Miquel y Costas & Miquel

a fundamental analysis

Symbol: MCM (Bolsa y Mercados Españoles)

Share Price: €11,9

Market Cap: €353,4 Million

Miquel y Costas & Miquel: Share Price History

Source: Google

By Manuel Maurício

June 17, 2020

Business

Miquel y Costas & Miquel is a famous tobacco paper manufacturer from Catalunya, Spain. The paper industry is a commoditized one where there’s no relevant differentiation between products or suppliers. This makes it a price driven business where the low cost manufacturers usually have an advantage over their competitors.

But although Miquel y Costas belongs to such an industry, since 1725, the two founding families have been able to carve out their own niche where the technical skills, the quality of the product and its reliability are more important than just the price. Miquel y Costas is known for manufacturing special low grammage paper for the cigarette industry. If you live in Europe and you’re a smoker, chances are that you have tried its products.

Miquel y Costas & Miquel old factory

The tobacco paper industry is dominated by a few big players. The paper that is used in the cigarettes (both the white part and the filter) is a highly specialized product (it has to combine high tensile strength, low air permeability and perfect burning speed control) that is crucial to assure the overall quality of the cigarette. Each tobacco maker will require its own specific paper so this is a tailor made product, not just some random paper everyone can manufacture. And once the tobacco companies choose a supplier, it’s very unlikely that they’ll be stopping their machinery just to switch to another type of paper. It’s also something of a low cost product for the tobacco companies. Although I don’t have the data to back it up, I’ve read estimates that point to 1% of the overall cost of their operations. The combination of high technical requirements together with a crucial role for the client and a relatively low cost is what constitutes the moat for companies like Miquel y Costas & Miquel.

For instance, among the few players in the industry, Miquel y Costas was one of the first to manufacture paper with LIP technology (Low Ignition Propensity). The European lawmakers were trying to reduce the risk of fires caused by cigarettes. The LIP paper extinguishes itself if it’s not actively smoked. This and other technological advances are what makes Miquel y Costas & Miquel stand out in a dull industry.

Apart from that, Miquel y Costas is almost completely verticalized (it controls the production process from the making of the pulp to the end product) which allows it to control the entire process and keep the costs low. It owns a cellulose plant, the paper transformation plants, some paper brands (i.e. Smoking rolling paper) and even a biomass plant in order to offset its high energy costs.

Although the company is based in Spain, 88% of its production goes is destined to foreign clients and I would bet that the largest one is Phillip Morris International (the Marlboro maker) given that the country to which Miquel y Costas sells the most is Switzerland, where Philip Morris is headquartered.

Following a wise strategy

Although the tobacco business is a great business, fortunately the number of smokers in the western world has been declining for decades. The management knows this and it has been actively seeking to diversify away from its legacy business into other applications where it can leverage its extensive know-how. The Industrials segment encopasses a broad array of products such as teabags, coffee pods, paper money, separator materials used in car batteries, legal books, medication paper, and almost every specialized low-grammage paper that you can think of.

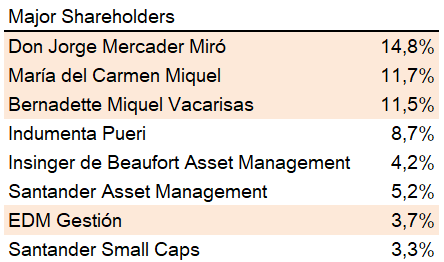

Owned and managed by old families

The two founding families still own about 41% of the company…

Source: CNMV

…and the CEO, Jordi Mercader Miró (the older gent in the middle), is the largest shareholder with 15% of the shares outstanding (up from 8,4% in 2008).

But these guys don’t tread lightly. Although the CEO is the largest shareholder, he earned €1,6 Million euro in 2019. Unfortunately, I wasn’t able to find how the goals are set for the variable compensation.

