Orca Energy

a fundamental analysis

By Manuel Maurício

December 15, 2020

Symbol: ORC.B (CVE)

Share Price: CAD$6.08

Market Cap: CAD$246 Million

Introduction

Orca Energy has CAD$5 of cash (per share) in the bank, it will likely be making $1.5 per share per year going forward, and it trades for $6.

Basically, Mr. Market isn’t ascribing any value to the future cash flows.

This is how I got sold to the idea of investing in Orca. Interested? Read on.

Business

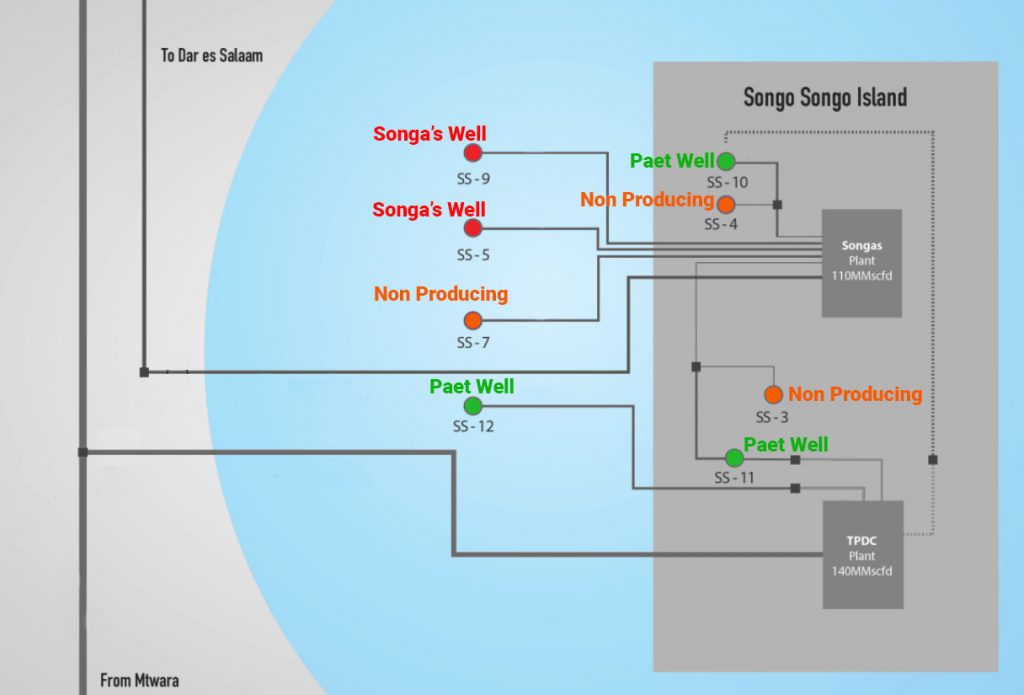

Orca is a gas production company that manages wells off the cost of Tanzania on an island called Songo Songo Island.

In the case your geographical knowledge is a bit rusty, Tanzania is located on the west coast of Africa, right below Kenya, and above Mozambique.

The Songo Songo gas field was discovered in 1974, but it was only in 2004 that it came onstream.

Gas is currently being extracted through 5 wells, processed in 2 processing facilities on the island and delivered to the capital, Dar es Salaam, via two parallel pipelines.

Understanding all of the parts involved in this story isn’t easy, but I will try my best to make it clear.

