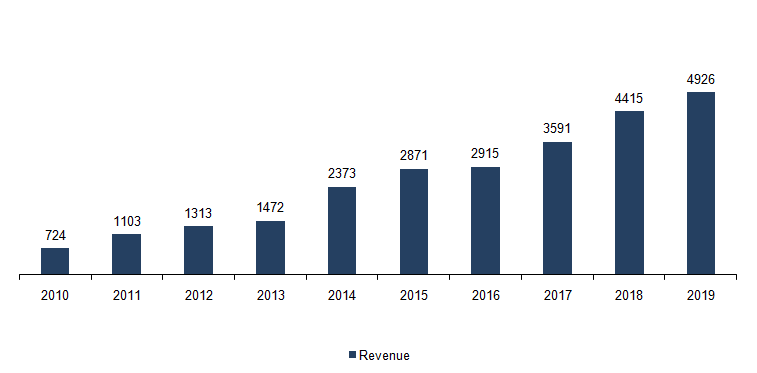

Revenue, $Million

Source: Company filings

Given the highly stable and predictable cash flows this business generates, the way it works is Berry raises debt to buy a new company, then it takes some time consolidating it, it reduces the debt to “safer” levels and when it’s able to raise debt again it will do it all over again. The logical question now would be, will it be able to keep pursuing this strategy? As far as I can tell, this is a highly fragmented industry with a long runway for growth by acquisitions.

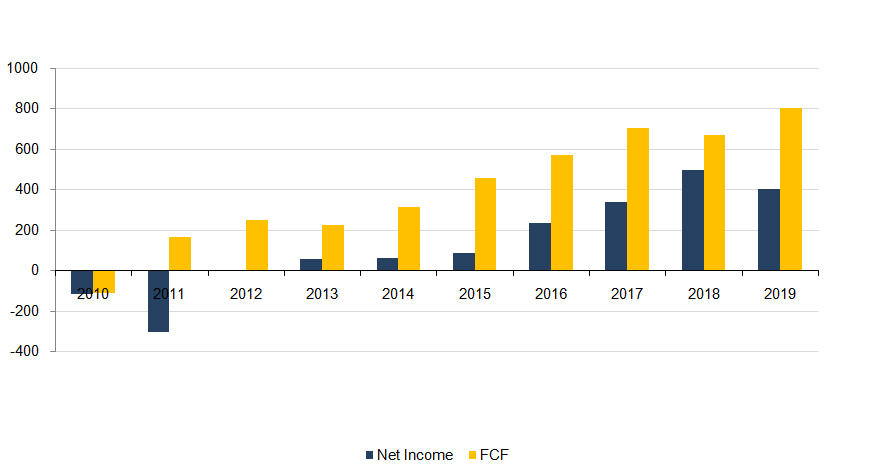

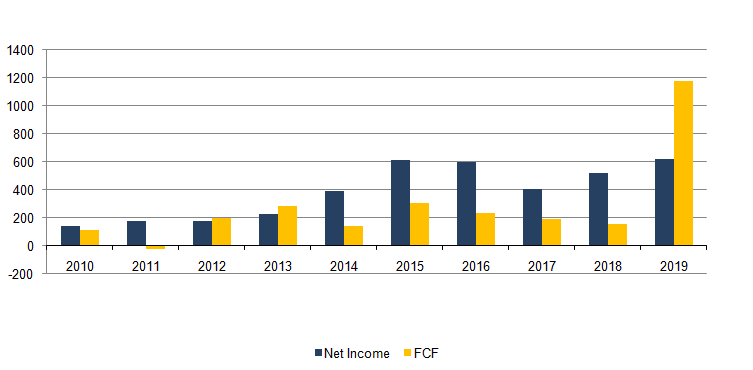

Net Income and FCF, $Million

Source: Company filings

Unlike what most people think, the Chinese can’t outcompete these guys (or any other) by using the common tactics of producing it at a much lower cost and shipping it across the world. That would mean that they would be shipping mostly air, and that’s not economical. That’s why there’s a ton of these factories all over Europe and the US. They’ve got to be near their clients. And that’s why there’s so many companies that can be bought.

When you look at Berry’s Income Statement, the line that catches your eye is the “Raw Materials”; resin to make plastics is its largest cost. And that’s why scale matters. By acquiring other companies in the same line of business, Berry is able to grow the volume of its already huge resin orders each year, thus allowing for higher bargaining power with its suppliers, driving the margins up.