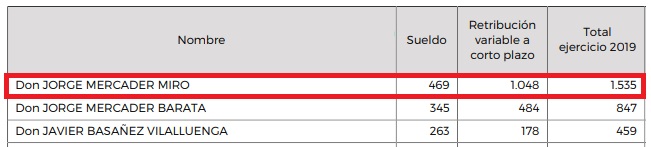

Management's strategy

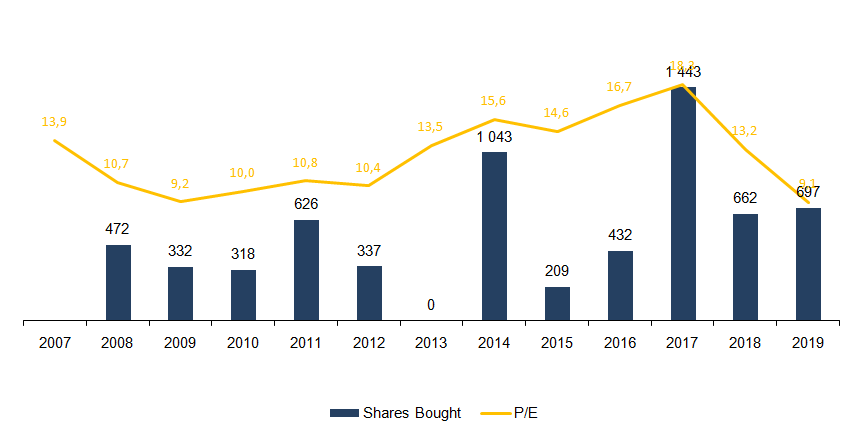

Except for 2013, the company has been buying back its own shares every single year. The fact that the major shareholders are in charge and are buying back shares should tell investors something about about their confidence in the future of the business.

*There is a mechanism – which isn’t reflected on the chart below – with which the company distributes new shares regularly as a kind of dividend. I am still to understand how it works.

Shares Outstanding and Market Cap

Source: Sentio, AiS estimates

But if we dig deeper, we’ll see that the largest share repurchases were made at times when the stock was the most expensive on a Price-to-Earnings basis. Or was the PE ratio the highest because the company was buying back its own shares? I believe we’re facing the chicken and the egg problem here.

Shares bought and Price/Earnings ratio

Source: Company data, AiS estimates

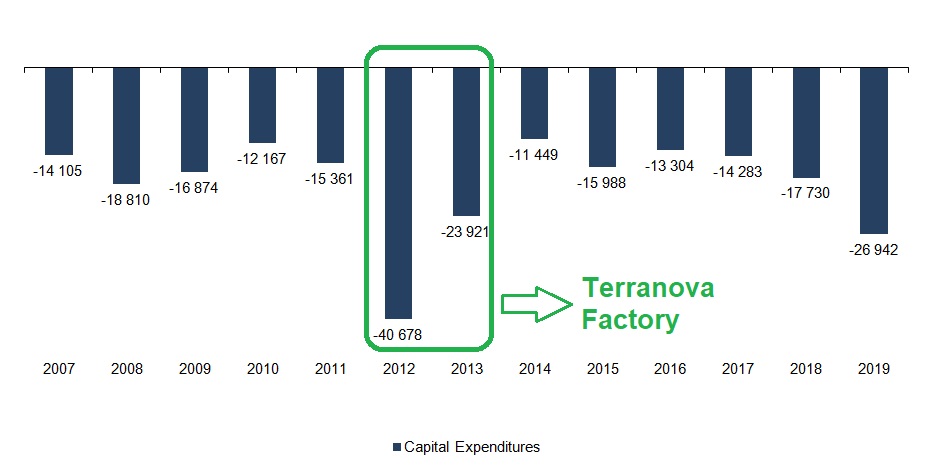

But the capital allocation strategy isn’t limited to share buybacks. In order to achieve the higher diversification of revenue streams we’ve seen previously, the management has made important investments such as the one in the high tech Terranova factory just outside Barcelona back in 2012. It’s there where most of the products that fall into the Industrial category are manufactured.

Investment in Property, Plant & Equipment

Source: Company data

Unfortunately (or not), the company is quite secretive about its facilities and it’s not easy to find a good photo of the inside of the factory. Most of the machinery the company uses is custom made or customized by the company’s highly specialized technicians.

And then, there’s acquisitions too, albeit in a much smaller scale. In 2018 the company bought Clariana, the Spanish leader in colored carton paper for €900 thousand. Clariana was struggling given that it filed for insolvency back in 2009 and Miquel y Costas was its saviour. Although this was seen as a good move for Miquel y Costas, I’m still not sure about it.

