O'Reilly

a 200 bagger stock

By Manuel Maurício

July 09, 2021

Symbol: ORLY (NASDAQ)

Share Price: $581

Market Cap: $40 Billion

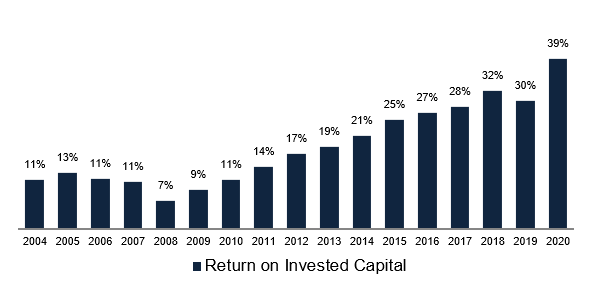

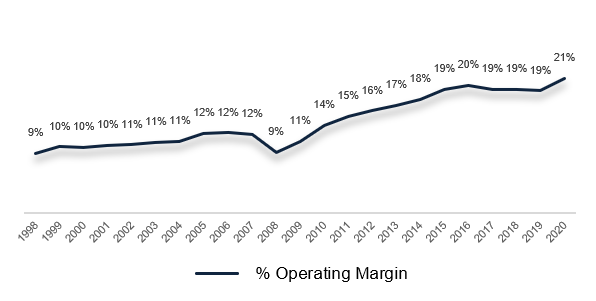

Take a look at the chart below.

Do you know what it means?

It means that we’re looking at a great business. One that, as it becomes bigger, gets higher returns on the invested capital.

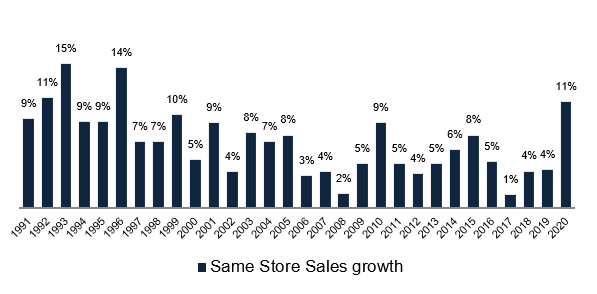

And now to the chart below…

Positive Same-Store-Sales growth in Every. Single. Year. This is a sign of a HIGHLY defensive business.

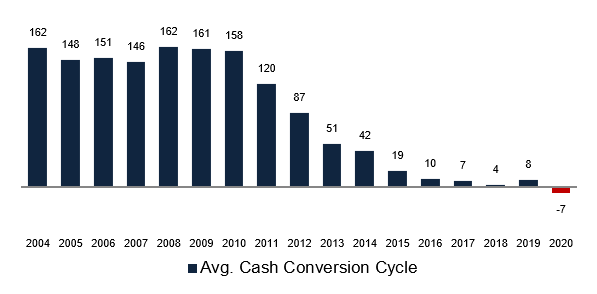

And now, take a look at this next chart.

Amazing. I’ve talked about the Cash Conversion Cycle before, but a quick breakdown is important.

The Cash Conversion Cycle measures the time that it takes for a company to complete a whole selling cycle, from buying the goods to collecting the cash from its clients (it’s measured in days). The lower the better.

So why the dramatic decrease in the Cash Conversion Cycle for O’Reilly?

I’m glad you asked.

The Cash Conversion Cycle is composed of 3 factors:

1) how long it takes for the company to pay its suppliers after an order is placed;

2) how long the inventory sits on the shelves before getting sold;

3) how long does it take for clients to pay after the sale is made;

Easy, right?