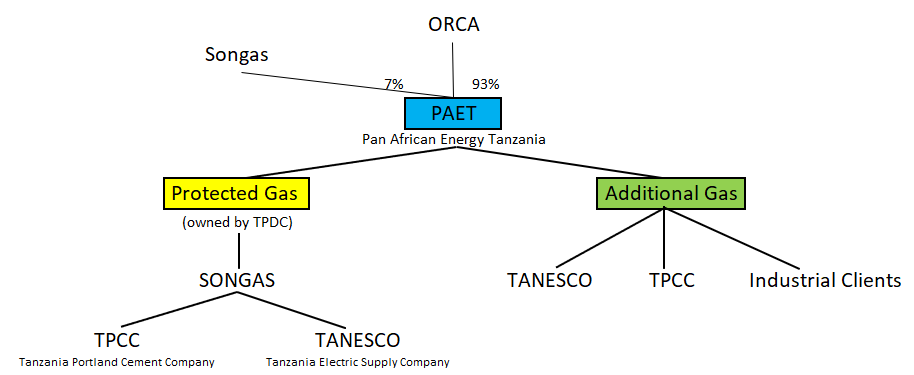

Orca owns 92% of Pan Africa Energy Tanzania (PAET), which is the Tanzanian company that actually extracts and processes the gas. The other 8% is owned by Swala, a local company.

PAET (Orca) has a Profit Share Agreement (PSA) with the Government of Tanzania and its national oil company Tanzania Product Development Corp (TPDC). This agreement allows for Orca to extract and sell gas until 2026. There might be a chance for renewal after that, but it’s better not to count on it.

Under this Agreement the gas extracted from the Songo Songo Island is divided into Protected Gas and Additional Gas.

PROTECTED GAS

Protected Gas is owned by the Tanzania Product Development Corp, (it’s the state’s gas) and sold to Songas, a local gas-to-power company owed, in part, by the same TPDC. Songas owns some of the Songo Songo wells as well as a processing plant on the island.

PAET operates Songas wells and Songo Songo gas processing plant on a “no gain no loss” basis. This means that the company earns no revenue from the Protected Gas.

This agreement ends in 2024, but the company’s can explore the gas reserves until 2026. This means that the Protected Gas won’t be protected between 2024 and 2026, thus meaning additional revenue for PAET (Orca).

The Protected Gas that is delivered to Songas is then sold to the Tanzania Electric Supply Company (TANESCO) and to the Tanzania Portland Cement Company (TPCC).

ADDITIONAL GAS

The additional gas is all the gas produced in excess of the Protected Gas. That’s the actual gas that the company makes money from.

Tanzania Electric Supply Company (TANESCO) is a state-owned company that supplies the majority of the electricity in Tanzania.

PAET (Orca) supplies gas to TANESCO in 2 different ways. First, indirectly via the protected gas supplied to Songas (mentioned above) and second, directly via the agreement that ends in 2026 which relates to the Additional Gas (the one that counts for the profits).

Confused? Don’t worry, here’s a diagram to help you understand.

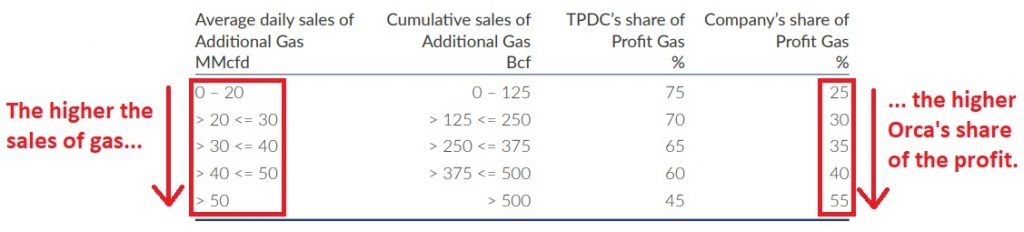

Now, regarding the right side of the diagram – the Additional Gas – the company shares the profit coming from this gas with TPDC which is just an arm of the Tanzanian Government.

The higher the sales, the lower the share of profit that goes to the Government and the higher the share of profit for Orca (see image below). This way the company is encouraged to increase production over time.

Just so you can get the feeling for the opportunity, only 37% of the Tanzanian population has access to the grid, and that percentage has been increasing fast. The government plans to increase that percentage to 100% in 2030. This means that the demand will only go up.

Orca – or should I say PAET – is also entitled to recover all costs incurred in the exploration, development and operations of the project. There are some additional details and contractual fine print, but I won’t bother you with that or else we would be here until the end of 2021.