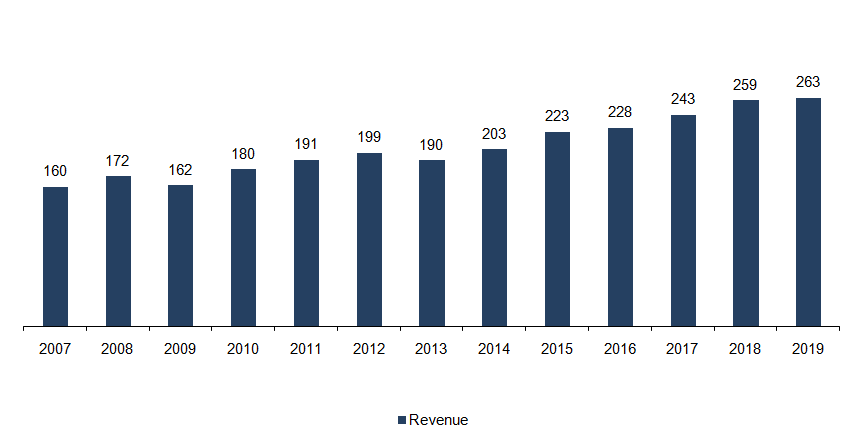

Strong and steady growth

And this strategy of continuous investment in the operations has led to a slow-but-steady growth over the years. On average, the company has been growing at 4% since 2007, having reached a record figure of €263 Million in 2019.

Revenue, € Million

Source: Company data

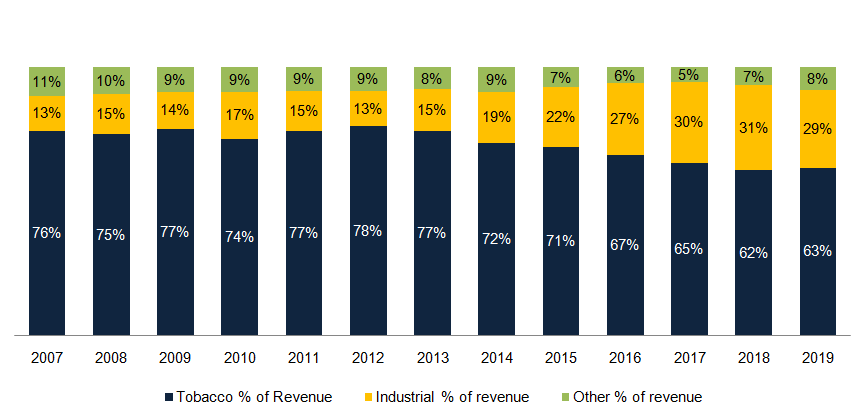

But although we’re talking about one company, I see it as two different business, Tobacco and Industrials. There is also a third segment, but I won’t be looking into that one today. The first thing I’ll want to be looking at is the relative weight of each segment in the company’s revenue over the years.

Revenue % by segment

Source: Google

The Tobacco segment still accounts for 63% of the business, but it has been declining and losing ground to the Industrial segment, especially from 2103 onward which coincided with the new Terranova facility.

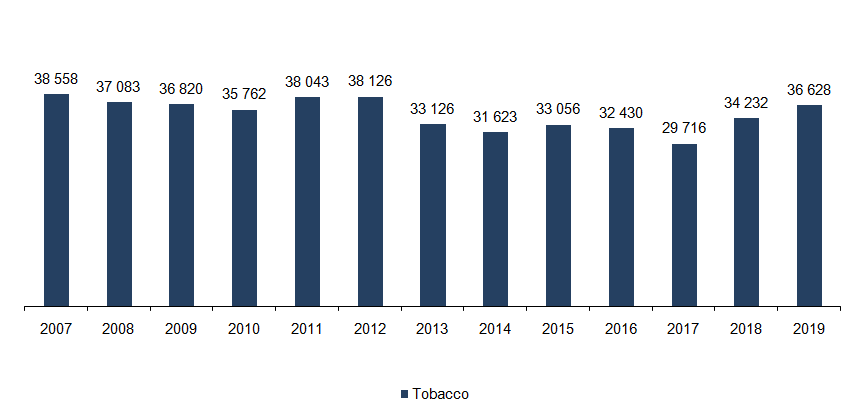

The second thing I’ll want to understand is if the Tobacco segment is declining or not. It’s widely known that the number of smokers in the western world is declining, but even in a dying industry, if a company is able to gain market share, it can become a great investment. So what I’ll want to be looking at are the volumes, measured in tones of tobacco paper sold.