Then, financial geeks put long and complicated names to each of these:

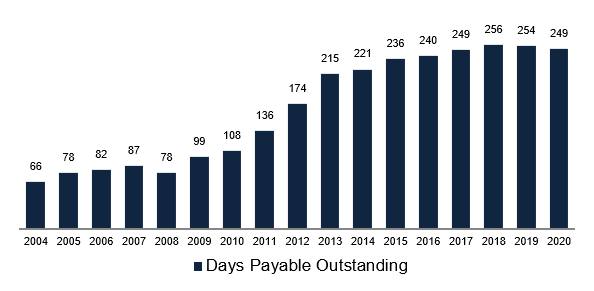

1) Days Payable Outstanding;

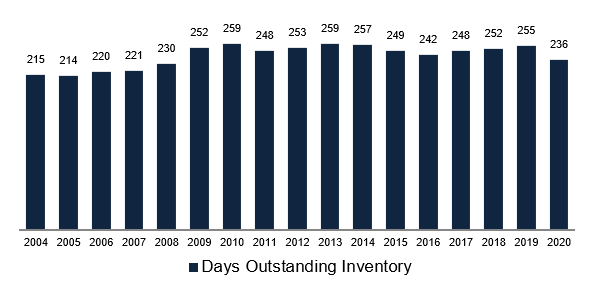

2) Days Inventory Outstanding;

3) Days Sales Outstanding;

When in doubt, just look at the word in the middle.

Depending on how these 3 move, the Cash Conversion Cycle will be moving too.

Generally, we’ll want to see our companies collecting earlier and paying later.

That’s exactly what happened with O’Reilly Auto Parts.

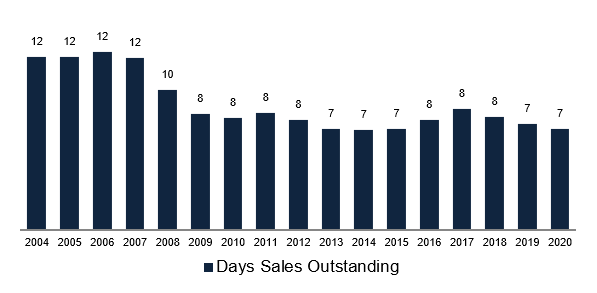

As the company was able to reduce the time it takes to collect from its clients…

… and increase the time it took to pay its suppliers (dramatically)…

… while maintaining its inventory levels stable…

… the company has been able to reduce its Cash Conversion Cycle, thus also reducing its Invested Capital.

Think about it. A negative Cash Conversion Cycle means that the company doesn’t invest 1 dollar (or Euro) in Inventory.

It’s all being financed by its suppliers.

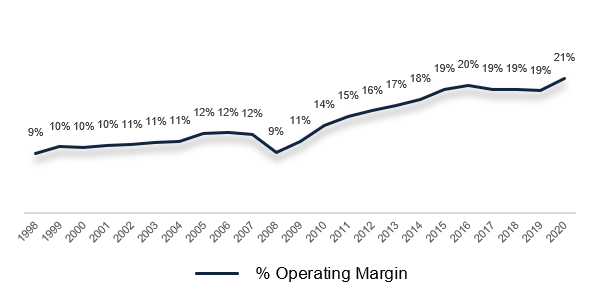

Not only that, but as the company grows, it gains other scale advantages such as higher margins.

Again, higher margins lead to higher Returns on Capital.

This, my friends, is what I call a Beautiful Business.

In fact, I first heard of it while reading a document called “Beautiful Business Analyses”. On it, there are 3 analyses to 3 different companies: Costco by Nick Sleep, Geico by Warren Buffett, and O’Reilly Auto Parts by John Huber.

It’s this kind of businesses that I want to have on my Watchlist (which I’m building right now and will be sharing with you soon). And it’s this kind of businesses that I would like to find early in the game, hence my inclination towards microcaps.

If you’ve been reading my newly created “Daily Emails” you already know the answer to my next question.

What should the managers and directors of such a company do with the cash generated by the business?

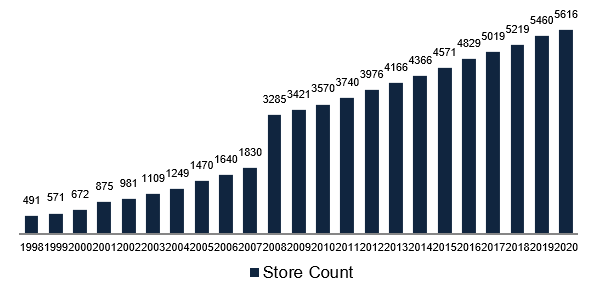

They should – obviously – reinvest it back into the business, build more stores.