Suffice is to say that whatever the company spends on improving the operations, it will be repaid eventually (!).

Financials

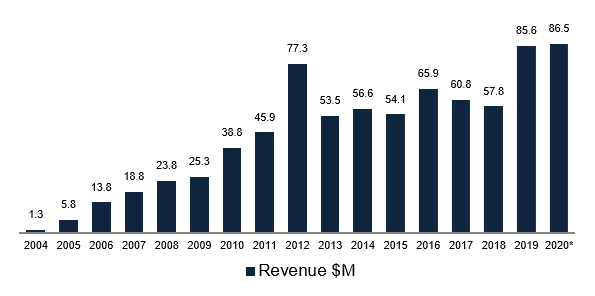

As we can see, the revenue is quite stable and predictable. The increase in 2019 was due to recent work of refrigeration that led to higher volumes of Additional Gas sold, and to higher demand.

* All figures in this write-up are in USD, unless stated otherwise.

And this is expected to increase going forward. The company has also commenced work for compression that will be required in 2021 to sustain gas pressure (over the years the gas wells lose pressure).

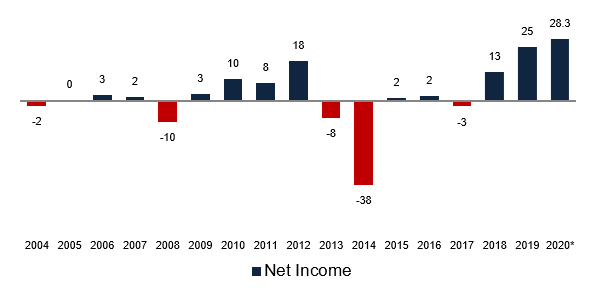

The net income hasn’t been as constant as the revenue, but it’s expected to stabilize, or should I say increase, from now on.

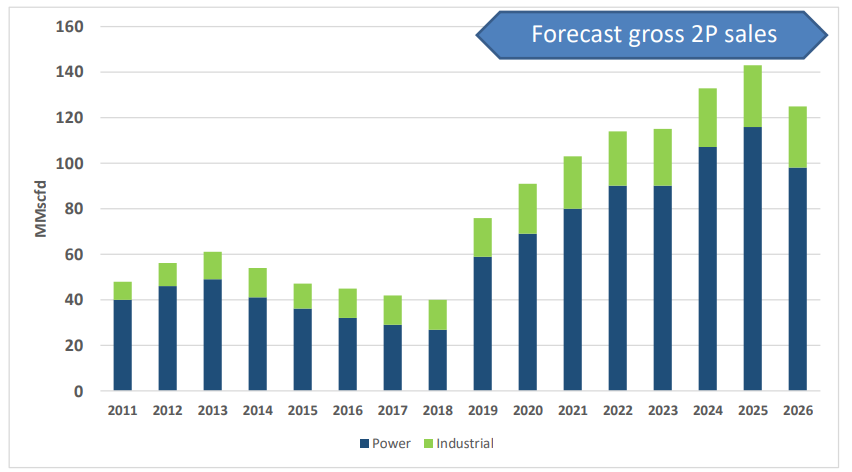

TANESCO, which is the major client, is completing an expansion to one of its power plants (Kinyerezy 1) which should need an additional 30 MMcf/ day.

I’m not sure if this will be sourced from Songo Songo or from the other Gas field in the South of the country (Wentworth Resources is the operator), but even if this was a 50/50 split, it would mean an increase of 25% of daily volumes by 2022. And this could be accomplished without further CAPEX.

On top of this, there are other power plants in construction that will need gas coming from the Songo Songo Island. The image below was taken from one of the company’s presentations and illustrates quite dramatically the increase in demand expected for the next few years. This isn’t for Tanzania as a whole. This is just the demand for Orca’s gas.