Oil prices are obviously important, but not as much as investors might think. Berry’s contracts with its clients allow for cost-past-through when the raw materials fluctuate. In fact, all of these packaging companies have these types of contracts. Some do it with a lag, others immediately. So although the price of the raw materials affects their margins, in most of the times, it is only temporary.

Regarding the balance sheet, the interest rate coverage is currently 2,4x and although I expect this business to stay strong during a downturn, I would like to do a liquidity test going forward. In 2019, the company has made a huge acquisition of an English plastics manufacturer called RPC for $6,5 Billion ($4,3 Billion equity + $2,2 Billion of debt). May I remind you that Berry is worth $5,6 Billion today? This substantially increased the company’s debt level to 6,9x (Net Debt/EBITDA).

Net Debt/EBITDA

Source: Company filings

But again, what a lot of investors don’t understand is that these companies can handle high levels of debt given their strong and bond-like cash-flows. Now, as I’ve mentioned previously, I will need to better understand the cost structure in order to create a negative scenario and check if the company will be able to keep paying its fixed costs as well as reduce the overall debt level.

Conclusion:

If everything goes well, the company will likely be making $950 Million in FCF in 2020 and $1 Billion in 2021. This means that it will be able to deleverage to 4x in 2021, which would make investors more relaxed about the debt levels. At an EV/EBITDA of 10x (quite normal for this industry), the stock could be worth about $80 to $94 in the next couple of years. It’s now trading for $41,66.

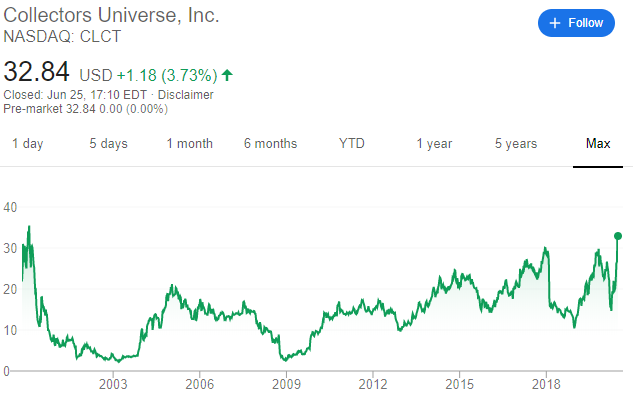

Collectors Universe

(CLCT: US$300 Million)

Collectors Universe was recently profiled on the MicroCapClub and I wasn’t really paying attention until I saw that Connor Hailey was going activist on it. I love activists stories. Don’t mix the concepts of an activist in a company with an environmental activist. An activist in a company is an investor that buys a large stake and tries to influence the management and board of directors, frequently by taking control of both. I’ve chatted with Connor several times about Mama Mancini’s, STKS, The Joint among some other names and this was an unexpected move.

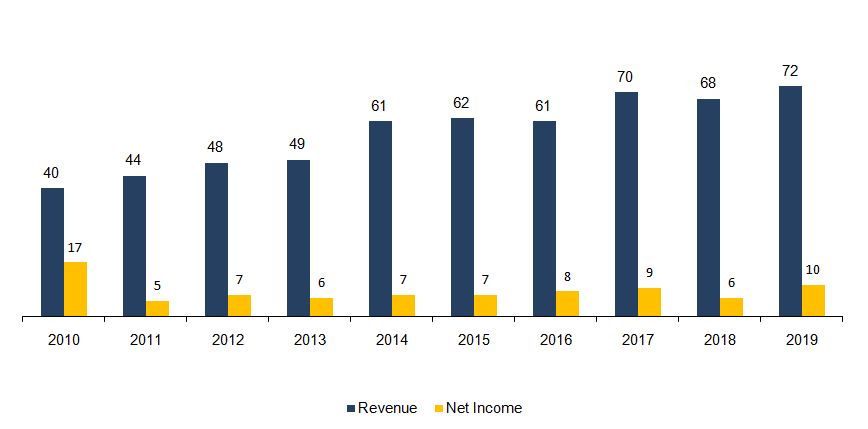

Revenue and Net Income

Source: Company filings

It turns out that Alta Fox Capital, Connor’s fund, has bought 5,2% of the company and he isn’t happy with the board of directors who are a bunch of old men that don’t have the mojo needed to bring the company to the XXI century. That’s why he is proposing the replacement of 6 directors for new ones he is nominating. You can read his letter HERE. Connor is of the opinion that with the right guidance, the share value could reach $100 in about 3 years time.