And that’s exactly what O’Reilly has been doing for all of its history.

But, although mathematically possible, as the company gets bigger and bigger, it becomes harder to reinvest all the cash at once.

What else can they do?

Exactly!

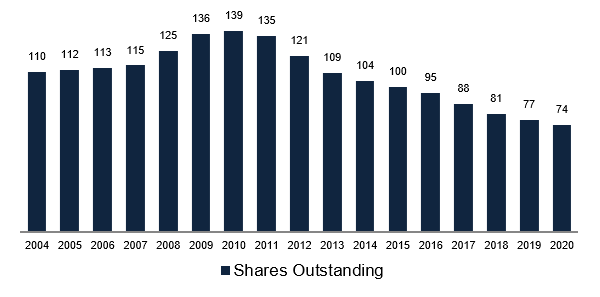

Buy back shares.

Massive amounts of it.

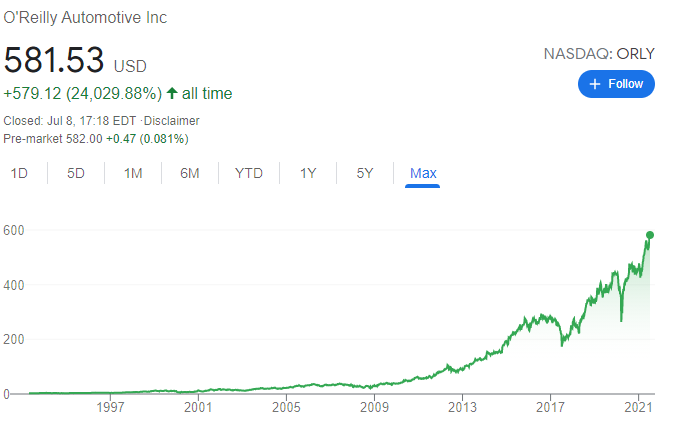

The combination of high returns on capital, relatively high reinvestment rate, and share buybacks has made this stock a 200 bagger, meaning that it’s price has gone up by more than 199 times.

If you’re still unsure about the prospects of Buy & Hold, here’s a comment from Seeking Alpha.

Ehehe!

OK, but what does O'Reilly do?

O’Reilly Auto Parts is a retailer of aftermarket auto parts. It sells things like engine starters, spark plugs, batteries, brakes, etc.

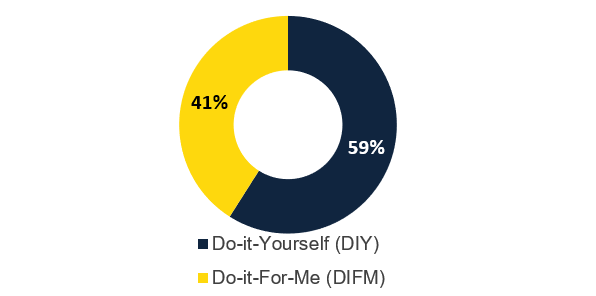

The company operates under 2 different segments: The Do-it-Yourself (DIY) and the Do-it-For-Me (DIFM).

If you’re not an American you’ll probably have a hard time understanding the DIY segment. You see, many Americans, given their suburban lifestyle, have their own shops inside their garages and they like to do this stuff by themselves.

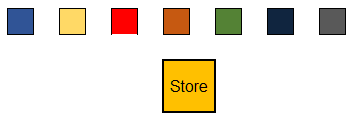

What matters most for the DIY customers is that they get the right part. They rely on O’Reilly’s highly trained employees to tell them what they need.

On the Do-it-For-Me segment what really matters to the customers is delivery time as these are professional mechanics or repair shops who, given the commodity-like service that they’re performing, need to turn as many cars as they can in the least amount of time.