Balance Sheet

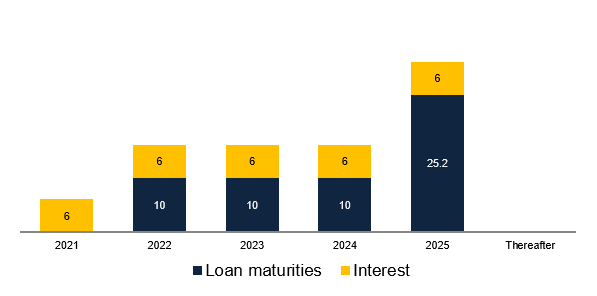

The balance sheet is very strong, with $98 Million in cash and $55 Million of debt with maturities spread over the course of the next 5 years.

The interest coverage ratio at 6x is also very comfortable. I would say that if there is any risk for investors looking to invest in Orca, it’s not on the balance sheet.

In fact, the cash on the balance sheet is one of the main components of the margin of safety. In such situations, investors should know where the cash is kept. The company has stated that “the majority of the cash is currently held outside of Tanzania“. Good to know.

Tanesco Receivables

This is where the story starts to get fishy (and interesting).

Tanesco, which is the company’s largest client, stopped paying its bills around 2011/12, coinciding with the share price plummeting. At first, I thought that it was the Tanzanian Government playing around with international companies, maybe showing intentions of nationalizing the company a la Venezuela.

But that wasn’t the case. Tanesco didn’t pay because it didn’t have the money to do so. Fast-forward a few years and the World Bank intervened and Tanesco started to pay its debt.

That’s still occurring today. Orca invoices Tanesco for the current volumes and Tanesco pays not only the amount due for the current volumes, but also some of the money that it should’ve paid Orca years ago. It goes through the Income Statement as Financial Income.

This amount, which should be accounted for as Receivables on the Balance Sheet have been provisioned for (meaning that it’s not there anymore), because it wasn’t reasonable to believe that Tanesco would ever pay it.

Right now, the amount owed is $31 Million. If the company will ever see the full amount is anyone’s guess.

Dispute with the Tax Authority

Then there’s an important incident that took place earlier this year. The Tanzanian Revenue Authority forced the company’s bank to release $5.3 Million from the company’s bank account to the Tax Authority. This wasn’t polite.

The company is of the opinion that there is a better than 50% chance of winning the dispute with the Tax Authority.

I have no clue as to if that’s going to happen or not. I just feel that this shows the perils of investing in countries where the law enforcement isn’t as clear as in other countries.

Shareholder Structure and Ownership

Until very recently, the company was looking to expand its operations by acquiring other gas companies in Africa. It even hired RBC Capital Markets, an investment bank, to find targets. But that’s all gone now.

Orca has a dual stock structure with the A shares having 20 voting rights each and the B shares 1 voting right each. The A shares, although much fewer in number (5% of the total), control 59% of all the voting rights. The WDL Estate owns most of the A shares. The WDL estate is the estate of the late David Lyons, who was the founder, Chairman, CEO, and largest shareholder of the company.

In 2018, Orca sold a 7.9% ownership in PAEM to Swala Oil and Gas for US$15.4 Million and US$4 Million in Swala convertible preferred shares. This operation valued the whole company at US$246 Million or CAD$314 Million. The company can be bought today for $246 Million, much lower than an informed buyer would pay for it.

Just recently, there was a big shift in power; the CEO was fired, and Jay Lyons, the brother of the late David Lyons, took over. He is currently the interim CEO and he abandoned all efforts to grow the company by acquisitions.

The company’s most recent statements mention that the company is pursuing a strategy of “continued value maximization through the optimization and monetization of the Company’s rights to develop the Songo Songo natural gas field and to suspend ongoing efforts to acquire and develop an integrated gas business in other African countries”.

There are signs that Jay Lions is looking to slowly liquidate the company.

Although there is the chance for a renegotiation and extension of the Profit Share Agreement with the Tanzanian Government, investors are better off not counting on it. One should assume that the company will close doors in 2026, even if the Songo Songo West and North areas (currently unexplored) have HUGE gas reserves.

