Netflix

Q3 2020

By Manuel Maurício

November 13, 2020

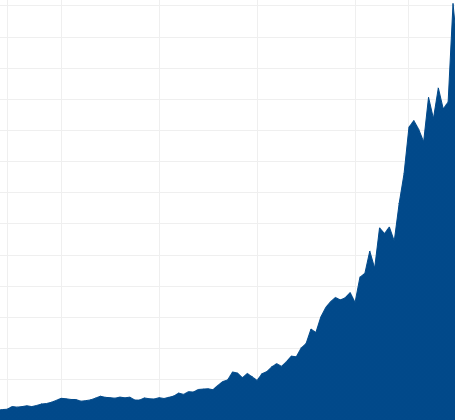

Just look at this chart…

Isn’t it amazing? Isn’t it a thing of beauty? It is.

But that’s not Netflix’s chart. That’s Microsoft’s chart on its magnificent ascent to 60 times earnings back in 2000.

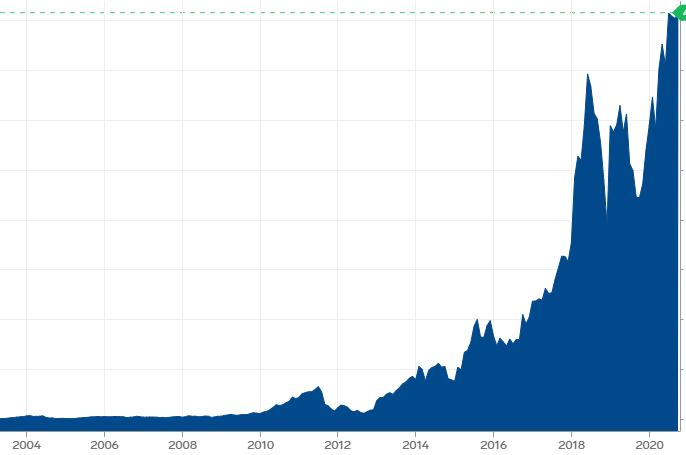

Here’s what happened next.

Investors had to wait for 16 years just to get to the same place. S I X T E E N years! This goes to show that a great business isn’t necessarily the same thing as a great investment.

Now, here’s Netflix’s chart.

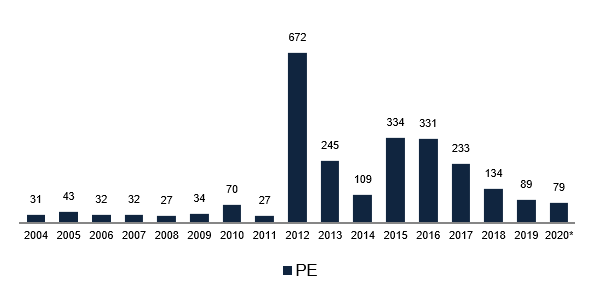

I’m not saying that the same will happen to Netflix’s shareholders, but the stock is currently trading at a Price/Earnings ratio of 79(!).

Yes, it was trading at 672x in 2012 and the shareholders still made big bucks, but there was no real competition back then, was there?

The meat of the thesis

I’ve cancelled my Netflix subscription recently and my girlfriend has subscribed to HBO on my suggestion that she might like Game of Thrones.

I could end this write-up here because I still feel Netflix has very low switching costs, but I know that Gonçalo Garcia, one of the subscribers, would say “One person isn’t sufficient evidence. Especially if YOU are that person“. He’s right. But then there’s a guy named Peter Lynch that would say “Buy what you know“… or, in this case, don’t buy what you know.

The reality is that Netflix has been a monster of a stock for the past, what, 10 years? I think it was one of the, if not the best performing stock of the past 10 years. It might’ve been Monster Beverage. Wait, let me check…

…from its lows in 2008 until today, Netflix has gone up 181 times (!!!) whereas Monster Beverage has gone up 24 times. Netflix wins.

So what has allowed Netflix to become this huge success story?

Many things. For me, the most important ones are a) a great (new) product, b) being in the right place at the right time, and c) taking advantage of slow competition. In fact, I don’t understand why the other guys took so long to get into the game. Their shareholders should be pissed.

But as the economical theory goes, when an industry has good returns on capital (does it?), the competition will come and eat away those returns. That is, unless you have a big moat. And that’s why I’m not bullish on Netflix.

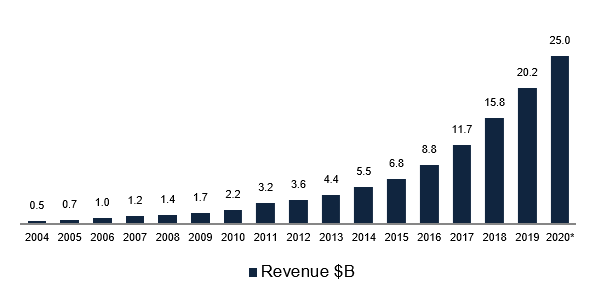

Let’s take a look at the financials to see if anything has changed.