They won’t even go to the store. They’ll have the parts shipped to them. But still they need a store nearby.

When these professionals find a supplier that meets their needs, they’ll call it their “First Call”. If their First Call can’t help them, they’ll go on to the Second Call and so on. The First Call is estimated to represent around 60% of a professional customer business.

So, the crucial part for the Do-It-For-Me segment is distribution.

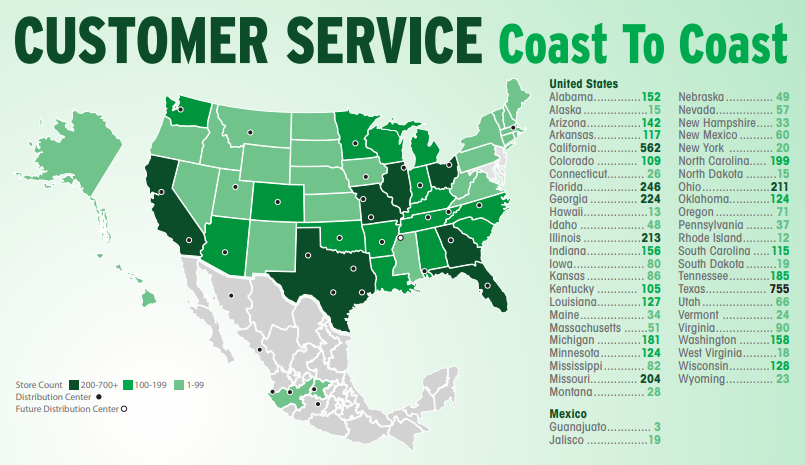

And this is where O’Reilly truly excels.

O’Reilly can deliver parts to their professional customers in under 1 hour.

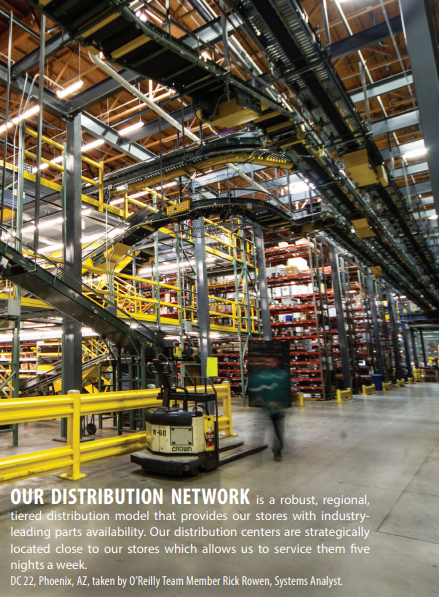

It does so because it has been building its distribution network over the years.

Unlike its closest rival Autozone, which delivers new parts to its stores 3 times per week, O’Reilly’s stores receive deliveries 5 nights a week. This allows the company to have a larger assortment of products in its stores, but not so much quantity of each SKU. High breath – low depth.

This increases the chances of the customer finding the right part while decreasing the inventory at the store level.

On top of this, the company also does same-day deliveries from its more than 350 hub stores to the smaller stores.

So, if a customer needs a part that isn’t available at the store, the company can ring up to its hub store or distribution center and have it delivered almost immediately.

The company currently has 28 regional Distribution Centers, 5.660 stores in the US, and 22 stores in Mexico following the recent acquisition of Mayasa Auto Parts.

