Ocean Bio-Chem

a fundamental analysis

Symbol: OBCI (NASDAQ)

Share Price: $13.68

Market Cap: $130 Million

By Manuel Maurício

September 25, 2020

Introduction

I’ve been looking at a set of companies that are being directly benefited from the pandemic. Mask manufacturers and disinfectant manufacturers all are seeing huge spikes in demand. If Ben Graham was alive, he would promptly urge me to dismiss them because the current spike in demand is just that, a spike. Or maybe he would ask me “How sure are you that this spike is going to last or be transformative for these companies?” That’s what I’ve been trying to answer.

One of those opportunistic plays created by the recent COVID-19 pandemic is the company I’m bringing you today, Ocean BioChem.

Business

Ocean Bio-Chem is a family-run manufacturer of maintenance and disinfectant products for boats, cars, recreational vehicles (RV’s) and home. It sells its products under the brands StarBrite, StarTron, and Performacide. The company is headquartered in Fort Lauderdale, Florida and it has one manufacturing plant in Montgomery, Alabama.

Ocean BioChem is an old company. It was founded back in 1973 by Peter Dornau who took it public in 1981. Historically, the company’s strongest segment has been the marine segment to which it sells all types of products, from hull cleaners to sealants or waxes. But although the company doesn’t disclose its segment numbers, there’s another segment on the spotlight right now.

With this virus around, every single institution, be it hospitals, schools, universities, government organizations, banks, railroads, you name it, will be cleaning everything all the time.

That’s where the 2014 acquisition of Performacide, its hospital grade disinfectant, starts to earn its stripes. Performacide works in a rather peculiar way. It comes in paper pouches and you just throw them into a bottle with water (sold together with the pouches) and voilà. You can scrub the floors, tables, chairs, whatever you’d like with it. Because it comes in small paper pouches, it doesn’t take as much space as the typical plastic bottles, making it a pretty handy solution for institutions that must stock a lot of disinfectant.

The best thing about it? It is certified to kill the COVID-19 virus.

Now, as with the other companies that I’m looking at right now, the hospitals/ schools/ government-agencies will want to keep stockpiles of this stuff. And although I argue that we humans have a lousy memory for bad stuff, I’m willing to bet that the fear of a new pandemic outbreak will linger in our minds for some years.

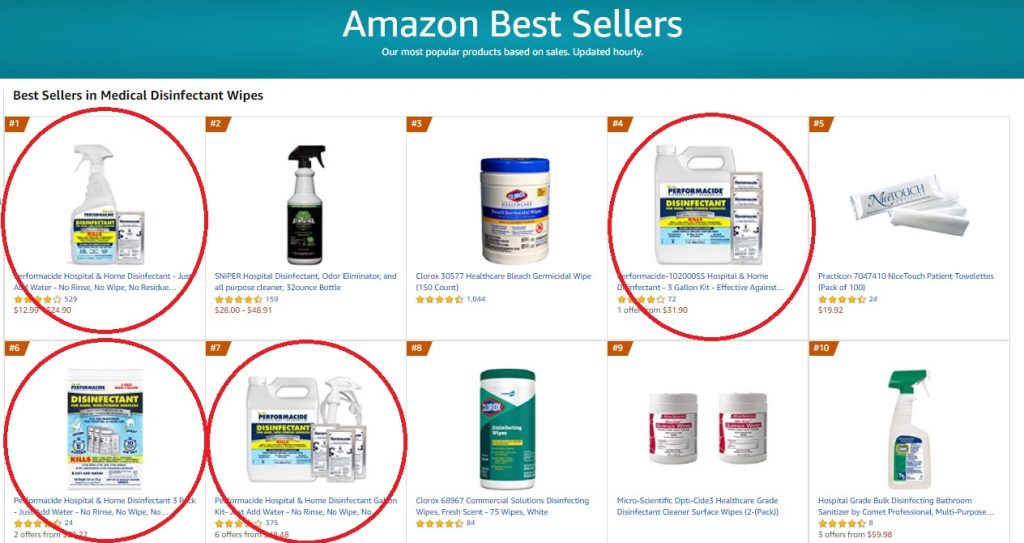

I’ve googled around and although the marine products all have the highest ratings on Amazon…

… I’ve read terrible reviews about Performacide. Much of the criticism is due to the short shelf life (15 days once opened), the difficulty of use (after mixing the pouches with water, you need to wait for 1 hour) and the poor quality of the spray nozzles. I can understand the arguments, but this is a product that was primarily developed for intensive use, not exactly for domestic use. Even so, I would like to understand what steps the company is taking in order to improve the shelf life. I’ve sent the CFO an email and I’m waiting for a reply.