Share Buybacks

This is a very different story from the ones that are constantly making the headlines with high growth rates. But investors should understand that value can be found in many different situations.

A liquidating company can be a great investment. Investors just need to buy it at the right price and be sure that the directors and managers return the cash flows to the rightful owners (aka the shareholders).

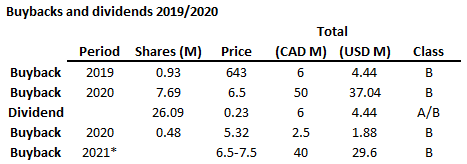

And in the case of Orca, that’s exactly what they’ve been doing. The company has been buying huge amounts of shares while raising its dividend.

In 2019, the company repurchased 20% of the total shares outstanding. As if this wasn’t enough, in December 2020, it announced a new massive share repurchase of $40 Million, or 16% of its Market Cap.

Valuation

There are several ways one can value such a company. In fact, it should be easy. One of the ways is by calculating the Net Asset Value. I’ve done some calculations, but it isn’t as easy as it seems.

Should one account for the $32 Miliion owed by Tanesco that are slowly being paid down? What about the interest on those receivables? And what about the debt on the balance sheet?

You see, although the Balance Sheet shows $55 Million in debt, it’s the subsidiary PAET that owes that money, not Orca. Orca, the holding company, only guarantees $30 Million. In other words, it’s complicated.

But we can try our best at guestimating the future cashflows up until 2026. That should tell us how much the shareholders will earn. On one of its presentations, Orca let’s us know the volumes it expects to be selling going forward.

If the company is able to generate $40 Million per year until 2026, and if we discount it back at 15% (this is called discounted cash flows method of valuation), we would be looking at a Net Present Value of CAD$15. The stock is trading at $6.2, so I would say that, from the math alone, the margin of safety is there.

Competition

The largest competitor is the Hydro generated power, but that has limited capacity. There is one other Gas provider operating in the south of the country, Wentworth, and that has been seen as a potential acquirer of the company.

All in all, the increase in demand in the next few years will be more than enough for all the players to get a piece of the pie.

Risks

- Unstable government with dictatorial tendencies is the major risk for the company

- Operational issues

Thoughts

A company selling for such a low valuation together with the steadiness of the cash flows is a value investors’ dream. Or is it? The cash is there, the cash flows are there, the margin of safety granted by the financials is there. But there are risks associated with the jurisdiction.

If the Tax authorities can take $5 million from the company’s bank account and the major client can just stop paying, investors aren’t safe.

Now, there is also the other point of view. Tanzania has some of the largest gas resources in the world and it will try to explore them and sell them abroad. But it can’t do it alone. It needs the help of foreign companies.

That’s why TANESCO has been paying off its debt, and why some investors believe that the government won’t do something stupid. No foreign company will want to do business without some assurance that it will be paid.

Note that I’m not saying that investors won’t come out of this with massive value retrieved to them. This is a great story. What I’m saying is that there is a possibility for it to crumble down.

The company is buying back shares. That’s tax efficient and allows for remaining shareholders to get a bigger piece of the pie (the cash flows). But what if those cash flows are interrupted for some reason? The price at which the company has been selling for has been roughly equal to the cash in the bank, and that’s for no reason.

That’s the only guarantee that shareholders have. If the company spends it in buybacks, there will be less cash in the bank right after the buyback. It’s true that, later on, there will be more cash accruing to each share, but there’s risk.

As odd as it may seem, in this case, I think I would prefer special dividends to buybacks. You see, the dividend, although not tax efficient, would de-risk the investment. The cash would be put in the shareholders’ hands.

Conclusion

I had already made up my mind not to invest in Orca (I sold the few shares I had left last week), but today there’s rumors that the WDL Estate (the CEO and his family) are selling their shares to the new share repurchase program.

They won’t be able to sell them all because the repurchase will be done on a proportional basis, but that goes to show that the guys who are in control are trying to get out.

Orca Energy is a great story, but that’s it. I’m not buying it for the Portfolio.

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.