Volumes, ton's

Source: Company data

I’ve been reading the competitor’s reports and it seems that the largest player in this industry has seen its volumes declining year over year while Miquel y Costas has been able to hold them more or less steady. This tells me that the company has been able to gain market share.

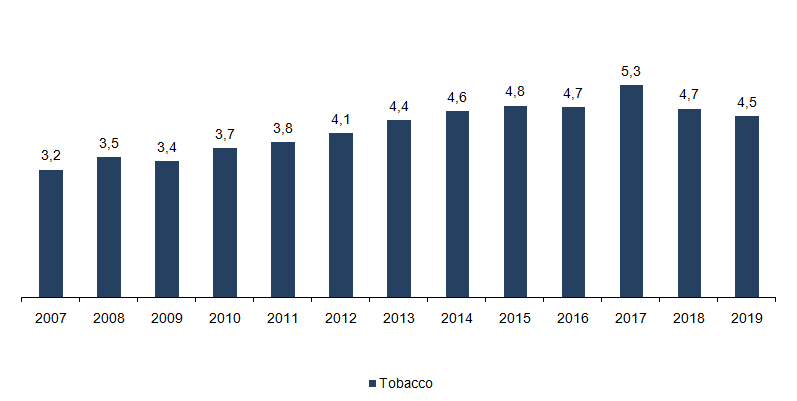

I’ll also be wanting to check if the company has been able to generate the same revenue from each tone it has sold or not.

Revenue p/ Ton (tobacco), € 000’s

Source: Company data

It seems that the company has been able to get increasing revenue per ton up to 2017 and lower ever since.

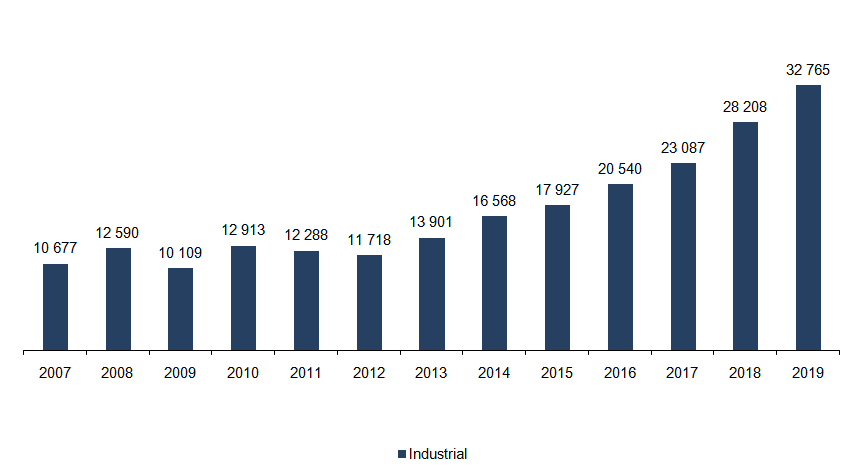

If we look at the Industrials segment instead, we can see how the company has been able to grow this segment quite nicely (especially after the Terranova investment in 2012). I wonder if the company’s factories are at full capacity. I believe so because the management is investing even more cash to get a 10% increase in capacity, but I would like to have this confirmed.

Volumes, ton's

Source: Company data

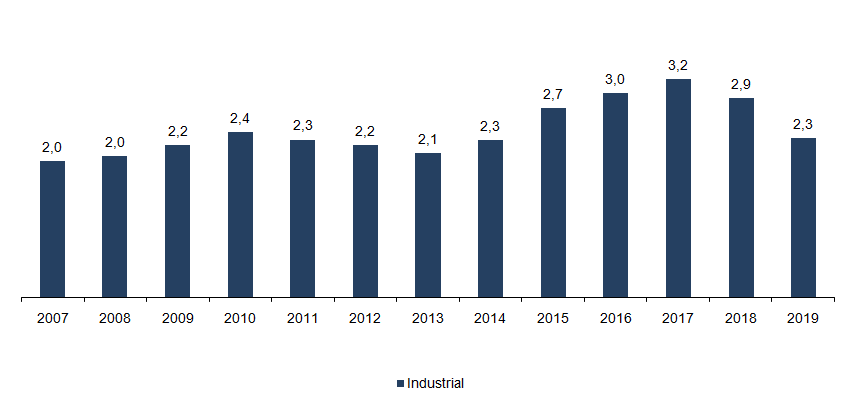

Both segments now account for roughly the same volume sold (46% vs 40%), but the tobacco paper, due to its specificity is able to be sold for a higher price than that of the Industrial segment (€4,5K vs €2,3K).