But even with all the bad reviews, you’ll find 4 Ocean BioChem’s products in the Top 10 of Medical Disinfectant Wipes on Amazon.

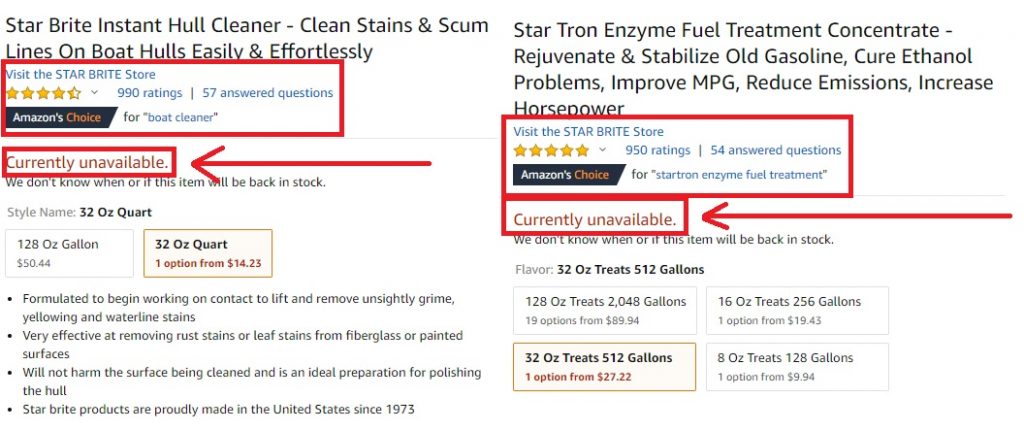

By the way, did you notice that all the Perfomacide products were “Currently Unavailable” on Amazon? The company is seeing such a surge in demand that it’s been hard to keep up with.

Manufacturing expansion

Back in 2017, the business was going so well that the company decided to make a third expansion to its plant (little did they know that only a few years later the world would be plagued by a virus). As you can see from the image below, the new expansion is the last section on the corner of the image. It’s about 8.000 square meter. Together with this, the company has also added new tanks to its tank farm with an additional capacity of 1.900 litres.

In order for you to get a picture of what their plant looks like, I recommend you to watch the video below. They even make their own plastic bottles.

If you read the press releases that the company has been posting since the start of the pandemic, you’ll see that the Recreational Vehicles (RV) products have been growing at double digit (it seems that because people can’t fly, they drive) and the demand for Performacide has been huge.

Since the beginning of the year the company has tripled its Performacide production capacity and it’s still not enough. In August the company said that it was building a third production line just for Performacide. Then they said that this third production line still wasn’t enough and that they were in the process of designing a high speed line of production just for this product alone. Clearly things are going pretty well.

Management and Ownership

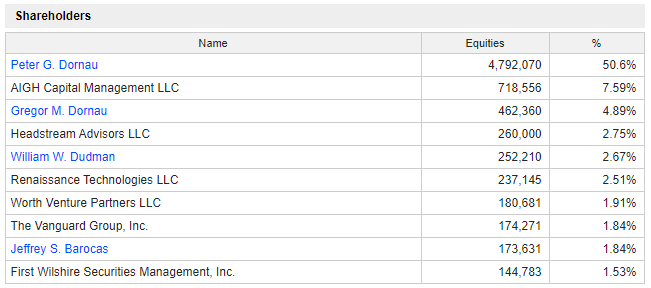

Peter Dornau (79) is the founder, CEO and Chairman of the board. Together with his son Gregor, they own 55% of the company. From the list of the larger shareholders, I can also spot the now famous Renaissance Technologies with 2,5%, and the quant fund O’Shaughnessy Asset Management with 0,13% (not shown in the image below).

Although I typically like to see a founder-led company, in these microcaps where the CEO is also the Chairman, investors can’t do much if they’re not happy with the management or the board of directors.