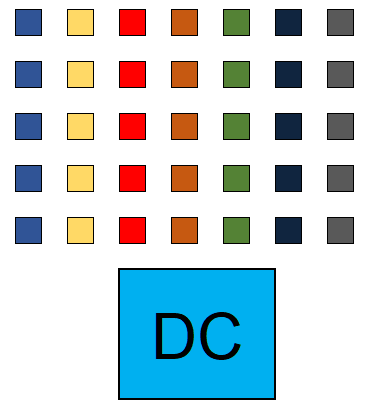

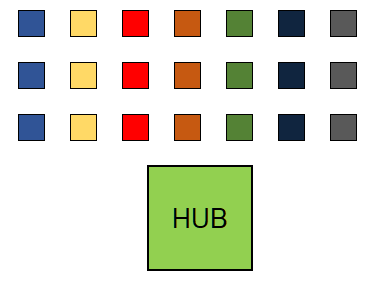

DC's - High depth and breath

Hub Stores - Medium depth, High breath

Stores - Low depth, High breath

Industry dynamics

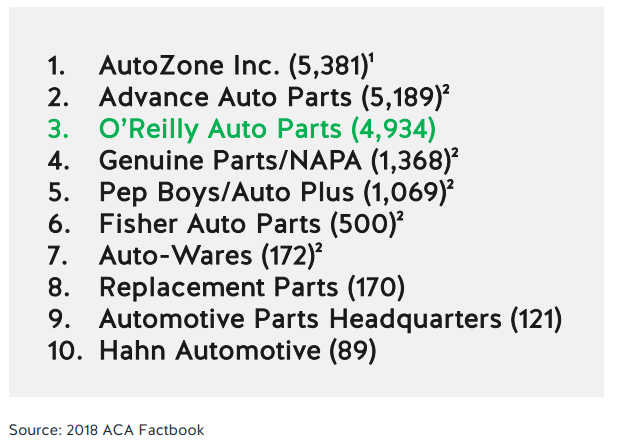

The auto parts business in the US is still highly fragmented.

The Top 10 companies account for roughly 50% of the total market and the Big 4 have a combined market share of around 40%. The rest are mom and pop shops.

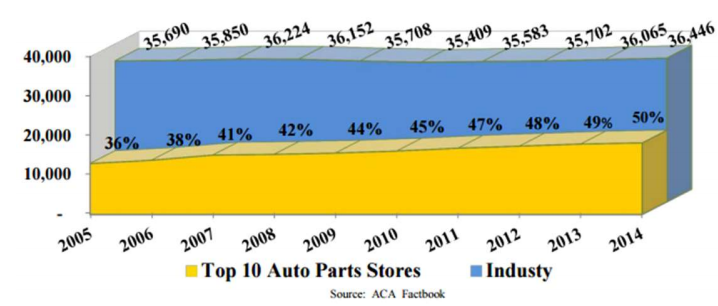

The image below is a bit old, but it goes to show how these companies have slowly but steadily gained market share over the years.

And that’s exactly what will keep happening in the future as the larger they get, the more efficient they become.

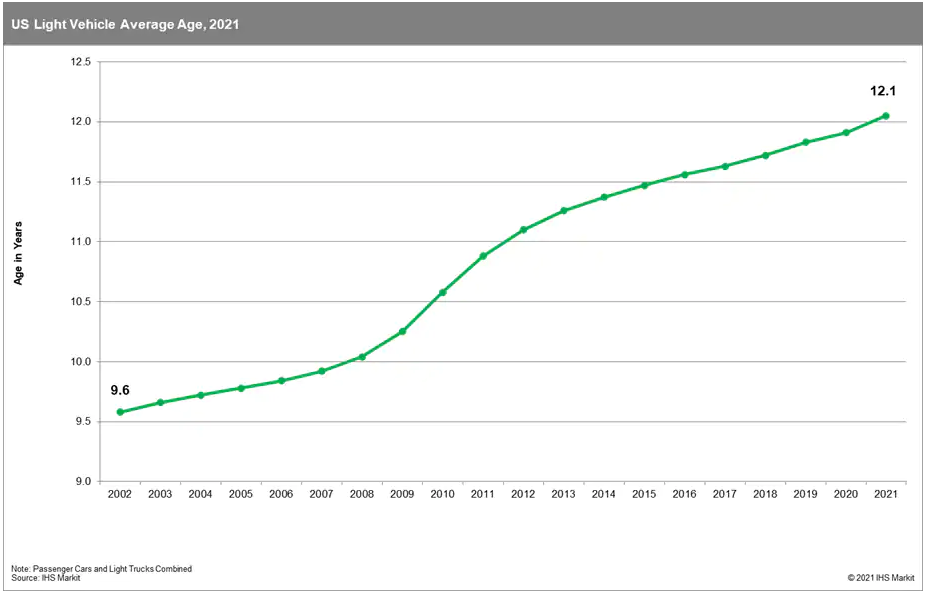

There are 2 major factors influencing the whole industry: the amount of cars over 6 years on the US roads, and the miles driven.