Revenue p/ Ton (Industrial), € 000’s

Source: Company data

The problem with looking a the revenue per ton is that, without knowing the cost of each ton of raw-material, we won’t know if the price variation was due to a cost-pass-through or not. I should be learning more about this.

Source: Company presentation

Margins and Competition

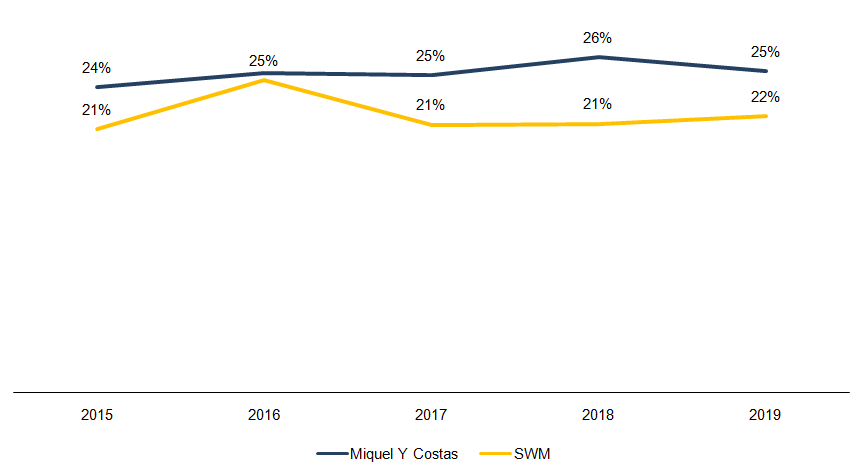

Miquel y Costas has got a few competitors in both segments. I’ll be comparing the Tobacco segment to SWM and the Industrials segment to Glatfelter, both of which are the largest producers in each specific segment.

By listening to the SWM Conference Calls you can understand that they’ve been selling less and less volumes of tobacco paper over the last few years and they’ve been diversifying away from this business into the plastics business.

I’ve seen several famous fund managers comparing Miquel y Costas margins to SWM, but while they separate the tobacco segment for Miquel y Costas, they don’t do it for the competitors, thus skewing the numbers in their favor. I wonder why they do this? It might be due to a junior analyst messing up or maybe it’s intentional.

Miquel y Costas has been able to get a higher operating margin in the tobacco segment, around 25%, over the years, against 21% of SWM. I believe this is likely fruit of its tight control over the whole process.

Operating Margin, Tobacco

Source: Company data

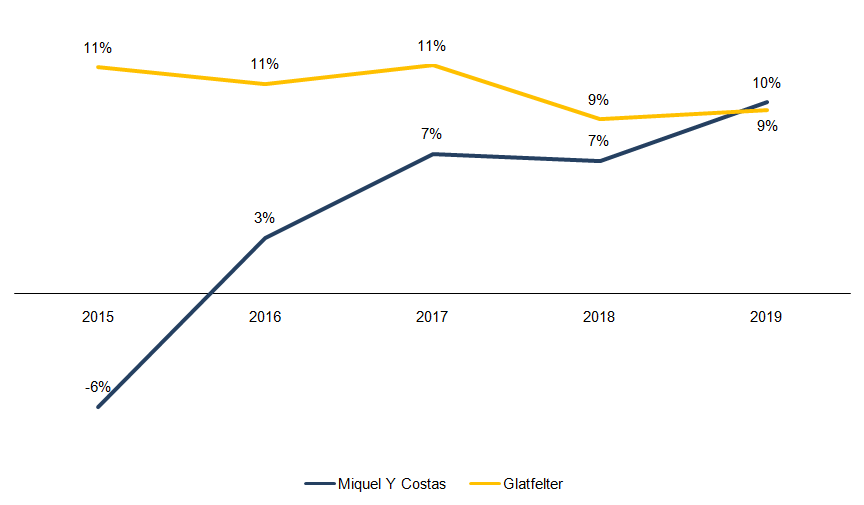

And the surprise here is the Industrials segment. Not only has the company been able to grow its revenue at a sound clip as we’ve seen previously, but it has also been able to streamline its production to a sound 10% operating margin versus a 9% for its largest competitor. It seems that these Catalan guys know how to run a tight operation.