Financials

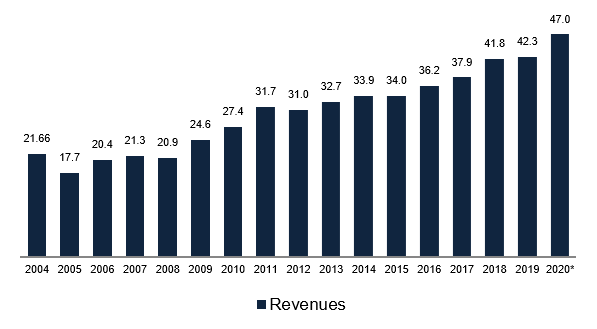

The revenue has steadily been going up at a 6% CAGR in the past 15 years.

Revenue, US$ Millions

Source: Company data, AiS estimates

I was intrigued by the decrease in revenue in 2005. It turns out that a major customer (West Marine) had its inventory policy revised , significantly reducing its inventory needs, thus buying less product. This goes to show the perils of high customer concentration.

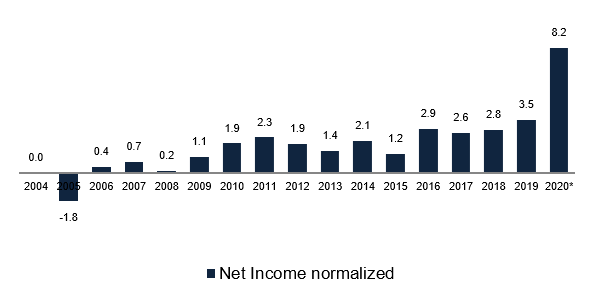

The net income has been positive ever since, and we’re witnessing a huge surge in profits in 2020 due to the higher revenue and some operating leverage (costs not rising as fast as revenue). Now, I’ve conservatively estimated Net Income of $8.2 Million for 2020, but it can easily be much higher. Given that there is no guidance from the management team and this is the first pandemic we’re going through, your assumptions are as good as mine.

Net Income, US$ Millions

Source: Company data, AiS estimates

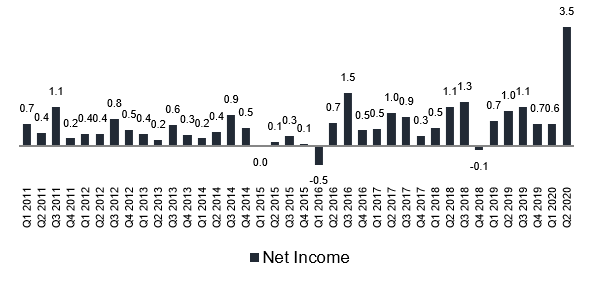

If you’re interested in financial modelling, here’s how I got to my estimates. Given that the management has said that the second quarter results are more indicative of the company’s financial current financial performance, I’ve assumed that the third quarter will be at least in line with the second quarter ($3,5 Million in profits), and that the fourth quarter will be in line with the first quarter. Both of them will very likely be much higher, but I prefer to stay on the conservative side.

Quarterly Net Income, US$ Millions

Source: Company data, AiS estimates

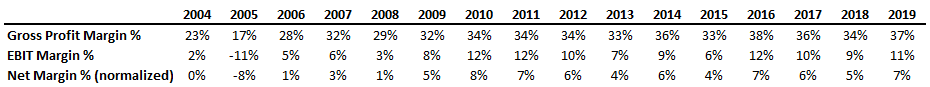

The historical net margins have been in the low to medium single digits.

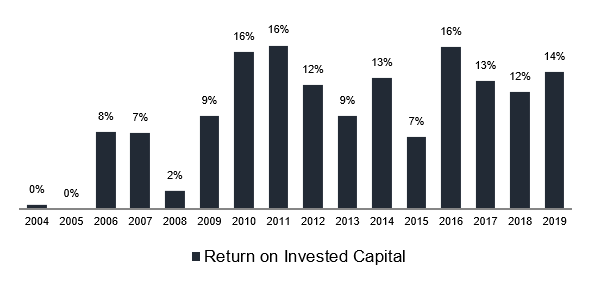

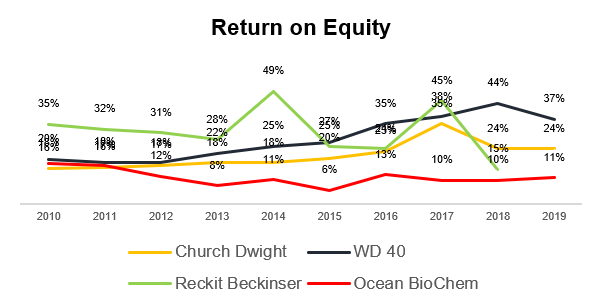

Which has led to a pretty average return on invested capital…

…in an industry where the best companies can reach high returns on capital.