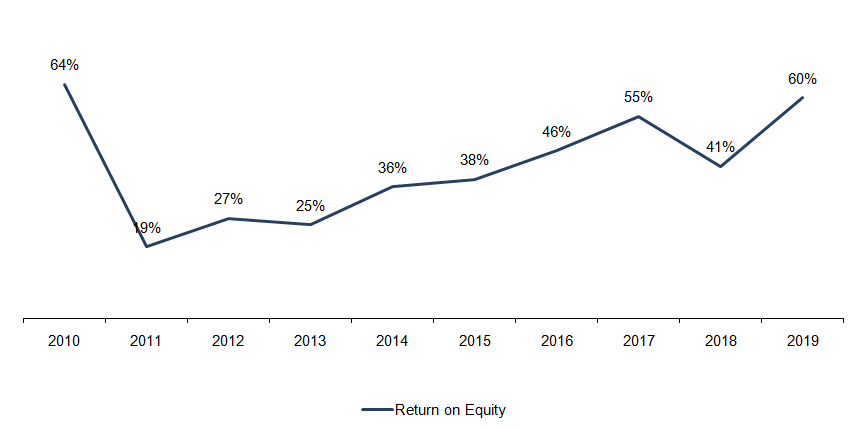

Collectors Universe is a great business. The company specializes in authenticating and grading trading cards (Baseball; Magic: The Gathering; Pokemon) and coins. It charges around $10 to grade a card and $20 to grade a coin. If the card is one of those rare ones, it can charge up to $1000 or more. This is one of those (good) businesses that don’t require much capital. It doesn’t need new factories or inventory and because of that, it can generate huge returns on invested capital.

Return on equity

Source: Company filings

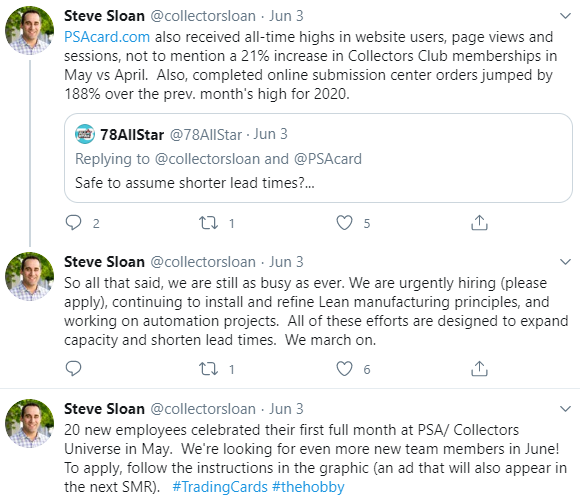

On the other hand, the company has been so badly managed that it hasn’t been able to keep up with the recent spike in demand. Its backlog is getting larger by the day. So much so that the company is desperately trying to hire new workers.

CLTC hiring on Twitter

Source: Twitter

Conclusion:

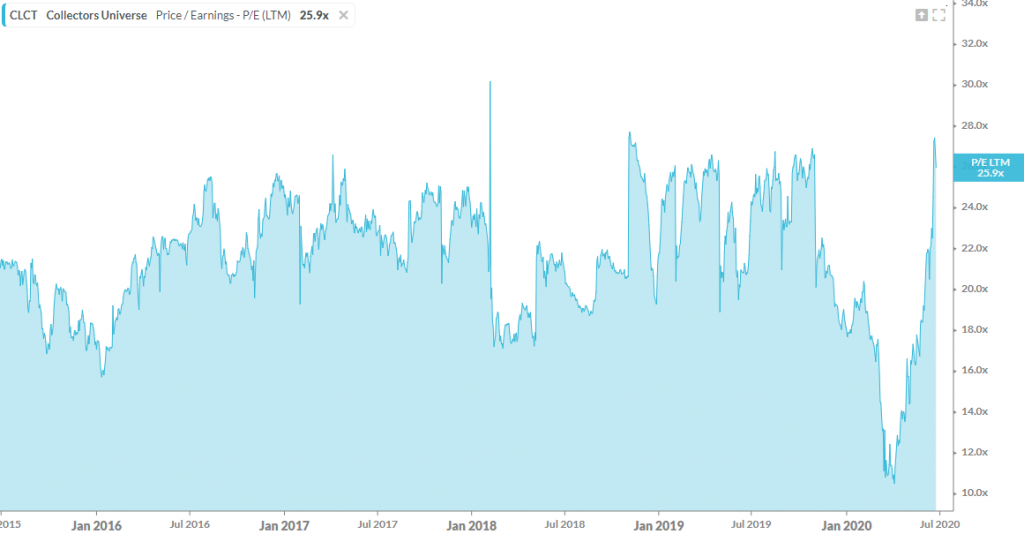

The company is worth around $300 Million, its normalized profit for the year would be $10 Million, it has $22M in net-cash so this means that its trading for a Price-to-Earnings ratio of 28x. It isn’t cheap. But then again, one of its segments is a duopoly, the other one is a triopoly, and the company is the undisputed leader in both, so the moat is wide. Now, Connor might be able to elect his slate of directors and turn it around and in 3 years time its underlying value might reach those $100. That is likely, but for now it’s just an expectation. I will keep following this one.

Price/Earnings Ratio

Source: Koyfin

Pax Global

(0327: HK$3,98 Billion)

It has been several months since I first read the in-depth report Gabriel Castro wrote on Pax Global. Pax Global is the second largest manufacturer of Point of Sales devices in the world (ex China), right behind Ingenico. My first thoughts were, this is a dying business that will be crushed by payments apps such as WhatsApp payments and what not. And I still think there’s a strong probability for that to happen. But the company is so ridiculously cheap that I haven’t been able to dismiss it. It seems that it was taken from the time when Ben Graham was still alive.

Revenue, HK$ Million

Source: Company filings

Pax Global had HK$0,567 in Earnings-per-Share (EPS) in 2019. Today, you can buy one share for $3,58. That would be a Price-to-Earnings Ratio of 6,3x. Cheap, you might say. But-there’s-more. The company has HK$2,93 in-cash-per-share. If we subtract the cash, we are effectively paying $0,65 per share to get $0,567 in profit at the end of the year (?). This seems too good to be true. This is a PE ratio of 1,6x (!). For a company that is growing 12% (?).

Now, in a company with such low Capital needs (Pax outsources the fabrication so it doesn’t spend in factories), the FCF should be roughly the same as the Net Income. But that’s not happening. The FCF is always lower than the net income. This is a yellow flag that needs closer study.

Due to the fact that the company’s strongest markets are emerging countries where it’s common for its clients to pay late while demanding the devices right away, the company carries huge working capital (Inventory and Receivables). In order to grow its revenues, it has to fund that working capital, and that doesn’t show on the Income Statement. That’s why the FCF always lags the Net Income. Just last year, the management team has been able to collect earlier from its clients and the result was a huge bump to the FCF (yellow bar).

Net Income and FCF, HK$ Million

Source: Company filings

When this happens, one way to look at it is to think about the company in a steady-state, with no growth. In such a scenario, the FCF would equal the net income.

Either way you cut it, this is unbelievably cheap. And that’s why I’m suspicious of it. I’ve been talking to Gabriel and he has done extensive research to be sure this isn’t a fraud. He is convinced that it isn’t. He is even helping the management be more promotional here in Europe and in the US so more investors get to know the company.

That being said, my gut feeling still tells me that this is a dying business, although the company makes a lot of different devices that are gaining traction such as those that we see at McDonald’s . Pax is also developing the Android-based software.

To appease that voice inside my head that’s telling me that this is a great opportunity, I’ve reached out to all the analysts that are covering Pax so I can get a feeling for why the market is valuing it like it is. Maybe someone knows something better than me.

Conclusion

So here you have it. A quick and rough look at 5 different companies that led me to a few conclusions:

This was a first approach to the packaging industry. If I were to invest in it (which I don’t discard), I should become knowledgeable on several different companies. As in other commodity-like businesses, there are constant threats coming in from different angles and looking at the financials of one single company isn’t enough. Having said that, the one that got me interested the most was Berry Global. I will probably be doing a deep dive on it in the following weeks.

I definitely liked Collectors Universe and I will keep following it. I love activist stories and even more so when I know the guy that is doing it.

Pax Global is the one that makes me scratch my head the most. As mentioned previously, I don’t see this company having a great moat at all. But it’s SO – CHEAP! Luckily, I don’t have to swing at every ball that’s thrown at me.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.