Operating Margin, Industrials

Source: Company data

Although I like to see the company successfully diversifying away from its legacy business, I would much rather prefer that the new business had higher margins, not lower.

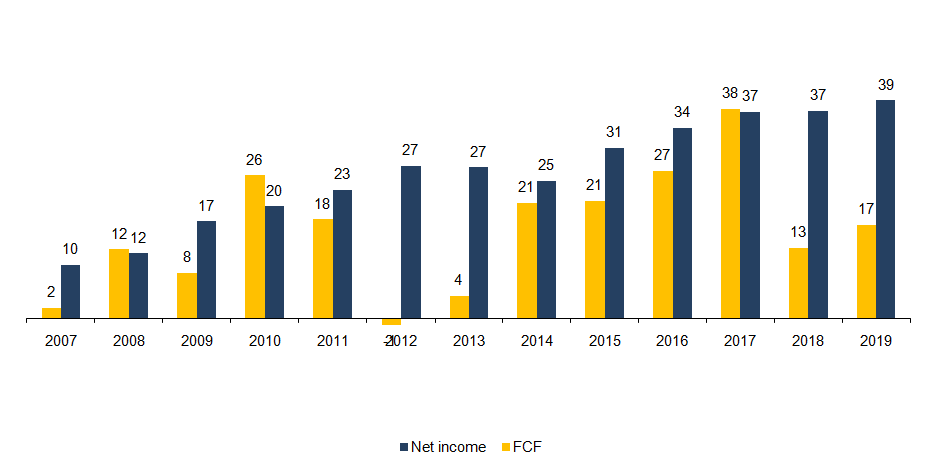

Net Income and FCF

The company has been profitable ever since 2007, but the FCF has been highly unpredictable and dependent on the management’s capital allocation decisions.

As we can see, in 2012 and 2013 it was -2 and +4 Million euros. This happened because the company was building its Terranova factory. Then in 2018 and 2019 the FCF was again much lower than the Net Income… humm, this got me thinking. Although the Capital Expenditures (in factories and machinery) was higher, it wasn’t sufficient enough to justify such a decrease in the FCF.

Net Income, FCF, € Million

Source: Company data, Ais estimates

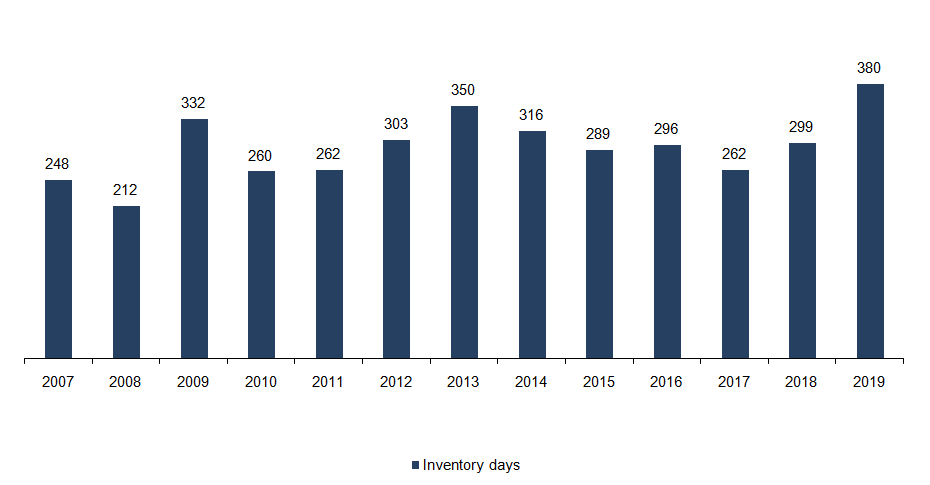

I went digging. And I found out that the reason why the FCF was so low was the increase in inventory. This can happen for one of two reasons, I believe: a) the company hasn’t been able to sell its inventory because of market dynamics, or b) it had to interrupt production and a lot of inventory just piled up. I will be sending an email to the company, but somehow I don’t believe they will give me a straight answer.