Balance Sheet and Profitability

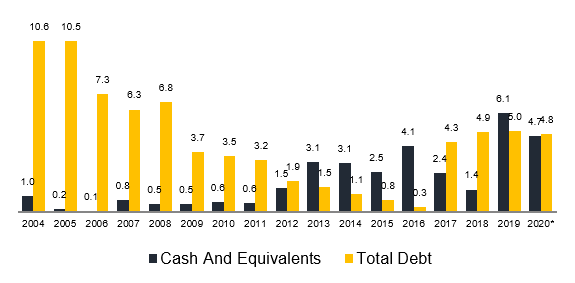

With $4,7 Million in cash and $4,8 Million in debt, there should be no worries about the balance sheet. In fact, one could argue that the company has been ran too conservatively. A bit more debt wouldn’t hurt it, right? Or it could return that excess cash to the shareholders.

By the way, the company still has $1,4 Million in restricted cash (from the last funding) that it’s already using for additional capital improvements.

Valuation

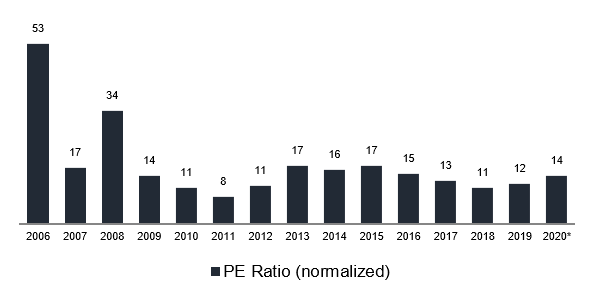

Over the years, the company’s PE ratio has wobbled between 8x and 17x on a normalized basis. Depending on ones estimates, the 2020 PE ratio might fall somewhere between 7x and 14x, in an industry where PE ratios are usually around the mid 20’s and can go as high as 50x (for WD40).

Competition

Given Ocean’s breath of products, the company considers that there is no single competitor, but several of them, each one in its own segment. Some of them would be the giants Unilever, Reckitt Benckiser or Procter & Gamble, or WD40.

Risks

- Customer concentration

- Key-man risk

- One manufacturing plant

- A lot of institutions own it. If anything goes wrong, these institutions will sell the share indiscriminately and we’ll see the share price go down a lot.

- Small auditor

- Economic downturn and less boats and RV’s bought

Thoughts on the business

As those of you who know me well are aware of, I’m not the type of investor who pursuits short term fads.

BUT, if the company is able to replicate the current revenue and profits going forward, it will likely be earning $1,2 per share in 2020, which at 15x would mean a share price of $18, or a 33% upside from here. If it’s able to get $2 per share, at a 15x valuation, that would mean an upside of 2,3x!

Now, one could argue that with the hard times that lie ahead, the company’s largest segment, the marine products, will surely take a hit because boats are big ticket items and people won’t buy them if they’re unemployed. That’s true, but absurd as it may seem, the sale of recreational boats in the US is actually going up, not down.

The other large segment, the Recreational Vehicles is also seeing a surge in demand because people can’t fly so they go out on road trips. That I can attest to because I’ve been hearing a lot of chatter about RV’s being sold out in many countries.

What I do believe is that this company can easily be sold to a larger competitor. It has good brands, good products, and a player with stronger distribution and marketing power could really do something with it.

Conclusion

I would definitely like to own a business such as Ocean BioChem, but I would have to be sure about what the management intends to do with the cash that the company is currently generating and I would also like to talk to the management to get a feeling for what type of people they are. I’ve sent an email to the CFO and another to a former employee of the company, but I haven’t had any replies so far. I’ll tell you when I do.

Further research material

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.