Millennium Investment & Acquisition

a fundamental analysis

By Manuel Maurício

September 21, 2021

Symbol: MILC (OTC)

Share Price: $6.7

Market Cap: $73.43 Million

Introduction

I have a group of friends who love smoking weed.

Every once in a while one of them tells me “Manuel, you should be looking into some cannabis companies. When you find a good one, let me know”.

I have never looked at the space because A) there was a bubble in the cannabis industry as we can see from the charts of two of the largest cannabis companies below…

…and B) agriculture is a lousy business.

The product has little to no differentiating characteristics (although my friends would argue about this), the crops are dependent on the climate conditions, and bugs can destroy an entire crop over night.

Yes, you can grow weed inside warehouses and there are pesticides, but still- agriculture isn’t famous for being a great business.

But as Afonso Pinto de Almeida (who is a very engaged subscriber) alluded to the other day, there’s always a price at which all of the problems become irrelevant.

That’s why I’m looking at Millennium Investment and Acquisition (MILC). If we were to believe the management team, the company is trading at a Price/Earnings of 1x or 2x (for 2023). This is so cheap that I just can’t ignore it.

Of course, why hasn’t the market noticed this?

Well, I would argue that the market has already started to notice this as the stock price has gone up by 31 times (!!!) in the past 9 months.

But before we talk about MILC, we need to talk about its sister company Power REIT because they’re fundamentally tied to each other.

The term REIT is short for Real-Estate-Investment-Trust. It’s a special type of company whose sole purpose is to own and lease real-estate.

Power REIT has become a 9-bagger over the past 2 years.

Cool, right?

Historically, Power Reit had been focused on buying and leasing land and railroad assets. At some point, David Lesser, CEO, shifted the focus to the cannabis industry where he buys the greenhouses and then leases them out to operators.

By law, a REIT must distribute all of its profits to the shareholders in the form of dividends. But because Power Reit has NOL’s (previous losses that allow not to distribute those profits), it can reinvest the profits in new assets at attractive returns.

Also by law, Power REIT can’t operate the business. Power REIT is just the owner of the real-estate.

Enter Millennium Investment and Acquisition. Through MILC, David can operate the greenhouses thus profiting from the two levels of the value chain.

David Lesser, who owns 27% of Power REIT and 20% of MILC is the CEO of both companies. Not only that, but he has invested $12 million of his own money in Power REIT earlier this year. This goes to show how bullish he is in the business (in Power REIT, at least).

MILC was previously an investment holding with nothing to do with cannabis. It didn’t even report the usual quarterly and annual reports with the Securities and Exchange Commission (SEC). It doesn’t even have revenues. But that will change in the coming quarter.

Also, the thing with the cannabis industry is that it attracts a lot of shady people making it hard to find good people to lease the greenhouses to.

In one of his deals, David met a young guy called Jared Schrader who fit the bill of a motivated, hard working operator with a similar view on how cannabis should be cultivated.

“Mr. Schrader grew revenue at a Colorado cannabis cultivation facility from annual revenue of $150,000 to weekly revenue of over $150,000 (i.e. > $8 million annually) over the span of two years.”

In recent interviews you’ll see both David and Jared talking about the business. David handles the acquisitions, Jared handles the operations.

MILC focuses on growing cannabis in greenhouses as opposed to growing them in warehouses with artificial light or hydroponic systems.

MILC wants to be the lowest cost producer and not worry much about growing the best flowers (which is what you smoke) as other competitors are doing.

There are several benefits to this strategy, namely lower ramp-up costs, lower operating costs (no lights, HVAC systems, etc) and shorter time to production.

Of course, there are also some negative factors like the lower quality of the weed.

MILC is also doing something differently from other cannabis farmers.

A BIT ABOUT THE STRATEGY

Farming and the sale of cannabis in the USA is illegal from a federal standpoint. But it’s not illegal from a state standpoint. It’s a legal limbo that has been going on for some time.

So, right now, you can grow weed in some states, but you can’t sell that weed to other states. This creates different markets altogether. Some are more restrictive and some are less.

Some operators focus on the most restrictive states as there’s a temporary MOAT created by regulation (it isn’t easy for new entrants to set up a greenhouse).

David and Jared do the exact opposite. They want to be in the less restrictive states. This way they’ll be faster to production and the costs will be lower (less state fees).