The first thing to catch my eye is the b-e-a-u-t-y-f-u-l revenue chart.

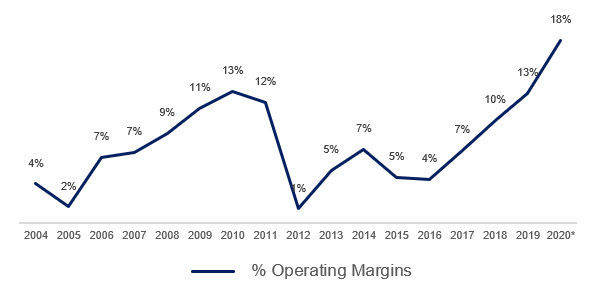

Which has led to a rising operating margin.

But this margin might not be telling the whole truth…

Net Income vs Free Cash Flow

Here’s where it starts to get interesting:

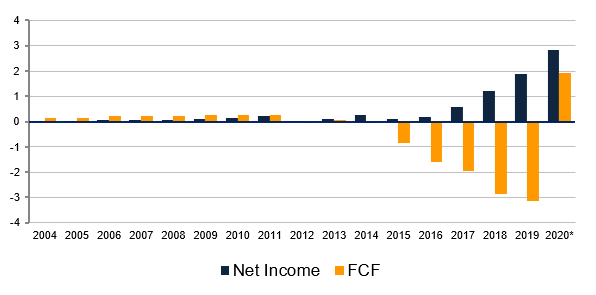

In the chart below I present the Net Income and the Free-Cash-Flow.

They’ve been going in opposite directions in recent years because the company has been growing fast. This has led to a mismatch between the lower content amortization on the Income Statement and the higher investment in content on the Cash Flow Statement.

This mismatch has been subject for some chatter. It seems that Netflix has been changing the amortization rate of its content in order to generate higher profits on the Income Statement. I find this very interesting, but I will spare you the details. Suffice to say that the profits that the company reports may be fruit of some accounting shenanigans.

That’s why we should also look at the Free-Cash-Flow. What I find interesting in the chart above is that, after years of burning cash, the company will finally be Cash-Flow positive in 2020. What has changed?

Much lower content spend due to the pandemic. All the productions were halted. This gives us a glimpse of the amount of cash that the company could generate if it took its foot off the gas. Let’s say it’s those $2 Billion dollars. At a Market Cap of $226 Billion, we’re talking about a Price/FCF of 113x. Yikes. In fact, let’s say that it’s three times that amount. It would still be trading at a Price/FCF of 38x.

But, as relayed on my previous write-ups, the halt in content spend can only be temporary. Netflix isn’t allowed the luxury of just ceasing to create content. Especially now that the big boys are coming.

You can say that the best directors are on Netflix, that the best screenplay writers are on Netflix, that the company will find new ways to prevent its subscribers from churning (it just announced a new Linear TV experiment in France), and yes, all that may be true. But the guys that are coming aren’t choir boys. It’s Disney, and Apple, and Youtube, and Amazon, and HBO, and the Peacock, and, and, and…

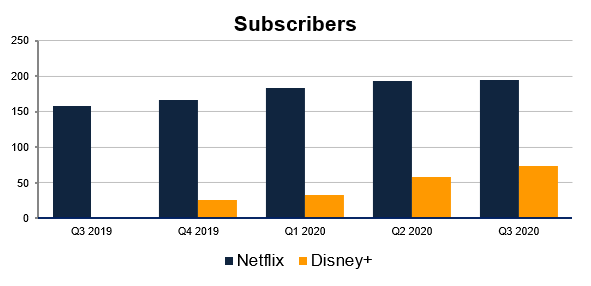

Disney+, which is Disney’s new subscription service, has gone from zero subscribers 11 months ago to 74 million today (!). In the spring of 2019, Bob Iger (previous CEO) had set out to reach the goal of 60 million subs by 2024.

Netflix has 195 million subscribers and it has been around for a decade in its present form. In the third quarter alone, while Netflix added 2.2 million new subscribers, Disney+ added 16.2 million.

Now, I can’t predict the future. In fact, one of the predicaments of intelligent investing as laid out by Ben Graham almost a century ago is that the future is something to be protected against in the first place. If there’s some profit to be taken, so much the better.

I don’t consider myself as a deep value Graham type of investor, but it’s not clear to me how Netflix will make money (and how much) when everyone is just starting to pour billions into this space. I’m not saying that Netflix won’t be a winner, it already is. I’m just saying that it’s not clear to me what will happen going forward, especially at this price.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.