Inventory days

Source: Company data, Ais estimates

As a side note, the other two times when inventory piled up coincided with record revenue in the ensuing years (compare with Revenue chart). I wonder if that’s what we’ll be seeing this year. Again, without knowing the price of the raw-materials, I can’t know for sure if the company is buying more of it to take advantage of prices or if it’s just not being able to sell it.

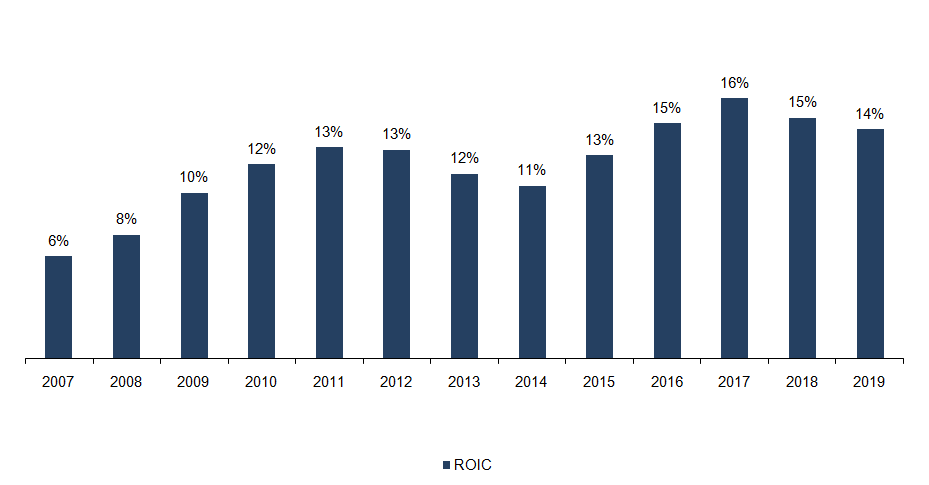

And we’ve come to one of the most important metrics of all. Some say it’s THE metric. The return on the invested capital. As we can see, this has been growing over the years with some ups and downs created by the acquisitions and inventory variations, but the important point here is that a mid teens ROIC is pretty good for such a business.

Return on Invested Capital

Source: Company data, Ais estimates

Balance Sheet

The company is in the enviable position of having net cash of €12 Million – this means that it could pay off all of its debt and still be left with $12M. This is not that usual for commodity companies that have low returns on assets and need to leverage up to compensate, and it goes to show the level of conservatism with which this company has been ran. Maybe too much, I might add. A little more debt would only benefit the shareholders.

The low debt bears interest at less than 1% and some of it will mature in 2020 and more in the ensuing years, but I’m certain the company will be able to pay it down or roll it over. I would like some clarification regarding what the short and long term financial assets are, but the company’s disclosures aren’t that great. That’s one of the reasons for such low interest from the investing community. What I do know is that it holds a 5% stake in IberPapel Gestion, another paper manufacturer from Spain.

Valuation Ratios

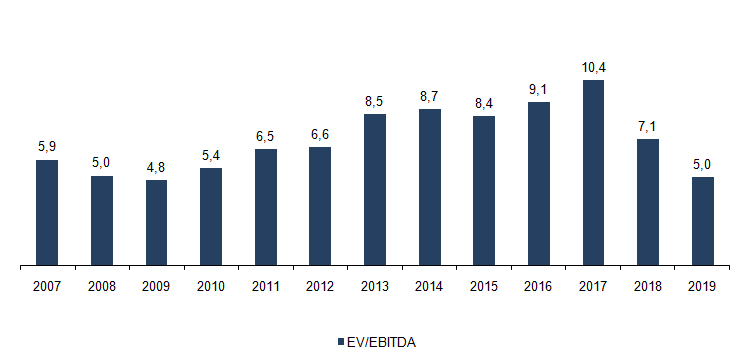

The stock is trading at €12 which means that Mr. Market is pricing the company at 5x EBITDA or..