On top of this, it’s in these states that Power REIT can find the most distressed assets to buy. Because everyone can start a cannabis crop, but not everyone can manage a cannabis plantation, they’ve been finding some good assets selling for cheap.

Banks typically don’t want to lend money to these businesses due to the legal limbo. That makes financing hard and expensive to come by. MILC doesn’t have that problem. Power REIT will buy the assets.

So far David has been very cognizant of dilution and has managed to come up with ways to finance Power REIT in a non-dillutive way.

If you hear him talk, you’ll notice that he gets it. He believes that Power REIT is trading for less than what it’s worth so he doesn’t want to issue new shares.

FACILITIES

Right now MILC has already began operating in two cannabis facilities in Colorado (greenhouse)…

and Oklahoma (greenhouse and outdoor)

But these two pale in comparison to the new facility in Michigan which is the second largest cannabis growing facility in the US with 4 times the size of each of the prior, even without considering the future expansion that is already being planned.

Below, you can watch a video interview with David and Jared inside the facility.

Estimates

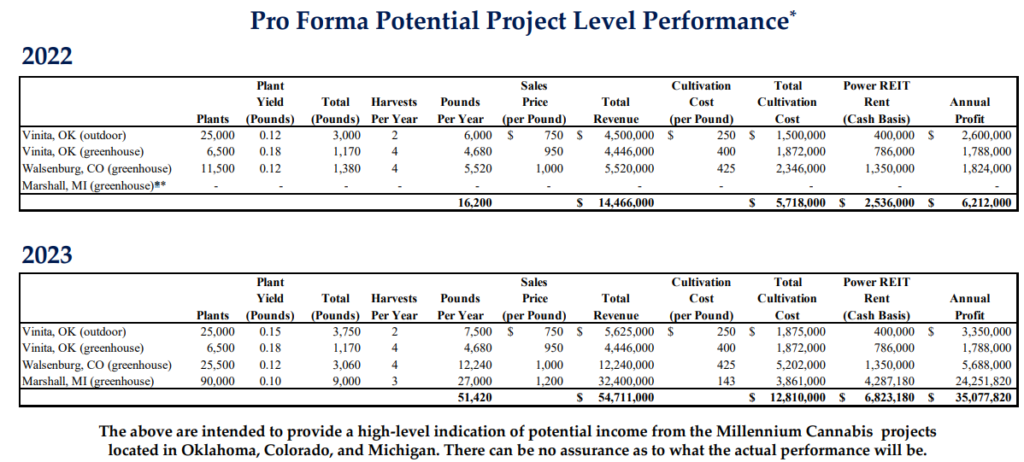

The whole thesis is based on the table below provided by the company (click to enlarge):

Let’s look at the Marshall facility in Michigan as it’s the largest one.

The company is estimating 90.000 plants whereas they’ve been talking about 100.000 plants in interviews. They’re being cautious.

The management has also been hinting at doubling the size of the current facilities inside the same property.

Then, they estimate a yield of 0.1 pound per plant. I’m no cannabis expert, but as far as I’ve been able to gather, that’s pretty easy to attain which tells me that the management is being highly conservative with its estimates.

They estimate 3 harvests per year when they will probably be doing 4.

They’re using a Price per pound of $1.200 when the price per pound in Michigan is currently $4.000. It looks like the current $4.000 per pound is highly inflated and it shouldn’t be sustainable over time as more producers come online. I welcome this highly conservative estimate at a third of the current price.

Then there’s the cultivation cost per pound which the company estimates at $143. No one knows for sure if they’ll be able to achieve this, but I’ll give them the benefit of doubt for now.

After all of this, the company gets to a profit of $32.6 million for 2023 (OK and CO are 77,5% owned by MILC).

The current marketcap is $71 million. This means that the stock is trading at around 2x earnings. Even after it has gone up 31 times. This is crazy!