Luckily for them, the average age of cars in the US has been breaking all-time highs since like forever. The current average age of all the cars on the US roads is 12.1 years old so it seems that all the factors for growth are there.

Income Statement

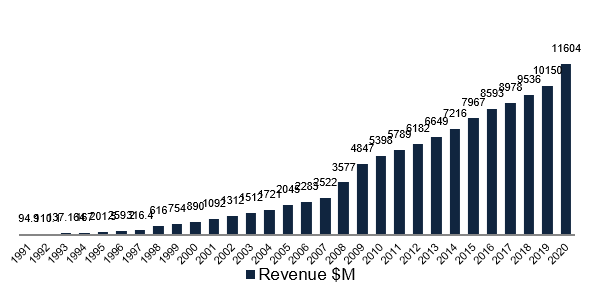

As expected, the company has been growing its revenue since the dawn of time.

And as it grows larger, it gets higher economies of scale: better pricing from its suppliers, and higher dilution of fixed costs over a larger footprint.

Making this a very well oiled cash flow machine.

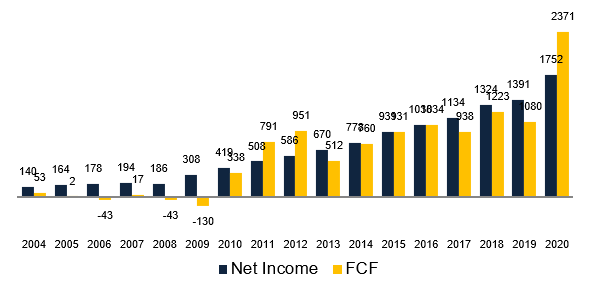

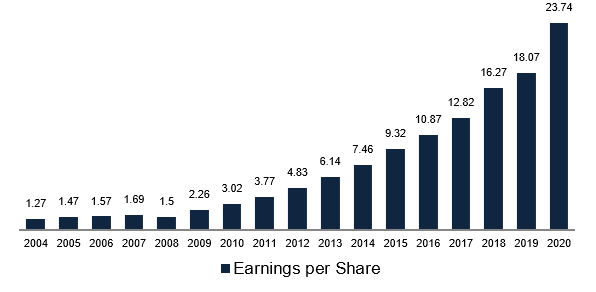

Not only that, but the ability to generate massive amounts of cash, together with a near perfect capital allocation strategy has led to a hyperbolic growth in earnings per share…

… leading to the 200 bagger stock I was mentioning before.

Balance Sheet

And with such cash generation ability, it’s obvious that the balance sheet is very sound.

The company targets a leverage ratio of 2.5x EBITDA, and it’s currently at 1,83x, so there’s still room for more debt.

Conclusion

My first thought about the future of this industry was how it can become a declining industry due to the rise of electric vehicles which need fewer parts.

But as counter-intuitive as it may seem, this dynamic may benefit O’Reilly. Mom and pop shops don’t stand a chance in a declining market because in this business you need economies of scale.

Even if the total addressable market enters in decline (which it hasn’t), the Big 4 will benefit from it (think tobacco companies).

You’ll notice that I haven’t talked much about the competition, risks or even valuation. I’m liking this company and this industry so much that I’ll be looking at Auto Zone in the coming week and I’ll then talk about all of that.

Further research material

DISCLAIMER

The material contained on this web-page is intended for informational purposes only and is neither an offer nor a recommendation to buy or sell any security. We disclaim any liability for loss, damage, cost or other expense which you might incur as a result of any information provided on this website. Always consult with a registered investment advisor or licensed stockbroker before investing. Please read All in Stock full Disclaimer.