EV/EBITDA

Source: Company data, Ais estimates

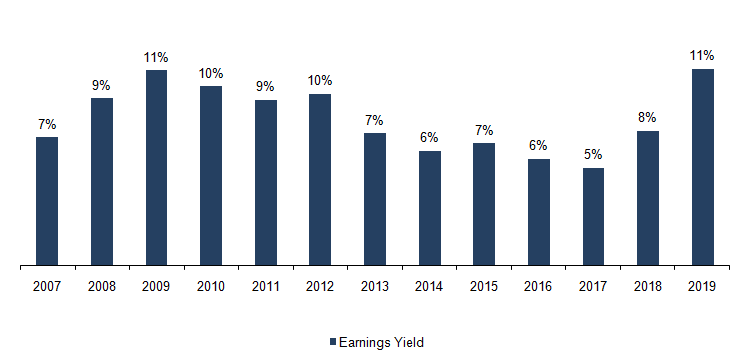

…an Earnings Yield of 11% (the earnings yield is the opposite of the PE ratio, so the higher the better). I believe that an initial earnings yield of 11% is quite good, don’t you think? I can’t see many investments that are able to give you such return right now, especially with such predictable revenues.

Earnings Yield

Source: Company data, Ais estimates

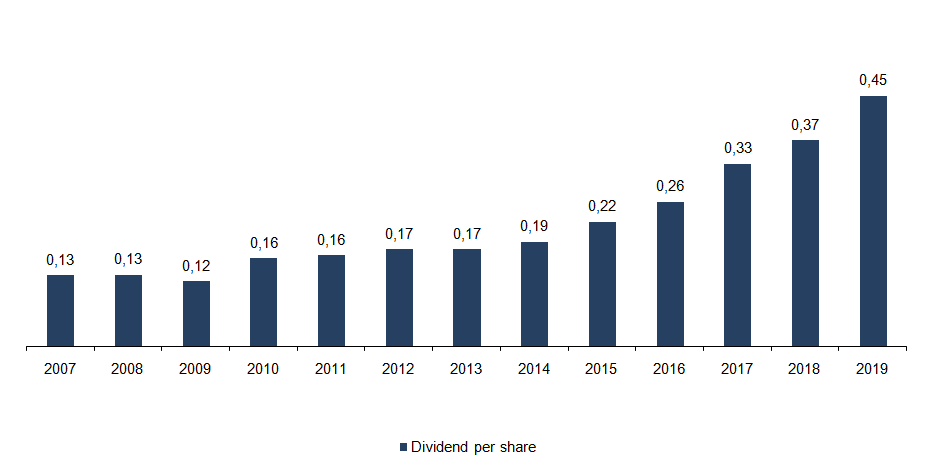

I almost forgot. There is also a dividend that has been growing forever. Right now the dividend yield is 3,7%. Think of it this way, you’re getting paid to wait for the stock to re-rate.

Dividend per share, €

Source: Company data

Risks

- Faster volume decline

- Increased competition in new segments

- Higher raw-material prices

- Difficulty integrating acquisitions

Valuation and Conclusion

The management has mentioned that they’re actively looking for international acquisitions with revenue between $100M and $300M and that they have the possibility to raise up to around €270 Million to do it. If they buy something at, let’s say 8x EBITDA, that would mean that they would be buying an additional $34 Million in EBITDA while still being conservatively financed at 2,5x EBITDA.

At a multiple of 9x, that would mean a share price of €22, more or less doubling from here. When will that be? I have no idea, but this is a solid company, with a moat and a strong balance sheet that will allow it to buy distressed assets if they show up. The fact that the owners still own much of the company and they don’t have plans to sell it also lets me sleep well at night.

But I’m not buying it right away because I still need to understand some things about the business before I get comfortable investing in it:

- the market share of the various competitors,

- the ability to pass-through the raw materials costs,

- how much of the raw materials are insourced vs outsourced,

- the production capacity of their factories (I fear I’ll never get the answer to this one),

- what are the long and short term financial assets (or this one),

- major industry dynamics,

- why is the inventory piling up

- how the share distribution dividends work

Having said all of this, it’s very likely that Miquel y Costas & Miquel will be entering the Portfolio soon.

Further research material

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.