Balance Sheet

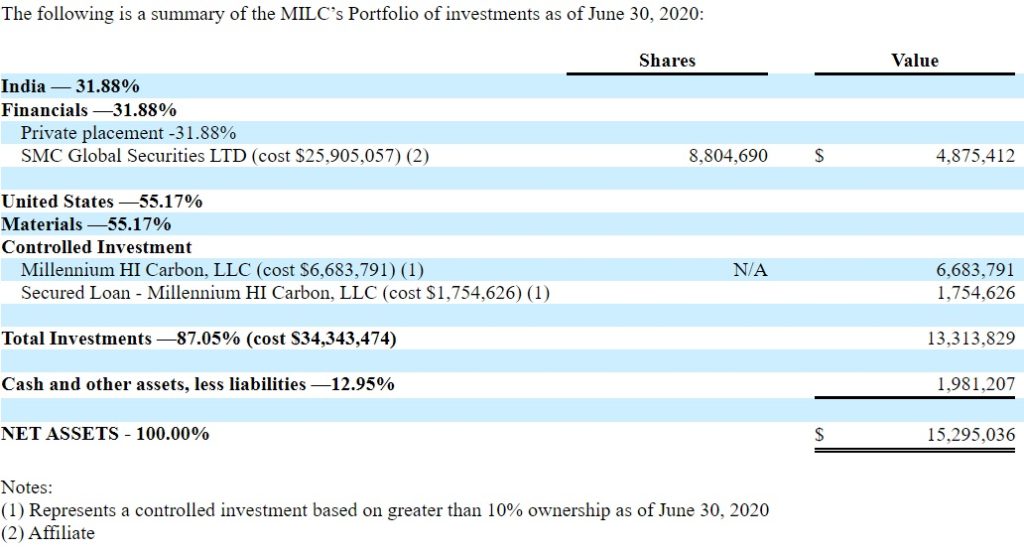

Given the shift from an investment holding to an operating company, MILC finds itself in the weird situation of not having a publicly shared balance sheet. At least not in “normal” terms.

All that I was able to find was a balance sheet from June 2020 that doesn’t raise any concern as the net assets were $15 million, but the truth is that we will find a very different balance sheet when the company finally posts a quarterly report.

I don’t expect to see any financial debt as the company has liquidated all of its stake in SMC recently.

Regulatory Overhang

But, of course, a PE of 1 or 2 doesn’t come without hair.

First, investors must believe that David and Jared will meet those numbers.

Then there’s the regulatory overhang. This is the biggest risk to investing in MILC.

The moment that cannabis is legalized at a federal level, everyone will be growing cannabis and the current barriers to “importing” cheaper cannabis from other states will vanish, thus making this a true commodity business where the cheaper producer will win.

As an example, Glass House Brands in California is producing at $150/pound and wants to take it down to $100/pound with scale.

I’ve been talking to fellow investors who have a better understanding of the regulatory environment than me and the general consensus is that the hypothetical legalization of cannabis at a federal level won’t be happening in the next year or two, but it’s a coin toss.

And then there’s the other side of the equation.

Legalization will mean lower margins, but it will also mean higher sales. Will legalization benefit or hinder MILC?

If we’re to believe in the management’s numbers, and if legalization really takes a few years, the current market-cap is low enough to de-risk an investment in MILC as the profits generated until the legalization comes will be enough to cover the current marketcap. At least in theory it works.

I haven’t talked to David yet and I’ll be trying to set up a call soon, but I would bet that he’s likely to have a plan.

I say this because the lease agreements that Power REIT has signed with MILC already account for a lower rent in the event that cannabis is legalized at a federal level which will lower the cost of capital for the entire industry (the banks will want to lend money and there will be more competition).

Conclusion

So, back to the beginning, this isn’t one of those beautiful businesses that I typically look for, but I like the management (from the limited sample available) and I like the price.

There are risks, but there is also the possibility that this doesn’t stop here and becomes a hugely successful speculation. There’s a big chance that we’ll be seeing Power REIT acquiring many more distressed greenhouses and leasing them out to MILC.

I realize that my knowledge of the industry is still limited, but I’m willing to learn as I go along. I don’t want to miss the boat in case the stock keeps rising as it has been doing recently. That’s why I’m posting this write-up on a Tuesday and not on Friday.

For those reasons, I’ve decided that I want to be part of this story with a 3% stake so I’ll be buying €5.000 worth of stock for the Portfolio tomorrow at close.

Subscribers interested in MILC should take into consideration that this will be the most speculative investment in the All in Stocks Portfolio so far.

* Note 1: The company also owns an activated carbon manufacturing facility in Hawaii, but I’m not ascribing any value to that right now.

*Note 2: As with Mama Mancini’s when I first profiled it, MILC isn’t available for trading in most online brokers and I don’t expect this to change anytime soon.

I’ve found it on Interactive Brokers and those are the commissions I’ll be considering in the Portfolio.

I’m sorry that MILC isn’t available to all subscribers. I’ll always be trying to find opportunities that can easily be accessed by all, but sometimes it just isn’t possible.

Further research material

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.